Understanding Cryptex: A Comprehensive Overview

Mar 26, 2024 ⋅ 16 min read

Key Insights

- Cryptex is a DeFi platform that offers a range of trading products, namely decentralized indices, with the end goal of bringing previously untradeable markets onchain.

- The protocol has evolved through multiple iterations, integrating Ethereum smart contracts, the Arbitrum Network, and Chainlink/Pyth oracles. Its latest version, Cryptex π, focuses on improving capital efficiency and low-latency oracle integration.

- Cryptex’s flagship product is its Total Market Cap (TCAP) token, which simplifies exposure to the market akin to a traditional index fund.

- Governance plays a central role in Cryptex's ecosystem. CTX tokenholders can participate in decision-making processes, influencing protocol upgrades and treasury management.

Introduction

Cryptocurrency markets can be volatile and difficult to trade. Building a well-balanced and diversified portfolio typically requires a significant time investment in order to understand and navigate the crypto world. Instead, many users opt for momentum-based trading strategies, as seen in the recent memecoin craze. For better or for worse, this style of trading could easily turn into a default for new traders, as opposed to strategies that are more anchored in fundamentals. As a result, this environment of extreme highs and lows can present a challenge for traders seeking to gain exposure to the fast-growing crypto sector. Rather than trying to “find the needle in the haystack,” some investors might prefer John Bogle’s approach of simply “buying the haystack” itself.

The strategy is exceedingly popular in the traditional finance world, with global exchange-traded fund (ETF) assets approaching $10 trillion. This strategy has proven to be favorable for investors, as it allows for building a well-balanced and diversified portfolio without the significant time investment. In the crypto world, there has been significant interest in the recently approved Bitcoin ETF, demonstrating plenty of traditional and crypto-native demand for this sort of financial product.

In an attempt to meet this demand, among others, Cryptex has focused its efforts and developments around a single goal: making untradeable markets tradeable. For those seeking to buy the haystack, Cryptex offers the Total Market Cap (TCAP) token which tracks the entire cryptocurrency market cap. This approach effectively unlocks a previously untradeable market and simplifies the investment process in the complex world of cryptocurrencies. In addition, Cryptex has managed to provide TCAP and other offerings without venture capital money or an initial coin offering. Instead, Cryptex stays true to the crypto ethos by providing unique products that are owned and developed by the DAO and protocol.

Background

Cryptex (CTX) was launched on April 8, 2021, with the goal of making crypto-native markets tradeable. Unlike many of its peers, Cryptex’s launch did not involve any venture capital money or initial coin offerings and was instead a fair launch. The story began with co-founder Joe Sticco’s vision to create the S&P 500 of crypto. He worked with co-founder Thomas Matzner to bring the idea to life with the help of Ethereum developer Preston Van Loon. Formerly at Google, Van Loon also helped establish Prysmatic Labs and worked on Ethereum's shift to Proof-of-Stake (PoS). Since launching, Cryptex has gone through several iterations, including Cryptex V1, Cryptex V2, and Cryptex π.

Cryptex uses Ethereum smart contracts, Perennial derivatives vaults, and Chainlink/Pyth data oracles to provide a unique trading experience for users on the Arbitrum Network. The protocol’s flagship product, the TCAP token, tracks crypto’s total market cap and functions similarly to an index fund. Cryptex offers several other innovative products such as its squared markets or its curated basket funds. Cryptex operates as a decentralized autonomous organization (DAO) where decision-making is in the hands of CTX tokenholders. The CTX token came into existence via a fair launch, establishing a foundation of transparency and community-driven governance. CTX tokenholders have the authority to cast votes on a range of governance matters, including the introduction of proposals, the implementation of system upgrades, and the strategic management of the treasury.

Technology

In its endeavor to enable the trading of previously untradeable markets, Cryptex has gone through several iterations: Cryptex V1, Cryptex V2, and Cryptex π. While the underlying goals remained the same, the means to achieving these ends varied significantly enough to merit a deep dive into the technology.

Cryptex V1

On April 8, 2021, the Cryptex team launched Cryptex V1. It introduced its inaugural product TCAP, which followed crypto’s total market cap. To track this metric via a price feed mechanism, Cryptex collaborated with Chainlink. Chainlink’s Price Feeds aggregated data from four distinct providers and provided the average value onchain for TCAP contracts to access. The Chainlink oracles updated said data based on every 1% change in price. To mint TCAP, Cryptex employed a collateralized debt position (CDP) design. Its users first deposited collateral, such as ETH, DAI, or WBTC, and then received the overcollateralized synthetic asset TCAP in return. The value of TCAP was then a simple, index-fund-like calculation of crypto’s total market cap divided by 10 billion (e.g., at the time of writing, TCAP is worth $259.10, reflecting a total market cap of $2.59 trillion).

Cryptex Finance encountered some challenges with the CDP design, which was integral to keeping TCAP close to its peg. Due to the oracle and token price's dynamic nature, the peg was difficult to maintain because it depended on market behavior.

To better engage with its community, Cryptex Finance introduced governance through its governance token CTX. With listings on several exchanges such as Gemini, Holbi, and Coinbase, users were given the ability to vote on protocol upgrades. However, the peg problem still posed a challenge for the platform, leading the team to innovate towards better methods of maintaining the token’s stability. Despite these issues, TCAP still saw about $200 million exchanged in mints and burns during Cryptex V1. The fees generated from burning TCAP (equal to 1%) are all owned by the DAO.

Cryptex V2

The Cryptex team launched V2 in June 2023. Its most notable change was moving from a CDP design to a perps-based approach that was fully decentralized. In addition to Chainlink oracles, the protocol’s architecture uses smart contracts on Ethereum, derivatives vaults on Perennial, and additional data oracles from Pyth. These all work together to provide a fully decentralized trading experience for users. Trading on Cryptex V2 is facilitated on the Arbitrum Network, which eventually led to an airdrop and additional incentives for V2.

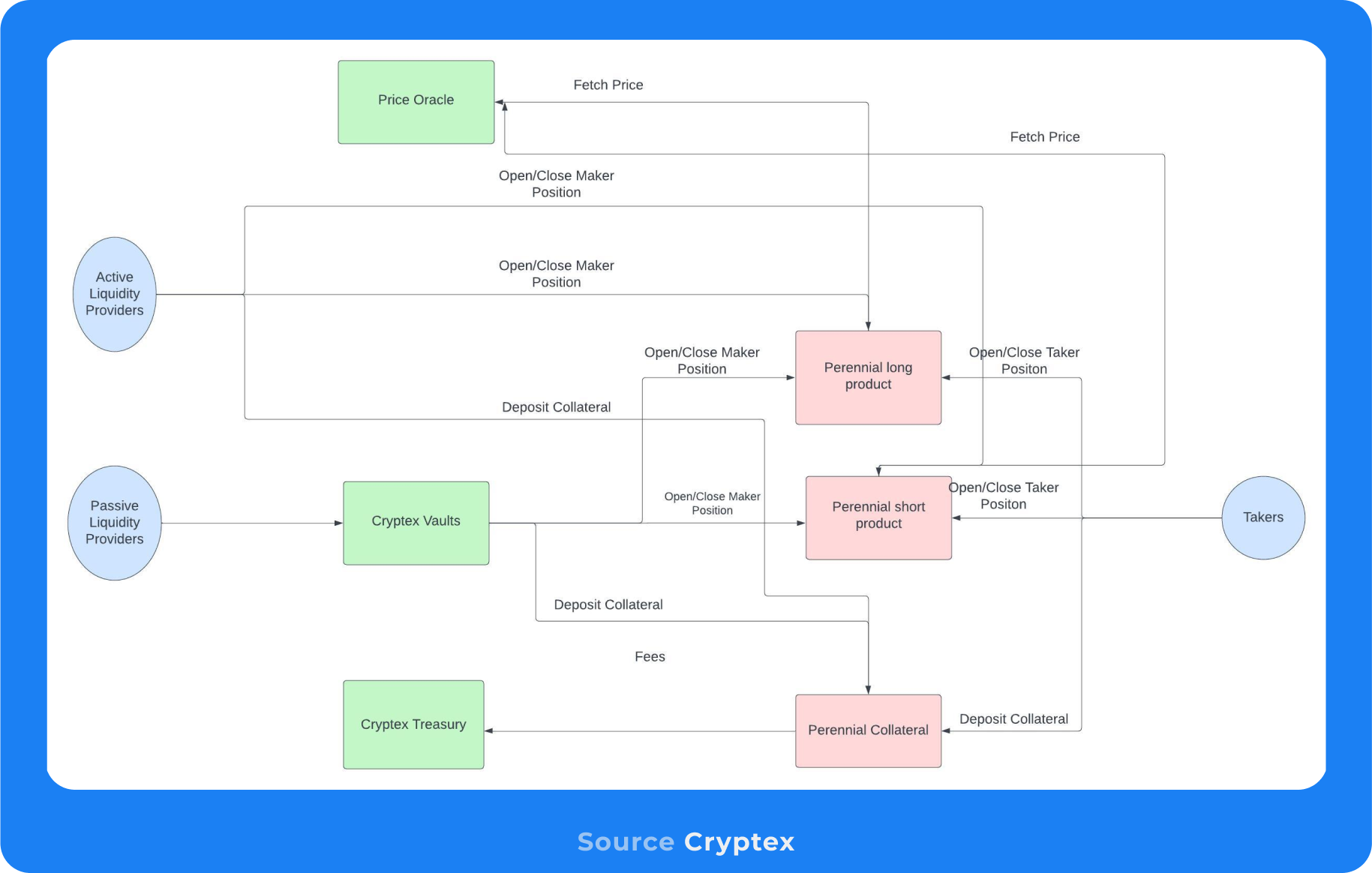

Under Cryptex V2, the mechanisms behind TCAP are more robust, thanks to being built on the DeFi primitive Perennial. The derivatives platform is a peers-to-pool automated market maker (AMM) that creates a two-sided market for traders and liquidity providers (LPs). At oracle price, LPs supply capital (acting as makers), and on the other side, traders can play the role of long/short takers.

There are two types of liquidity providers: passive, those who contribute to vaults that manage positions with baked-in hedging strategies; and active, those who choose to provide liquidity on one side of the market (long or short). LPs also have access to vaults, which allow makers to hedge their positions. They use predetermined logic to manage these makers’ positions and then share the fees, profits, and losses with the makers. While these makers provide capital in the protocol, the takers (i.e., users) deposit their collateral to gain leveraged exposure to the Oracle price feeds. Trades are settled continuously with profits and losses distributed among participants according to their respective positions.

All of these trades are tracked by Perennial's collateral contract, which oversees the collateral deposited by users. Cryptex also utilizes Perennial’s product contracts as the core components holding the logic for the perpetual futures. However, the long and short positions are established as distinct instances of these product contracts.

Perennial's architecture introduces plenty of capital efficiency, as it directly matches up taker and maker trades. While Perennial does charge a variable funding rate based on market usage, it is affordable when compared to platforms like GMX. Perennial also ensures that Cryptex trades can be executed with zero slippage since it is glued to oracle price points.

Cryptex π

In the middle of Q4’23, the Cryptex team built upon V2’s features and launched Cryptex π. The overall intentions of Cryptex π’s architecture were to further increase capital efficiency and to incorporate more low-latency oracles like Pyth. As a result of these efforts, Cryptex was able to offer several additional markets, including BTC-USD, ETH-USD, and SOL-USD. It also introduced squared markets for BTC and ETH, which allow for leveraged trading. Across these markets, Cryptex has over $12 million in total liquidity and over $1 million in open interest. It incorporated several features and strategies to achieve these goals.

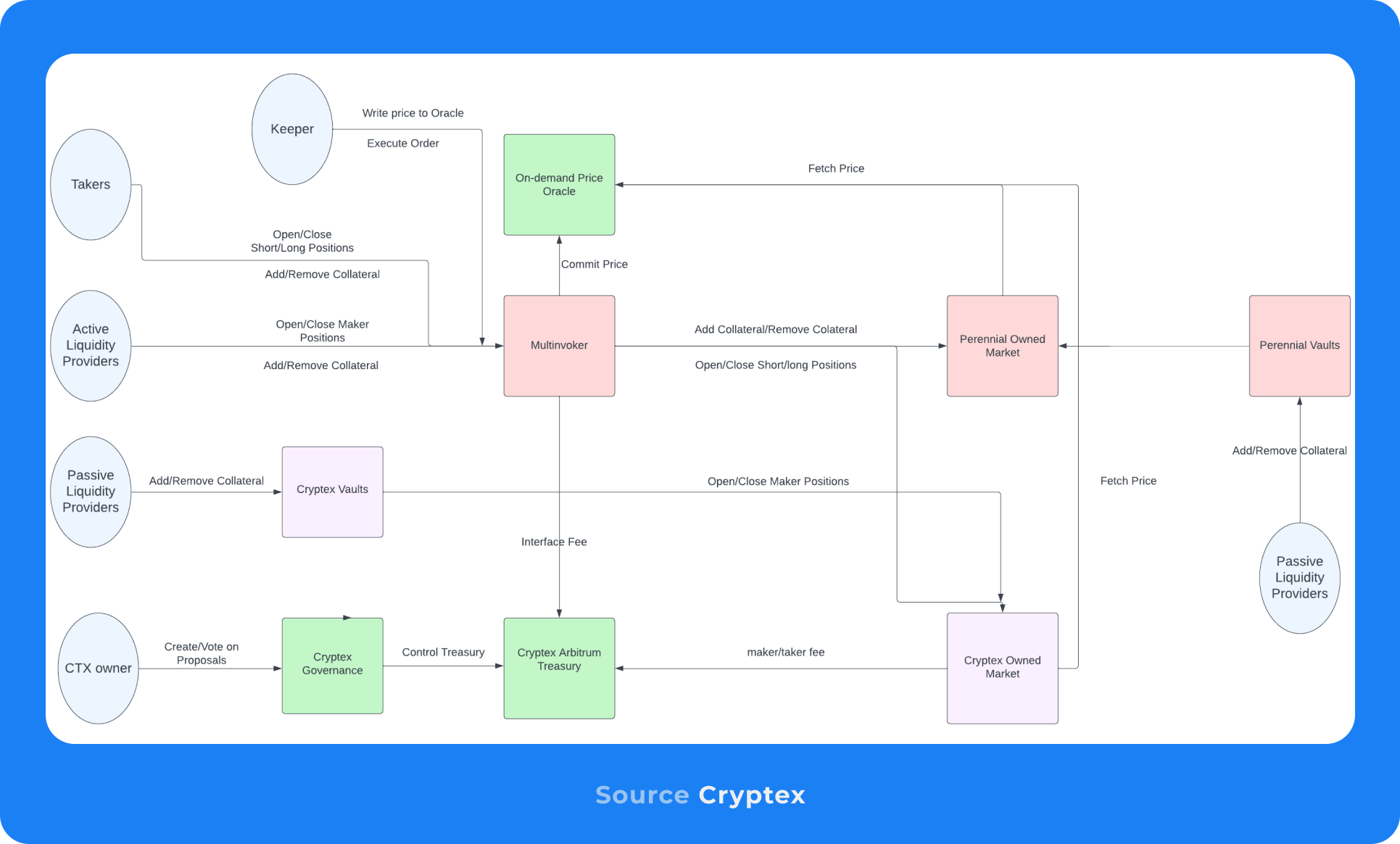

Improving Capital Efficiency

Rather than matching takers directly with LPs, Cryptex π first matches long takers with short takers and then turns to LPs to handle whatever’s left over. This system allows for a faster and more efficient user experience compared to V2. Also, Cryptex π uses bidirectional markets, e.g., one pool per market, as opposed to V2’s unidirectional market which uses one long and one short pool. On the technical side, Cryptex uses the “multi-invoker” feature. It serves as a smart contract that functions as a gateway to Perennial's smart contracts. Multi-invoker enables users or interfaces to execute several operations within Perennial with just one transaction.

The latest Cryptex version encourages more usage, which would ultimately improve efficiency, by introducing different order types such as stop losses, market, limits, and take profit. To enable these trades, Cryptex created another user type called “keepers.” In addition to executing these orders, keepers are responsible for verifying that price updates have been written onchain.

Cryptex π also addresses the potential friction caused by Perennial’s variable funding rate fee. Instead of relying on market usage, Cryptex π’s funding rate is determined by a PID mechanism, which is one of the most well-established methods of employing feedback to establish control in a system.

Low-Latency Oracles

In addition to the Chainlink Core oracles, Cryptex π allows the protocol to expand and include low-latency oracles. As of writing, it has integrated with Pyth to attain these features. Pyth is a robust oracle network that offers prices for cryptocurrencies, equities, foreign exchange pairs, ETFs, and commodities. It sources its data from several notable providers, including A few notable providers include Jane Street, Chicago Trading Company (CTC), Binance, and Galaxy. By tapping into this network, the Cryptex team has been able to get one step closer to realizing its goal of making untradeable markets tradeable.

Fees

Because Cryptex is built on Perennial, it inherits a dynamic fee structure. Perennial charges an exchange fee that varies depending on the market skew of each trade. Perennial levies three types of fees. Settlement fees are applied whenever a position is altered, aimed at offsetting the costs associated with oracle keeper fees. Taker fees are charged when opening or closing long/short positions. And, maker fees are charged when maker positions are opened or closed.

Cryptex π also introduced an interface fee, which is fixed at 2 basis points. The interface fee acts as compensation for simplifying the smart contract experience for users.

Governance

The history of Cryptex’s evolution from V1 to V2 to Cryptex π can be followed in the many community discussions and proposals submitted to the Cryptex DAO. The DAO runs off of Cryptex’s native token CTX, which is further detailed in the Tokenomics section. The ability to submit proposals is limited to addresses that hold over 100,000 CTX ($515,000). For a proposal to pass, it then needs at least 400,000 CTX cast within 3 days and a simple majority.

After passing, the proposals are queued in the Timelock contract. This contract governs adjustments to system parameters, upgrades to logic, and contract modifications through a 'time-delayed, opt-out' mechanism. It uses a minimum of 2 days' notice for any governance action and 30 days for more significant changes like alterations to the risk system. All pending and executed actions are transparently visible on the Timelock Dashboard.

Although Cryptex governance is only on Ethereum Mainnet, the protocol has a bridge from Ethereum Mainnet to the Arbitrum Network through two primary contracts. First, the Arbitrum Message Relayer encodes and conveys proposal data to Arbitrum's delayed inbox, and second, the Arbitrum Message Executor subsequently executes the received calldata on the Arbitrum network.

The Cryptex DAO has a collection of data points that highlight just how involved its community is. For example, the number of delegations is at an all-time high, showing strong interest in the Crypt Keeper initiative (detailed below). The Cryptex team also stated that its core team doesn’t engage in staking in order to avoid double dipping.

Single-Sided Staking

CTX tokenholders have access to single-sided staking as another way to participate in Cryptex governance. By staking CTX, participants delegate their voting power to designated DAO representatives, known as Crypt Keepers, while still earning staking rewards. There is a 7-day lockup period during which withdrawals are not permitted. Rewards can be monitored via the Cryptex dApp or on platforms like Zapper.fi. Cryptex offers step-by-step guides on how to delegate CTX and how to become a Crypt Keeper. The single-sided staking program was extended in November via community vote.

Tokenomics

CTX

In April 2021, Cryptex announced the launch of its governance token, CTX. Tokenholders can use CTX to submit governance proposals, vote on such proposals, or delegate their votes.

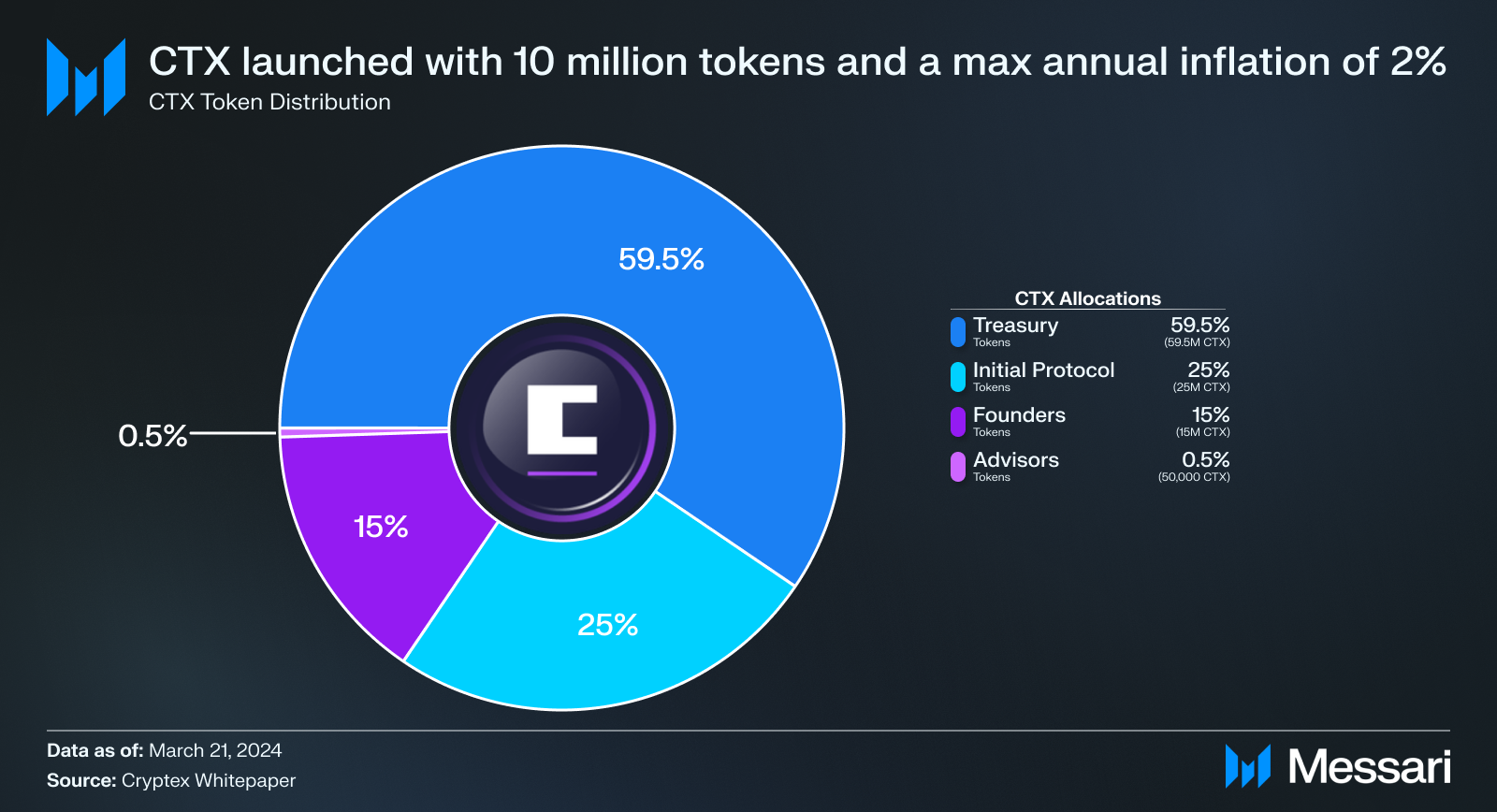

CTX Distribution

CTX had an initial supply of 10 million tokens, which could inflate at a maximum of 2% per year, depending on the community. Minting new tokens could help in situations like when TCAP vaults are undercollateralized or incentives are needed for product development. The token distribution for CTX was as follows:

- Initial Protocol Incentives (25%)

- Treasury (59.5%)

- Founders (15%)

- Advisors (0.5%)

There was also an early adopter allocation to kickstart the governance process. Users who owned a vault during the first 14 days of CTX’s launch would be eligible for a portion of the 500,000 CTX allocated towards this initiative.

CTX currently has a little over 2,000 holders, with the top 100 addresses holding about 60% of the total allocation (excluding the Timelock address). In November, the community voted on a retroactive airdrop to further incentivize governance participation. The airdrop was made available for eligible participants to claim in February.

TCAP

TCAP is a synthetic asset that is backed by ETH, DAI, and wBTC. Its price represents the total market cap of crypto divided by 10 billion, likely due to unit bias. Cryptex uses Chainlink Oracles to aggregate data from four distinct providers (CoinMarketCap, CoinGecko, Coinpaprika, and CoinLore), which are used to find the average value onchain. To acquire TCAP, users can either perform a swap on Uniswap/Sushi/Cryptex dapp or mint TCAP by locking up their own ETH, DAI, or wBTC. If the users wanted their collateral back, they would simply burn their TCAP. To protect users from malicious activity, the Cryptex DAO can pause the TCAP minting/burning software. As of writing, the community has not voted to use this feature.

TCAP functions similarly to a traditional index fund, and it offers some of the same benefits. These include more diversification, simplified portfolio management, and reduced costs. For a trader to gain exposure to crypto’s market cap, they would have to invest significant time and resources into understanding the intricacies of every wallet, exchange, and token.

The Cryptex dapp allows users to take both long and short positions on TCAP and to use up to 20x leverage on these trades. While it is free to mint TCAP, it should be noted that there is a 1% burn fee associated with the token. Users can also take the maker side of the market by providing liquidity for TCAP trades.

Airdrops

The Cryptex DAO has received two airdops, both of which ended up bolstering the liquidity of TCAP. In April 2023, the Cryptex team announced that Cryptex was granted 75,000 ARB in recognition of its efforts in the DeFi space. The Cryptex team proposed to reinvest these tokens back into the community. Half of the ARB tokens were designated to enhance liquidity for the DAO's TCAP over a 60-day span. The remaining half was set to reward Cryptex V2 traders and a tiered referral system. The vote passed, with 90% in favor of the plan.

When Cryptex integrated with Pyth in November, Cryptex was airdropped 100,000 PYTH. The protocol subsequently conducted a community snapshot vote to decide how to use these tokens. The consensus led to the tokens being allocated to enhance TCAP liquidity.

Risks and Challenges

While Cryptex has several unique offerings, it has some hurdles to clear before it can claim a significant place in the DeFi space. One of the most notable challenges that Cryptex faces is overcoming a competitive landscape that is filled with larger, more established protocols. There is no shortage of decentralized perp exchanges, such as GMX or Vela. Both exchanges far outpace Cryptex in terms of total volume and users. For reference, GMX has seen $189.61 billion in total volume compared to Cryptex’s $8.1 million. For Cryptex to close the gap, it will likely have to establish a defensible moat by offering a unique product and continuing to foster an engaged community. In addition to TCAP and squared markets, Cryptex already has plans to offer baskets that track a curated list of top protocols by sectors (e.g., an AI basket).

Regarding TCAP itself, there is a fair amount of trust that must be placed in the oracles and their sources to provide accurate and up-to-date data. That said, Cryptex has not experienced any significant issues to date with this oracle dependency. In terms of liquidity, TCAP has been reinforced two times by outside resources through the Arbitrum and Pyth airdrops. While helpful in the short term, airdrops are not a sustainable source of liquidity.

While all decentralized trading platforms carry some risk, Cryptex faces the additional challenge of being limited by geo-political factors. In some countries like the U.S., there is a lack of clear legislation surrounding DeFi projects. As such, Cryptex’s offerings are only available on certain exchanges and platforms. Recognizing the inherent challenges that come with decentralized trading platforms, the Cryptex team proactively audited their protocol. Three separate audits were conducted regarding Cryptex’s vaults, single-sided staking, and governance bridge.

Closing Summary

For several years, Cryptex has iterated on its goal of making untradeable markets tradeable on the blockchain, as demonstrated in its flagship product, TCAP. The protocol’s evolution from Cryptex V1 to Cryptex π reflects a commitment to innovation. Its ongoing adaptations have been aimed at enhancing capital efficiency and trading experience on a foundation of decentralized governance. Through CTX governance, Cryptex aims to foster a participatory community, underscored by airdrops and strategic reinvestments to bolster its offerings.

Nevertheless, Cryptex must contend with formidable competitors and an ever-changing regulatory environment. Both factors pose substantial challenges to its expansion and long-term establishment in the market. The team plans to continue building custom indices and deploy new perpetual markets, as well as eventually expanding to more L2s and networks. Cryptex’s constant innovation, coupled with the engagement of its governance community, will be pivotal in securing a sustainable position in the DeFi space.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Cryptex Finance LLC. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Stephen is Messari's Research Editor. After graduating from Cairn University with a BA in English and a minor in education, he worked as an editor for a multidisciplinary journal before joining Messari. He enjoys reading anything and everything, so long as it's well-written.

Read more

Research Reports

Read more

Research Reports

About the author

Stephen is Messari's Research Editor. After graduating from Cairn University with a BA in English and a minor in education, he worked as an editor for a multidisciplinary journal before joining Messari. He enjoys reading anything and everything, so long as it's well-written.