Understanding Core Chain: A Comprehensive Overview

Apr 3, 2024 ⋅ 18 min read

Key Insights

- Core Chain is a scaling and programmability solution for Bitcoin.

- Satoshi Plus is a hybrid model of Delegated Proof-of-Work (DPoW) and Delegated Proof-of-Stake (DPoS). It’s Core Chain’s biggest differentiator from other Bitcoin layers.

- Core Chain uses the EVM for its execution environment. The developer community around the EVM has helped grow a diverse ecosystem, with 10+ native ecosystem projects and others brought over from other EVM ecosystems.

- Governance of Core DAO, managed through the CORE token, is mostly offchain now but is moving towards becoming fully onchain.

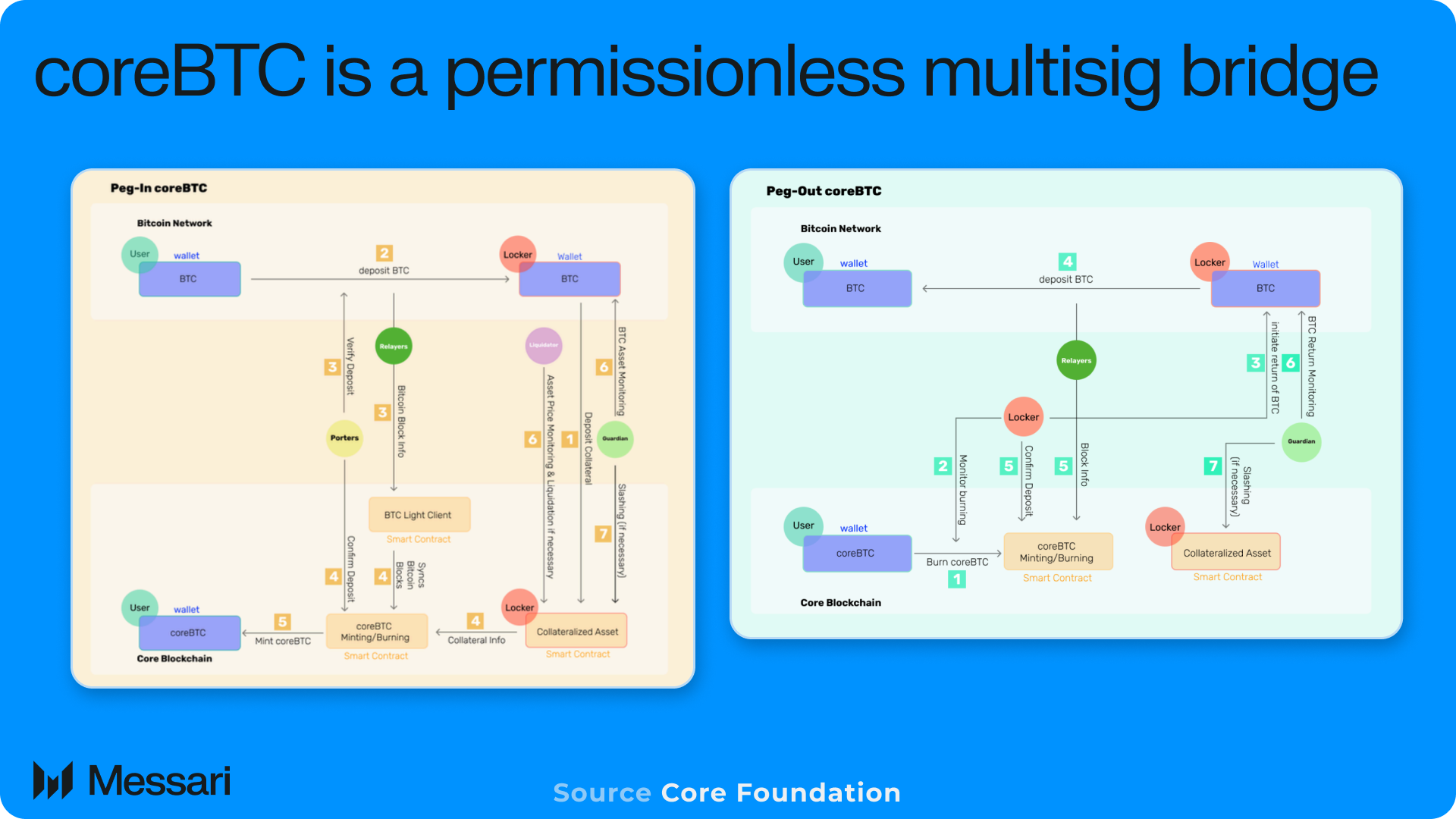

- The coreBTC bridge is a permissionless multisig bridge enshrined into the protocol. coreBTC is minted by locking BTC on Bitcoin. This enables users to utilize BTC on Core Chain in a less custodial way than popular federated bridges.

Introduction

Bitcoin has historically been focused on enabling peer-to-peer payments and being a store of value, but not so much on DeFi, NFTs, and other narratives enabled by programmability. Instead, those narratives were deferred to alternative protocols, mainly Ethereum. However, Bitcoin is now experiencing a renaissance of programmability, largely thanks to two recent innovations, Ordinal Theory and BitVM.

After the Ordinals meta-protocol and its BTC-based token standards were launched, it became undeniably clear that the Bitcoin community had a serious appetite for NFTs, fungible tokens, and general programmability. In December of 2023, Bitcoin’s NFT sales volume (including BRC-20s, which are technically nonfungible) exceeded that of Ethereum and Solana combined. This is especially significant due to their multiyear head starts of developing NFT communities.

BitVM, a strategy for executing arbitrary computation anywhere and then verifying it on Bitcoin, opened the door for new bridging mechanisms and ideas for enforcing transaction validity. While certain dimensions of Layer-2s (L2s), such as data availability, are more straightforward, Bitcoin L2s will still need innovations in order to scale to support dozens of layers. Up until these recent developments, other functions, such as the aforementioned trustless bridging and enforcing transaction validity, were believed by many to be impossible without a soft fork.

Ordinal Theory emphasized the demand for added functionality, and then BitVM made expressive and trust-minimized L2s seem possible. This has sparked a frenzy of Bitcoin layers, dubbed the “Bitcoin L2 Season.” However, some teams, such as the Core Foundation, were already building in the Bitcoin ecosystem and were greatly positioned to capitalize on the momentum of Bitcoin layers. While many other layers are still building towards mainnet, Core Chain offers a platform for Bitcoin programmability today.

Background

Core Chain is a Bitcoin layer (specifically, a sidechain) that uses the EVM and the novel Satoshi Plus consensus mechanism. Satoshi Plus is a combination of Delegated Proof of Work (DPoW) and Delegated Proof-of-Stake (DPoS). It was designed with the goal of retaining Bitcoin’s decentralized security while achieving the scalability of more performant smart contract platforms. Parameters of Satoshi Plus, as well as other facets of the network, are governed in a decentralized fashion by Core DAO (powered by the CORE token). Core Chain is EVM-compatible, similar to Binance Smart Chain’s implementation of Geth. And finally, Core Chain features an enshrined BTC bridge, making BTC available on the network in the form of coreBTC.

The Core Foundation and Core DAO were founded in May 2022. The Core Foundation is self-funded and consists of contributors Rich Rines (previously a transfers engineering lead at Coinbase, and Founder and CEO at AutoReach), CJ Reim (Co-Founder and Managing Partner Amity Ventures, and a Genesis block Ethereum investor), Lindsey Haswell (previously the Chief Legal Officer at Blockchain.com and MoonPay, and the Regulatory Director at Uber), Jack (with 10 years of technical blockchain and Web3 experience and previously an engineer for BI software), Brendon Sedo (previously the Founder/CEO of Joist and EHF Investor Fellow), Max (with 18 years of experience as an entrepreneur, engineer, and product designer), and Charles (with a MSc in Computer Science and Theory and previously a senior design developer at multiple Web3 projects).

Technology

There are four key features of Core Chain that separate it from its competition:

- Satoshi Plus: the novel consensus mechanism, which is a hybrid of DPoW and DPoS

- Core DAO: the DAO that manages onchain governance

- EVM: the adapted Ethereum virtual machine for smart contract execution

- coreBTC: the enshrined Core-native bridged BTC

Satoshi Plus

Core Chain’s biggest differentiator from other Bitcoin layers (and merge-mining in general) is its Satoshi Plus consensus mechanism. Satoshi Plus is a hybrid model of Delegated Proof-of-Work (DPoW) and Delegated Proof-of-Stake (DPoS).

DPoW is performed by Bitcoin miners and mining pools who delegate their existing Bitcoin hash rate to select validators on Core Chain. DPoS is performed by CORE tokenholders staking/delegating their CORE tokens to select validators on Core Chain. The DPoW hash and DPoS stake contribute to the calculation of a weighted score that determines which validators qualify for the next round of block creation. Certain parameters of the weighting are variable and set by the Core DAO; currently, the weighting ratio is two-thirds to hash and one-third to stake.

This hybrid model separates block production from Bitcoin miners, which removes any possible incentives for Bitcoin miners to censor Core Chain. This novel approach combats a classic issue with merge-mining (and other forms of parent-child shared security). In this issue, the security provider network can perform MEV or censorship on the child chain with no penalties and no incentives not to, as they are theoretically more aligned with the parent chain than the child chain.

Network Participant Roles

Participants in Satoshi Plus consensus include Bitcoin miners, CORE stakers, validators, relayers, verifiers, and Core DAO. Together, they secure the Core network through PoW and DPoS, as well as adjust consensus-related variables through an onchain governance process.

Bitcoin Miners

Bitcoin miners and mining pools participate in Satoshi Plus consensus by mining Bitcoin blocks and subsequently delegating the blocks to a Core validator in each block they produce. This process involves adding the data to the op_return field, a data field for including arbitrary data used in many other network functions such as inscriptions. The consensus process signals to the Core network that a miner is delegating their hash to that validator and participating in Satoshi Plus. It comes at no additional cost to the miner, and miners can even include their own Core address in order to receive the CORE tokens distributed in the consensus process.

Because this process comes at no cost to the miner, it carries no guarantees that a participating Bitcoin miner is aligned with Core. Consequently, block production is managed by a distinct role, the validator, to whom miners delegate their hashing power.

This flavor of shared security is on an individual opt-in basis per miner. It’s also non-rivalrous, meaning that a single miner does not exclude themself from participating in merge-mining or shared security for another network (e.g., PoX with Stacks) by delegating hash to a Core validator. The exception to this non-rivalrous nature could be if other shared security models also require data to be posted in the op_return field, which has a size limit of 80 bytes.

CORE Stakers

CORE token stakers participate in Satoshi Plus by delegating CORE tokens to validators on Core Chain.

Validators

Validators take part in Satoshi Plus by both running validator hardware and staking their own CORE tokens. Miners delegate hash, and delegators delegate stake to validators, which, combined with their own stake, create their weighting scores. As an open and permissionless system, validators can also run Bitcoin miners themselves and delegate hash to themselves if they choose.

Also, liquid staking is natively available through the stCORE token. This theoretically increases consensus participation, as users don’t have to choose between staking and utilizing liquidity in DeFi or other protocols.

Relayers and Verifiers

Relayers participate in Satoshi Plus by relaying Bitcoin block headers to the Core network via the onchain light client. Like all other roles in Satoshi Plus, the set of relayers is permissionless. Anyone can participate by registering and locking up a refundable CORE token deposit. However, relayers must both register and pass verification in order to earn rewards.

Verifiers participate in Satoshi Plus by identifying and reporting malicious actions within the network. If successful, validators may have their stake slashed or be jailed outright. Verifiers are compensated for their monitoring when block rewards are dispensed. Acting as a verifier is permissionless.

Consensus Process

Weighting

Both hash power (from Bitcoin miners) and staked CORE tokens (from CORE delegators) are combined to create an overall score. The formula for weighting uses only one dynamic variable, the m Parameter. The value of this parameter is set by Core DAO and can be changed at any time through a vote (more on voting in the Governance section). Each validator’s hash and stake are measured as a direct linear percentage of the total value from all validators, and the m Parameter dictates the weighting for hash and stake inversely. In other words, an m Parameter of 0.3 would mean hash represents 30% of the total weight and stake represents 70% of the total stake.

S = rHp / tHp * m + rSp / tSp * (1 - m)

Where:

rHp = hash power delegated to the validator

tHp = total hash power

rSp = stake delegated to a validator

tSp = total stake

m = a dynamic weighting that can be adjusted over time

Measuring stake is straightforward, as Satoshi Plus uses a linear voting mechanism (i.e., one CORE token equals one vote). Hash is slightly more complicated, as it’s exogenous. relayers fetch BTC block information to bring Bitcoin’s consensus data into Core Chain’s environment, and block production is used to estimate hash. Hash is represented by the number of blocks produced by any miner, as over the long term, this ratio should be directly equivalent to a miner’s share of the total hashrate.

Every round (roughly one day), hash power is calculated by counting the number of blocks produced by participating miners from exactly one week prior (i.e., today’s hash delegations are decided by last week’s block production).

Validator Election and Leader Selection

The top 21 validators system is ranked by the weighted score of hash and stake. These validators are able to participate in block production. Core uses its Validator Election mechanism to rank the top 21 validators based on hybrid scores, creating the validator set for a consensus period of 200 slots, known as an epoch. Each slot presents an opportunity for a block to be created and lasts 3 seconds. As such, each epoch lasts 600 seconds, or 10 minutes, and gives a validator up to 10 chances to create a block once accepted for an epoch.

Because slots are distributed in a round-robin pattern, not randomly, each validator is guaranteed at least 9 slots( i.e., opportunities) to create a block. If a validator misbehaves, it can be jailed and subsequently removed from the quorum for the next epoch.

Rewards

Block rewards, consisting of both transaction fees and a coinbase reward, are split between validators and the System Reward Contract, which pays out relayers and verifiers.

Validators receive consensus rewards in the form of both transaction fees and a coinbase reward, all paid in CORE. Validators keep a fee (which they set as their personal commission) and then distribute the rest to miners and delegators. Hash and stake delegators are distributed rewards based on the same m Parameter that dictates the weighting between hash and stake for the Validator Election.

The System Reward Contract accumulates rewards to pay out both relayers and verifiers, which must be claimed by the parties (rather than automatically sending the tokens, as is done with validator rewards to their delegates). The current maximum caps of rewards held by the contract are 10 million CORE and 1 million CORE for relayers and verifiers, respectively. Any excess CORE rewards are burnt.

Ethereum Virtual Machine Compatibility

Core Chain uses the Ethereum Virtual Machine (EVM) for its execution environment. While this environment was initially created for Ethereum, it has been adopted by many other networks, including BNB, Avalanche, Arbitrum, Optimism, and zkSync.

The EVM is the most robust execution environment in crypto, with the most active developers. Solidity, a popular EVM language, is the most popular language among crypto developers. Core Chain gains access to this pervasive ecosystem, including all developer tools and crypto infrastructure known by EVM developers from Ethereum, Polygon, BNB, Avalanche, and others. Toolings include Remix, Hardhat, Solidity, Truffle, ethers.js, and more. Infrastructure includes MetaMask, token standards (e.g., ERC-721 or ERC-20), blockchain scanners, smart contracts, and connections to middleware such as IPFS.

Electric Capital’s 2023 developer report highlights both EVM dominance and developer interest in the broader Bitcoin ecosystem. Most notably:

- 87% of multichain developers work on at least one EVM chain

- Bitcoin and Ethereum account for 40% of all crypto developers (not counting other EVM environments)

- 40% of all Bitcoin developers were focused on Bitcoin layers and scaling

coreBTC

Core Chain has a BTC bridge enshrined into the protocol, which locks BTC on Bitcoin to mint coreBTC on Core Chain.

The minting, securing, and burning of coreBTC operates as follows:

Minting coreBTC:

- A user sends BTC to a Locker's Bitcoin address

- Porter monitors the Bitcoin blockchain and submits proof of transaction to the Core Chain smart contract

- Smart contract verifies transaction via Bitcoin Light Client and mints equivalent coreBTC

Protecting coreBTC:

- Lockers deposit overcollateralized assets as collateral

- Liquidators monitor collateral ratios and force liquidation if collateral drops too low

- Liquidators use coreBTC to buy Locker's tokens at discount, burning coreBTC

- Guardians monitor Lockers for misbehavior like unauthorized transfers

- Slash Locker's collateral as penalty, burning coreBTC equal to violation

Burning coreBTC:

- User requests to burn coreBTC, specifying Bitcoin address

- Smart contract burns coreBTC and alerts Locker

- Locker sends equivalent BTC to user's address

- Transaction verified by Bitcoin Light Client

Key participants include:

- Users

- Send BTC to mint coreBTC

- Request to burn coreBTC to redeem BTC

- Lockers

- Hold users' BTC on Bitcoin blockchain

- Deposit overcollateralized assets as collateral

- Send BTC to users redeeming coreBTC

- Porters

- Monitor Bitcoin blockchain for transactions to Lockers

- Submit proof to Core Chain to initiate coreBTC minting

- Core Chain Smart Contracts

- Mint and burn coreBTC

- Verify Bitcoin transactions via Light Client

- Manage Locker collateral and slashing

- Bitcoin Light Client

- Verifies Bitcoin transactions for Core Chain

- Liquidators

- Monitor Lockers' collateral ratios

- Force liquidation if collateral drops too low

- Guardians

- Monitor Lockers for misbehavior

- Trigger slashing of Locker collateral for violations

- Slashers

- Can report Locker violations to trigger slashing

- Rewarded with portion of slashed collateral

The CORE Token

The CORE token is used for transaction fees, staking (and mining) rewards, and governance. It has a total supply of 2.1 billion, to be distributed through block rewards over 81 years. CORE also has a minor deflationary mechanism, as it can burn excess rewards for relayers and verifiers.

The development of Core Chain was entirely self-funded. CORE’s total supply of 2.1 billion is distributed between contributors, users, miners, reserves, treasury, and relayer rewards.

Governance

Governance of Core DAO, managed through the CORE token, is in Stage 1.5, with Stage 3 being the end goal for decentralization. Changes to Core Chain are proposed through Core Improvement Proposals (CIPs) and can be proposed by any member of the community.

Stage 1: Offchain Governance

Proposals are made offchain and are passed with a majority vote. The voting period is seven days.

Stage 2: Partial Onchain Governance

If passed, the next stage of governance would allow changing fixed parameters with onchain voting. The m Parameter is already subject to governance, but this would extend it to other variables, such as the percentage of burned fees (currently 0%). There are also discussions around adding time delays to discourage vote selling.

Stage 3: Full Onchain Governance

This Stage is not fully fleshed out and is in development by the community. Ideas include requiring collateral to post proposals.

State of the Core Ecosystem

Many protocols in Core Chain’s ecosystem are focused on BTC and BTC derivatives (i.e., Bitcoin-native assets based on BTC such as Ordinals NFTs). BTC is largely an underutilized asset, as the limited programmability of Bitcoin Script makes it challenging to activate BTC in conventional DeFi protocols while maintaining custody of the asset(s). With a consensus mechanism integrated with Bitcoin’s own consensus, Core Chain aims to provide a DeFi environment for protocols to utilize BTC assets with minimal trust assumptions. Core Ignition is a six-month incentive program intended to catalyze more growth around Bitcoin DeFi.

Notable native projects already on Core Chain include:

- Glyph — a DEX and liquidity hub

- Colend — a borrowing and lending protocol

- NLX — a perps DEX

- Spiritdex — a Uniswap V4 style DEX

- WizardNFT — an NFT marketplace for Core NFTs and bridged Bitcoin Ordinals

- CoreX — a social DEX

- Pinksale — a launchpad

- Element Wallet — a Core-native mobile app with built-in chat and wallet features, designed to be the end-to-end interface for Core Chain users.

- Satoshi App — a mobile application designed for Core ecosystem airdrops, enabling users to earn tokens of protocols launching on Core Chain.

- BitStable — a stablecoin issuers that takes both BTC assets and Ethereum assets as collateral

As discussed in the Technology section, Core Chain has an enshrined BTC bridge, but it also has connections with third-party bridges to interop with other ecosystems:

- LayerZero — a bridging integration that connects Core Chain to Avalanche, BNB, Arbitrum, Polygon, and other networks

- Multibit — a BRC-20 focused bridge connecting Core Chain to Ethereum, BNB, and Bitcoin

Core Chain also features cross-chain dapps and infrastructure that have originated in other ecosystems, including:

- Pyth — an oracles service

- Ankr — an RPC service

- IceCreamSwap and SushiSwap — DEXs

Upcoming Core ecosystems projects include

- NLX — a perpetuals DEX

- A launchpad and DEX for bridged Ordinals (NFTs and BRC20s)

Competitive Landscape

Bitcoin layers have proliferated dramatically since the start of 2023. A space that previously only consisted of a handful of state channels, client-side validated (CSV) networks, and sidechains, is now home to over 40 projects, although most are still in development.

The leading incumbents include Stacks, Rootstock, Liquid, and Lightning Network. Core Chain’s EVM-compatible, sidechain model is

- Similar to Stacks in that they’re both sidechains. Both networks’ consensus adaptations (Stacks’ Stacking and Core Chain’s Satoshi Plus) rely on not only Bitcoin miners but also a PoS component for added security. Stacks uses the Clarity execution environment, which does not a community as robust as the EVM one.

- Similar to Rootstock in that they’re both sidechains. Both networks’ execution environments are the EVM. Rootstock uses direct merge-mining without any PoS component, unlike Core Chain’s Satoshi Plus consensus, which includes a PoS component.

- Similar to Liquid in that they’re sidechains. Liquid is more limited in functionality, unlike the Turing-complete EVM execution environment of Core Chain. Liquid operates as a federation, as opposed to the open network that is Core Chain.

- Unlike Lightning Network, which is a state channel. Lightning offers no added functionality (other than scaling), unlike the Turing-complete EVM execution environment of Core Chain. Lightning does not require any additional trust assumptions (i.e., users can unilaterally exit from a channel after a challenge period). Unlike Core Chain’s Satoshi Plus consensus, it places trust in Core nodes for duties such as consensus and transaction integrity.

More recently, newer layers have emerged, such as BOB, Citrea, Bison, and more. Several of these entrants are leveraging the EVM as they explore the development of rollups. Currently, rollups cannot exist on Bitcoin due to technical limitations. However, this could change in a few years time, building on innovations such as BitVM to support the key features needed to be considered a rollup:

- Enforcing the validity of rollup transactions on Bitcoin L1 with validity or fraud proofs. With fraud proofs, it a rollup would require a permissionless and open set of challengers rather than a federated set like many of today’s BitVM-based models propos).

- Storing necessary calldata on Bitcoin to recreate the rollup’s state.

- BTC bridging with minimal trust assumptions, allowing for unilateral exits from the rollup back to Bitcoin L1.

Many existing sidechains will likely reduce their trust assumptions and gravitate towards rollup models as the tech becomes available. Also, many of the upcoming rollups will initially launch as sidechains. This would be a similar route compared to the gradual development of Ethereum L2s, which ran in production for years before nearly any of them had working proofs (fraud or validity) to enforce transaction validity.

Roadmap

Core has a series of development plans on its roadmap:

- Non-custodial BTC Staking: A third component of Satoshi Plus, any BTC holder can use absolute time-locks to delegate their Bitcoin to Core validators in exchange for token rewards, all without giving up custody of their private keys.

- Local fee markets: These can make transactions more predictable and potentially cheaper.

- Atomic swaps: Leveraging HTLCs, atomic swaps could be used for general purposes.

- coreBTC improvements: Integrating coreBTC with Core Chain’s Satoshi Plus consensus and using multisig wallets can increase the security of the asset. Additionally, Lockers could be given more collateral options.

- coreBTC as a gas token: This would allow users to pay for transaction fees in either CORE or coreBTC and would enable users to interact with the ecosystem without using any other asset than BTC.

- Bitcoin LST: This would allow BTC stakers to earn yield on their BTC while also using that BTC for various applications on Core Chain.

- Restaking: This would enable other protocols to benefit from Core Chain’s Bitcoin protection.

Closing Summary

The number of Bitcoin layers has exploded over the past six months, with renewed optimism for Bitcoin programmability. Core Foundation was one of several teams already building in the Bitcoin ecosystem for years, finding themselves greatly positioned to capitalize on the momentum of Bitcoin layers.

Core Chain is a scaling and programmability solution for Bitcoin that is differentiated by its Satoshi Plus consensus, EVM execution environment, Core DAO governance, and coreBTC bridge. The Core Chain community is building an ecosystem of Bitcoin-focused applications, leveraging Bitcoin security wherever possible along the way. In the coming months, Core Chain plans to iterate towards its governance role and catalyze more ecosystem development with incentives programs.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Core Foundation. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Red is a researcher, educator, and developer in the web3 space. Red's background is in electrical and software engineering. His main interest is privacy technology, through zero-knowledge proofs and general cryptography.

Read more

Research Reports

Read more

Research Reports

About the author

Red is a researcher, educator, and developer in the web3 space. Red's background is in electrical and software engineering. His main interest is privacy technology, through zero-knowledge proofs and general cryptography.