Key Insights

- Macroeconomic factors are pushing users to high-revenue, uncensorable social platforms.

- Open Social ecosystems are competitively favored relative to closed-source social platforms.

- Creator revenues and reputation features can provide DeFi ecosystems much-needed inflows decoupled from speculation.

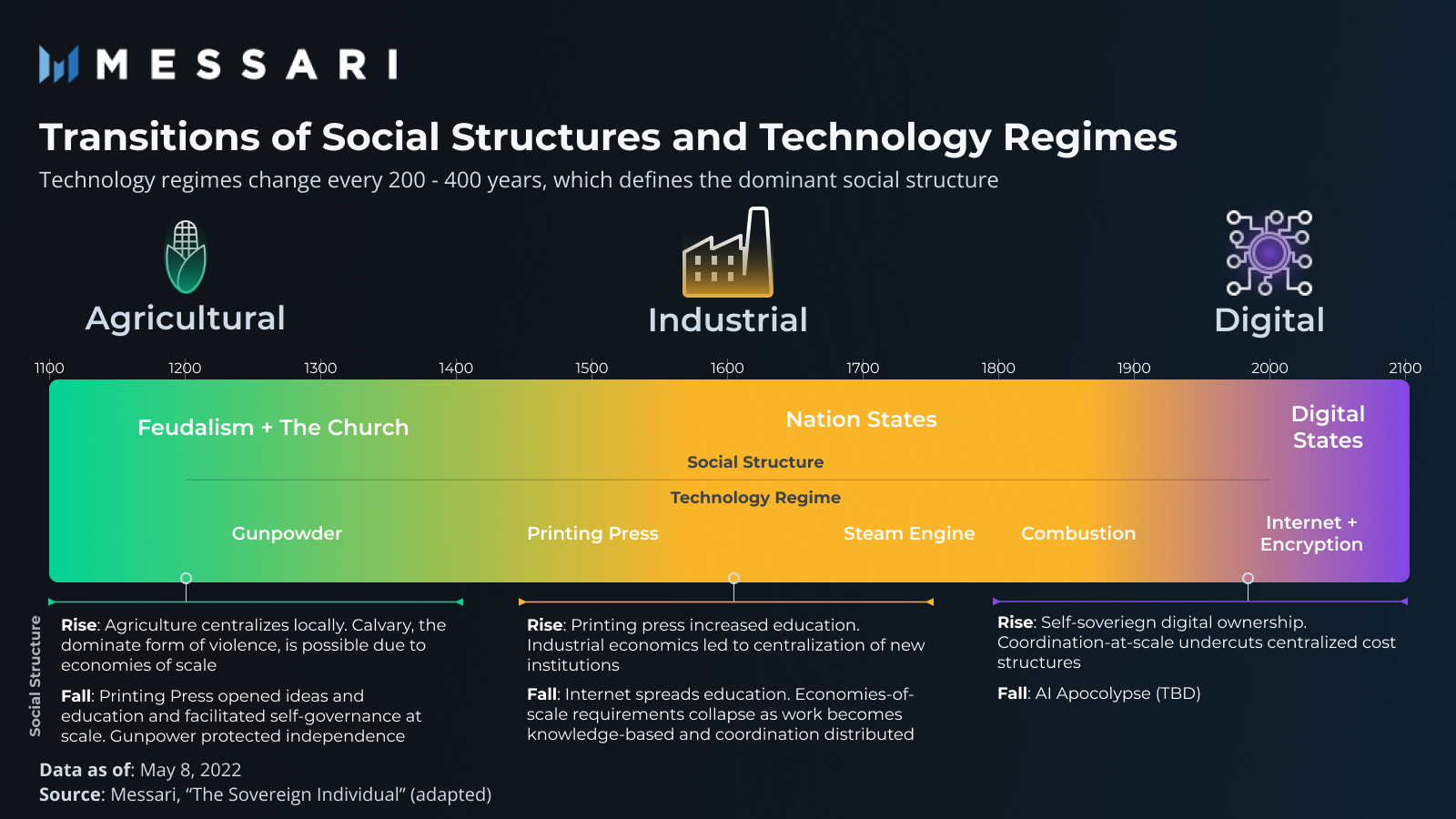

Crypto isn’t a financial tool, it’s a social tool. It breaks down industrial-age economies of scale and replaces them with digital-age coordination at scale. Given today’s macroeconomic backdrop of demographic-induced wage strain and monetary debasement, people are looking for new ways to earn and connect. In the future, social protocols will define how people organize and how culture flows.

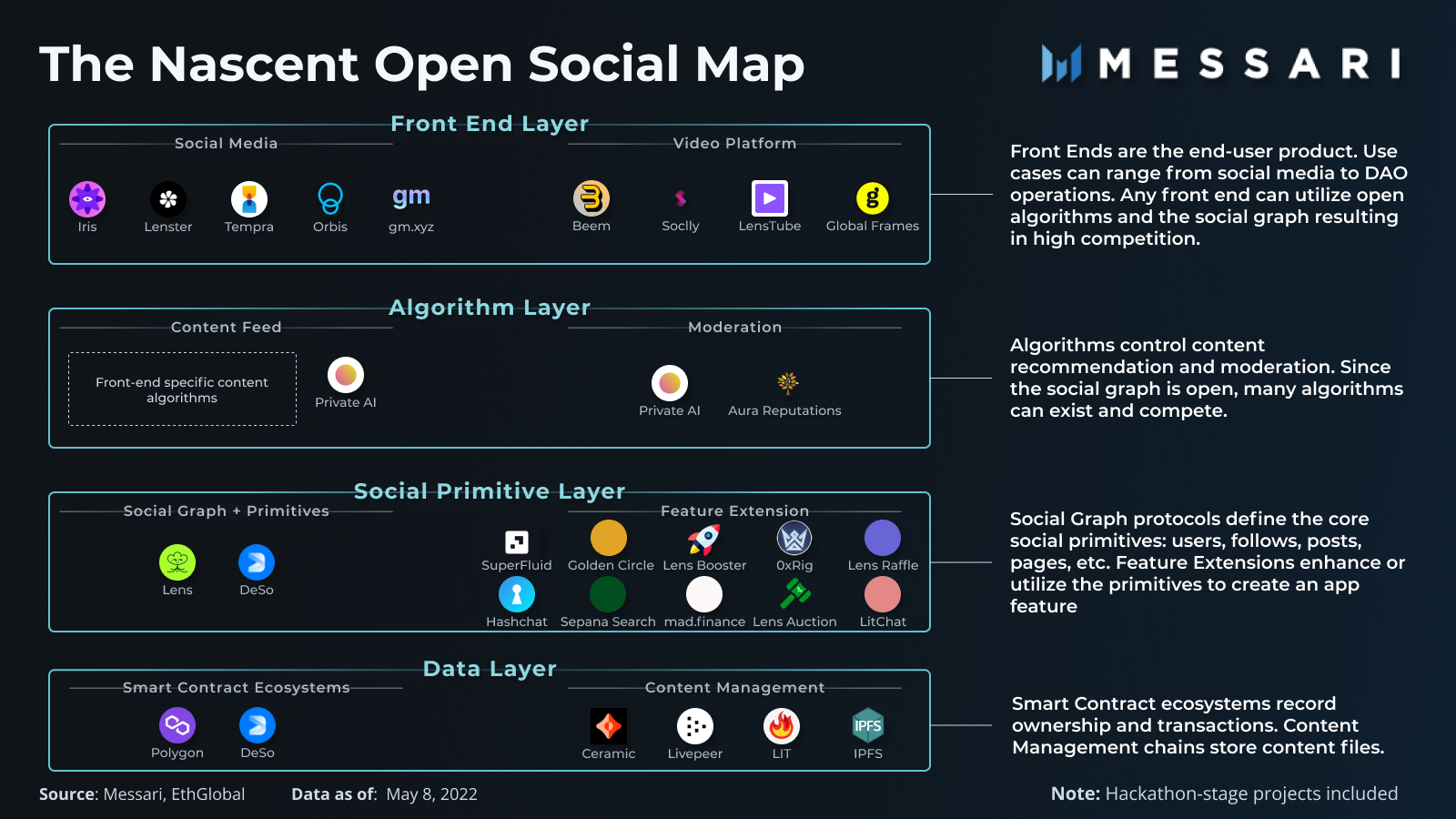

Open Social is the crypto-native approach to rearchitecting the traditional social media (tradSoc) tech stack. Instead of closed databases, algorithms, and source code, the Open Social stack is transparent. An open social graph (data layer) is uncensorable and interoperable — any front end, algorithm, or application feature can build on top without first getting its own user network or asking permission.

The result is a fundamentally different competitive landscape for social media platforms.

Before, upstart social platforms faced the cold start problem where significant amounts of users had to be onboarded before adequately testing the product’s product-market-fit. Acquiring users is the toughest and most expensive aspect of new social platforms. This led to existing social platforms dominating the marginal feature addition as they poured their outsized advertisement revenue share back into feature development.

Open Social breaks the cold start problem with token incentives. Additionally, feature development becomes Darwinian as free competition on top of an open social graph ensues. Instead of centralized platforms choosing feature capital allocations, users and venture become the dominant allocators. This model undercuts the centralized closed social cost structure and optimizes feature richness.

The Open Social stack is nascent but can be broken down into a few key layers, each with its own value capture attributes.

The Open Social Stack

Data Layer

The Data Layer can be broken out into two distinct functions. The first function is the smart contract ecosystem. It stores the smart contracts themselves and facilitates transaction settlement. Polygon is the chain receiving the most development attention due to its low-cost transactions. Social protocols will produce sizable, low-value transactions such as following and retweeting which would not be economical even on Ethereum rollups where transaction costs are over $1.

The second function is more specific to social protocols and is focused on content management. These protocols are often a standalone network (Layer-1) that is specifically designed to manage and store content file data. Think images, video, text, etc. Three protocols in this area are currently sponsoring social protocol development: Livepeer, Ceramic, and Lit Protocol.

Livepeer is a decentralized video hosting network that powers many livestreaming and video social network features being built. Ceramic is more generalized and offers content storage on top of IPFS. Additionally, Ceramic offers an identity tool that serves as a cross-chain linkage to content. Lit Protocol is primarily focused on privacy via content access control. It encrypts data and uses its node network to store and check a user’s access to the encrypted data. This enables a variety of use cases like private chats, token-gated interactions, or private content feed parameters. It can also work alongside Ceramic to provide a privacy wrapper around its open content data.

Protocols in this layer likely capture significant value as they become indispensable, tightly integrated cornerstones for decentralized social applications (migrating data and integrations is difficult).

Social Primitive Layer

The core building blocks of a social application are known as the primitives and they include structures like users, followers, posts, comments, and pages. These primitives define the basic data layouts and the relationships between data like who follows who or who owns a post. As the linkages between the primitives are established, a social graph is formed.

Developed out of Aave’s team, Lens Protocol serves as the social graph protocol. Its smart contracts define the core primitives in a composable fashion for others to build on. Each primitive is represented as an NFT. Each profile is an NFT, every follower holds a Follower NFT, every post is an NFT and so on.

Since every post is an NFT, followers can ‘collect’ (purchase) content directly from creators. However, this is just a basic monetization property. The composable nature of Lens shines when it comes to feature extension protocols. Payment streaming protocols like SuperFluid can be bolted on to build content subscriptions. Additionally, developers can build even more complex monetization and content gating rules off the Lens core modules.

Each Lens profile can also be a DAO where its followers or a subset of its followers can be members of the DAO. Proposal interaction and general DAO activities can then be gated by holders of the follow NFT. As a result, DAO formation and operation can happen on the same platforms other social activities take place.

Value capture at the social graph layer is significant. There likely will only be one or two social graphs due to the network effect value. Additionally, the social graph spreads with followers having to take an action and hold the follower NFT. This means the social graph cannot be forked by copying the open data. The social graph layer likely also benefits from a more competitive front-end layer issuing tokens to grow their user base. This grows the social graph layer without having to directly incentivize.

Algorithm Layer

Algorithms are widely used in social applications to intelligently suggest content, moderate content, conduct searches, deliver ads, and more. They have effectively become the key component that social media platforms compete on.

With an open social graph layer, algorithm development becomes democratized. In theory, any developer team can create algorithms on top of the open data, and any front-end application can utilize the algorithm.

The openness and competitive aspects of democratization of the algorithm layer benefits users, but it does come with tradeoffs. Traditionally, algorithms benefit from the vast amounts of data collected on the front-end side (views, scroll times, etc.). The first iteration of Open Social apps will likely have critical algorithms built in conjunction with their front end for this reason.

Value capture is murky, with the front end owning the user and the social graph layer owning the data. This leaves the algorithms in a middleware state with no strong claims to either of the two strongest moats. Likely, this results in commodity-like value for the layer on a long-term horizon.

Front-End Layer

Front-end applications are the user-facing layer. With an open social graph, multiple front-ends can exist on top of the same data. Additionally, front-ends are free to use any algorithm or feature set within their app. This shifts the competitive dynamics from tradSoc’s proprietary data to superior user experience. Iris, Lenster, and Tempra are a few examples of recent hackathon projects in this layer.

Key Features of Open Social

Although the Open Social stack has many notable features, there are a few that really stand out.

Monetization Models

The most significant aspect of Open Social is the variety of monetization models available.

Creators on tradSoc platforms are limited to slim revenue shares sourced almost exclusively from advertisements. Additionally, the advertisement model has blanketly applied to all content verticals such as entertainment, news, and educational content. Advertisement’s perverse incentives degrade the content, and the low-revenue share leads creators to find supplemental revenue sources further fragmenting the user experience.

The open-source nature of Open Social allows creators to use a unique monetization model specific to their content style and vertical. Monetization isn’t limited to direct selling of content (NFTs) or subscriptions either. Here are a few examples:

- Curation-as-a-Service — Lens Protocol’s mirror (retweet) function allows the curator to earn a referral fee from any NFTs bought via their feed. Essentially, users can get paid if their follower buys an NFT post of another user they have reshared. This applies to any NFT post such as images, art, or music.

- Loss-Less Content Subscriptions — Followers can receive premium content by staking funds into a creator’s vault. The full amount of the funds can be withdrawn by the follower at any time, but while staked, the creator earns income from the yield generated. For example, 10,000 followers staking $100 at 10% APY is $100,000 in annual creator revenue.

- Follower Scarcity — Limit the number of premium followers and monetize via Harberger tax. This effectively introduces an order book price discovery mechanism for the creator’s premium content where followers self-set the price they are willing to sell their membership. The creator earns tax payments from the going membership price (introduced by Golden Circle).

Native DAOs

DAOs are social organizations at their core and natively belong on social platforms. Currently, the DAO experience is fragmented between Twitter, Discord, and various governance and treasury management solutions. Lens Protocol enables any profile to become a DAO. People can join and contribute to a DAO all on the same platforms they hang out on.

Private Social

Infamously, tradSoc sells user data and its algorithms use our data in opaque ways. Open Social democratizes the data but at the expense of perhaps too much transparency. Lit protocol provides a framework for making posts, chats, etc., private to only select users. This puts creators and users in control of their data visibility.

Open Reputations

On-chain reputations can be built with follower and activity data. The reputation score for an address can be extended to DeFi or used inside of social to limit bot activity.

Extendable

Fitting with the ethos of crypto, Lens Protocol is built to be extendable: any developer can add features on top of the core primitives. Additionally, it is built on the most common smart contract environment (EVM) and benefits from surrounding developers and DeFi apps. This development model is distinct from standalone social graph protocols like DeSo and full-stack applications like gm.xyz.

Open Social’s Effect on DeFi

DeFi is currently plagued by circular speculation. While useful protocols are being built, the utility has been restricted to facilitating leveraged purchases of tokens with the singular hope of price gains. All DeFi protocol revenue flows are derivative of this activity.

On-chain social networks open up content creators and curators to earn cash flows. Not only is this potentially significant revenue (Meta earned $27 billion Q1 2022), but its economic value also is derived from commerce as opposed to speculation. With income streams not tied to speculation, DeFi can take its next step in utility. For example, undercollateralized lending can then be conducted against these future cash flows and open social graphs (pseudo-identity).

Additionally, the smart contract ecosystem that facilities Open Social will gain outsized value. Once the social graph is formed, the relationships are unforkable. This cements the social graph in the network and attracts DeFi protocols to service the revenues and utilize the potential undercollateralized aspects.

Challenges

There are three key challenges social protocols face.

First, tradSoc has crypto ambitions backed by significant network effect and resource advantages. Open Social is in its nascent stages with many protocols just exiting the hackathon stage. Essentially, it comes down to this qustion: Can Twitter become Web3 enough faster than Open Social protocol developers can attract new users?

Second, social protocols produce significant amounts of data and transactions. Every retweet, post, comment, etc., is a transaction. At a meaningful social network size (10–100 million monthly active users) would produce significant transaction amounts that far exceed current chain throughputs (Polygon currently has roughly 400,000 daily active addresses). This is by far the most significant challenge.

Third, mobile is by far the preferred way to access social media. However, crypto has a notorious lack of native mobile support. The current options for using mobile crypto-based applications is a fragmented experience with wallets in one app and applications in the browser. In order to achieve meaningful adoption, the mobile user experience has to be improved.

Final Thoughts

Open Social is largely about establishing the core primitives of communities. Arguably, the rise of NFTs and DAOs has been about community as much as it has been about speculation. People simply want to connect and earn. The open social framework established by Lens Protocol natively connects all the appealing aspects of crypto thus far — DAOs, NFTs, and DeFi. As a result, the Open Social sector has a legitimate opportunity to bring the next wave of users to crypto.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Nothing contained in this report is a recommendation or suggestion, directly or indirectly, to buy, sell, make, or hold any investment, loan, commodity, or security, or to undertake any investment or trading strategy with respect to any investment, loan, commodity, security, or any issuer. This report should not be construed as an offer to sell or the solicitation of an offer to buy any security or commodity. Messari does not guarantee the sequence, accuracy, completeness, or timeliness of any information provided in this report. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Dustin was previously the Enterprise research director at Messari. He has a broad focus across crypto with a particular interest in AI x Crypto, Consumer financialization, DeFi, and general infrastructure.

Read more

Research Reports

Read more

Research Reports

About the author

Dustin was previously the Enterprise research director at Messari. He has a broad focus across crypto with a particular interest in AI x Crypto, Consumer financialization, DeFi, and general infrastructure.