Synthetix Q1 2024 Brief

Apr 8, 2024 ⋅ 7 min read

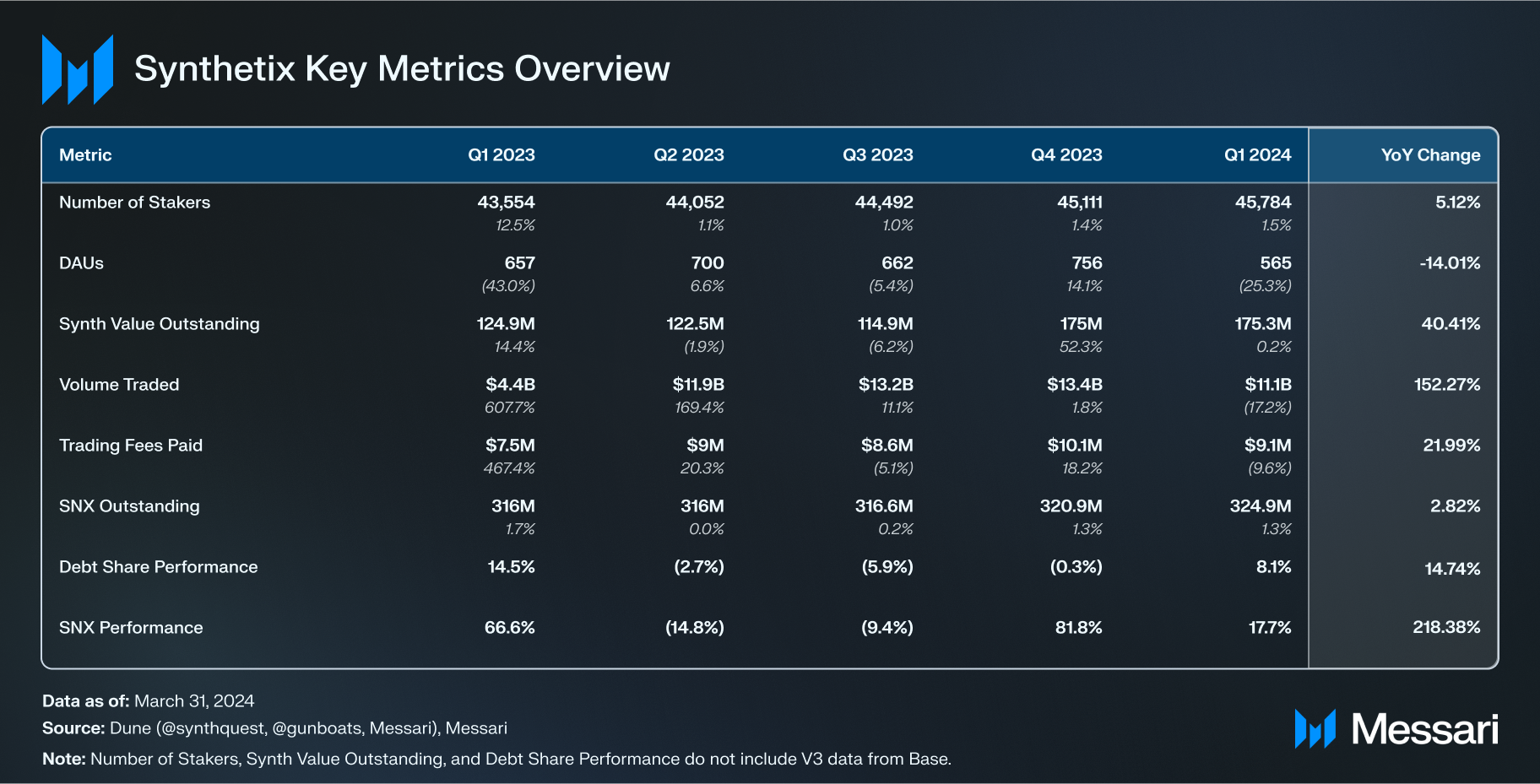

Key Insights

- Synthetix Perps V3 on Base is growing quickly with over $325 million in volume in the quarter despite limited open interest (OI) caps.

- The DAO also approved a SIP to launch V3 on Arbitrum, treasury proposals to fund R&D for launching on Sui and Solana networks, and listed new underliers on Base beyond ETH and BTC currently.

- Perps volume fell in the quarter but remained over $11 billion for the fourth consecutive quarter. DAUs also fell QoQ to 565.

- The first full quarter of no SNX inflation saw little-to-no impact on the network staking ratio, and stakers earned an average 4.3% APY from trading fees. The number of stakers grew slightly to nearly 46,000.

Primer

Synthetix (SNX) is a decentralized synthetic asset issuance and liquidity protocol that enables users to trade synthetic cryptocurrencies. Each synthetic asset tracks the price of an external asset through the use of Chainlink, Pyth, or Uniswap V3 TWAP oracles. Users can either trade in spot or in perpetual futures markets for synthetic assets. SNX is the native protocol token, used for governance and as the primary collateral asset that backs the liquidity of the network. SNX can be staked as collateral for sUSD, the Synthetix stablecoin, which can be traded on Synthetix for any other synth (sAsset). Synthetix V2x is live on Ethereum and Optimism, and V3 launched on Base in Q4 2023. Synthetix Perps is the protocol’s leading product. The DAO uses a novel V3 Governance Module (V3GM), which has councils of representatives voted on by SNX holders.

Website / X (Twitter) / Discord

Key Metrics

Performance Analysis

Perps Volume and DAUs

Strong trading volumes on Synthetix continued in the first quarter of 2024 with over $11 billion in volume for the fourth consecutive quarter. Volume on V3 was over $325 million in its first full quarter. Meanwhile, the open interest (OI) caps on BTC and ETH slowly increased (OI caps were $1 million for January and most of February, then increased to $10 million in mid-February with a proposal pending to increase to $20 million). Q2 will likely see a larger rollout of V3 on Base, with SNX, SOL, and WIF perps recently approved and likely more coming.

Fees to Stakers

In the first quarter without SNX inflation incentives, SNX stakers earned over $9 million in fees in Q1’24, down slightly from the $10 million in the previous quarter. The Synthetix Optimism deployment continues to generate nearly all of the fees for stakers. Trading fees on Optimism and mainnet are not paid as a dividend but rather by burning sUSD, which reduces debt for stakers. Synthetix Perps V3 on Base instead takes a portion of fees (40%) and allocates them to buying back and burning bridged SNX. In Q1’24, Perps V3 on Base generated over $130,000 in total fees paid and led to over 9,300 SNX burned. The rest of the trading fees are split between LPs (40%) and integrators (20%).

OI and Staker PNL

Following a wildly successful first year of Synthetix Perps V2, stakers continued to earn positive PNL in Q1’24. V2’s key feature empowers market makers to collect the spread created by takers buying or selling against LP collateral (staked SNX). This design keeps LP exposure near zero (though certainly not risk-free). Instead of collecting spread, LPs collect fees on increased volumes (the initial trade and the market maker) and have significantly reduced exposure to trader’s directional preference.

Open interest (OI) also measures the risk being taken and the demand for Synthetix Perps. After peaking at over $200 million in December 2023, OI fell in the beginning of 2024 but later increased along with trading activity. The quarter ended with $154 million in open interest on Synthetix. OI on Synthetix is a bit different than on order-book DEXs, but it probably gives a better read-through on demand for perps. Synthetix V2 continues to attract demand, and in the last quarter, it did so without any added incentives to traders.

Synthetix V3 is Growing

Synthetix Andromeda brought Perps V3 to Base in 2023. OI caps increased from $10,000 to $1 million in January, then to $10 million in the second half of February. SIP-363 was also passed, allowing the listings of SNX, SOL, and WIF perps on V3. As activity on Base picks up, Synthetix V3 will be well-positioned in the new economy. To help further grow adoption, the DAO approved USDC and SNX incentives on Base. V3 has different tokenomics than Perps V2, with USDC staking as collateral (instead of SNX) and a fee split that sends 50% of fees to the burner address that can buy and burn SNX.

Key Developments

V3 Updates

- January 8, 2024: Increase the ETH and BTC OI and LP limit on Base from $10,000 to $1 million SCCP-309, SCCP-310.

- January 10, 2024: Launched the SNX bridge to Base and added liquidity to Aerodrome. Enabling easy bridging helps facilitate asset bridging for SNX burns and increases liquidity on Base.

- January 28, 2024: Allocated 225,000 SNX from the treasury to incentivize USDC LPing on Base STP-14.

- January 30, 2024: Implemented SIP-237, enabling SNX stakers to migrate their debt from Ethereum to Optimism without unstaking, simplifying SNX staking.

- January 31, 2024: SIP-358 introduces the lockedOImultiple to Perps V3. During liquidations, the multiple of LP collateral to OI rises to ensure sufficient liquidity for liquidations to complete.

- February 15, 2024: SIP-354 brings asymmetric funding to V3. This is a technical parameter meant to balance incentives for new LPs to enter a pool while also disincentivizing traders who monopolize OI as liquidity is being bootstrapped.

- February 24, 2024: Increase the ETH and BTC OI limits on Base from $1 million to $10 million SCCP-311.

- March 11, 2024: Deploy Perps V3 on Arbitrum SIP-367 in a new experiment for Synthetix. Perps V3 on Arbitrum will enable new collateral assets ETH, DAI, and ARB in addition to USDC. The launch will be scaled similarly to how V3 on Base has been handled.

- March 17, 2024: Increase the ETH and BTC OI limits on Base from $10 million to $20 million SCCP-312.

- March 20, 2024: SCCP-313 and SCCP-314 prepare to launch a rewards distributor contract controlled by the pDAO to distribute USDC and SNX incentives to LPs on Base.

Other Notable Updates

- January 21, 2024: SCCP 2077 activated the emergency capabilities (from SIP-2048) for a short list of assets so that the max market value can be set to zero in extreme scenarios by the pDAO.

- February 7, 2024: Kain blog on 2024 roadmap. Some ideas mentioned:

- Ethena and Synthetix partnering by launching an ETH pair on L1.

- SnaxChain, a rollup on the Optimism Superchain for governing the Synthetix protocol across networks and managing the capital flows/resource allocation among them.

- Risk council replacing pDAO and other governance improvements for the long term future of Synthetix.

- February 21, 2024: Raising fees on loans to 30% beginning on March 1 to encourage the repayment of existing Synthetix loans outstanding.

Closing Summary

After the first full year of Perps V2, perp trading on V2 in Q1’24 continued to see strong traction and drive meaningful fees to stakers. The first quarter marked the fourth consecutive quarter of volumes over $11 billion and fees to stakers over $9 million. Beyond managing V2, much of the focus now is on scaling and growing V3. The first stage includes expanding to Base and Arbitrum, and V3 has already facilitated over $325 million in volume on Base, even with restrictive OI caps. Caps are being raised and new underliers are being added, while the DAO allocates treasury assets to incentivize more liquidity. Synthetix continues to ship and is off to a great start in 2024.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Synthetix DAO. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Before joining Messari as a Senior Research Analyst, John worked in Equity Derivatives on the buy-side and sell-side for over five years. He studied macroeconomics and markets for almost a decade. Now, John spends time thinking about token design, DeFi protocols, and governance.

Read more

Research Reports

Read more

Research Reports

About the author

Before joining Messari as a Senior Research Analyst, John worked in Equity Derivatives on the buy-side and sell-side for over five years. He studied macroeconomics and markets for almost a decade. Now, John spends time thinking about token design, DeFi protocols, and governance.