Key Insights

- By the end of Q2 2022, The Graph had 392 mainnet subgraphs, up 24% QoQ.

- The migration of over 24,000 subgraphs from the hosted service to the mainnet is expected to be completed by Q1 2023.

- The Graph's ecosystem of staked indexers (+3%), delegators (+6%), and curators (+4%) continued to grow QoQ.

- In Q2 2022, The Graph saw a 36x QoQ increase in GRT revenue from query fees; with more subgraphs being migrated, this growth may offset the market downturn.

- StreamingFast, a core developer team, aims to speed up indexing by up to 100x.

A Primer on The Graph

The Graph is an indexing protocol that provides verifiable data from a wide spectrum of blockchains. It removes the need for developers to build out complicated infrastructure to get data. Thanks to The Graph, projects like Uniswap and Aave don’t have to run their own proprietary data indexing servers. Instead, developers can query open APIs of on-chain data — called “subgraphs” — from networks supported by The Graph via the GraphQL API.

To ensure the protocol runs correctly and efficiently, The Graph Network incentivizes several key roles within its ecosystem of participants:

- Indexers operate nodes on The Graph Network (“Graph Nodes”) that index data from subgraphs.

- Curators analyze subgraphs for quality, signaling which subgraphs are valuable to index.

- Delegators stake The Graph’s native token GRT to indexers, earning a portion of query fees and indexer rewards without running a Graph Node.

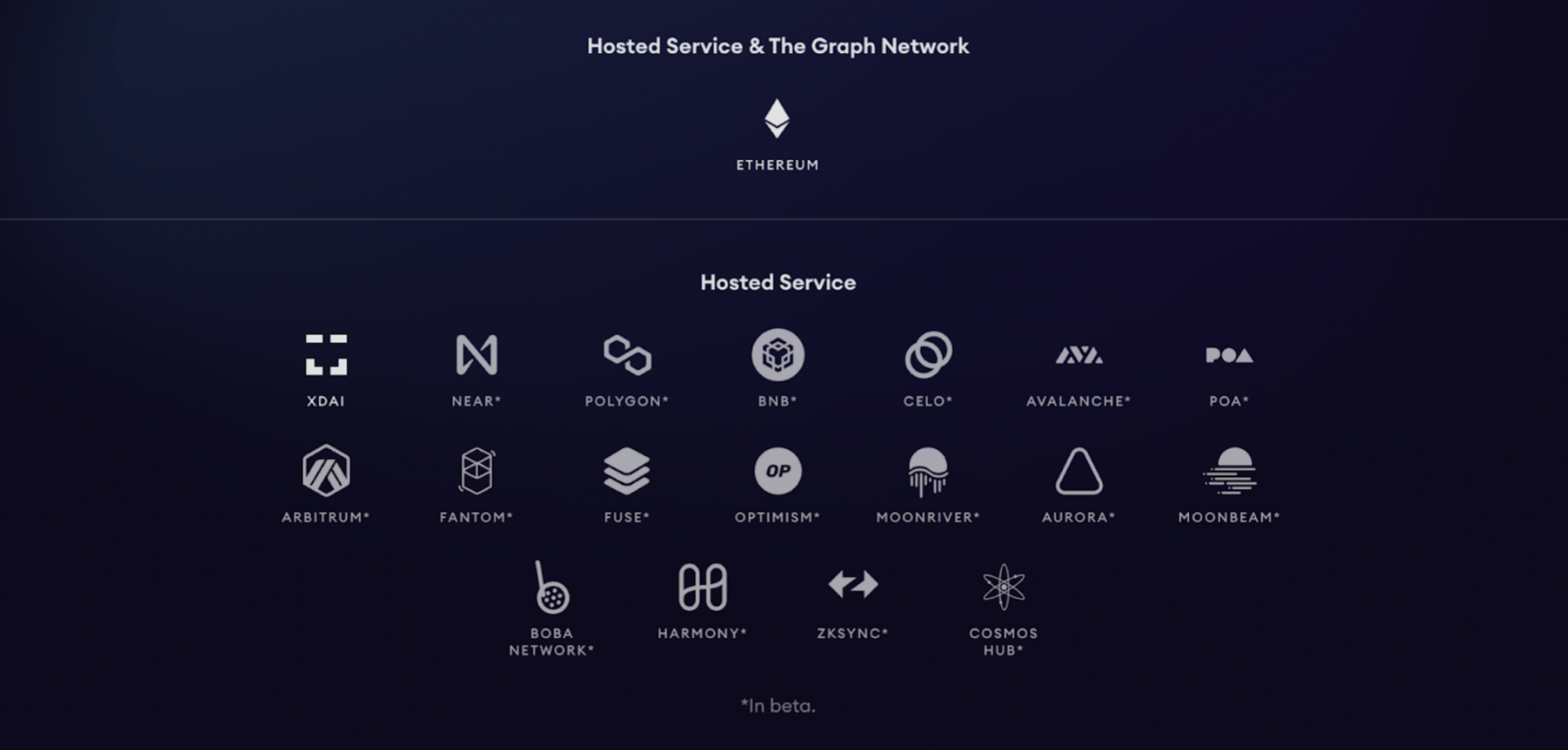

As of July 2022, only Ethereum is supported by The Graph’s decentralized protocol; over 30 networks are currently supported by The Graph’s hosted service.

Performance Analysis

The Graph ecosystem revolves around the relationship between subgraph developers and data consumers (e.g., app developers) that pay to query subgraph data. The performance of The Graph Network can be measured by the number of active subgraphs, the network’s revenue in query fees, and the activity of indexers, delegators, and curators.

Network Usage (Subgraphs)

To bootstrap The Graph, a hosted service was initially created. The hosted service is free and consists of a large indexer run by Edge & Node, the initial team behind The Graph. As of Q2 2022, the hosted service supports over 24,000 subgraphs. The goal of this service is to host subgraphs as the protocol gradually transitions into its decentralized mainnet.

Today, The Graph protocol is a hybrid of its hosted service and decentralized mainnet. The first subgraph launched on the mainnet in Q1 2021. Since then, the number of subgraphs launched to the mainnet has been growing steadily QoQ. Unlike the hosted service, the mainnet requires users to pay a fee per query. As of June 30, 2022, there were 392 active subgraphs on the decentralized mainnet, which is a 24% increase from the previous quarter. In addition to the active subgraphs, 165 subgraphs are currently in deployment.

Source: The Graph Explorer

Over the next several quarters, the number of deployed subgraphs on the decentralized mainnet is expected to continue growing. The Graph community aims to migrate all subgraphs from the hosted service to its decentralized mainnet by the end of Q1 2023. This increase in mainnet subgraphs is expected to facilitate growth among other key metrics of The Graph, ranging from ecosystem participation to the amount of revenue generated from query fees.

Ecosystem Participation

Subgraphs provide an arena for both technical and non-technical ecosystem participants to interact symbiotically. Indexers operate Graph Nodes to process and store on-chain data. Data consumers can then query this data via GraphQL. Curators signal to indexers which subgraphs are valuable to index. Curators may also often act as subgraph developers. Those ecosystem participants who lack the technical know-how or resources to index may choose to delegate GRT to indexers. Staked GRT is required for indexing subgraphs. As indexers receive more GRT via delegation, they increase their capacity to collect a larger portion of the indexing rewards.

The number of indexers (+7%), delegators (+6%), and curators (+4%) continues to increase QoQ as more mainnet subgraphs are deployed. In particular, the growth of indexers is critical to scaling the network and thus requires a more detailed analysis.

Indexers monetize their indexing and query processing services on The Graph’s query market by staking GRT. The minimum stake for an indexer is currently set to 100,000 GRT ($9,340 as of June 30, 2022). Indexers don’t need to provide all of the stake, as they can also receive delegated stake from other users.

There are two types of indexers: active and inactive. Active indexers allocate their own stake towards their subgraphs to earn rewards. In contrast, inactive indexers do not earn rewards, since they do not stake their own GRT.

While the number of active indexers has been hovering between 155 and 167 since Q1 2021, the number of inactive indexers continues to grow. An explanation for this growth may be that inactive indexers are anticipating the migration of more subgraphs to the mainnet, which would lead to more indexing opportunities relative to the number of staked indexers, provided they decide to stake their own GRT.

Network Revenue

Participants in The Graph’s ecosystem earn revenue in GRT by performing work in the form of indexing and querying services on the mainnet, which requires GRT to be staked. This makes GRT a work token. The two main sources of revenue on The Graph are inflationary indexing rewards and query fees paid by end users. Revenue from both indexing rewards and query fees is funneled through indexers.

Source: The Graph: Choosing Indexers

Every indexer is free to define their own individual cut of query fees and indexing rewards, based on the supply and demand dynamics of the open marketplace. According to this individual cut, each indexer then distributes the revenue to delegators. As per the above example, if an indexer set the query fee cut to 15.2%, the delegators who delegate stake with them would receive 84.8% of the fee revenue.

Indexing Rewards (Protocol Rewards)

Indexing rewards come from a 3% annual inflation in the GRT supply and are distributed to staked indexers in return for providing indexing and querying services on the open marketplace.

The amount of GRT rewarded in Q2 2022 increased 6% for indexers and 12% for delegators on a QoQ basis. Notably, since Q3 2021, indexers have seen an increase in indexing rewards.

The steady increase in indexer rewards since July 2021 can be attributed to indexers continuing to stake more GRT, given that indexing reward cuts generally stayed flat for individual indexers. As the number of The Graph participants continues to increase and more GRT is staked/delegated, indexers and delegators will have to increase their staked GRT share to earn a similar nominal amount of rewards.

Although the total allocated GRT has remained between 2.7 billion GRT and 3.1 billion GRT since July 2021, the number of staked GRT continues to grow with the number of indexers. The amount of staked GRT should also increase to account for the onboarding of new indexers as more subgraphs are deployed to The Graph mainnet and more indexers service the growing protocol.

Query Fees (Network Usage Fees)

The second source of network revenue comes from query fees. Data consumers (e.g., app developers) pay query fees for indexers to fetch and organize data for them. Query fees are determined by market demand and distributed to curators, indexers, and delegators. That is, not only do indexers and delegators benefit from query fees, but so do curators.

Because queries are priced in USD and determined by market demand, query fee revenue earned in GRT is affected by both network activity and GRT price volatility. Holding demand constant, if the price of GRT increases, query fees collected in GRT would decrease.

While query fee cuts generally stayed flat for individual indexers, revenue from query fees increased 36x in GRT terms in Q2 2022 relative to the previous quarter. The increased subgraph usage somewhat offset the GRT price drop in USD terms. With more subgraphs migrating to the mainnet, query fee activity should continue to increase for, at least, the next two quarters. This may further lead to increased revenue in GRT terms.

Qualitative Analysis

Notable Events

Amid the overall market downturn and the troubling global macroeconomic environment in Q2 2022, The Graph community continued to steadily develop its ecosystem. There are several notable developments in Q2 2022 that are worth highlighting.

Developments

Released by The Guild, a core dev team, The Graph Client is a suite of tools aimed to enhance the experience of building decentralized applications. One of the tools from The Graph Client allows consumers to query data from multiple subgraphs and create unified views. Similar to joining tables on SQL, if a DEX is launched on two separate blockchains, an end user could aggregate the DEX data from each blockchain into a single location using this particular tool.

Geo Browser was announced by Edge & Node in June 2022. Geo Browser allows users to create, publish, and vote on user-contributed content, from blog posts to job boards to data sources. Data consumers can index Geo’s smart contracts and IPFS data via the Geo Browser subgraph.

StreamingFast, a core developer team of The Graph, is building a tool called substreams to improve indexing performance for subgraphs. Substreams add composable, high-throughput, parallelized pathways that feed data to subgraphs and end-user applications. These new pathways are set to increase the indexing speeds by up to 100x.

The Graph AdvocatesDAO was introduced in April 2022 as a step toward decentralizing governance of community grant proposals. It received a $250,000 grant from The Graph Council to seed the DAO’s treasury that funds grants under $20,000. The AdvocatesDAO is responsible for the operations and scaling of the Advocates Program, a community-led initiative where advocates contribute content related to The Graph and Web3 to inform the public.

Grants

In June 2022, The Graph Foundation awarded Messari $12.5 million to become a core subgraph developer. Messari plans to build and standardize 200 subgraphs over the next two years using this grant. Messari’s goal is to make data readily accessible across protocols and to include alternative datasets, e.g., governance and account holdings, investments, and debt positions.

The Graph Foundation also awarded GraphOps, a blockchain data infrastructure company, $12 million to become a core developer. GraphOps plans to provide R&D on protocol economics and network operations. It also plans to lead the core development of various initiatives, including a Gossip Network for indexers and an improved indexer experience.

In April 2022, The Graph Foundation announced that it distributed $1.25 million to over 30 grantees in its fifth wave of community grants. These grants were awarded to individuals and teams working on protocol infrastructure, tooling, decentralized applications, subgraphs, and community building.

Integrations

Source: The Graph

The Graph completed beta integrations to its hosted service with three major protocols in Q2 2022: Arweave, Cosmos, and Arbitrum. The beta integration with Arweave brings data consumers closer to fully accessing storage data on the protocol. Cosmos Hub marks the third integration with a non-EVM network on The Graph, enabling consumers to index data directly from the Cosmos Hub blockchain. The beta integration with Arbitrum adds indexing and querying support to yet another EVM-compatible blockchain.

Roadmap

In the spirit of decentralization, various teams contribute to The Graph’s development. These working groups focus on five key areas of the protocol’s roadmap: data & APIs, SNARK Force, The Graph protocol economics, network operations, and indexer experience.

In Core R&D Calls, The Graph contributors maintain high-level discussions about rolling updates from the five working groups. The working groups cover several roadmap items based on Q2 R&D Calls (12, 13, and 14) and passed Graph Governance Proposals (GGPs).

Key Roadmap Items

- The migration of all functionalities to The Graph’s mainnet in Q1 2023 will effectively sunset the hosted service.

- StreamingFast is currently building the substreams tool which is set to increase indexing speeds by up to 100x.

- GGP 0012 will allow indexers to altruistically serve queries and close expired allocations without penalty. Additionally, GGP 0011 will increase the minimum curation signal to 500 GRT.

- The Indexer Allocation Optimization tool, implemented by Semiotic AI, will help indexers allocate GRT for optimized rewards. Semiotic AI is also developing the Graphism tool to allow developers to work within a walled-off, locally run version of the protocol, like a test environment.

- Messari is presently developing and maintaining roughly 200 standardized protocol subgraphs.

- Epoch Block Oracle is set to facilitate multichain indexing and let indexers know which blocks should be used to close allocations.

- The capability to index Arweave as a file storage network in addition to simple blockchain data is currently under development.

Closing Summary

The migration from a hosted service to a decentralized network (mainnet) is at the forefront of The Graph’s priorities. As of July 2022, The Graph Network’s mainnet only supports Ethereum, while the hosted service supports Ethereum and 30 other networks. The Graph is expected to sunset the hosted service by the end of Q1 2023. The coming quarters should see large increases in query fees and revenue as over 24,000 hosted service subgraphs are migrated to The Graph Network’s mainnet. This increase in volume may attract more key participants to the protocol as it drives profitability for existing ones. By increasing its number of subgraphs, The Graph will continue to remove technical barriers for developers, ultimately leading to faster innovation across Web3.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

Messari is a Core Subgraph Developer for The Graph and the recipient of a grant from The Graph Foundation. Author(s) may hold cryptocurrencies named in this report, and each author is subject to Messari’s Code of Conduct and Insider Trading Policy. Additionally, employees are required to disclose their holdings, which are updated monthly and published here. This report is meant for informational purposes only and should not be relied upon. This report is neither financial nor investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Nothing contained in this report is a recommendation or suggestion, directly or indirectly, to buy, sell, make, or hold any investment, loan, commodity, or security, or to undertake any investment or trading strategy with respect to any investment, loan, commodity, security, or any issuer. This report should not be construed as an offer to sell or the solicitation of an offer to buy any security or commodity. Messari does not guarantee the sequence, accuracy, completeness, or timeliness of any information provided in this report. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Mihai is director of research at Messari. Mihai and his team cover base layers, mid-layer infrastructure, DeFi, and consumer. Prior to joining Messari, Mihai was a tech entrepreneur and worked in AI at UBS and Swiss Re. His background is in computer science and math. Mihai holds a PhD in information systems from ETH Zurich, Switzerland

Onchain Jíbaro. Background: Photography, Quantitative Banking, & Manual Labor.

Read more

Research Reports

Read more

Research Reports

About the authors

Mihai is director of research at Messari. Mihai and his team cover base layers, mid-layer infrastructure, DeFi, and consumer. Prior to joining Messari, Mihai was a tech entrepreneur and worked in AI at UBS and Swiss Re. His background is in computer science and math. Mihai holds a PhD in information systems from ETH Zurich, Switzerland

Onchain Jíbaro. Background: Photography, Quantitative Banking, & Manual Labor.