Key Insights

- On September 23, the 11th protocol upgrade went live. The next protocol upgrade, slated for mid-Q4, will introduce Smart Contract Optimistic Rollups (SCORUs). The primary focus of core developers continues to be scaling.

- In general, network-wide activity decreased during the third quarter, with the exception of NFT sales volume (XTZ), which hit an all-time-high.

- NFT marketplaces continued to lead, representing the top four applications by active users.

- New smart contract deployments set an all-time-high in advance of the launch of the WebAssembly (WASM) execution environment.

A Primer on Tezos

Tezos is a Liquid Proof-of-Stake (LPoS) blockchain network that relies on low power consumption and energy-efficient consensus. It combines on-chain governance with self-amending functionality to implement forkless network upgrades and manage future changes. Tezos supports multiple smart contract languages, has a robust NFT ecosystem, and is scaling through EVM and WASM-compatible rollups and data availability layer improvements.

Performance Analysis

Financial Overview

Q2 was the worst quarter for the crypto markets in the last decade, with the total crypto market cap decreasing by 58%. Multiple bearish events coincided including the Terra LUNA collapse, 3AC insolvency, the escalating Russia-Ukraine war, and a hawkish Federal Reserve. Tezos was not spared from the carnage, losing 61% of its value by market cap.

During Q3, Tezos recouped some of the losses with a 31% bear market rally. However, the rally was short-lived because of continued hawkish central bank rhetoric. Ultimately, Tezos ended the quarter near opening levels.

Intramural metrics related to the XTZ token were consistent, while revenue-centric metrics were down substantially. During Q3, Tezos’s revenue was $191,000 (a 60% drop QoQ) with a circulating P/S ratio of 2,181x. A welcomed drop in transaction fees (58%) primarily drove the drop in revenue and a marginal drop in transaction volume (6%). For comparison, Avalanche’s Q3 revenue was $2.3 million with a circulating P/S ratio of 665x, and Polkadot’s (specifically the Polkadot Relay Chain) was $115,000 with a circulating P/S ratio of 19,945x. By traditional standards, each of these base layers has abysmal metrics. The poor revenue-centric metrics paired with high valuations highlight the difficulties in evaluating base-layer protocols.

XTZ is the native token of the Tezos ecosystem, and it has a 4.5% average annualized inflation rate with no maximum supply. XTZ also has multiple burn mechanisms including: when creating a new Tezos account, when creating a new smart contract, when allocating additional smart contract storage, and slashing for validator missteps. The token burns are purposely un-substantial; instead, they exist to disincentivize network spam and validator miscues. Through 2022, Tezos has burned an average of 73,000 XTZ per month (equaling 2% of the newly minted supply and 0.01% of the total supply per month).

Network Overview

In general, network-wide activity decreased during the third quarter. The declines were dispersed across the DeFi, gaming, and NFT sectors (more on this in the ecosystem and development section). Looking at 2022 as a whole, network usage has held up well, while account-related metrics have steadily decreased. The preservation of network activity paired with the decrease in users suggests active users are very active on the network.

Nonetheless, during Q3, overall account activity declined. Cleared accounts, defined as accounts that were emptied, decreased to the lowest level since the start of 2021. A decrease in cleared accounts is a net positive because it signals fewer people are leaving the network.

Concurrently, new accounts created decreased to their lowest level since the start of 2021. Overall, new accounts created have decreased six of the last seven quarters. When analyzing new account creation, there are critical points to note. First, all new accounts created on Tezos must pay a small one-time fee, often around $0.25. The fee exists to disincentivize people from spamming the network by creating multiple new accounts. Additionally, if someone acquired a Tezos asset for the first time, like an NFT, but did not create an account, they would be excluded from this dataset. These are important factors to consider when evaluating account activity across ecosystems.

Unlike account-related metrics, network usage, composed of smart contract calls and transactions, has been consistent. Smart contract calls are defined as direct calls from an end-user wallet to a smart contract. Transactions are defined as token transfers.

For most of the network’s life, smart contract calls were a fraction of total activity. However, beginning in Q1 2021, smart contract calls began to rapidly increase. They went from less than 100,000 per month to 3.6 million at the January 2022 peak. The rise began with the launch of the first NFT platform, Hic et Nunc, and continued with the ensuing Tezos NFT bull market. Comparatively, transactions have been consistent. Through the 2022 bear market, Tezos has averaged 1.3 million transactions per month, a 25% increase over the 2021 bull market. Overall, network activity has been relatively flat during 2022, which can be considered a net positive during a bear market.

In June, Tezos released Transaction Optimistic Rollups (TORUs) during the Jakarta upgrade. TORUs were the first step in scaling through rollups. As the first product release in a lengthy roadmap, TORUs were purposely simplistic and only allowed the exchange of assets. As such, minimal adoption was expected, and therefore network activity was not expected to increase. The upcoming release of Smart Contract Optimistic Rollups (SCORUs) in the L-upgrade should jumpstart activity. SCORUs will vastly expand rollup capabilities by supporting smart contract execution and introducing the WebAssembly (WASM) execution environment.

Ecosystem and Developer Overview

In Q3, to reiterate, activity largely decreased across the network. However, we find mixed outcomes when evaluating different sectors.

With active users in mind, NFT marketplaces continued to dominate. During Q3, NFT marketplaces accounted for the top four applications by active users with approximately 11,000 unique weekly active users (representing 75% of active users across the network). Objkt is the dominant marketplace accounting for 40% of all active users. DeFi had the second largest presence with three applications, followed by gaming with two. Overall, active users declined across each of the three sectors during Q3.

Despite the bear market and drop in users, NFT sales volume (XTZ) increased for the sixth consecutive quarter, reaching another all-time-high. Beginning in early 2021, with the launch of Hic et Nunc, the NFT ecosystem has experienced steady growth with new marketplaces and notable partnerships like Manchester United, Oracle, Red Bull Racing, McLaren Racing, Team Vitality, Gap, Papa Johns, Evian Water, Ubisoft, CCP Games, LVMH Guerlain, and more. The continued growth in volume, despite the lack of activity and incentives, suggests the current growth is organic and users are likely to continue with the network.

Although robust and growing, Tezos NFT activity still trails leading chains Ethereum and Solana by a wide margin. During the third quarter, Ethereum registered 1.5 million unique NFT buyers and Solana 1.2 million unique buyers, compared to the 85,000 active traders on Tezos.

Tezos ended Q3 2022 with approximately $40 million in TVL. When compared to Q3 2021, TVL is down 76% from $162 million. The leading DeFi applications offer diverse services including:

- Liquidity Baking: a liquidity pool subsidized at the protocol level

- Youves: a synthetic asset protocol

- Kolibri: a stablecoin protocol

- QuipuSwap: a DEX

- Plenty DeFi: a DEX

Overall, Tezos TVL ranks approximately 50th among ecosystems.

Tezos was listed among the largest developer ecosystems, according to the annual Electric Capital Developer Report. Despite the bear market, Tezos developer activity (measured by new smart contract deployments) set an all-time-high of 29,000 new smart contract deployments in Q3. Overall, new smart contract deployments through the first three quarters of 2022 are 189% greater than the same period last year.

Today, Tezos smart contracts execute on the Michelson Virtual Machine. The virtual machine is relatively high-level, functional, and statically typed. Application developers typically use one of several smart contract languages like SmartPy, JSLIGO, Archetype, and others.

In the upcoming L-upgrade, Tezos will release Smart Contract Optimistic Rollups (SCORUs) that extend beyond Michelson to support environments like the WebAssembly (WASM) and the Ethereum Virtual Machine (EVM). By supporting new environments, Tezos will support several popular programming languages like C++, Rust, and Solidity. The new environments and supported languages should lead to further increases in development and the migration of applications from other networks.

Decentralization and Staking Overview

During Q3, decentralization and staking metrics remained consistent. The number of active validators has been relatively stable while their stake has decreased. Meanwhile, the number of active delegators and delegator stake reached an all-time-high. Overall, the consistency in metrics related to decentralization and staking points to a functioning and healthy ecosystem.

Tezos validators, known as bakers, are well dispersed across the globe. During Q3, active validators were present in 40 countries, with the United States, Switzerland, France, and Canada having the largest presence. Members of the core development team have stated they are looking to increase Tezos’s presence in Africa, India, and South America.

Contrary to the globally distributed validator set, the validator distribution by stake is top-heavy. The top five validators, Coinbase, Binance, Kraken, Everstake, and Pos Dog, secure 36% of the network’s total stake. Additionally, the Tezos Foundation controls seven validators responsible for 12% of the total stake. As a result of the heavily concentrated validator stake distribution, Tezos has a Nakamoto Coefficient of 5. The Nakamoto Coefficient was 11-13, however, the Ithaca upgrade introduced a new consensus algorithm, Tenderbake, which implemented a BFT consensus format that requires two-thirds of the validators to sign off for the chain to progress. The shift to safety over liveliness reduced the Nakamoto Coefficient, yet it remains in range of the industry average.

The Ithaca upgrade also introduced multiple validator improvements including reducing the minimum validator requirement from 8,000 XTZ to 6,000 XTZ, increasing rewards, and improving functionality. Despite the updates, validator-related metrics have lagged. The number of active validators has been relatively stable while their stake has decreased.

Contrary to the stagnant validator metrics, delegator metrics have steadily improved. Since Q1 2021, the number of active delegators has increased by an average of 9% QoQ. Active delegator stake has followed at a slower pace increasing 1.5% QoQ, suggesting new delegators are delegating smaller amounts. Delegators are earning a nominal 6% annualized staking yield.

Since the beginning of 2021, the percentage of total supply staked has been consistent with a range of 74-79%. Approximately 80% of the total stake comes from delegators, and the proportion is becoming an increasingly larger percentage.

Tezos uses a Liquid Proof-of-Stake (LPoS) mechanism. LPoS consensus differs from the commonly used Delegated Proof-of-Stake (DPoS) consensus. In an LPoS mechanism, delegators can participate in consensus without conceding custody of their tokens. As a result, the delegated stake is completely liquid. Having a large percentage of staked tokens liquid benefits the network because the liquid tokens can be reused.

Qualitative Analysis

Strategy and Outlook

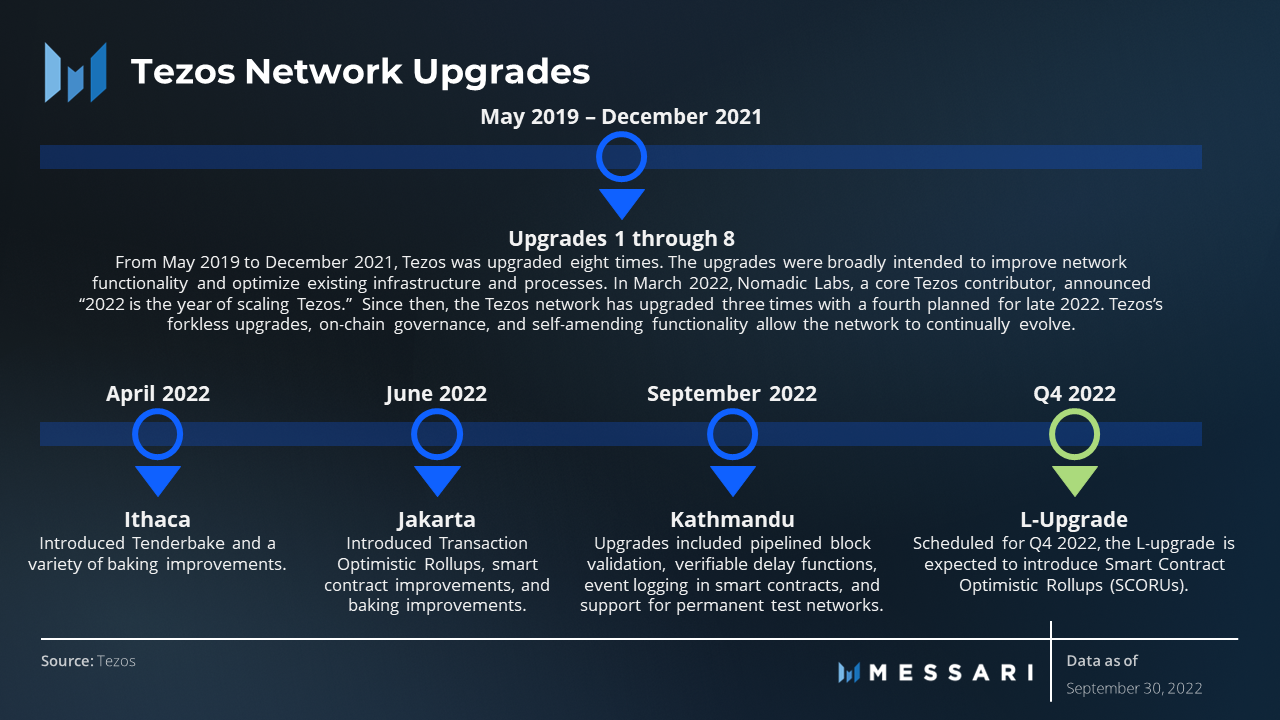

In March, Nomadic Labs, a core contributor to Tezos, announced that “2022 is the year of scaling Tezos.” Since then, the Tezos network has upgraded three times. Tezos’s forkless upgrades, on-chain governance, and self-amending functionality have allowed the network to continuously evolve.

Ithaca

The Ithaca upgrade was implemented on Apr. 1, 2022. At the time, it was the largest upgrade in Tezos history as it transitioned the network to a new consensus algorithm, Tenderbake. The upgrade, comparable to the Ethereum Merge, was intensely challenging. The team compared it to “replacing the engine of a car while it is running.” The Ithaca upgrade introduced several new features including:

- A shift to fast, deterministic finality (roughly one minute).

- A shift toward safety over liveliness by implementing a BFT consensus format where two-thirds of the validators are required to sign off for the chain to progress.

- A plethora of validator updates including reduced node operations requirements, increased rewards, and improved functionality.

Tenderbake, the new consensus algorithm, was the first step in scaling Tezos by improving latency and finality. However, it did not improve network throughput.

Jakarta

On Jun. 29, 2022, to improve the network throughput, Tezos released Jakarta, the tenth protocol upgrade. Jakarta introduced Transaction Optimistic Rollups (TORUs), an experimental solution meant to scale in the near term and help the ecosystem infrastructure adapt to rollups. While TORUs allow the exchange of assets, they don’t enable the execution of smart contracts.

Additionally, TORUs, and eventually all rollups, are built into the Tezos chain in what is known as enshrined rollups. This differs from Ethereum-based rollups, which are implemented as smart contracts. Enshrined rollups are made possible on Tezos because of the network’s self-amending capability. The benefits of enshrined rollups, over smart contract-based rollups, include reduced security vulnerabilities, reduced storage costs, increased decentralization, and forkless upgradeability along with the rest of the network.

Kathmandu

On Sep. 23, 2022, the 11th protocol upgrade Kathmandu went live. Kathmandu upgrades include pipelined block validation, verifiable delay functions, event logging in smart contracts, and support for permanent test networks. It did not, however, introduce additional scaling functionality. That will come in the L-upgrade in the form of Smart Contract Optimistic Rollups (SCORUs), scheduled for late 2022.

L-Upgrade

Currently, Smart Contract Optimistic Rollups (SCORUs) are being tested on Tezos testnetworks. They are designed with a generic structure that extends beyond Michelson to support environments like the WebAssembly (WASM) and the Ethereum Virtual Machine (EVM). By supporting new environments, Tezos will support a number of popular programming languages like C++, Rust, and Solidity, thus allowing a larger developer community to build on the network. Tezos will first focus on supporting WebAssembly.

Closing Summary

Coming off of a historical second quarter, Q3 had substantially fewer fireworks. The broader crypto market rallied 36%. Ultimately, though, the market fully retracted because of a continued hawkish central bank. Overall, Tezos’s key performance indicators yielded mixed results.

In general, Tezos’s financial and network activity had a negative quarter. Both total active accounts and total new accounts dropped for the third consecutive quarter. The decrease in account metrics was present across the DeFi, gaming, and NFT sectors. Total transactions and smart contract calls also had QoQ declines. The decrease in network activity led to a significant drop in transaction fees, which ultimately caused a 60% decrease in revenue.

There was, however, one silver lining: NFT sales volume (in XTZ terms) increased for the sixth consecutive quarter and reached another all-time-high. NFT activity continues to be the largest engine of growth across the network. The top four applications by active users are NFT marketplaces, which accounted for 75% of total active users. The persistence in NFT sales despite a bear market and lack of incentives suggests organic activity in the Tezos NFT ecosystem.

Metrics related to staking and decentralization were consistent. Since the beginning of 2021, the percentage of total supply staked has been consistent with a range of 74-79%, of which approximately 80% comes from delegators. The consistency in metrics related to decentralization and staking point to a functioning and healthy ecosystem.

Looking ahead, Tezos core developers’ focus will be on scaling the network. The Ithaca upgrade introduced a new consensus algorithm that improved latency and finality. The Jakarta upgrade introduced Transaction Optimistic Rollups. The upcoming L-upgrade is expected to introduce Smart Contract Optimistic Rollups. The rollup-centric upgrades are scaling Tezos’s throughput. While Tezos scales, it is paramount that the network continues to attract liquidity and users.

Tezos NFT activity has been persistent despite the bear market. Yet, it still trails the leading ecosystems by a wide margin. DeFi activity remains relatively small, ranking 50th amongst base layers; this space is becoming increasingly competitive. Tezos faces an uphill battle if it wants to become the dominant ecosystem.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Tocqueville Group, Inc. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Nick is a research analyst at Messari on the Protocol Services team. Prior to joining Messari, Nick worked in Deloitte's Consulting practice.

Read more

Research Reports

Read more

Research Reports

About the author

Nick is a research analyst at Messari on the Protocol Services team. Prior to joining Messari, Nick worked in Deloitte's Consulting practice.