Key Insights

- The highly anticipated Mumbai upgrade was launched on March 29. The upgrade includes Smart Contract Optimistic Rollups, reduced block times, and ZK-rollups on testnet.

- The Tezos Foundation and Google Cloud partnered to enhance Web3 application development and services to Google Cloud customers. The collaboration aims to make it easier for institutions to join the Tezos ecosystem and for developers to build on the Tezos blockchain by offering enhanced infrastructure and developer tooling.

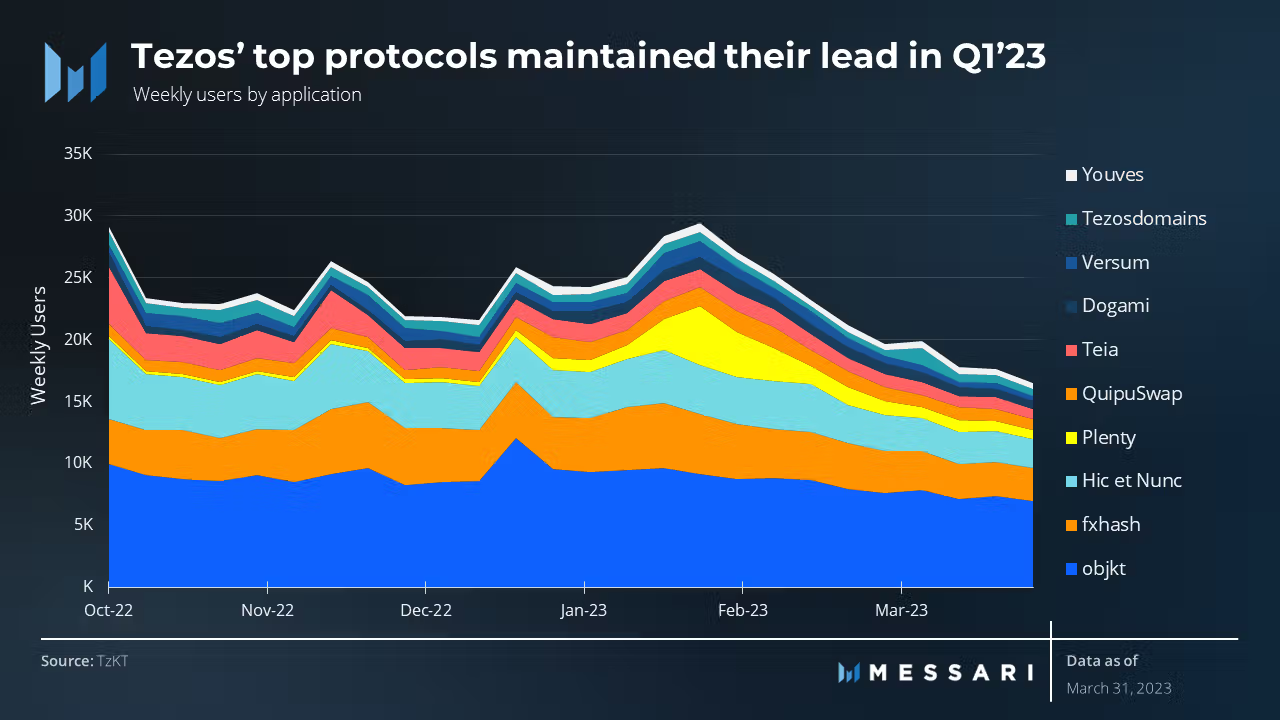

- NFTs continue to be the main driver of activity. NFT marketplaces objkt.com, fxhash, and Hic et Nunc were the top three applications by active users.

- DeFi saw a notable uptick in activity. DEX's Plenty and QuipuSwap jumped to the fourth and fifth spots in terms of active users. TVL (XTZ) set another all-time high.

Primer on Tezos

Tezos is a Liquid Proof-of-Stake (LPoS) blockchain network that relies on low power consumption and energy-efficient consensus. It combines on-chain governance with self-amending functionality to implement forkless network upgrades and manage future changes. Tezos supports multiple smart contract languages, has a robust NFT ecosystem, and continues to scale through EVM- and WASM-compatible rollups and data availability layer improvements.

Key Metrics

Introduction

The crypto industry continued to face challenges in Q1 2023, including Operation Choke Point 2.0 and early signs of systemic banking issues. Nevertheless, Tezos remained resilient and continued to build and grow. In fact, Tezos doubled down on scaling the network, delivering the 13th and arguably most important forkless network upgrade with Mumbai. Furthermore, Tezos announced multiple partnerships in its NFT and gaming sectors, while DeFi had a strong quarter.

Performance Analysis

Financial Overview

Tezos outperformed the total crypto market cap during Q1 2023, increasing 55% compared to the market's 46% increase. However, revenue from total gas fees spent decreased 23% QoQ (excluding storage costs).

XTZ serves as the native token of the Tezos network, and 42 million XTZ are minted annually. Before the Mumbai upgrade, Tezos had 30 second block times and minted 40 XTZ per block. However, after the upgrade, block times were reduced to 15 seconds, and block rewards were cut in half to maintain the annual inflation rate of 42 million XTZ. The inflation rewards are split equally between validators and endorsers. As a result, the annual inflation rate becomes a smaller percentage of the circulating supply with each passing year. The Tezos token is completely vested, meaning that the circulating supply is equivalent to the total supply.

Additionally, Tezos has implemented multiple burn mechanisms. These include creating a new account or smart contract, allocating additional smart contract storage, and slashing for validator missteps. Despite these burn mechanisms, the burn rate is minimal, with less than 1% of tokens burned annually. In Q1 2023, the circulating supply of XTZ increased 1.1% QoQ and 4.4% annually.

Historically, Tezos' staking yield has been around 5.9%. As a result, the real staking yield for XTZ, which is the nominal staking yield adjusted for inflation, is estimated to be approximately 1.5% per year.

Network Overview

Tezos network activity displayed mixed results in Q1 2023, following a strong fourth quarter. While total active accounts increased by 1.4% QoQ, reaching their highest level since Q1 2022, total new accounts decreased by 40% QoQ. The spike in new accounts during Q4 2022 was due to the minting of Manchester United NFTs.

In terms of network usage, daily average smart contract calls fell 25% QoQ, reaching their lowest level in a year. However, transactions were marginally up QoQ, consistently averaging around 45,000 transactions per day for the last year. The drop in smart contract calls came from the NFT and gaming sectors, which will be discussed further in the Ecosystem and Development section.

Tezos' Mumbai upgrade, which was launched in March, marked a significant milestone for the network. With this upgrade, Tezos introduced Smart Contract Optimistic Rollups (SCORUs). SCORUs can significantly improve the network's capabilities by increasing its throughput and supporting new execution environments. This upgrade allows Tezos to offer better scalability, security, and functionality, which should lead to increased development and activity. More detailed analysis on SCORUs and their potential impact are discussed in the Strategy and Outlook section of this report.

Ecosystem and Development Overview

Tezos' top applications during Q1 2023 were primarily NFT marketplaces, with objkt.com, fxhash, and Hic et Nunc leading the way. Q1 saw DEXs Plenty and QuipuSwap jump to the fourth and fifth spots respectively. Plenty's active users saw a significant increase due to the PLENTY token airdrop and the addition of XTZ based pairs. QuipuSwap, the leading DEX on Tezos in 2022, launched its V3 in February. This differed from the previous quarter when the top five applications were all NFT marketplaces.

Comparing Q1 2023 to the previous quarter, NFTs and gaming experienced a net decrease in users, while DeFi saw a 24% increase, reaching its highest level in a year in terms of users.

NFTs

NFTs are the main driver of activity on Tezos. In 2022, Tezos NFT sales rose 115% YoY from 19 million to 41 million. The excitement around NFTs continued into Q4 2022 with the minting of Manchester United NFTs. The trend continued in Q1 2023 with the release of McLaren F1 collectibles, which had over 240,000 owners at the end of the quarter.

Tezos is expanding the scope and user experience of its NFTs. Rarible, a popular NFT marketplace, launched support for Tezos on its aggregated marketplace. According to Rarible co-founder Alexander Salnikov, Tezos is popular among artist communities and the most crypto-native culture. In addition, Wert.io developed a payment module that enables seamless fiat and credit card purchases of digital assets. Wert.io allows consumers to buy any NFT on-chain, interact directly with the smart contract, and pay with fiat currency or credit cards.

Gaming

Although Tezos gaming activity has decreased since its peak in Q1 2022, Tezos remains committed to investing in the gaming industry. In Q4, Tezos established partnerships with major game developers Unity and Ubisoft. The Ubisoft partnership resulted in the creation of UbisoftQuartz, a platform allowing players to acquire NFTs for Ghost Recon Breakpoint. Unity released a software development kit (SDK) for Web3 game development on Tezos in Q1. Blockborn, a subsidiary of Misfits Gaming, announced a $10 million budget for a Tezos gaming incubator fund. It will include the development of a platform and resources to foster the growth of the Tezos gaming ecosystem.

A significant development in the Tezos gaming ecosystem is Stables, an NFT-powered horse racing platform that partnered with PMU, one of France's largest gambling brands. Stables aims to build a horse racing-centered metaverse that connects real-world horse racing with its stakeholders. When someone owns a digital horse, it will have a unique link to a corresponding real horse. The Stables team has plans to create a Play-to-Earn game.

DeFi

Tezos TVL saw a significant increase in Q1 2022. The TVL denominated in USD rose 76% QoQ from $52 million to $92 million, while the TVL denominated in XTZ increased 24% QoQ from 68 million to 84 million, setting another all-time high. The larger increase in TVL denominated in USD suggests the majority of gains came from the 50% increase in the XTZ price QoQ. However, there was still organic DeFi growth.

For more than a year, synthetic asset protocol Youves has held the top spot for TVL among protocols, with liquidity baking Sirius and CDP Kolibri following in second and third place, respectively. DEXs Plenty, QuipuSwap, and Vortex come next in the rankings. Their DEX volume aligns with their TVL rankings, with Plenty accounting for 60% of the volume, followed by QuipuSwap (30%) and Vortex (10%).

The lack of dominant lending protocols like Aave and Compound has been a challenge for the Tezos DeFi ecosystem. However, the Tezos ecosystem is addressing this gap with the recent launches of TezFin and Yupana, along with the upcoming launches of Mavryk Finance and Zenith. These new developments are being closely monitored and can lead to the next leg up for Tezos DeFi.

Stablecoins

As of the end of Q1, Tezos had a total stablecoin market capitalization of $55 million. Among the stablecoins, native-USDT dominated with a market cap of $37 million, accounting for 67% of the total stablecoin market cap on Tezos. The second most popular stablecoin was Youves' uUSD, which had a market cap of $11 million.

Development Activity

Tezos’ developer activity was recognized in the 2022 Electric Capital Developer report as a top developer ecosystem with over 100 full-time developers. However, the report also noted that Tezos full-time developer growth was flat year-over-year. Despite this, the Tezos ecosystem still boasts over 300 total developers and 20X growth since 2018, with over 120 full-time developers.

The recently launched Mumbai upgrade has significant implications for Tezos development. It introduces a new method of developing decentralized applications on Tezos using any language that compiles to WASM, including Rust, C/C++, Go, and Python. Additionally, Tezos has plans to further support the Ethereum Virtual Machine (EVM) in the future. With the launch of Mumbai and its supporting developer applications and Smart Contract Optimistic Rollup functionality, the Tezos ecosystem is expected to attract more developers.

Additionally, Google Cloud and the Tezos Foundation have teamed up to provide enhanced Web3 application development and services for Google Cloud customers. The partnership aims to help onboard institutions to the Tezos ecosystem and reduce the barriers for developers to build on the Tezos blockchain. The initiative includes a corporate validator program that enables customers to build Web3 apps and deploy nodes and indexers on Tezos' protocol. Additionally, startups incubated by Tezos will benefit from credits and mentorships from Google.

Decentralization and Staking Overview

Tezos uses a Liquid Proof-of-Stake (LPoS) mechanism. Unlike the more common Delegated Proof-of-Stake (DPoS) consensus, LPoS allows delegators to participate in consensus while maintaining custody of their tokens. As a result, the delegated stake is completely liquid. The Tezos network benefits from having a large percentage of staked tokens liquid because the liquid tokens can be reused. During Q1 2023, Tezos’s decentralization and staking metrics yielded mixed results.

Validators

Tezos experienced its largest QoQ increase in active validators in the last year, with 13 new validators added to the set. Notably, there has been a surge in the number of new corporate validators, including Ledger Leopard, Telindus, Google Cloud, and ZirconTech. These new corporate validators join existing ones such as Ubisoft, Wakam, EDF Group, and Sword France, further diversifying Tezos' validator set.

Tezos' validator stake distribution remains in line with industry norms. Coinbase is currently the largest validator, holding a 14% share, followed by Everstake (6%) and Binance (5%). The top 20 validators on Tezos account for 64% of the total stake. Additionally, Tezos' validator set is globally diverse, with validators spread out across different regions.

Delegators

For the eighth quarter in a row, the number of active delegators on Tezos has increased. Over the past two years, the number of active delegators has risen by 72%, approaching 200,000. Delegators on Tezos are earning an annualized staking yield of 5.9%.

Stake Distribution

As of the end of Q1 2023, Tezos had a circulating supply of 954 million XTZ tokens, all of which are fully vested. Out of the total circulating supply, 692 million XTZ (73%) is currently being staked on the network. Of the staked XTZ, 572 million (83%) comes from delegators, while validators hold the remaining 120 million (27%). The percentage of supply staked has remained consistently around 70%, indicating a long-term commitment to the network by stakeholders.

Qualitative Analysis

Strategy and Outlook

The Tezos core developers have prioritized scaling the Tezos network as outlined in the Tezos 2022 quarterly reports. Thanks to the self-amending feature of Tezos, on-chain governance can be utilized for protocol upgrades. This dynamic eliminates the need for hard forks and enables quick network upgrades. In 2022, Tezos successfully implemented four forkless network upgrades, confirming the network's ability to upgrade rapidly.

Mumbai Upgrade

The much-awaited Mumbai upgrade was launched on March 29. This upgrade is significant as it includes:

- Smart Rollups live on Mainnet: With Smart Rollups, anyone can deploy decentralized WebAssembly applications with dedicated computational and networking resources.

- Block time reduced to 15 seconds: With improved pipelining validation fully deployed, block propagation times are significantly reduced, allowing for minimal block time to be halved to 15 seconds.

- Ticket transfers between user accounts: With Mumbai, Tezos tickets can be transferred between user accounts (i.e., implicit accounts) and not just to/from smart contracts and rollups.

- RPCs for ticket balances: Two new RPC endpoints were added to improve the visibility of ticket ownership.

- New Michelson operations: Michelson opcodes were extended to support logical operations on bytes, and an opcode was added to convert between bytes and nat values.

- A peek at validity rollups: Validity rollups (ZK-rollups), arrived on the testnet.

Smart Rollups play a crucial role in Tezos' scaling plan and are essential to achieving the target of 1 million transactions per second. However, Smart Rollups offer more than just scaling. They provide a new method of developing decentralized applications on Tezos, using any language that compiles to WASM, including Rust, C/C++, Go, and Python.

Closing Summary

Tezos exhibited resilience and ongoing growth in Q1 2023. It launched the significant Mumbai upgrade, which brought Smart Contract Optimistic Rollups (SCORUs) and decreased block times. NFTs remained the primary activity driver, with objkt.com, fxhash, and Hic et Nunc leading as top protocols by active users. DeFi experienced increased activity, with DEXs Plenty and QuipuSwap gaining popularity and TVL (XTZ) reaching a new all-time high.

The 2022 Electric Capital Developer report ranked Tezos' developer ecosystem among the top with over 100 full-time developers. Tezos Foundation's collaboration with Google Cloud seeks to enhance Web3 application development and simplify the onboarding process for institutions. Active validators and delegators saw growth, with 73% of the supply being staked.

The Mumbai upgrade was arguably the most crucial development of the quarter. It incorporated Smart Contract Optimistic Rollups, reduced block times, and ZK-rollups on the testnet. This upgrade enables decentralized application development on Tezos using any language compatible with WASM, such as Rust, C/C++, Go, and Python.

In summary, Tezos persistently advances its technology and expands the network. As Mumbai launches, it will be vital for the network to continue boosting adoption.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Tezos Foundation. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Nick is a research analyst at Messari on the Protocol Services team. Prior to joining Messari, Nick worked in Deloitte's Consulting practice.

Read more

Research Reports

Read more

Research Reports

About the author

Nick is a research analyst at Messari on the Protocol Services team. Prior to joining Messari, Nick worked in Deloitte's Consulting practice.