Key Insights

- The crypto market rebound in Q1'23 was not accompanied by a resurgence in network usage. Despite the featured L1s experiencing an average QoQ increase of 83% in market cap, network usage decreased by around 2.5%.

- Stacks outperformed its peers in several metrics, as Ordinals renewed interest in Bitcoin programmability. Stacks led featured L1s in QoQ growth in market cap (340%), revenue (218%), network usage (~35%), DeFi TVL (276%), and DEX volume (330%).

- Ethereum remained the leader in most key financial and ecosystem metrics including market cap, revenue, DeFi TVL and volume, NFT volume, and full-time developers.

- USDC’s temporary depeg and Paxos ceasing BUSD issuance shifted stablecoin dominance toward USDT, benefitting TRON. TRON’s stablecoin market cap increased 30% QoQ to $43.6 billion; all other featured L1s with a significant stablecoin market cap saw theirs decrease QoQ.

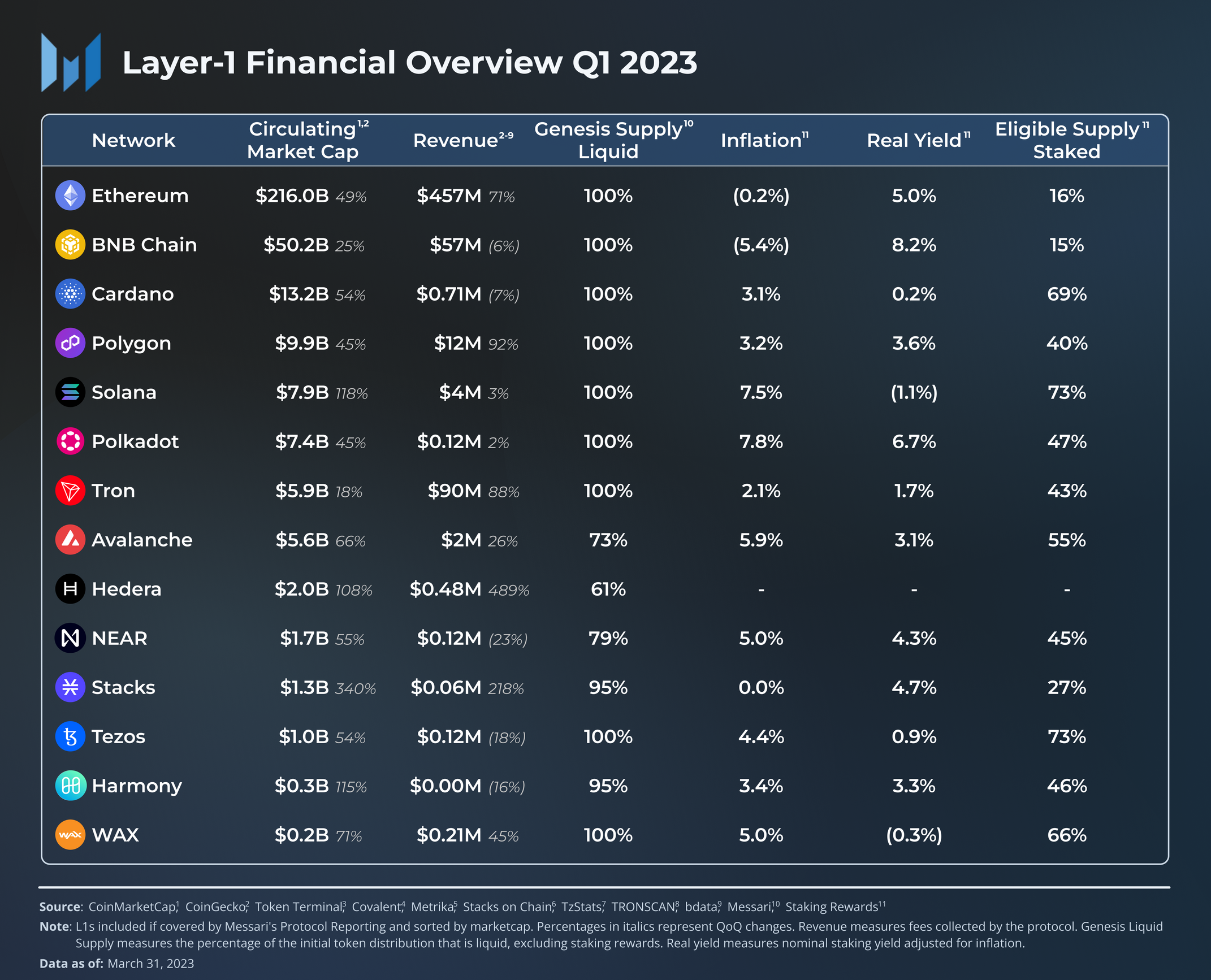

This report aggregates and compares the financial, network, and ecosystem analyses of the 14 Layer-1 (L1) smart-contract platforms covered by Messari through our Protocol Services’ engagements. These L1s, along with links to each of their individual quarterly reports, include: Avalanche, BNB Chain, Cardano, Ethereum, Harmony, Hedera, NEAR, Polkadot, Polygon, Solana, Stacks, Tezos, TRON, and WAX.

Financial Analysis

Market Cap

The crypto market rebounded in Q1’23 following a tumultuous 2022. On average, the market cap of featured L1s increased 83% QoQ but was still down 58% YoY. STX outperformed during Q1, driven by the popularity of Bitcoin Ordinals which renewed interest in Bitcoin programmability. On an absolute level, ETH’s market cap remained over 2x the other networks’ tokens combined.

Revenue

Revenue is defined as the sum of all fees collected by the protocol, regardless of how the protocol distributes those fees. Jon Charbonneau wrote an in-depth explanation of why revenue should be treated this way, but briefly consider the following example:

- Blockchain X collects 100 tokens through fees. All 100 tokens are burned, but it mints 100 tokens to reward validators. If revenue is measured as only fees that accrue to tokenholders, revenue is 100.

- Blockchain Y collects 100 tokens through fees. All 100 tokens are distributed to validators. No additional tokens are minted or burned. If revenue is measured as only fees that accrue to tokenholders, revenue is 0.

These two blockchains have the exact same end results in fees collected, inflation, and validator rewards, but their revenue would be very different if measured based on fee distribution.

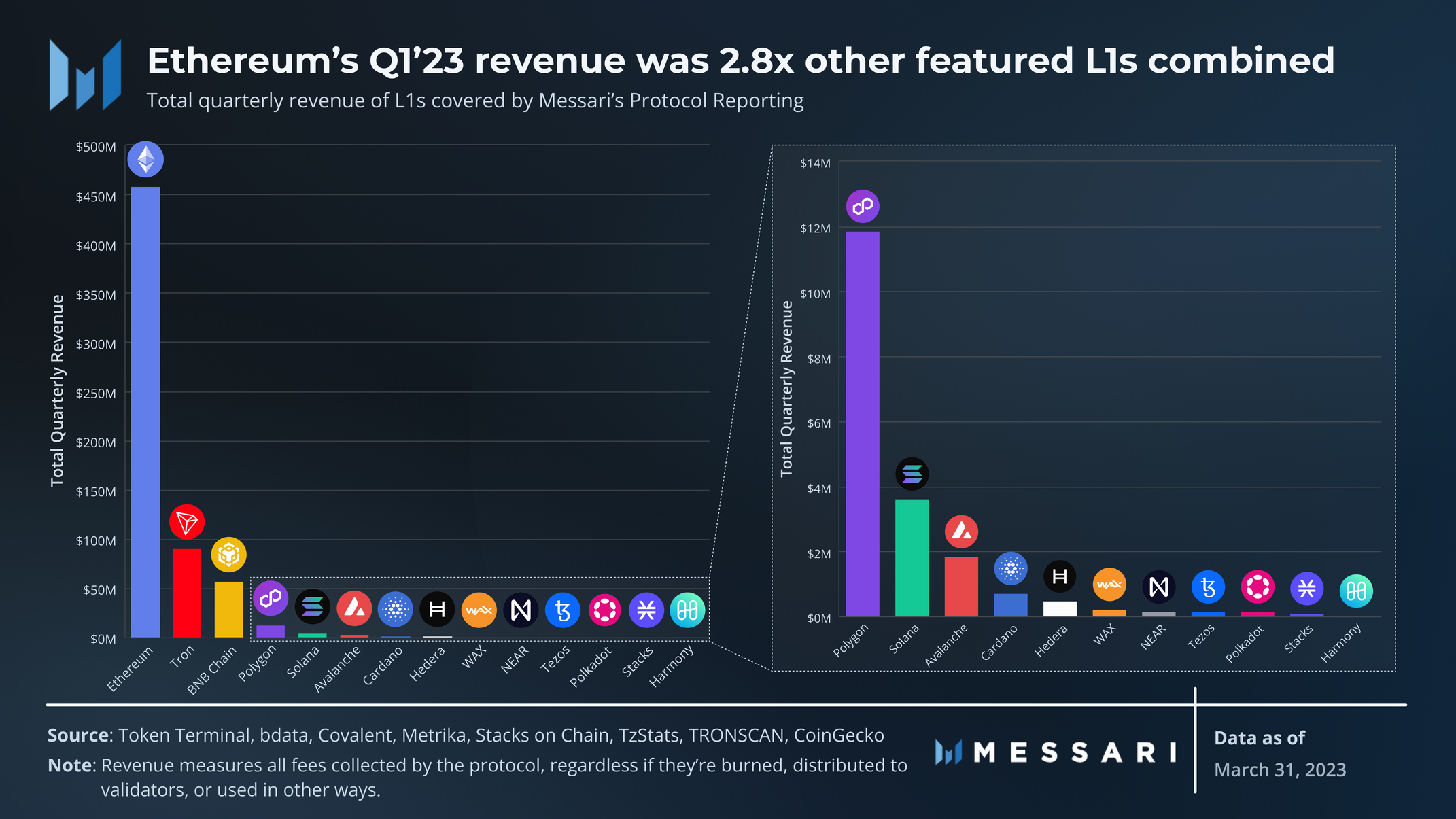

Driven by its relatively high usage and gas fees, Ethereum’s Q1’23 revenue was $457 million, almost 2.8x the combined revenue of all other featured L1s.

The most significant revenue growth came from Hedera, seeing an increase of 489% QoQ. It was largely driven by an increase in the usage of its Consensus Service, which enables the verifiable time-stamping and ordering of events for Web2 and Web3 applications. These applications include tracking supply chain provenance, counting votes in a DAO, and monitoring IoT devices.

P/S Ratio

A P/S ratio shows the relative price of a network’s token compared to its revenue. While it can be a helpful gauge, network tokens are new assets that likely require new valuation models, such as the Expected Demand for Security Model.

That said, TRON led the featured L1s with a 16x P/S ratio in Q1’23, followed by Ethereum at 188x. WAX stood out as the only network outside the top 20 in market cap to fall into the top half of P/S ratios. Whereas most networks earn revenue from transaction fees, WAX’s revenue is driven by a 2% tax on NFT marketplaces.

TRON, Ethereum, Polygon, and Hedera were the only networks whose P/S ratio decreased this quarter. In other words, their increase in revenue outpaced their tokens’ increase in market cap. The networks with the largest P/S ratio increases QoQ were NEAR (100%), Solana (112%), and Harmony (156%).

Inflation

Inflation from PoS reward issuance is a wealth transfer from holders to stakers. The higher the inflation, the more it helps to be a staker and hurts to be a holder, and vice versa.

BNB and ETH were the only deflationary tokens during Q1’23 at -5.4% and -0.2%, respectively. Both networks burn a portion of their transaction fees. Additionally, the Binance team buys back and burns tokens every quarter, which accounts for the bulk of its deflationary pressure.

Genesis Supply Liquid

Besides PoS reward issuance, inflationary pressure can also come from genesis token unlocks. Genesis Supply Liquid measures the percentage of genesis tokens that have been unlocked, excluding staking rewards. This metric standardizes between networks that have a capped supply, with a fixed amount of staking rewards included in the initial distribution, and an uncapped supply, with infinite staking rewards that are not included in the initial distribution.

Most of the featured networks’ tokens have fully vested, except for Avalanche, Hedera, NEAR, and Harmony:

- Stacks is around 95% with around 0.5% unlocking in Q2’23 toward its treasury.

- Harmony is around 95% with around 0.6% unlocking in Q2’23 toward ecosystem development.

- NEAR is around 79% with another 3% unlocking in Q2’23 to grants, core contributors, and investors.

- Avalanche is around 73% with another 2.5% unlocking in Q2’23 toward strategic partners, the Foundation, and the core team.

- Hedera is around 61% with another ~4% unlocking in Q2’23.

Note that Avalanche and Hedera have a capped supply and these unlock percentages are of the genesis supply (which excludes staking rewards) rather than the total supply.

Real Yield and Eligible Supply Staked

The rate of PoS reward issuance usually depends on the percent of supply staked and/or the number of validators. Networks rely on different equations to set the relationships that determine where the inflation rate, staking yield, and percent of supply staked will settle.

Tokens with low inflation like BNB, ETH, and STX allow holders to freely use the token without being as penalized for not staking, hence the lower stake rates. On the other hand, tokens with higher inflation rates optimize for higher stake rates. Although liquid staking can allow staked tokens to also participate in the ecosystem, LSTs often introduce worse liquidity, smart contract risk, and different tax implications. Additionally, Cardano and Tezos both have liquid staking enabled at the protocol level, but there are still some additional complexities to allowing liquid-staked tokens to participate in DeFi and other ecosystem applications. (For an in-depth analysis of Ethereum staking post-Shapella, check out Kunal’s report).

Network Analysis

Usage

User activity is difficult to compare across different systems (e.g., EVM vs. SVM vs. Antelope). Each architecture has a unique way of processing and logging transactions and address activity. Additionally, addresses are not 1:1 with users, with the ratio varying across networks.

The total number of transactions and addresses is not as informative as the economic activity facilitated in those transactions and addresses. Thus, we briefly covered the growth of user activity, which is more viable for comparing networks than absolute figures. But if looking to compare user activity based on absolute figures, the ecosystem section further below provides a better gauge.

Transaction activity did not grow along with the market rebound. The average QoQ change in daily transactions of featured networks was -2%. Stacks was a notable exception: its user activity increase slightly preceded the spike in STX’s price and finished the quarter up 34% QoQ.

Note that Avalanche figures only include C-Chain activity. C-Chain transactions were down 82.7% YoY due to the launch of subnets. Including subnets, average daily transactions increased 130% YoY. However, none of the current subnets use AVAX for gas. While subnets can use AVAX for gas, subnet value accrual generally rests on subnets contributing at least one validator to the global set while simultaneously increasing demand for security (for a deeper discussion on subnet value accrual, see State of Avalanche Q1 2023).

The average QoQ change in daily active addresses of featured networks was -3%. As with transactions, Stacks led the group in growth at 35%. Harmony’s 28% increase was largely driven by an anomalous spike near the end of the quarter that was not sustained.

NEAR had the largest YoY growth in average daily active addresses at 157%, driven by the launch of Sweat Economy in mid-September.

Only Avalanche C-Chain and WAX increased their address growth rate in Q1’23. Avalanche’s new addresses increased 56% QoQ. WAX's new addresses increased 38% QoQ, driven by the “BlastOff” NFT marketing campaign and NFT drops from Funko, a toy company that sells licensed pop culture collectibles.

Solana’s average transaction fee in Q1’23 was substantially lower than other featured L1s at $0.0003. Solana developer teams have released several upgrades in the past year to improve its fee markets and overall network performance, most notably, local fee markets (together with priority fees). Most blockchains have one global fee market, where all users are forced to compete in an auction. If an NFT mint causes a gas war, users who just want to transfer a token would also be impacted. As denoted by its name, Solana’s local fee markets place compute limits on each account and allow users to engage in individual gas auctions to modify the state of each account. Local fee markets, along with QUIC and stake-weighted quality of service, are explained in more detail in the Q4’22 and Q1’23 Solana reports.

Validators

All networks experienced a QoQ increase in total staked tokens denominated in USD, as is expected during a market uptick. Stacks (403%) and Solana (125%) led in QoQ growth. Each network’s increase in total staked (USD) slightly outpaced its market cap growth, indicating a net increase in staked native tokens. Ethereum’s security budget remained the largest by over $20 billion, ending Q1’23 with $32.6 billion in ETH staked.

As with users, validator counts are not perfectly standardized across networks. While it’s easy to track the number of validators, it’s more difficult to track the number of node operators. The ratio of validators per node operator will vary for each network, largely depending on the stake-weight mechanism.

Featured networks with some sort of stake-weight limit include:

- Ethereum: Stake-weight is capped at 32 ETH (0.0001% of the end of Q1’23 total stake).

- Avalanche: Stake-weight is capped at 3 million AVAX (1.3% of the end of Q1’23 total stake).

- Cardano: Stake-weight limit is determined by dynamic parameters and currently is at 70 million ADA (0.3% of the end of Q1’23 total stake).

- Polkadot: All active validators receive the same rewards regardless of stake-weight. The minimum stake-weight is dynamic and currently around 2.14 million DOT (0.3% of the end of Q1’23 total stake).

- Harmony: Stake-weight is bound between 85% and 115% of the effective median stake.

Relative to its total stake, Ethereum has the lowest stake-weight limit. While there were over 560,000 validators at the end of Q1’23, there were far fewer node operators than that. According to ethernodes there were over 3,500 synced physical validator nodes — likely an underreported figure. Nodewatch’s figure was around double that, although it’s unclear whether Nodewatch also includes other nodes besides validators.

The figures for the other featured networks in the table above are just their validator counts. Compared to Ethereum’s figure, they are all upper bounds. Even if a network lacks a stake-weight limit mentioned above, there can still be incentives for node operators to spin up more than one validator, such as geographical proximity to other nodes to improve latency and MEV opportunities. All that said, after Ethereum, the networks with the most validators were Cardano (2,932), Solana (1,620), and Avalanche (1,192).

The Nakamoto coefficient measures the number of entities that could cause a network halt. A Nakamoto coefficient of one or two is often cited for Ethereum, mainly due to the concentration of stake from Lido. However, we instead used a figure calculated by the Solana Foundation which considers the individual node operators within Lido and uses a 50% stake threshold instead of 33%.

While the Nakomoto coefficient is typically used today to measure the distribution of voting power among validators, there are several other important factors that impact the resilience of a validator set, including:

- Geographic distribution: Too many nodes in the same location could jeopardize the health of a network due to geopolitical risks, regulations, natural disasters, and other events.

- Hosting provider distribution: Too many nodes using the same hosting providers could jeopardize the health of a network due to outages or crypto node operator bans (see Hetzner and Solana). Although validator nodes can self-host, it becomes more difficult as hardware requirements increase. The Ethereum community hangs its decentralization hat on how many home-stakers it has. Although the numbers are not exact, Ethereum likely has more self-hosted validator operators than what many networks have in total validator operators.

- Delegator distribution: A high concentration of the total stake from one delegator can destabilize a network should that delegator unstake. Additionally, the foundations of many networks currently delegate a significant portion of tokens to subsidize minimum validator requirements and spread out voting power.

- Client diversity: Most networks rely on one validator client, making the system susceptible to client bugs or attacks. Jump’s Firedancer client will make Solana the only multi-client network besides Ethereum (excluding clients that are forks of each other).

Notes: We excluded Hedera from the analysis here as its validator set is permissioned. As with the user activity analysis, only Avalanche C-Chain validator figures are included. Each subnet can use anywhere from three to all validators from the global set. At the end of Q1’23, launched subnets had from 4 to 14 validators.

Ecosystem Analysis

DeFi

As expected during the market rebound, TVL in USD grew as well. For the majority of featured networks, the QoQ change in market cap was greater than that of TVL. This relationship potentially indicates that TVL increases were more due to price appreciation than net capital inflow.

Nonetheless, Ethereum remained the dominant TVL player followed by BNB Chain and TRON. Stacks and Cardano outperformed the bunch, increasing 276% and 172%, respectively. Stacks TVL increased significantly from roughly February 17 to 22, coinciding with STX’s price appreciation. Cardano TVL rose more steadily throughout the quarter and benefited from the launch of several stablecoins detailed further below.

NEAR was the one exception, with its TVL decreasing throughout the quarter. The 22% QoQ decrease mainly occurred during the USDC depeg detailed further below.

DeFi Diversity measures the number of protocols that constitute the top 90% of DeFi TVL. A greater distribution of TVL across protocols reduces the risk of widespread ecosystem contagion resulting from adverse events like exploits or protocol migrations.

Ethereum scored a 22 in DeFi Diversity, followed by Polygon (19), Solana (18), and BNB Chain (16). The ranking is roughly similar to the ranking of TVL, with a notable exception being TRON. TRON had the third-highest TVL ($5.4 billion), but over 70% of it was in JustLend. Furthermore, JustLend TVL was dominated by three unique wallets.

Average daily DEX volume increased for the majority of featured networks QoQ. As with TVL, Stacks and Cardano saw the biggest QoQ increases at 330% and 101%, respectively. Daily DEX volume spiked on March 11 during the USDC depeg, driven by over $20 billion volume on Ethereum. The spike nearly doubled the previous yearly spikes which occurred during the Terra/Luna, Celsius, and FTX collapses.

As a whole, stablecoin market caps continued their steady decline in the past quarter, which featured several large stablecoin-related events:

- The run on Silicon Valley Bank caused USDC to temporarily depeg from March 10 to March 13, reaching a low of ~$0.87. From March 10 to quarter end, USDC’s market cap across all chains decreased by 24%.

- On February 13, regulators directed Paxos to cease the issuance of Binance USD (BUSD), which at the time was the third most popular stablecoin after USDC and USDT. From February 13 to quarter end, BUSD’s market cap across all chains decreased by 52%.

Ethereum, Polygon, Solana, Avalanche, and Hedera all have native USDC issuance. They were negatively impacted by the outflow of USDC, which was each of the chains’ top stablecoin before the depeg. Similarly, BUSD was the primary stablecoin on BNB Chain, leading its stablecoin market cap to decrease by 31% QoQ. This was the largest QoQ decrease of featured networks except for Hedera, which only uses USDC and declined by 36% QoQ.

The above events caused some BUSD and USDC holders to swap to USDT, whose market cap across all chains increased by 17% from February 13 to quarter end. TRON was the biggest beneficiary of this migration, as one of TRON’s primary use cases has become holding and transferring USDT. Its stablecoin market cap increased by 30% QoQ.

Only Cardano had a greater QoQ stablecoin market cap increase at 262%. Cardano does not have any USDC, USDT, or BUSD and thus was not affected by the above events. Cardano’s top two stablecoins by market cap, IUSD and DJED, launched in Q4’22 and Q1’23, respectively. Their continued growth will be crucial to the strength of Cardano’s ecosystem.

The total value borrowed metric gives additional context to a network’s DeFi activity. Although a large number of borrows can lead to more destabilizing liquidations, borrows typically indicate where users trust taking out debt and where protocols make money (from liquidation and borrowing fees). Note that DefiLlama does not include CDP debt in its borrow figures. Thus, Cardano, Stacks, and Tezos have been excluded from this analysis as all or the majority of their DeFi debt arises from CDP protocols.

Across all featured networks, the total value borrowed increased by 17% QoQ. As with TVL and DEX Volume, Ethereum remained the dominant network at almost $4 billion followed by BNB Chain at $735 million. Unlike those metrics, Avalanche finished ahead of Polygon, although the gap lessened throughout the quarter.

NFTs

Despite higher gas fees, Ethereum remains the foremost home for NFT activity. Blur established itself in Q1’23 as the dominant Ethereum marketplace in terms of volume, gaining a strong foothold through its token launch and airdrop in mid-February. Its average weekly share of volume increased from 31% to 59% QoQ, per hildobby’s Dune dashboard. Only Polygon outgrew Ethereum in QoQ average daily volume, increasing by 101% QoQ.

Although Ethereum also leads in daily unique NFT buyers, the gap between it and other chains is smaller with this metric than with volume. Ethereum average daily unique NFT buyers increased by 88% QoQ. Coinbase launched a commemorative NFT on Ethereum near the end of February celebrating its Base L2 announcement. The “Base, Introduced” collection, which was free to mint for several days, peaked at over 122,000 unique buyers on February 26.

Once again, only Polygon outgrew Ethereum in QoQ average daily unique buyers, increasing by 89% QoQ.

Although its average daily figure decreased QoQ, Tezos' unique NFT buyers increased to over 10,000 on average in the week following the launch of the free, open-edition McLaren F1 collection near the end of the quarter.

Developers

Developer data is always imperfect, but Electric Capital’s Developer Report sets the best standard for measuring developer activity. It measures developers as authors who contribute original, open-source code to an ecosystem and full-time developers as those who do so 10+ days in a month.

Across featured networks, full-time developers (devs) decreased by 4% QoQ. Ethereum only declined by 0.1% and remained the top ecosystem for developers by a significant margin. Ethereum’s full-time dev count of 1,976 is almost equal to all other featured networks combined. Hedera’s full-time dev count increased the most of featured networks, growing 28% QoQ to 64.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Nothing contained in this report is a recommendation or suggestion, directly or indirectly, to buy, sell, make, or hold any investment, loan, commodity, or security, or to undertake any investment or trading strategy with respect to any investment, loan, commodity, security, or any issuer. This report should not be construed as an offer to sell or the solicitation of an offer to buy any security or commodity. Messari does not guarantee the sequence, accuracy, completeness, or timeliness of any information provided in this report. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Peter is a Research Analyst in Protocol Services focused on Layer-1s. He recently graduated from Boston College where he studied economics and computer science and led the school's blockchain club.

Read more

Research Reports

Read more

Research Reports

About the author

Peter is a Research Analyst in Protocol Services focused on Layer-1s. He recently graduated from Boston College where he studied economics and computer science and led the school's blockchain club.