State of Filecoin Q2 2022

Jul 12, 2022 ⋅ 10 min read

Key Insights

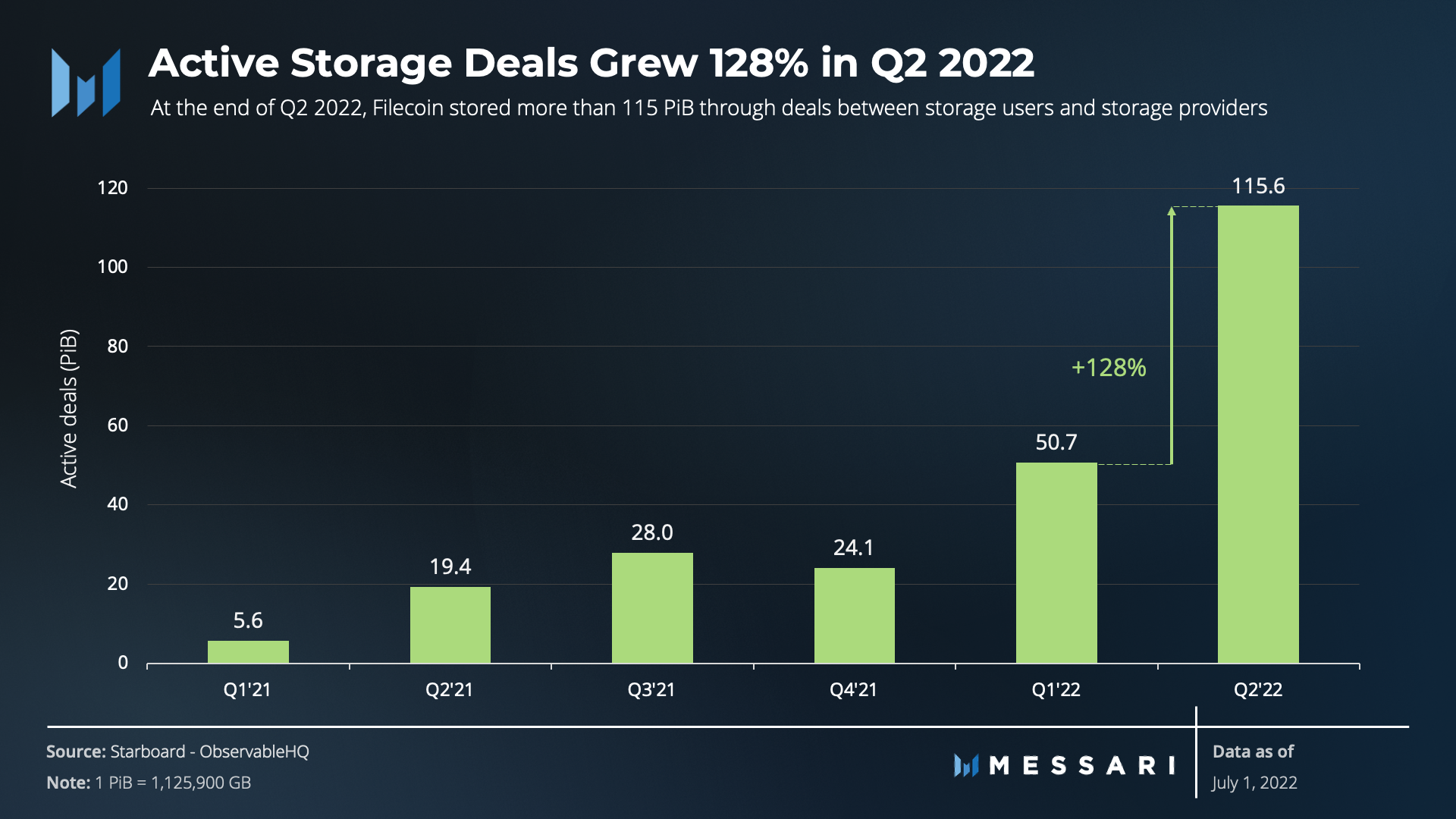

- Q2 2022 has been a strong quarter for Filecoin, as active storage deals grew 128% QoQ and network storage capacity grew 7% QoQ.

- Protocol revenue increased 264% in FIL terms QoQ; however, it's still a whopping 74% lower YoY since the HyperDrive upgrade in July 2021 lowered network transaction fees.

- Supply-side revenue decreased 4% in FIL terms QoQ, as storage providers continued to increase their footprint in Europe and USA.

- The number of projects building on Filecoin grew 32% in Q2 2022, showing a healthy development of its ecosystem.

A Primer on Filecoin

Relying on centralized data storage has a major shortcoming: it’s hard to verify data integrity. Filecoin is a peer-to-peer version of AWS that verifies the storage of data on a regular basis. To achieve this, Filecoin uses storage deals on an open marketplace.

A storage deal is like a contract with a service level agreement (SLA) — users pay fees to storage providers to store data for a specified duration. To keep data safe, Filecoin uses a cryptoeconomic incentive model that verifies the storage with zero-knowledge proofs. At the same time, storage providers are penalized if the data is unretrievable or the storage fails. To retrieve data, users pay a retrieval provider to fetch the data. Unlike storage deals, which involve transactions on-chain, retrieval deals can use payment channels to settle payments off-chain, resulting in faster retrieval.

Performance Analysis

Network Revenue

The Filecoin blockchain is used by both the demand side (i.e., storage users) and the supply side (i.e., storage providers) of the network. Any storage deal or proof requires a transaction-based network fee. All network participants — both demand and supply side — pay this fee to interact with the network.

As per our recent in-depth analysis of Filecoin revenue structure, protocol revenue is the sum of all network fees excluding the “tip” collected by block miners to speed-up transactions. This “tip,” together with the token rewards paid to storage providers, constitutes the supply-side revenue.

The Filecoin network experienced a 264% growth in protocol revenue QoQ. It was the first positive quarter in protocol revenue growth in five quarters. However, it’s still a whopping 74% lower on a year-over-year basis.

This lower protocol revenue could be attributed to the HyperDrive network upgrade. HyperDrive was introduced in July 2021 as a mechanism to scale throughput to 10–25x of its original capacity. A key implication of HyperDrive was that storage proofs were aggregated, which significantly reduced congestion and freed up blockspace. While the HyperDrive upgrade benefited most network participants, it hurt the protocol’s revenue because it led to a reduction in transaction fees.

Supply-side revenue decreased 4% in FIL terms QoQ, corresponding to a 48% decline in USD terms. Near-zero storage fees impacted supply side revenue since it limited storage providers’ revenue to just block rewards and tips. Potential future revenue streams for storage providers may include other fees, such as fees from smart contract apps or decentralized compute services. For now, near-zero storage fees are only possible because of the dynamics of both the supply and demand side of the network, as explained below.

Network Supply

Storage Capacity Growth

Filecoin’s open-market policy and incentive mechanisms have enabled storage providers to supply capacity, participate in deals, and compete on price. Through block rewards paid in the network's native token (FIL), Filecoin incentivizes storage providers to supply capacity to the network.

Regardless of overall market conditions, Filecoin’s committed storage capacity has grown steadily during the past six quarters. As of Q2 2022, network storage capacity reached over 16 EiB, up 7% from the previous quarter. This network capacity is equivalent to more than 65,000 copies of Wikipedia or 1,600 Netflix movie archives.

Storage Capacity Breakdown

Filecoin’s storage capacity is supplied by over 4,000 decentralized storage providers distributed around the globe.

An attempt to show the geographic distribution of storage providers reveals that nearly half of the storage providers have chosen not to disclose their location. At the same time, there is a high storage capacity in Asia (32%) and North America (14%). Throughout Q2 2022, storage providers have grown more diversified geographically: network capacity has been gradually replaced by storage providers from other geographies. Notably, storage providers increased their footprint in Western Europe (+3%) and USA (+2%) to partly offset regulatory concerns in China.

Prominent examples of storage providers that have built on the Filecoin network around the globe include: Seal Storage (Canada and USA), Non-Entropy (Japan), Origin Storage (Hong Kong, Singapore, USA), and Dcent (The Netherlands).

Supply dynamics tell only one side of the story about the network activity. The other side is told through Filecoin demand in the context of actively stored data.

Network Demand

Storage Deal Growth

Demand for Filecoin comes from both Web2- and Web3-specific storage. The most straightforward metric to gauge demand on the Filecoin network is the amount of data stored in active storage deals between storage users and storage providers.

At the end of Q2 2022, Filecoin stored more than 115 PiB through active deals — a 128% increase relative to the previous quarter. This could be attributed to low to zero fees charged to users to store data.

Storage Deal Breakdown

To prevent the gaming of network rewards by storage providers and to increase the amount of useful storage capacity on Filecoin, the Filecoin Plus (Fil+) incentive program was developed. The program incentivizes storage providers to participate in verified deals by increasing their probability to win block rewards over time. Competing for storage deals, storage providers will undercut other providers’ fees when competing for storage deals. This led to storage being offered at little to no costs.

Since Q4 2021, there has been a transition from Filecoin Regular (unverified data deals) to predominantly Filecoin Plus (verified data deals). The transition corresponded to a sustained upward trend in Filecoin Plus deals. Filecoin Plus deals represented over 99% of all new deals in Q2 2022. The flippening of Filecoin Regular deals by Filecoin Plus deals, coupled with the massive uptick in new deals, indicates that the verified data incentive mechanism is working as planned.

Filecoin Plus further enabled two primary services — NFT.Storage and Web3.Storage — to offer essentially free storage on Filecoin. These services provide simple user interfaces to end-users and act as aggregators where data from multiple users is bundled and stored with a storage provider.

NFT.Storage is a service that provides a simple user interface specifically for storing NFT content and metadata on Filecoin. It focuses on perpetual redundant storage through dedicated IPFS servers managed by NFT.Storage and Filecoin. The simplicity of the service has brought the advantages of perpetual NFT storage to a wide range of users from individual artists to large marketplaces such as OpenSea, MakersPlace, MagicEden, Holaplex, Jigstack, and Project Galaxy.

Similar to NFT.Storage, Web3.Storage is a service that simplifies the process of storing and retrieving Web3 data on Filecoin for developers and end-users. Its focus is to make it easy for developers to build Filecoin storage into their applications.

By participating in the Filecoin Plus incentive program, both Web3.Storage and NFT.Storage are able to offer storage on the Filecoin network at no additional charge to end-users. Overall, both services experienced significant growth in Q2 2022 – Web3.Storage was up 25%, while NFT.Storage grew 39% QoQ. While the introduction of the Filecoin Plus program is a step forward in terms of demand generation, there is a concerted effort to incubate new businesses and use cases for building on Filecoin.

Ecosystem Overview

Filecoin is actively supported by several organizations with the common goal of growing the Filecoin ecosystem. The most prominent organizations in the group include Protocol Labs, Filecoin Foundation, and Outercore. Together, they form the Ecosystem Working Group. The responsibilities of the Ecosystem Working Group participants include maintaining and upgrading the underlying protocols, supporting the growth of the ecosystem, and facilitating governance.

These efforts have translated into Filecoin’s development activity reaching an all-time-high in Q2 2022. The ecosystem has been actively developing a funnel of developers and builders through activities such as hackathons, accelerators, grants, mentorship, and growth support. This has led to a 32% QoQ increase in projects building on Filecoin. A significant portion of the growth originated from new projects participating in Accelerators, up almost 4x to 114 in Q2 2022 from just 29 in the previous quarter.

The funnel is designed to help early-stage projects and teams develop enough to receive funding and investments. As a result, over 450 projects are currently being built on Filecoin. The Filecoin ecosystem is channeled towards onboarding a large variety of use cases: from decentralized storage for NFTs, to music and video streaming, to metaverse and gaming. An overview of these use cases is available in Messari’s recent coverage of Filecoin’s ecosystem.

Qualitative Analysis

Key Events

v16 Skyr upgrade

The v16 Skyr upgrade was developed during Q2 2022 and completed on July 6. It brought the Filecoin non-programmable WASM-based Filecoin Virtual Machine (FVM). The FVM could enable perpetual storage (similar to Arweave), undercollateralized loans to SPs, and insurance to protect from slashing.

Filecoin Storage Provider Mentorship Grants (FSPM)

Filecoin launched a grant program in April 2022. Qualified grantees can receive subsidized expert storage provider operator consulting. The total amount allocated to this program has not yet been disclosed, but the program will be kicked off with 10 qualified applications receiving 10 hours of fully subsidized consulting services (valued at $4,000).

Network Indexer

Protocol Labs launched a Network Indexer in April 2022. This indexer is aimed to enable searching for content-addressable data available at storage providers. Storage providers can publish the content IDs of their data to the Network Indexer, and users can query the Network Indexer to learn where to retrieve the content identified by those IDs.

A full list of Filecoin events can be accessed via Messari Intel.

Roadmap

New services such as CDN-quality retrievals and decentralized compute are on the roadmap for the remainder of 2022. These services combined with the addition of smart contracts through the Filecoin Virtual Machine should increase demand for blockspace, therefore leading FIL to capture more value. At the end of the day, FIL's value revolves around the strength of the Filecoin economy.

In addition to increasing the network’s storage capacity and utilization, the Ecosystem Working Group is focused on helping as many early-stage projects in the Filecoin ecosystem to translate into full-fledged businesses — i.e., advancing from initial stages all the way through Series D and beyond.

Closing Summary

Q2 2022 has been a strong quarter for Filecoin, as active storage deals grew 128% quarter-over-quarter. Should Filecoin continue to onboard demand, it stands a chance to be a prominent provider of decentralized storage and cloud services for Web3 and traditional apps. While decentralized storage is still in its early days, the Filecoin ecosystem continues to thrive, as over 450 projects are currently being built on Filecoin. Filecoin is being leveraged by several use cases, including NFTs, Web3, gaming, metaverse, and audio/video.

In the future, the adoption of decentralized storage solutions and the integration of smart contracts built on top may open the door to novel applications. Open data initiatives and decentralized compute may enable the next generation of apps beyond storage. Another massive milestone would be getting major browsers to adopt IPFS. Filecoin’s main goal is to prove its reliability as a storage provider and potentially become an enabler of a wide range of data-intensive services.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Protocol Labs. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Mihai is director of research at Messari. Mihai and his team cover base layers, mid-layer infrastructure, DeFi, and consumer. Prior to joining Messari, Mihai was a tech entrepreneur and worked in AI at UBS and Swiss Re. His background is in computer science and math. Mihai holds a PhD in information systems from ETH Zurich, Switzerland

Sami Kassab is an Enterprise Research Analyst focusing primarily on Web3 Infrastructure and Bitcoin. Sami previously spent 5 years as an Aerospace Engineer designing aircraft engines and missile & defense systems.

Read more

Research Reports

Read more

Research Reports

About the authors

Mihai is director of research at Messari. Mihai and his team cover base layers, mid-layer infrastructure, DeFi, and consumer. Prior to joining Messari, Mihai was a tech entrepreneur and worked in AI at UBS and Swiss Re. His background is in computer science and math. Mihai holds a PhD in information systems from ETH Zurich, Switzerland

Sami Kassab is an Enterprise Research Analyst focusing primarily on Web3 Infrastructure and Bitcoin. Sami previously spent 5 years as an Aerospace Engineer designing aircraft engines and missile & defense systems.