Key Insights

- Ethereum Name Service (ENS) allows users to interact with wallets via human-readable domain names.

- Despite market weakness, ENS monthly active addresses remain robust. While down 33% from the May 2022 peak, monthly active addresses are still 2.5x higher YoY.

- ENS domain name registrations reached an all-time-high of 1.12 million in Q3’22, up 71% QoQ. Simultaneously, renewals grew 3x QoQ to over 100,000 in Q3’22.

- Revenue from ENS name registrations and renewals decreased 17% QoQ in USD terms (up 30% in ETH terms), due to a 27% decrease in registration revenue in USD terms.

- ENS treasury holds $185 million in unlocked funds and over $1 billion in locked tokens.

Primer on ENS

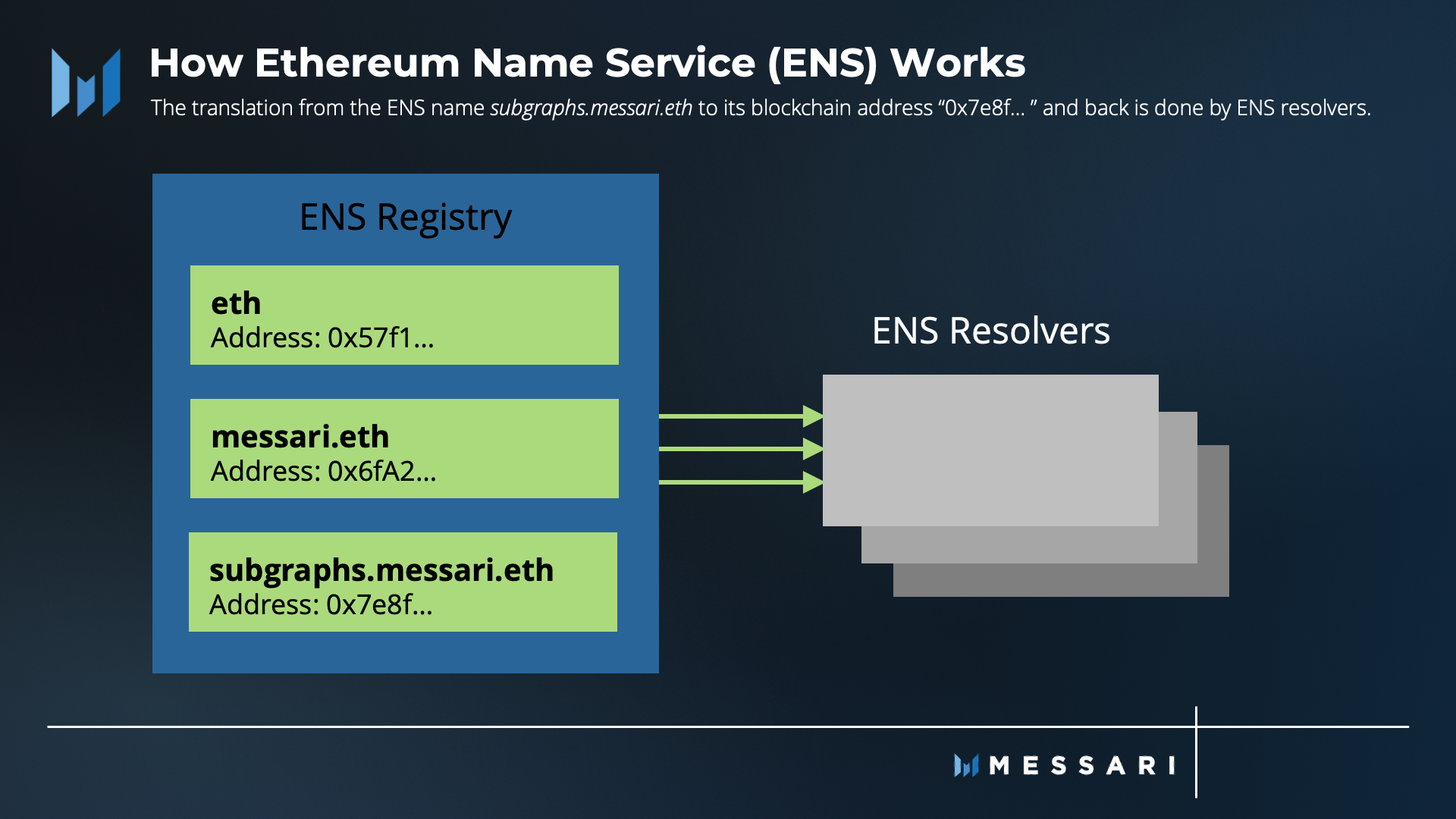

Handling blockchain addresses is error-prone. That’s because blockchain addresses consist of a series of alphanumeric characters such as “0x57f1…” For humans, that’s anything but intuitive. The Ethereum Name Service (ENS) allows users to interact with blockchain addresses via human-readable domain names. ENS offers a user-friendly solution that maps blockchain addresses to domain names which are easy to reproduce.

In contrast to a normal Web domain, an ENS domain name:

- can be used as a payment gateway — for example, one can send money to sassal.eth instead of typing out or copy-pasting Sassal’s hexadecimal address.

- cannot be ceased and their content cannot be deleted.

At its core, ENS operates on a system of hierarchical names. A top-level registry deployed as a contract on-chain keeps a record of each ENS domain (e.g., messari.eth) and subdomains (e.g., subgraphs.messari.eth). The ENS registry controls domains and governs the distribution of subdomains. The translation from ENS domain names (e.g., messari.eth) to the corresponding blockchain addresses (e.g., “0x6fA2… ”) and vice versa is done by smart contracts called resolvers.

Performance Analysis

ENS quarterly performance can be gauged in terms of ENS domain usage and in terms of revenue accrued.

Usage

ENS domains can be registered and owned on a multi-yearly basis, and the number of years is chosen by the user (the minimum is one year, the maximum is eight years). Price and time period share a positive relationship: price increases as the period of registration increases. To retain the domain ownership, users must renew within 90 days of expiry. Domains unrenewed after a 90-day renewal period are available for registration.

ENS reached an all-time-high of 1.12 million domain name registrations in Q3’22, up 71% QoQ. Simultaneously, ENS domain name renewals grew 3x from 35,135 in Q2’22 to 105,546 in Q3’22. This significant increase in renewals QoQ must be understood within the context of the expected expirations due when renewals occur.

The 3x increase in renewals QoQ corresponded to a 6x increase in expirations QoQ. This increase in expirations due in Q3’22, coupled with holders’ willingness to keep their domain names by renewing them before expiration, may have led to the corresponding increase in renewals. This shows overall ENS user stickiness.

Source: Twitter

Despite these increases in registrations and renewals, not all ENS domain names are created equally. In fact, 3 character and 4 character names appear less frequently than 5+ character names. By default, it costs more to both register and renew 3 or 4 character names: $640 and $160 per year registered, respectively, compared to only $5 per year for 5+ character names. Within the landscape of name lengths, different combinations of characters have different rarities. The distribution of registrations and renewals relative to name length reveals how rarity is perceived by ENS name holders.

In terms of ENS name length, 5+ character names account for 1.06 million (96%) out of all 1.12 million registrations in Q3’22. Notably, with a 79% QoQ increase in absolute terms from 0.6 million in Q2’22 to 1.1 million in Q3’22, the registrations of 5+ character names grew faster than the overall ENS registrations (up 71% QoQ). Two potential explanations exist: longer names are cheaper, and the popular 3 and 4 character names have been largely registered. This combination of cost and scarcity resulted in the registration of more 5+ character names.

The ENS secondary sales volume by character length shows the explosive growth short character names experienced over the last two quarters. Even as 3 and 4 character name transaction volume decreased from Q2’22 to Q3’22, current volumes were still up more than 10x compared to Q1’22. Despite the overall market weakness and lower liquidity, ENS was one of the few assets that experienced robust sales volume, especially when it comes to scarcer digital assets. This increase in sales volume implies that the perceived value of ENS domain names ranks highly among digital asset users.

While there is an increased sales volume of 3-4 character names, the relative percentage of ENS registrations of 5+ characters domain names has consistently remained well above 90% over the past six quarters.

The renewals of 3 and 4 character names have increased over the last six quarters to account for 27% of all renewals in Q3’22. In contrast, renewals of 5+ characters domain names have consistently decreased throughout the last six quarters. A potential explanation is that ENS name holders may want to keep names of 3 and 4 characters in the longer-term, as they are rarer than 5+ character names. This implies that 3 and 4 character domain names may represent a good long-term store of value.

Potential gauges of activity to account for ENS active addresses include one of three of the following:

- having a domain name registered or renewed

- committing on-chain transactions

- adding metadata (such as avatars, handles, links, or email addresses)

Data shows that ENS monthly active addresses remain robust even as the broader Web3 market suffered large user drawdowns over the past quarters. The current level of active addresses is still 10x higher than at the beginning of 2021 and 2.5x higher than a year ago, despite a 33% reduction from the May 2022 all-time-highs.

Revenue

ENS revenue is generated by charging two separate fees: registration fees and renewal fees.

In Q3’22, the overall revenue from both domain name registrations and renewals went down 17% in USD terms (up 30% in ETH terms). This was driven by a 27% decrease in registration revenue in USD terms from $18.6 million in Q2’22 to $13.6 million in Q3’22 (up 18% in ETH terms). In contrast, revenue from renewals went up 66% in USD terms from $2.13 million in Q2’22 to $3.6 million in Q3’22 (up 127% in ETH terms). Given the two revenue streams, analyzing the revenue in Q3’22 at a more granular level yielded a clearer picture.

Over the past two quarters, ENS domain renewals have grown into a substantial percentage of total revenue. From a Q2’22 low of 6% in May, the relative share of ENS domain renewal has quadrupled to account for 24% of revenues as of October.

One potential explanation for this growth is a large spike in the number of ENS names that are released or expected to be released over the coming months.

While roughly 400 ENS domain addresses were released in May, by August the number grew 12x to approximately 4,900. As of October, over 23,000 names are up for renewal. The fact that a large percentage of ENS address holders are renewing their addresses may explain why the percentage of revenue from renewals has increased considerably.

Another aspect worth considering when evaluating ENS revenue is the type of registrations and renewals. Registering and renewing ENS names with 3-4 characters cost substantially more than registering ENS names with 5+ characters. As of September 2022, the average cost to register ENS domain names can be clustered among three tiers: $332 (3 characters), $92 (4 characters), and $7 (5+ characters). Similarly, as of September 2022, the tiers of average cost to renew ENS domain names are: $191 (3 characters), $66 (4 characters), and $6 (5+ characters).

In Q2’22, people rushed to mint 3 and 4 character names and short words. As the number of those types of ENS names went down, the opportunity to mint expensive names also fell. With the possibility to register these expensive names, relative to 5+ character names, the share of revenue derived from registrations of 3 and 4 character names went down significantly in Q3’22.

Given these differences in price tiers, USD revenue from registrations and renewals of 5+ character names is still up 8% QoQ.

Qualitative Analysis

Governance

ENS is operated by a DAO that is governed by the holders of the native ERC-20 token — ENS. Tokenholders are able to submit and vote on proposals.

An early proposal to transfer ownership of treasury funds from multisig.ens.eth to the DAO contract at wallet.ensdao.eth resulted in ENS token holders being transferred governance rights over the protocol treasury.

Source: Messari Governor

There are three working groups within the ENS DAO: meta-governance, ecosystem, and public goods. The Q3/Q4 draft budget overview describes the budget for each group as follows:

- Meta-Governance: $632,000, with an allocation of $200,000 to support ENS DAO tooling, governance partnerships, and gas-fee reimbursement. A full description of the Meta-Governance budget can be found here.

- Ecosystem: $2,254,300, with the largest allocation of $1.5 million to support bug bounties, hackathons, gitcoin grants, and more. A breakdown of the Ecosystem budget can be found here.

- Public Goods: $430,650, with $173,000 allocated to the ENS DAO small grants program. The full breakdown can be found here.

Treasury

The ENS treasury grew 20% since the May lows in Q2’22, reflecting the growth in ENS price over the same time period. In total, the treasury holds $185 million in unlocked funds as well as an additional $1.07 billion in locked ENS tokens.

EP 2.2.4: ENS Endowment: In September, the DAO recently submitted a Request For Proposal to find a fund manager to manage the treasury. The fund manager would draw on idle ETH and USDC treasury funds and deploy them with the goal of returning a minimum of $4 million per year to the DAO.

Key Events

The recent ENS Town Hall and Devcon talk by ENS founder Nick Johnson offered a glimpse into the current status and key events.

Coinbase & ENS: Coinbase announced a partnership with ENS to create cb.id usernames. Users can connect their existing .eth addresses or their new cb.id to build their Web3 profiles. The usernames are available through Coinbase Wallet Extension.

ENS Ecosystem Steward Election: Q3/Q4 2022: The DAO recently finished voting on a proposal to elect three stewards for the ENS Ecosystem working group of the ENS DAO for the second term of 2022 (Q3/Q4, 2022). The DAO elected bobjiang.eth, validator.eth, and slobo.eth as stewards.

A full list of ENS events can be found on Messari’s Intel and Governor pages.

Closing Summary

In terms of user experience, ENS made a significant step forward for the entire Web3 space. ENS offers a user-friendly solution that maps blockchain addresses to domain names which are easy to reproduce. Anyone can register and own ENS domains on a multi-yearly basis. The number of ENS domain name registrations reached an all-time-high in Q3’22. Simultaneously, renewals grew 3x QoQ. It remains to be seen whether registrations and renewals will continue to grow, given that many ENS names are up for renewal over the next months.

Despite market weakness, ENS monthly active addresses remain robust. While down 33% from the May 2022 peak, monthly active addresses are still 2.5x higher YoY. This shows that ENS is being used widespread at an accelerated rate. While being an unarguably unique and solid project, the real test for ENS is building a sustainable base of users around solid use cases.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Nothing contained in this report is a recommendation or suggestion, directly or indirectly, to buy, sell, make, or hold any investment, loan, commodity, or security, or to undertake any investment or trading strategy with respect to any investment, loan, commodity, security, or any issuer. This report should not be construed as an offer to sell or the solicitation of an offer to buy any security or commodity. Messari does not guarantee the sequence, accuracy, completeness, or timeliness of any information provided in this report. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Mihai is director of research at Messari. Mihai and his team cover base layers, mid-layer infrastructure, DeFi, and consumer. Prior to joining Messari, Mihai was a tech entrepreneur and worked in AI at UBS and Swiss Re. His background is in computer science and math. Mihai holds a PhD in information systems from ETH Zurich, Switzerland

Read more

Research Reports

Read more

Research Reports

About the authors

Mihai is director of research at Messari. Mihai and his team cover base layers, mid-layer infrastructure, DeFi, and consumer. Prior to joining Messari, Mihai was a tech entrepreneur and worked in AI at UBS and Swiss Re. His background is in computer science and math. Mihai holds a PhD in information systems from ETH Zurich, Switzerland

Kel likes asymmetric opportunities and good debates.