Key Insights

- The community decision to wind down the Liquidity Staking Module (LSM) led to a $2 million reduction in DYDX emissions.

- Daily active users increased 39% after the FTX collapse.

- An amendment to the vesting schedule extended the lock on 150 million DYDX tokens.

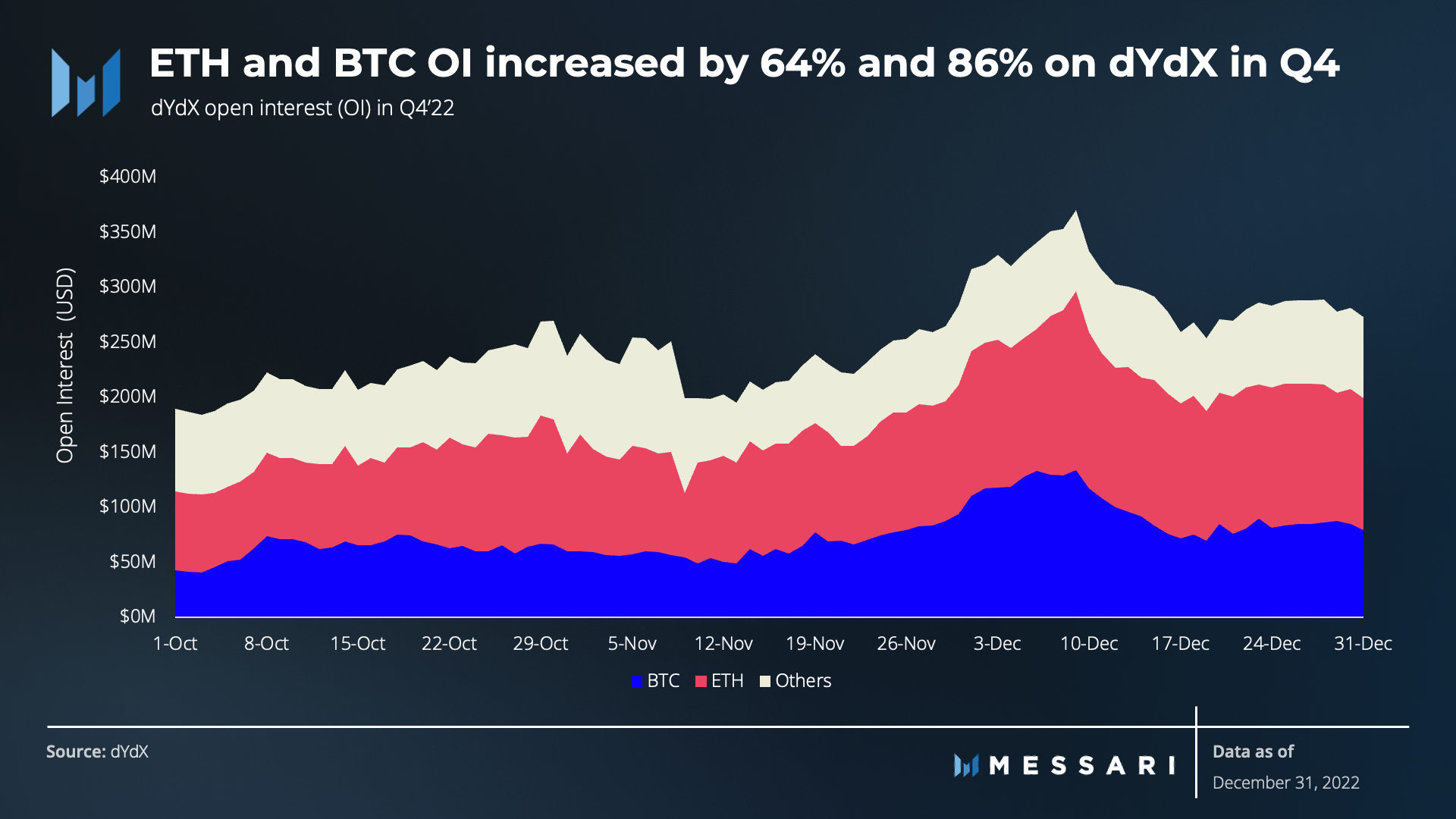

- Open interest (OI) increased 43% in Q4.

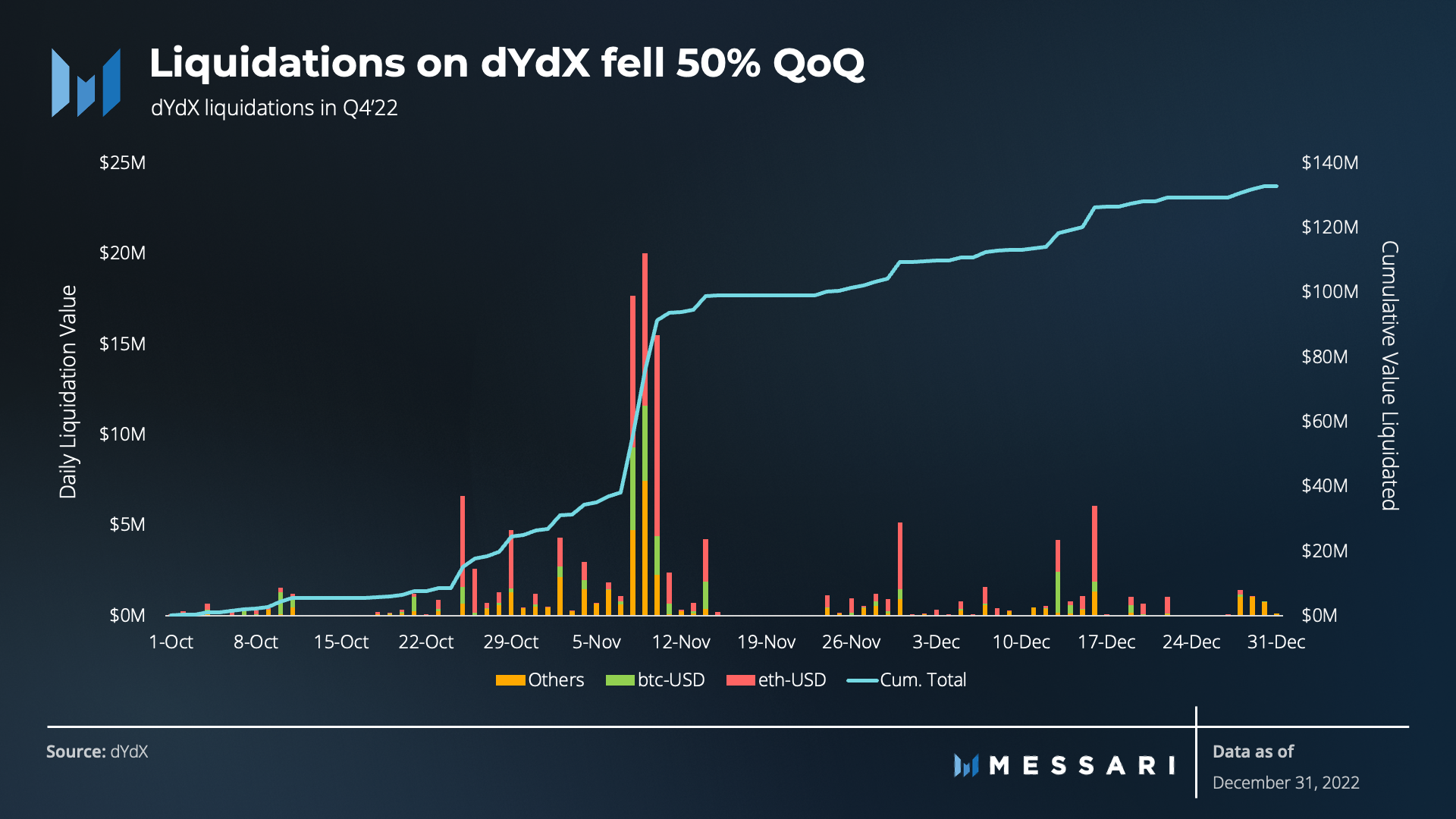

- Liquidation volumes decreased 50% in Q4, following a 43% reduction in Q3.

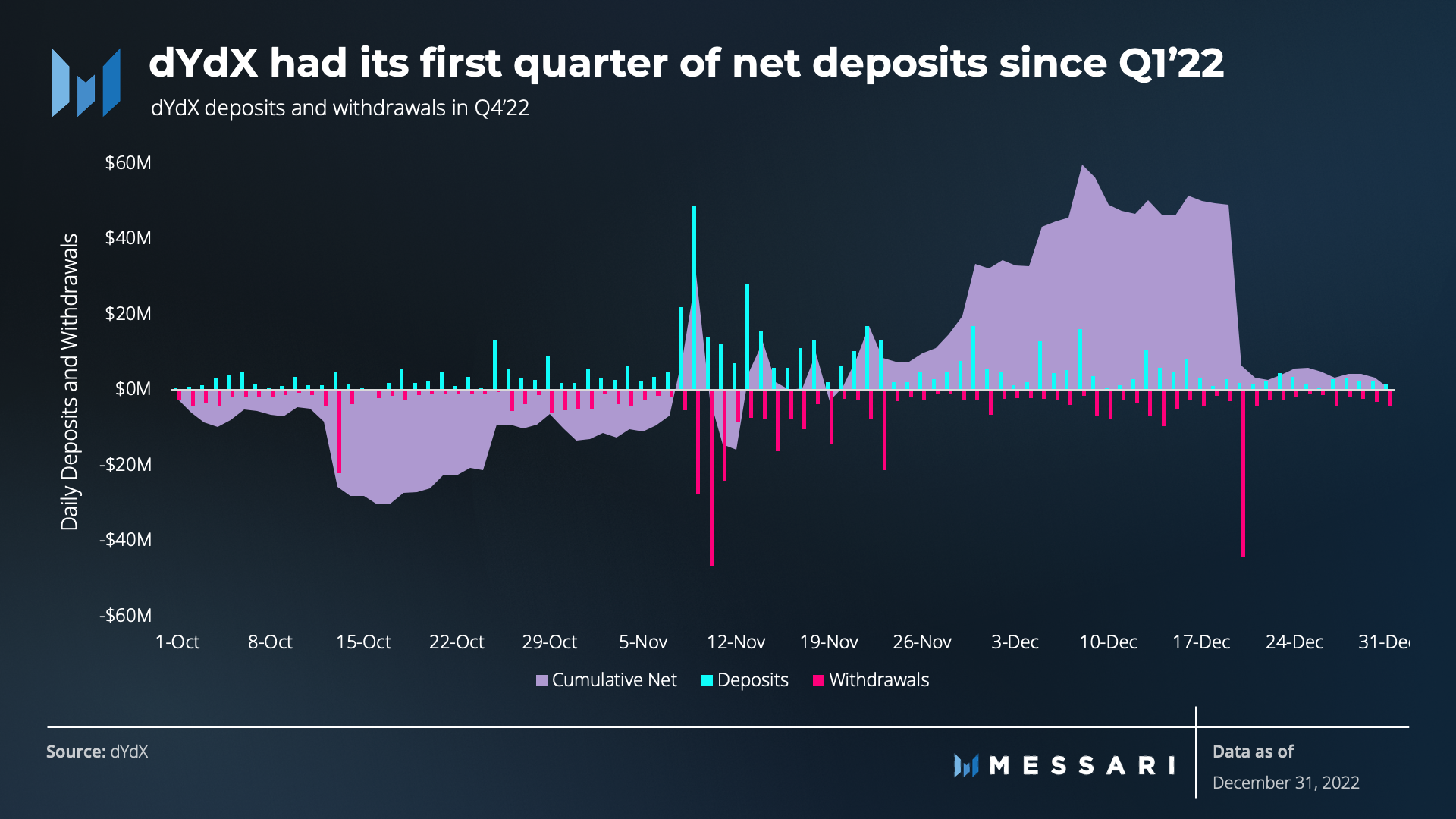

- A $14.1 million swing in net deposits was observed after the FTX collapse, with net deposits totaling $7.3 million thereafter.

Primer on dYdX

dYdX protocol operates a derivatives exchange on the Layer-2 (L2) StarkEx network. The hybrid-decentralized exchange offers perpetual futures contracts similar to the ones found on Binance and other centralized exchanges. dYdX Trading Inc. ultimately hopes to build a fully decentralized derivatives exchange where no single party, including the team itself, can claim authority over the protocol’s fundamental operations.

In the summer of 2017, Antonio Juliano, an ex-Coinbase engineer, founded dYdX. The protocol’s first two products, Expo and Solo, were built for margin trading on Ethereum. After seeing the explosion of perp trading on Bitmex in 2019, dYdX decided to become the first DeFi protocol to provide perp trading. The launch of perps for major tokens such as BTC and ETH quickly grew in popularity among traders seeking to use margin. Ease of use was further improved with the addition of StarkEx L2 rollups in 2021.

In Q2 2022, dYdX announced V4 of the dYdX protocol and a transition from StarkEx to its own native blockchain, called dYdX Chain, as part of its effort to fully decentralize.

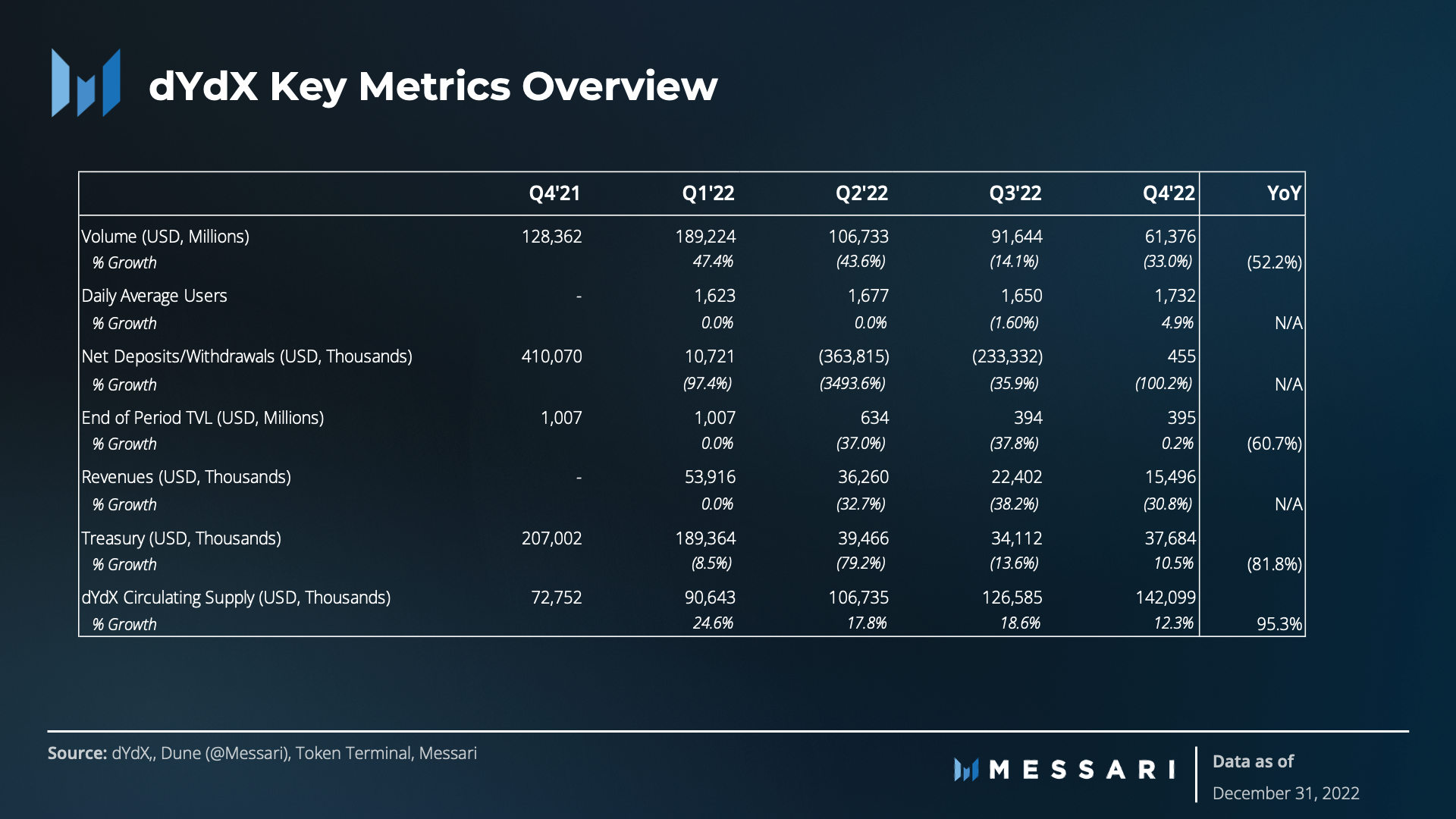

Key Metrics

Performance Analysis

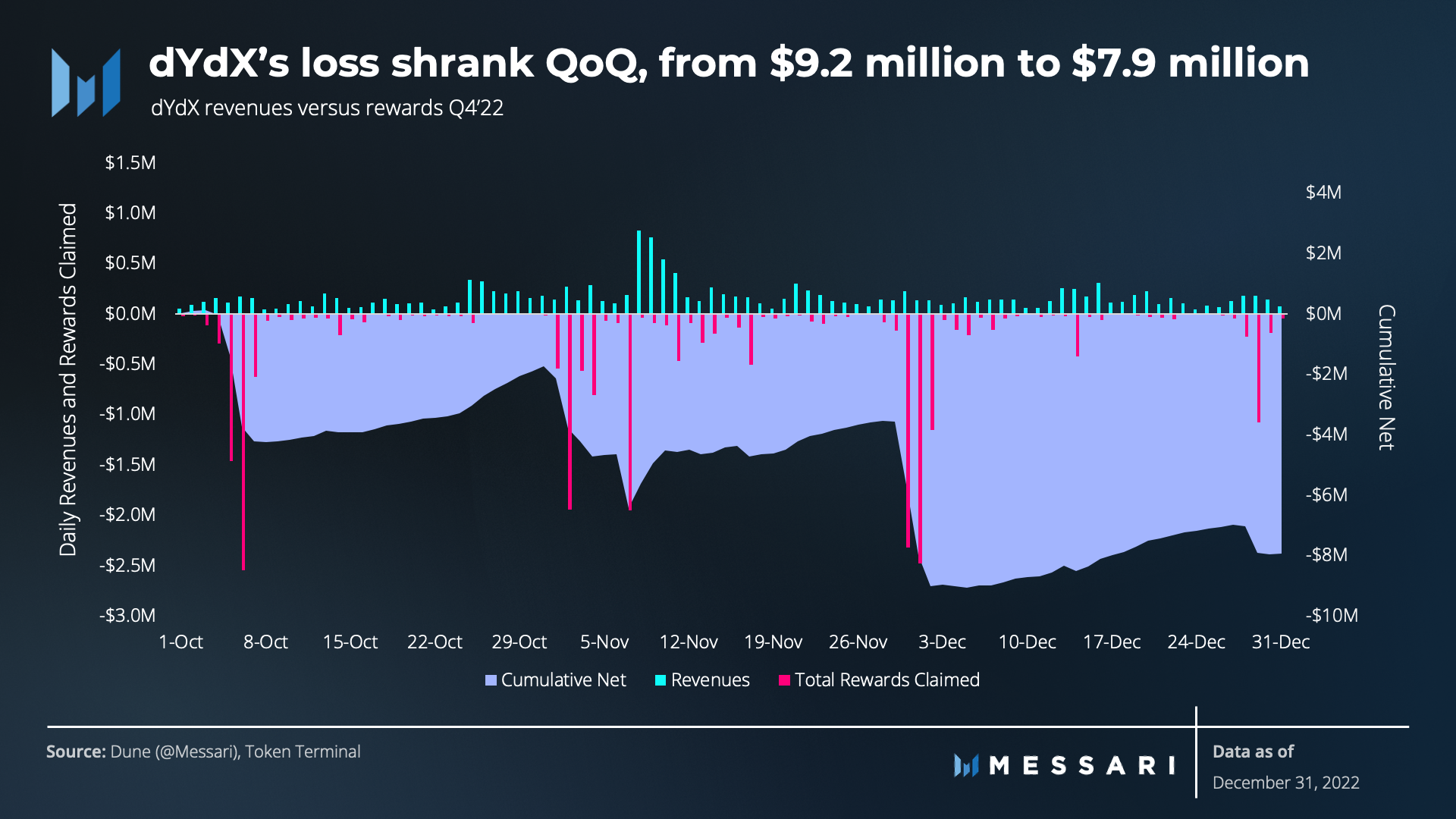

Despite a significant drop in revenue from $22.4 million in Q3 to $15.5 million in Q4, the protocol experienced a positive change in net income. A 14% improvement in losses was observed, from $9.2 million in Q3 to $7.9 million in Q4. The improvement is a result of the community's decision to wind down the Liquidity Staking Module (LSM) at the end of Q3. This decision led to a reduction of inflation rewards, which totaled $2 million in Q4.

Overall, in 2022, the protocol generated $128.1 million in revenue and paid out $197.3 million in rewards, resulting in a total net loss of $69.3 million. While 65% of the loss came from Q1, notably only 42% of the revenue came from Q1, indicating that the community has been able to cut costs at a faster rate than the decline in revenue (though revenues still go to dYdX trading while costs are measured in DYDX dilution, allocated by dYdX Foundation during the token launch). Spikes in rewards claimed are due to the epoch schedule, allowing reward collection approximately every 28 days.

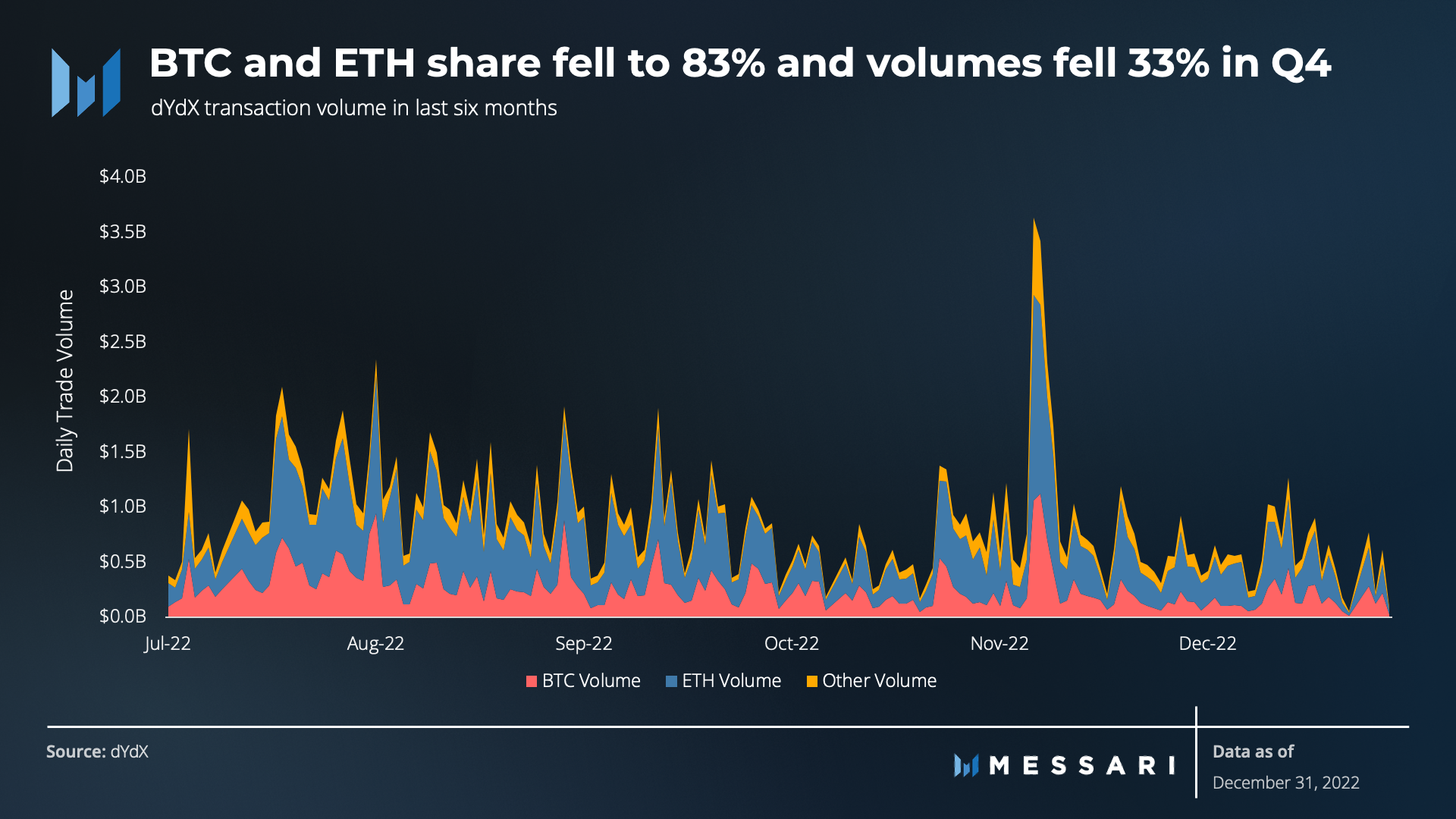

In Q4, dYdX experienced a 33% decrease in quarter-over-quarter (QoQ) volumes, falling from $91.6 million to $61.4 million. Additionally, the BTC and ETH share of total volume decreased from 87% to 83%, with an increase in Doge volumes accounting for 48% of the difference. The one large volume event in Q4 surrounded the collapse of FTX and produced 18% of the quarterly volume within a four-day period, beginning November 8.

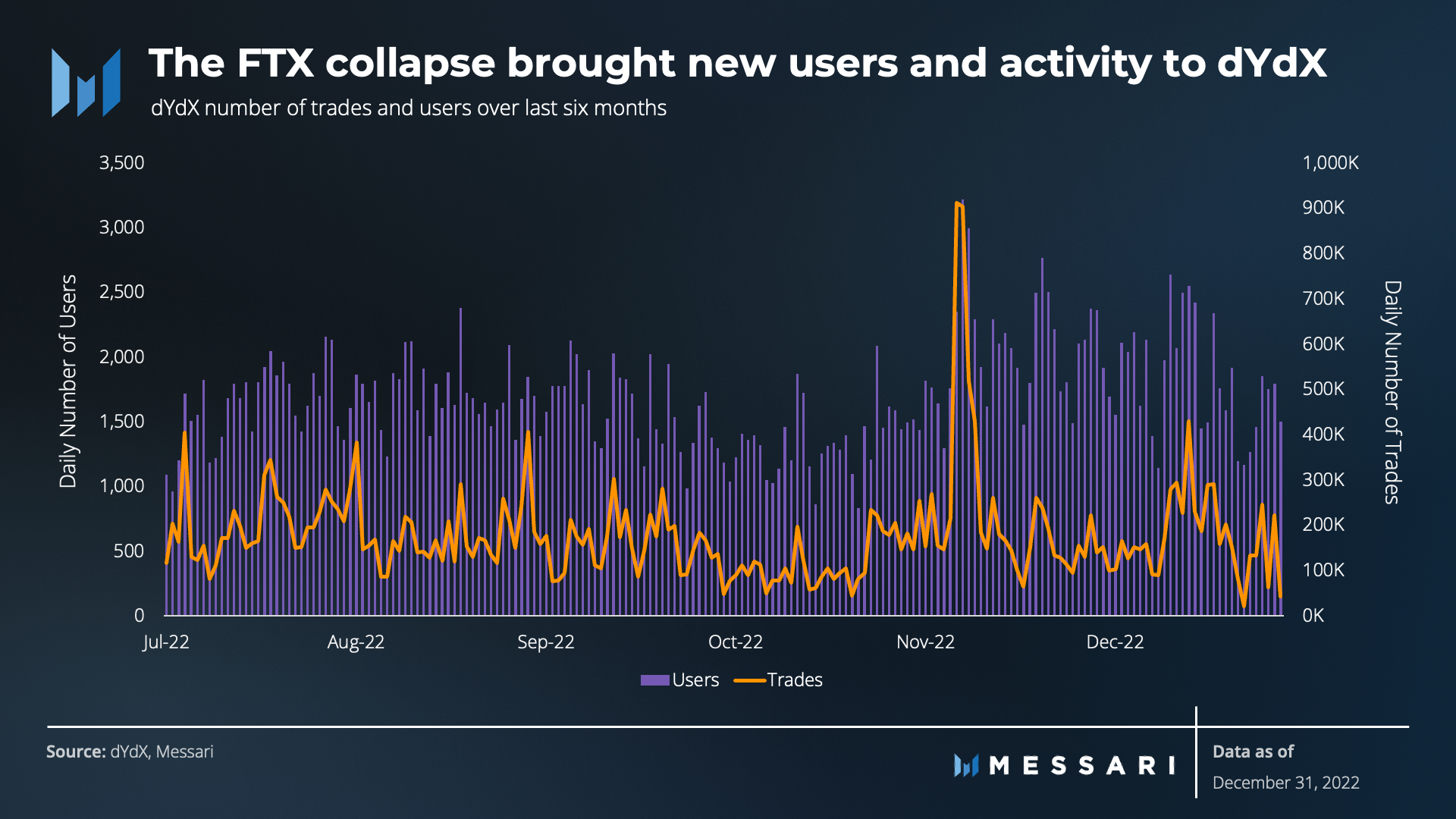

In Q4, dYdX experienced a 10% QoQ decrease in the median number of trades and a 2% decrease in median daily active users (DAUs). Both of these metrics reached yearly lows in October, which negatively impacted overall Q4 numbers.

Protocol usage was bolstered by the FTX collapse. Notably, though, usage began to increase about a week before the elevated volumes began on November 8. From October 31 to November 7, there was a 25% increase in the seven-day moving average of DAUs and an 18% increase in the number of trades.

When netting out the four days (November 8-11) of elevated volumes in Q4 and comparing the period before and after, a 41% increase in median DAUs and a 36% increase in the median number of daily trades were observed, indicating a positive trend in user retention.

After $597 million was withdrawn from the platform between Q2 and Q3, dYdX had its first quarter of net deposits since Q1, totaling $455,000. When isolating the timelines to pre-FTX collapse and thereafter, a $14.1 million swing was observed, with net deposits totaling -$6.8 million before and $7.3 million after.

Notably, quarterly net deposits stood at $49 million until one whale withdrew $44 million on December 20, as shown by the large spike above. A closer look at the wallet reveals the address withdrew a total of $95 million in 2022 and has net deposited $14 million so far in January 2023.

Open interest (OI) increased 43% in USD terms in Q4. In contract terms, BTC OI jumped 120%, while ETH OI increased by 59%. Other assets such as BCH, XMR, YFI, and ZEC experienced a decrease of 50% or more in OI. On the other hand, ALGO, ENJ, EOS, FIL, ICP, NEAR, SOL, TRX, XTZ, and ZRX joined BTC with at least a 100% increase. In USD terms, ICP OI increased the most at 336%, while SOL OI had the highest increase in contract terms at 709% as the price fell 70% over the quarter.

In Q4, the overall stability in asset prices resulted in a 50% decrease in liquidation volumes. This follows a 43% reduction in Q3, resulting in Q4 liquidation volumes being only 29% of what they were in Q2. The BTC share of liquidations increased from 14% to 19%, while the Ethereum share decreased from 64% to 52%. Notably, liquidation volumes for 1INCH, ALGO, DOGE, LTC, SUSHI, and TRX all increased by more than 100% and cumulatively accounted for 30% of the total liquidation volume in Q4, compared to 15% in Q3.

After a small lull in September and October, dYdX's share of the BTC perpetual market experienced a significant increase in the wake of the FTX collapse. Throughout the remainder of the year, the protocol's 28-day moving average share of the BTC perp market continued its upward trend, growing from 0.8% to 1.5%. Other major players also experienced an increase in their share of the BTC perp market. Binance's share grew from 50% to 69%, OKX's from 10% to 13%, and ByBit's from 13% to 17%. On average, these three platforms gained 33% of their previous market share, while dYdX grew 95% of its previous share. Despite this, dYdX's share of the total market remains relatively small compared to these other players.

In Q3, dYdX was able to maintain its market share of ETH perpetual trading as volumes soared, likely due to uncertainty leading into The Merge. This exhibited the protocol's ability to compete with the funding rates of the largest centralized exchanges and likely affirmed dYdX as a viable alternative for traders at the time, and for traders who would later be impacted directly or indirectly by FTX and other centralized exchanges. On a quarterly basis, dYdX's market share remained steady at 2.1%. However, when isolating the Q4 timeline to post-FTX collapse, the market share jumped to 2.6%, signifying trust in the protocol to provide a reliable and stable trading environment for its users, even in uncertain times.

Qualitative Analysis

Safety Staking Module

The dYdX Safety Staking Module (SSM) allowed users to deposit DYDX tokens, which could be slashed by governance in the event of a protocol shortfall, such as an exploit or insolvency. Users were rewarded for their participation in the form of proportionate distribution of 383,562 DYDX tokens at the end of every 28-day epoch.

However, a research report on the SSM by Xenophon Labs, a dYdX grantee, found that the SSM had a nominal value that was significantly higher than its actual insurance power. This is because in the event of a shortfall, the protocol would not be able to convert all of the DYDX in the SSM without severely impacting the market price. Additionally, it would not be fair to assume that the DYDX token price would remain unaffected in the case of a shortfall event, as the event provides new information that the protocol is less economically secure and capitalized than previously thought.

Due to these findings, on October 29, the community voted to wind down the SSM and send the remaining rewards to the community treasury. This decision was also influenced by the fact that there is already a $17 million+ USDC insurance fund operated by dYdX Trading Inc. This vote, along with the vote to wind down the borrowing pool and reduce trading rewards by 25%, reduced the protocol emissions by a total of 1,726,028 DYDX per 28-day epoch.

Milestone 2 completed on the road to V4

In November, the dYdX team announced the completion of the second milestone in the development of the dYdX V4 Blockchain. Two internal blockchain networks have been established, one for development and the other as a general testnet. Each blockchain includes core trading functionality such as leverage, fees, oracle price updates, hourly funding rates, and liquidations.

Work on Milestone 3 has since begun. The primary goal of the launch is an external testnet with a small group of validators. This testnet will include advanced order types, dynamic funding rates, key-permissioning and access management, and a web trading interface. A roadmap update provided new timeline estimates with an expected launch in H2 2023. Milestone M3 (Private Testnet) is expected to be completed by the end of March, M4 (Public Testnet) by end of July, and M5 (Public Mainnet) by end of September.

DYDX Token Unlock Delayed

dYdX Foundation released an announcement regarding an amendment to the vesting schedule of private DYDX tokens. Per the initial token distribution, 27% of the total supply was allocated to past investors of dYdX Trading Inc., 15.3% to founders, employees, advisors, and consultants, and 7% to future employees and consultants. 30% (150 million DYDX) of the vesting tokens were scheduled to unlock at the beginning of February and would have increased the circulating supply by more than 100%. However, the amendment extended the lock on the tokens until December 1. The DYDX token price surged more than 25% on the news, indicating positive sentiment from investors.

Operations SubDAO

On December 18, the dYdX community voted to launch the dYdX Operations Trust (DOT) as the next step toward fully decentralizing the protocol. Prior to this, the dYdX Foundation initiated a discussion surrounding the near- and long-term goals of the dYdX DAO and presented the use of subDAOs as an effective means of allocating resources and responsibilities, while further decentralizing the decision-making process. DOT, which was funded with $360,000 DYDX tokens from the community treasury, has the primary goal of publishing a comprehensive dYdX DAO playbook that will serve as a guide for the community in launching new subDAOs. A draft version of the playbook is scheduled to be delivered to the community in March, and updates on its progress can be found on the DOT homepage.

Improving User Experience

The dYdX team has been noticeably working to enhance the user experience on its platform. In October, the company partnered with Banxa, a global fiat-to-crypto on-and-off ramp solution, to allow users to purchase USDC directly on the platform using a variety of payment methods, including credit card, bank transfer, and other local payment options. This partnership aims to make the trading experience on dYdX more accessible and user-friendly for a wider range of traders, who may be unfamiliar with the process of converting fiat to crypto.

In November, dYdX launched its new "Swap Mode" feature, which provides users with the ability to trade perpetuals with leverage through a user-friendly, swap-style interface. This feature aims to increase accessibility for traders who may be unfamiliar with trading perpetuals, while a Pro Mode remains available for professional traders. Each effort demonstrates dYdX's commitment to creating a better user experience.

Fee Analysis

In "Analysis of the Impact of Fees on dYdX Trading Volumes," a recent study, dYdX grantees 0xCLR and 0xCchan, found that dYdX's trading volumes have not shown a strong preference for lower fees overall, despite the implementation of three separate, zero-fee, trial periods. The study also found a difference in fee elasticity between markets, with the most developed markets, ETH and BTC, showing a stronger preference for lower fees before the Luna collapse. The study concludes that differentiating lower fees in these markets could better segment trader preferences and support the goal of maximizing the total value created by dYdX.

Closing Summary

dYdX experienced a 14% improvement in net loss in Q4, largely as a result of the community's decision to wind down the Liquidity Staking Module (LSM). Despite a 33% decrease in QoQ volumes, protocol usage was boosted by the FTX collapse, with a 41% increase in median DAUs and 36% increase in the median number of trades observed thereafter. The platform also saw a 43% increase in Open Interest and a 50% decrease in liquidation volumes in Q4. Overall, the community is showing positive signs of growth and stability as it continues to improve its user experience and cut costs.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by dYdX Grants Programs. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Prior to joining Messari, Kentrell worked in real estate finance. After first diving into crypto in 2019, he became fascinated with DeFi in 2020, drawn to its data transparency, real-time settlement capabilities, and high yields. Today, Kentrell spends his time researching more sustainable yield strategies and writing about DeFi protocols at Messari.

Read more

Research Reports

Read more

Research Reports

About the author

Prior to joining Messari, Kentrell worked in real estate finance. After first diving into crypto in 2019, he became fascinated with DeFi in 2020, drawn to its data transparency, real-time settlement capabilities, and high yields. Today, Kentrell spends his time researching more sustainable yield strategies and writing about DeFi protocols at Messari.