Powered by Messari’s Proprietary Fundraising Data

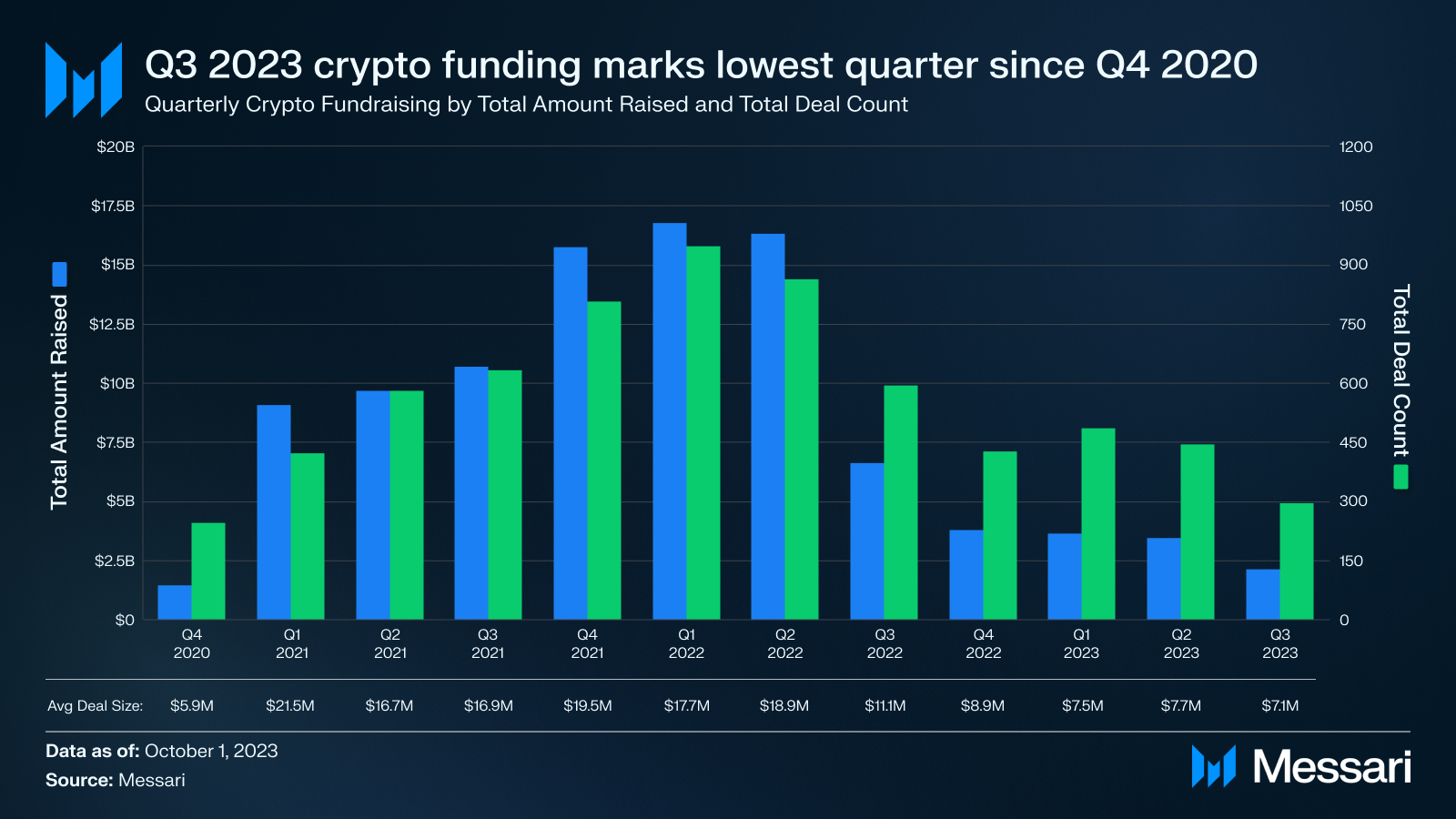

Crypto’s ongoing bear market is possibly best exemplified by the industry’s fundraising data. Q3 2023 was no exception to the multi-quarter downtrend we’ve witnessed since the beginning of 2022 – Q3 marked new lows in both overall funding amounts and deal counts that have not been seen since Q4 2020. The quarterly totals checked in at just under $2.1 billion across 297 total deals, down 36% in both categories from last quarter.

Fundraising by Stage

Breaking Q3’s deals out by stage, we can see that the majority of deals are concentrated in early stage rounds. Seed funding accounted for the largest stage total with $488 million raised over 98 rounds. Trends in deal counts show a significant shift away from later stage projects and into early stage projects over the last three years.

Early stage deals (defined by Pre-Seed, Seed, and Series A deals) have increased from a 37% deal share in Q4 2020 to a 48% share in Q3 2023. Meanwhile, later stage deals (defined by Series B or later deals) have decreased from an 8% deal share in Q4 2020 to a 1.4% deal share in Q3 2023. This is indicative of strategic bear market positioning as investors attempt to fund projects with asymmetric upside that can return greater multiples when market sentiment eventually shifts in a positive direction.

There was also a significant amount of funding that came in the form of strategic investments during Q3, highlighted by corporate and private equity deals like the $200 million investment into Islamic Coin. Strategic funding deals have been steadily increasing throughout the bear market. At the peak of the bull market in Q4 2021, strategic rounds only had a 0.2% total funding share. In Q3 2023, that share climbed to 22%, suggesting that the harsh market conditions are forcing projects to raise short-term bridge rounds or ultimately get acquired by larger projects.

Fundraising by Sector

Sector Trends

The distribution of sector funding for Q3 followed a similar pattern to what we’ve seen over the last 12 months. The chain infrastructure, DeFi, and gaming sectors have consistently been the most well-funded sectors during this time period. The services sector, defined by complementary business functions such as marketing, incubators, security, and legal services, was the only other sector to average over $100 million in funding over the last 12 months. While other sectors are important to growing the crypto industry as a whole, these four sectors continue to attract the majority of investor attention.

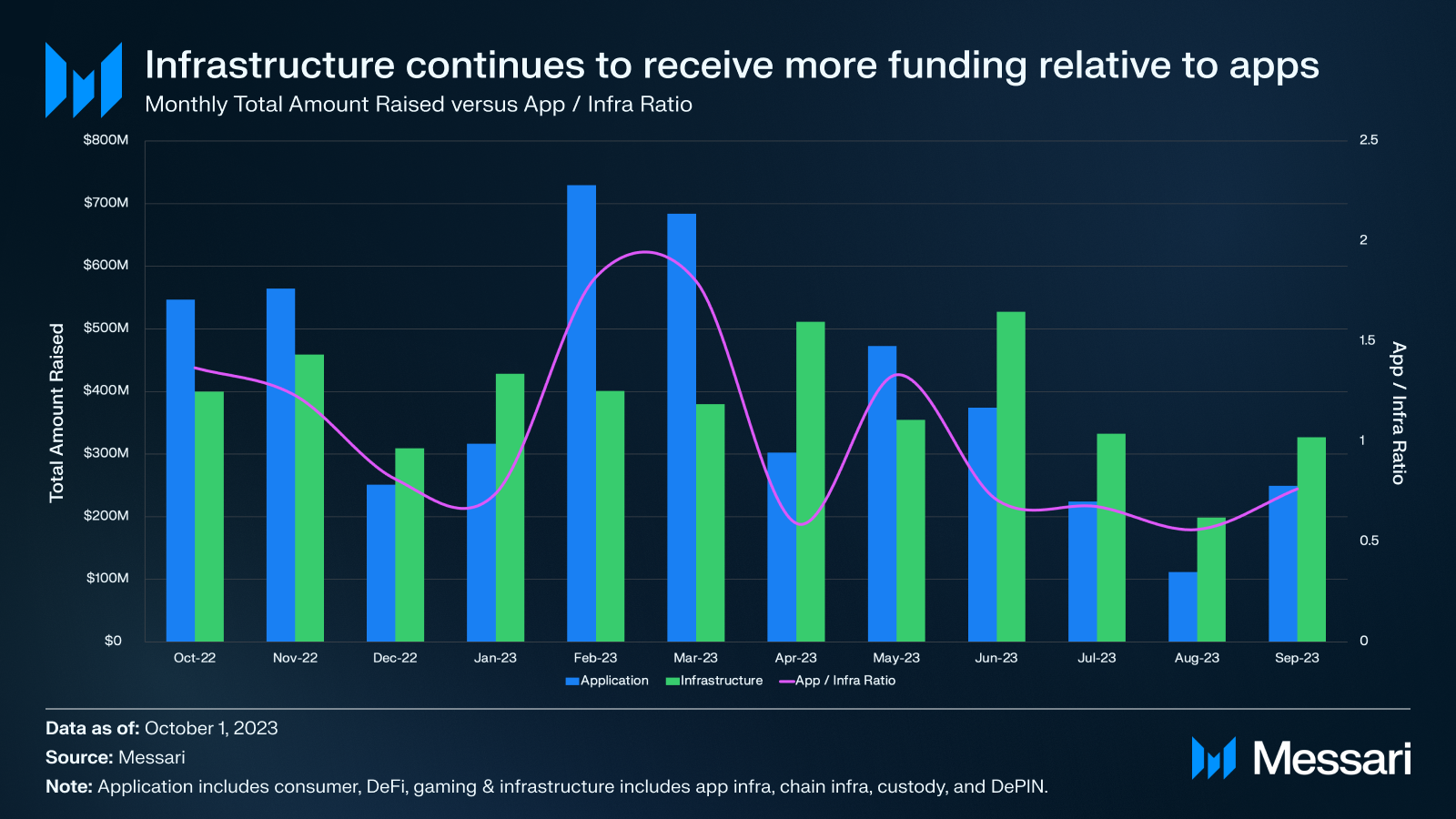

Another notable trend from the last year is an increased amount of funding for infrastructure-based projects compared to user-facing applications. This is best demonstrated by grouping the consumer, DeFi, and gaming sectors together in an “application” bucket and the application infrastructure, chain infrastructure, custody, and DePIN sectors together in an “infrastructure” bucket.

When looking at the ratio of amounts raised for each of these buckets, we see a subtle shift away from user-facing applications towards infrastructure projects. This relationship has been buoyed by consistent funding for infrastructure projects compared to the higher variance application bucket. However, this trend may not last for long as more investors are beginning to realize that without successful user-facing crypto applications, infrastructure investments are less likely to generate their desired returns.

Leading Sectors

Funding for Q3 was relatively spread out across sectors. Chain infrastructure accounted for the largest share of capital at 18% while DeFi led the way in terms of number of deals funded with 67. Finally, the gaming sector had another strong quarter with almost $250 million invested into the sector.

Chain Infrastructure

The chain infrastructure sector accounted for the largest share of funding during Q3 despite seeing only 21 deals. One third of these deals took place in the smart contract platform subcategory, highlighted by Fhenix’s $7 million raise to build fully encrypted smart contracts.

Scaling solutions were responsible for 43% of the capital raised within the sector. This represents a continued shift away from smart contract platforms into scaling solutions. Q1 2022 marked the first time that funding for scaling solutions outpaced funding for smart contract platforms when Polygon raised $450 million for its suite of scaling solutions. The ratio of capital invested in scaling solutions to smart contract platforms has eclipsed the previous Q1 2022 high in three of the last four quarters. The ratio has reached as high as 7x during Q4 2022 mostly due to a lack of investment activity in the smart contract platform category during the quarter.

Over 40% of the chain infrastructure’s $387 million in funding during Q3 2023 came from the Optimism Foundation selling approximately 116 million OP tokens to further its development efforts in late September. Other prominent deals included Flashbots’ $60 million Series B round to continue development on SUAVE, along with Bitmain’s $54 million strategic investment in Core Scientific, a leading Bitcoin mining company.

DeFi

DeFi was the sector with the most projects funded during Q3 with 68 deals. Investments within the sector were heavily concentrated with the exchange category accounting for 38% of all invested capital across 33 deals. Altogether, DeFi projects raised a collective $210 million with a $3 million average deal size.

Binance Labs was an active investor in the DeFi sector with seven deals during the quarter including $10 million strategic investments in both Helio Protocol, a liquid staking platform on BNB Chain, and Radiant Capital, a money market built on LayerZero. The largest DeFi deal of the quarter came in the form of a $16.5 million Series A funding round for Brine, an order-book DEX built on Starkware.

Three of the top four DeFi investors by deal count in Q3 were ecosystem entities. Binance Labs, the Base Ecosystem Fund, and Polygon were responsible for a combined 16 deals.

Gaming

The gaming sector amassed a handful of early-stage deals that helped it become the third-highest funded sector of Q3 with $249 million raised across 33 deals. When compared to other user-facing applications in the consumer sector, gaming accounted for 67% of capital invested during Q3.

The vast majority of deals within the gaming sector came from the long tail of investors. Only seven entities struck deals with two or more projects while 104 investors made single project investments within the sector.

The largest deal within the gaming sector was a $54 million Series A deal for Futureverse, a platform for combining AI and metaverse worlds. Other metaverse-based gaming projects such as Mocaverse and Mahjong Meta were also able to secure funding during the quarter. Finally, Proof of Play raised a massive $33 million seed round from lead investors a16z and Greenoaks. The onchain gaming studio was founded by Amitt Mahajan, one of the original co-creators of the popular Zynga game Farmville, and is hoping that blockchain-based gaming can follow a similar growth trajectory to early free-to-play mobile games.

Investors

Crypto’s most active investors generated 144 investments during Q3. Despite this activity, this group only accounted for 7% of all investor deals, indicating that crypto fundraising is still dominated by the long-tail of investors.

Outlier Ventures and Binance Labs were by far the most active investors – their 23 and 22 deals, respectively, during Q3 were more than double the next closest investor, Robot Ventures. Outlier Ventures mostly concentrated its bets in the payments (six deals) and DeFi (five deals) sectors.

As we highlighted in August, Binance Labs has been actively investing throughout 2023 with an emphasis on the DeFi and gaming sectors. Additionally, projects developing zero-knowledge and privacy technology also have investment targets for Binance Labs. It should be noted that 12 of Binance Labs’ 22 deals were projects participating in its accelerator program. However, even if these were excluded, Binance Labs’ other 11 investments would still leave it tied for second with Robot Ventures for Q3 deal activity.

Finally, 54% of the active Q3 investors were based in the United States. This figure is in line with the quarterly average from the last four years (55%). Despite project founders slowly leaving the United States in favor of more regulatory-friendly jurisdictions, the United States is still the home to the majority of crypto’s accredited investors.

Messari Fundraising Screener

All of the data from this report and more can be accessed using the new Messari Fundraising Screener. Duplicate existing screeners or create your own screeners to view Messari’s proprietary fundraising data in any way you’d like.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Nothing contained in this report is a recommendation or suggestion, directly or indirectly, to buy, sell, make, or hold any investment, loan, commodity, or security, or to undertake any investment or trading strategy with respect to any investment, loan, commodity, security, or any issuer. This report should not be construed as an offer to sell or the solicitation of an offer to buy any security or commodity. Messari does not guarantee the sequence, accuracy, completeness, or timeliness of any information provided in this report. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Chase's interest in crypto lies at the intersection of economics, psychology, and social coordination.

Read more

Research Reports

Read more

Research Reports

About the author

Chase's interest in crypto lies at the intersection of economics, psychology, and social coordination.