Key Insights

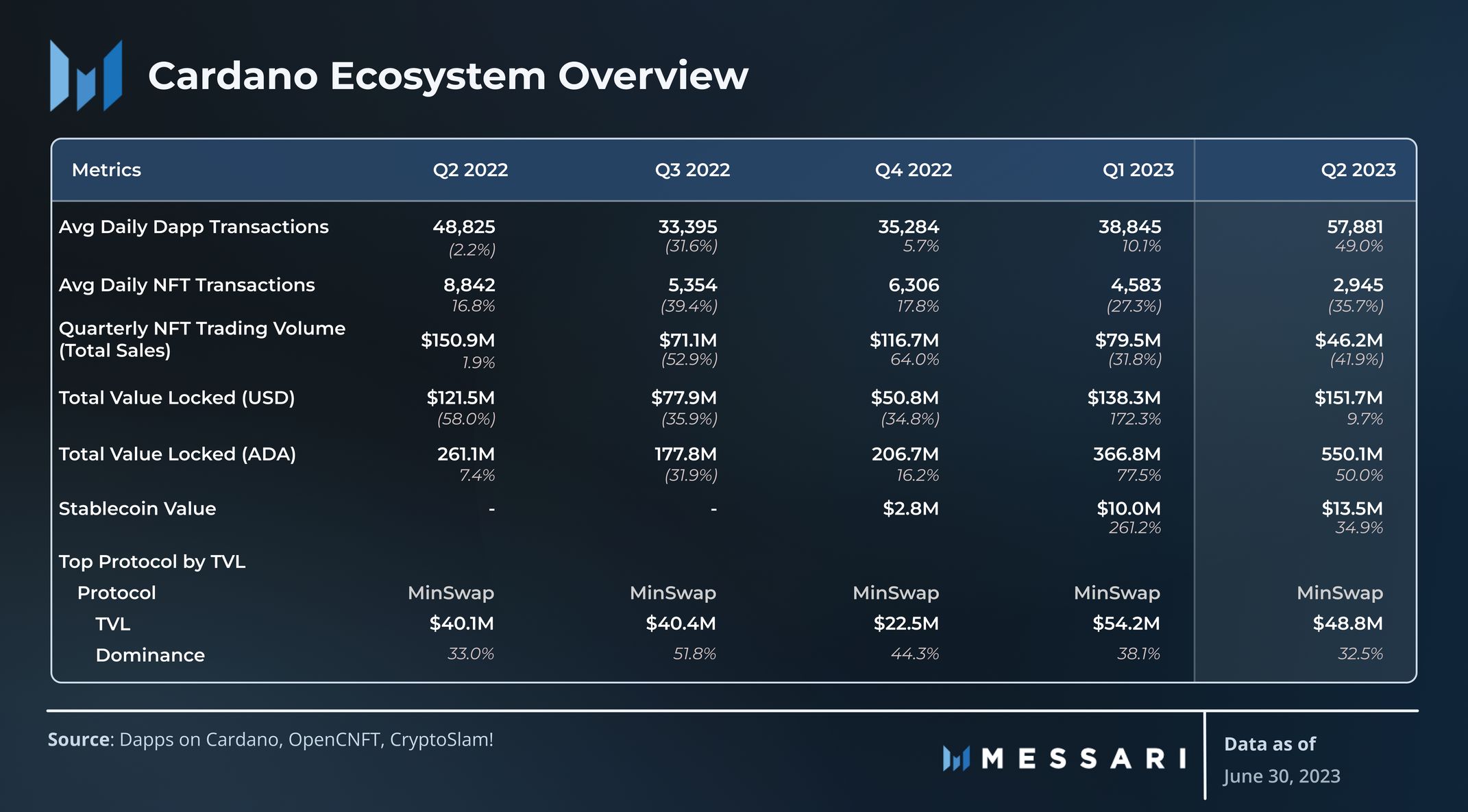

- Average daily dapp transactions were up 49% QoQ. Minswap had the largest absolute growth, but several new dapps contributed to the overall increase.

- TVL (USD) was up 9.7% QoQ and 198.6% YTD. Through 2023, Cardano moved up from 34th to 21st in TVL ranking across all chains.

- Hydra Head development continued with proposed topologies, interest from ecosystem teams, and a demo shared.

- Milkomeda C1, Midnight, Wanchain, and IOG’s sidechains team continue to build towards increased interoperability and new use cases in the greater Cardano ecosystem.

Primer on Cardano

Cardano is a Proof-of-Stake (PoS) Layer-1 smart contract network launched in 2017. Cardano’s PoS mechanism allows for delegation of stake. Cardano aims to provide security, scalability, and sustainability to decentralized applications and systems building on top of the blockchain. In addition to the community of developers, node operators, and projects, Cardano is supported by multiple entities: Input Output Global (IOG), dcSpark, The Cardano Foundation, EMURGO, and more. They work together to support the network’s development, adoption, and finances while Cardano moves toward the age of Voltaire.

Cardano has taken a unique approach to development when compared to other smart contract networks, based on a phased roadmap:

- Cardano’s development is methodical and deliberate — prioritizing sustainability and stability over speed. For example, smart contracts were not enabled until the Alonzo hard fork in 2021, over four years after the network launched.

- The extended unspent transaction output (eUTXO) accounting model enables native token transfers, scalability, and decentralization.

- Cardano has offered liquid staking and economic models to incentivize decentralization on its Ouroboros PoS consensus model since inception.

With a dedicated community of users and developers, Cardano has demonstrated staying power. Post-Alonzo, Cardano began to compete in more traditional crypto markets, such as DeFi and NFTs, while remaining focused on its core goals.

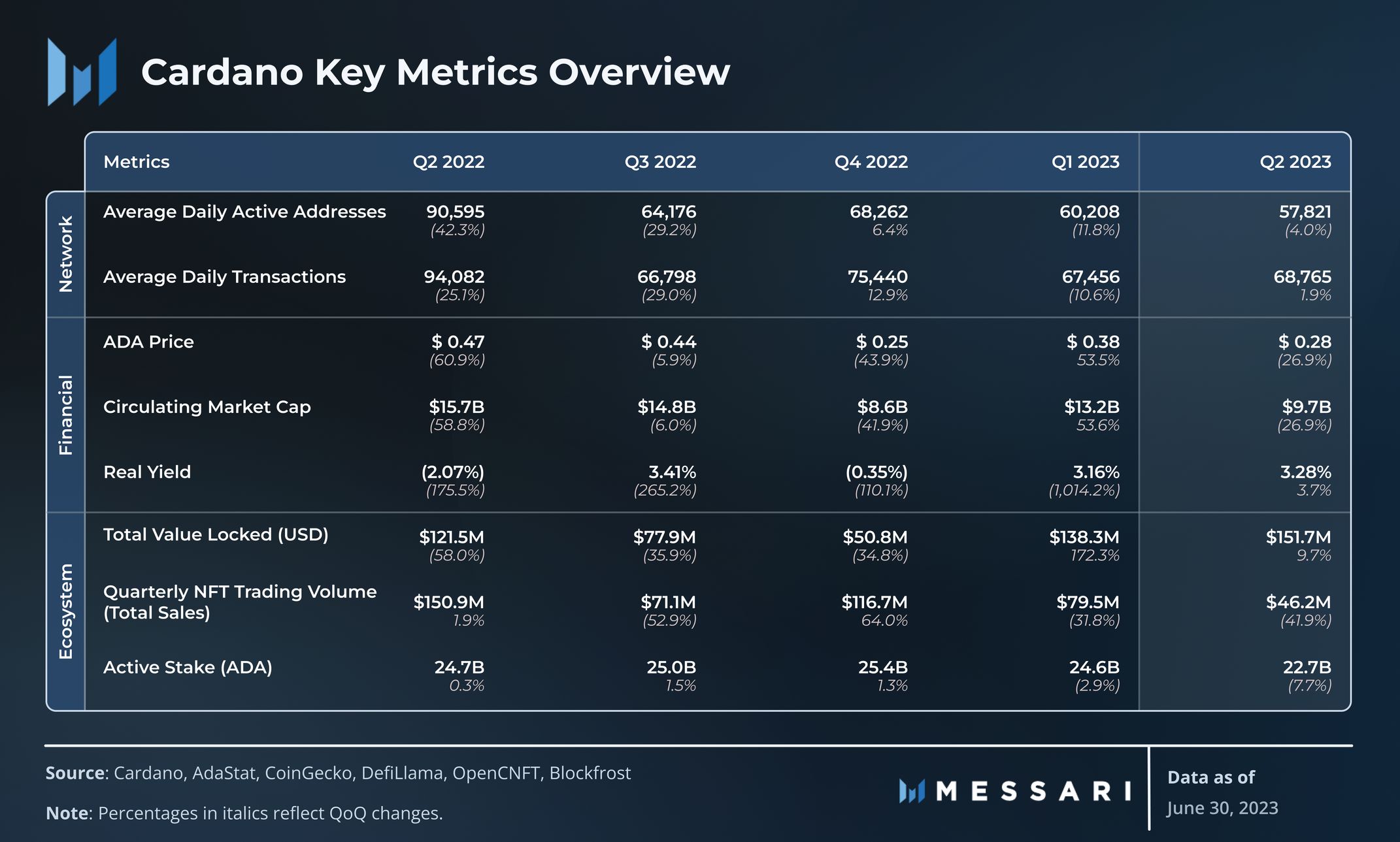

Key Metrics

Performance Analysis

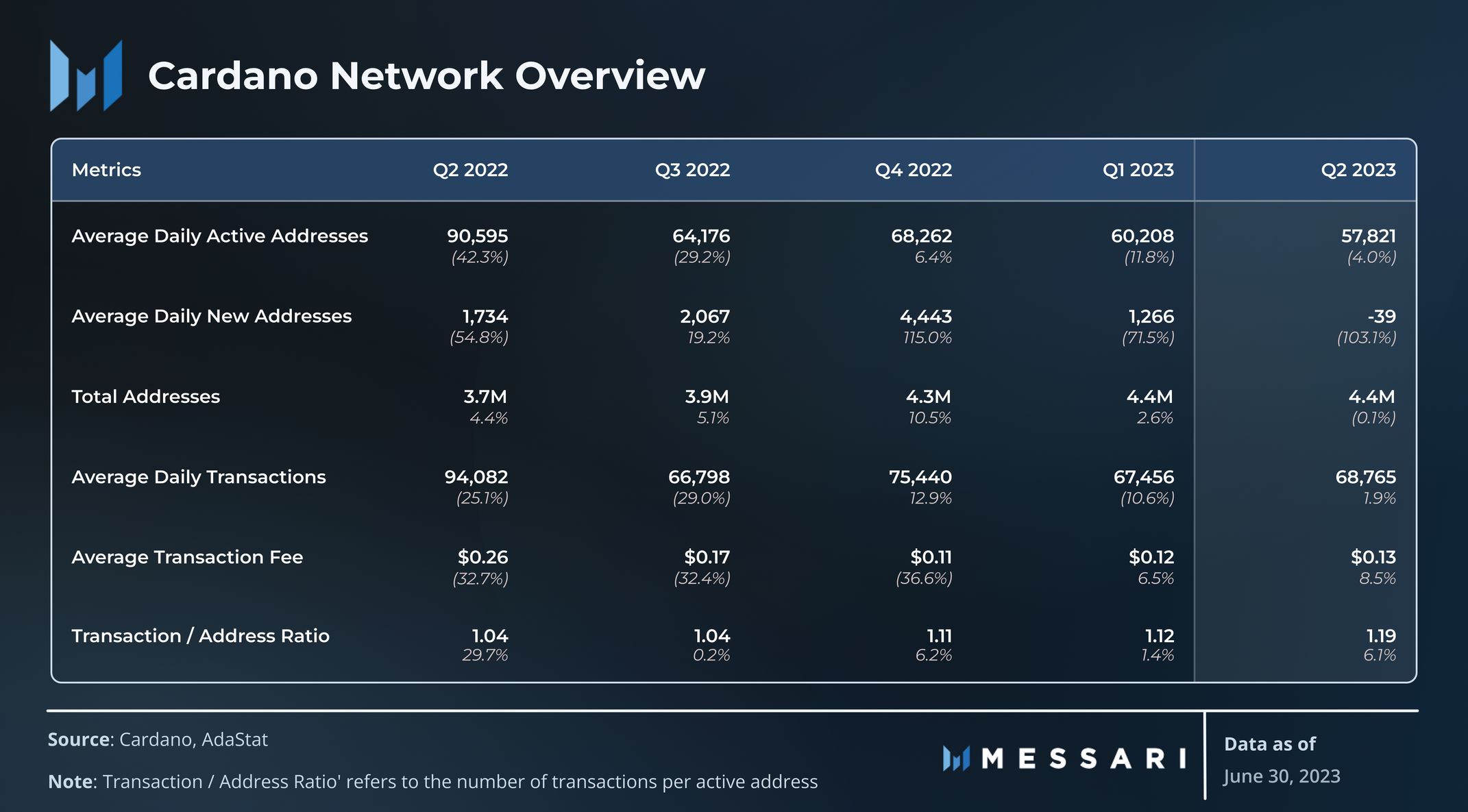

Note that Cardano uses a variant of the Unspent Transaction Output (UTXO) accounting model, like Bitcoin. Activity metrics such as those involving addresses and transfers are fundamentally different from those on networks with account-based accounting models (e.g., Ethereum, Solana).

Network Overview

The average transaction fee increased 8.5% QoQ from $0.117 to $0.126. Despite the increase in back-to-back quarters, the average transaction fee (USD) is still down 50.8% YoY, because of lower YoY ADA prices. Each transaction on the network is accompanied by a fee for processing actions and storage costs. Fees are calculated by a minimum payable fee in addition to transaction size.

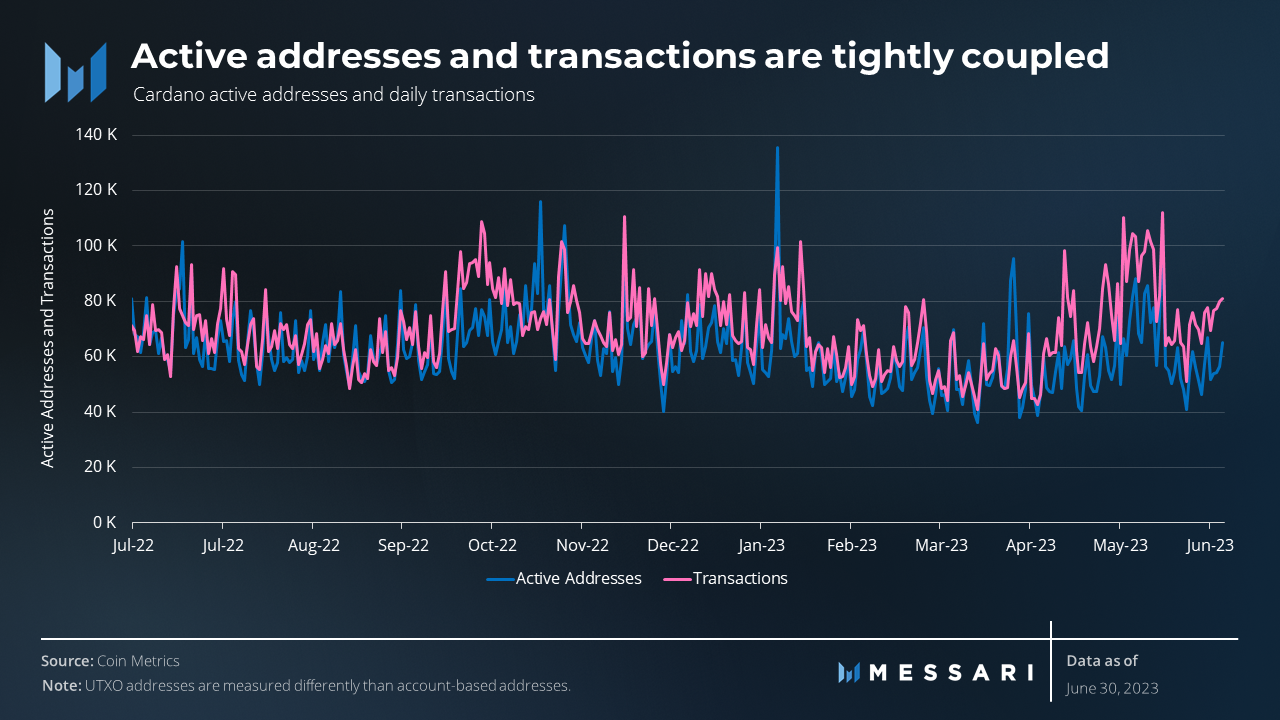

Various growing niches on Cardano, such as DeFi, have not been enough to increase overall activity metrics. Daily active addresses declined again in Q2, down 4.0% QoQ from 60,200 to 57,800. This marks the fourth QoQ decrease in address activity in the past five quarters.

Transaction activity, on the other hand, did increase in Q2. Average daily transactions were up 1.9% QoQ from 67,500 to 68,800. This is important to note as movement in transactions and active addresses are typically correlated, but have deviated slightly in recent quarters. The ratio of transactions to active addresses has been growing steadily over the past five quarters, suggesting that the average user is more active now than they previously were. In Q2, the Transaction / Active Address ratio of 1.19 was up 6.1% QoQ and 13.2% YoY.

Cardano’s average blockchain load increased from just under 40% in Q1 to over 50% in Q2. Average daily load in Q2 peaked at 81.2% in May, a level not seen since early 2022. A 100% load would mean that all blocks are full (currently 90 kb per block), and 0% load would mean that all blocks are empty. Smaller transactions, created by more efficient coin selection algorithms, would help increase Cardano’s TPS and bandwidth in the event of a 100% blockchain load.

Coin selection algorithms affect block load, fees, and general network metrics. Development team dcSpark recently launched a UTXO Selection Benchmarking tool to help wallet developers create more efficient coin selection algorithms. Different algorithms have varying processes to select UTXOs to build transactions and directly affect how ‘change’ (change refers to the leftover funds from a transaction that are sent back to the original sender's address) is distributed. There are various heuristics used by data infrastructure providers that account for nuances in the UTXO system, but not all 'change' is caught by these heuristics; change can look very different depending on the wallet building the transaction and which UTXOs are available in the user's wallet in the first place.

Financial Overview

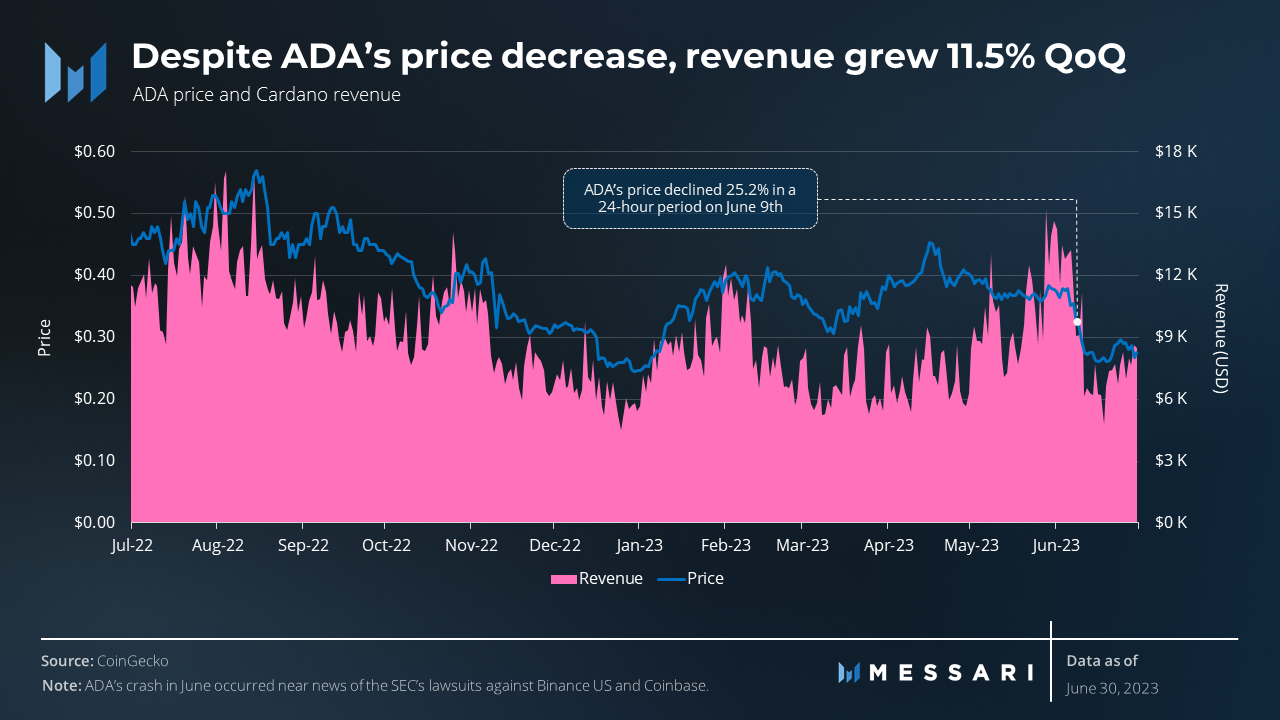

ADA’s price and market cap pulled back after a 53.5% increase in Q1. Despite the 26.9% QoQ decline, ADA is still up 12.0% YTD. ADA’s Q2 pullback made it lag behind the overall crypto market, which was up 0.1% QoQ. ADA is the native asset of Cardano and has three primary use cases: (1) settling network fees, (2) being used to register a stake pool to participate in network consensus as a pool operator, and (3) staking as a pool operator or delegator to help secure the network and earn token rewards.

Additionally, ADA is being used to reward voters and fund projects in Project Catalyst, Cardano’s decentralized innovation engine that uses a novel governance process to fund ecosystem projects via the Cardano Treasury. Project Catalyst is explored in depth in the Qualitative Analysis of this report. Cardano’s Treasury balance grew 8.5% to 1.30 billion ADA during Q2. The 100 million ADA increase is generally in line with growth from previous quarters. Due to ADA price depreciation, the treasury’s value in USD terms decreased 20.7% QoQ from $452 million to $358 million.

The nominal staking yield on Cardano is generally 3.3% for ADA delegators, although it can vary by stake pool. Real yield is calculated as nominal yield minus inflation to account for any value dilution due to inflation and was 3.28% in Q2. Any reference to inflation refers to ADA’s circulating supply rather than total supply since ADA’s supply is capped at 45 billion. Each epoch, 0.3% of ADA reserves (i.e., the ADA not in circulation) is used for SPO rewards.

The SEC separately charged both Binance US and Coinbase in early June and, in the process, alleged various crypto assets to be securities. One of the alleged assets was ADA. While there was no court ruling or clarification on ADA, some insight may be gained from the SEC’s case regarding XRP. A judge ruled that XRP, the token itself, is not an investment contract and thus not in and of itself a security.

ADA’s price dropped 22.4% (from $0.352 to $0.273) in one week from June 6 to June 11. On June 9, ADA dipped 25.2% in 24 hours (from $0.318 to $0.238), which caused a series of liquidations on DeFi borrowing protocols.

Ecosystem Overview

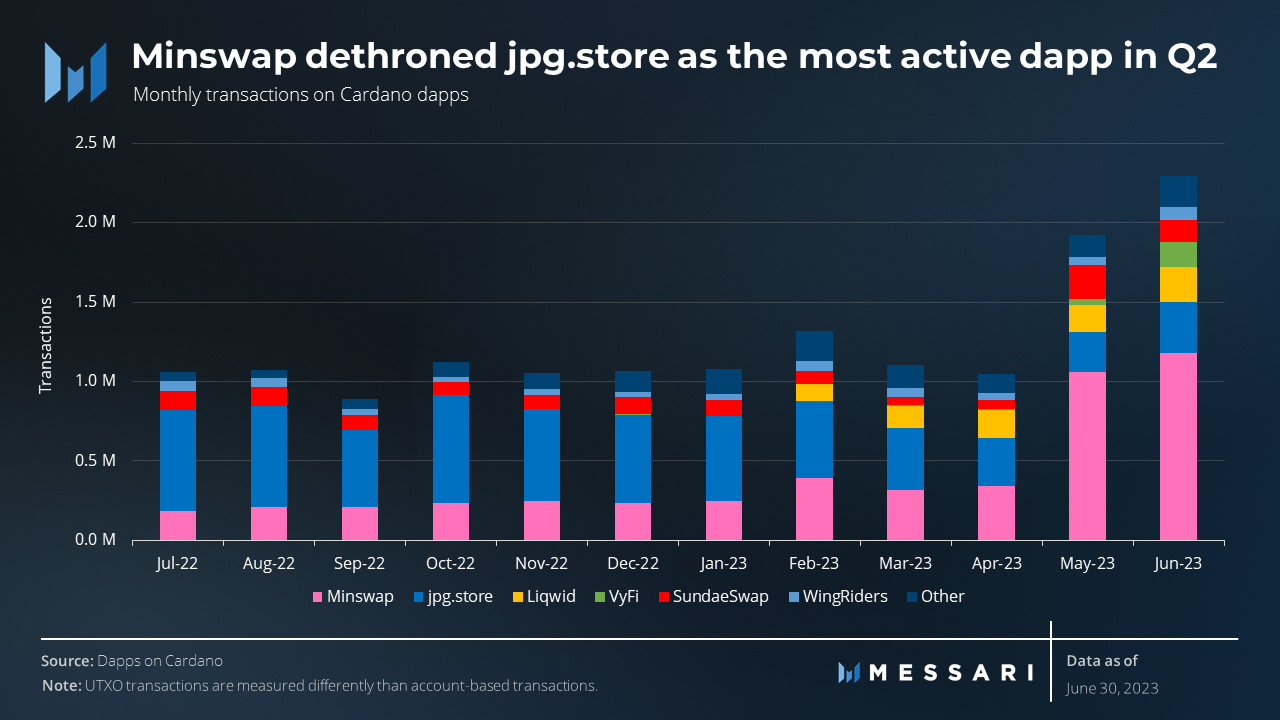

Average daily dapp transactions have increased for the third consecutive quarter. Dapp activity accelerated to a 49.0% QoQ increase in Q2, averaging 57,900 daily transactions.

Minswap, an automated market maker (AMM), was the most popular Cardano dapp by transactions in Q2, clearing 1 million monthly transactions in May and June. Increasing 167.5% QoQ, Minswap surpassed leading NFT marketplace jpg.store for most dapp transactions. This aligned with an overall sectoral shift, as DeFi activity rose and NFT activity declined. Minswap remains the liquidity king of Cardano DeFi, ending Q2 with a TVL of $48.8 million and 32.2% dominance.

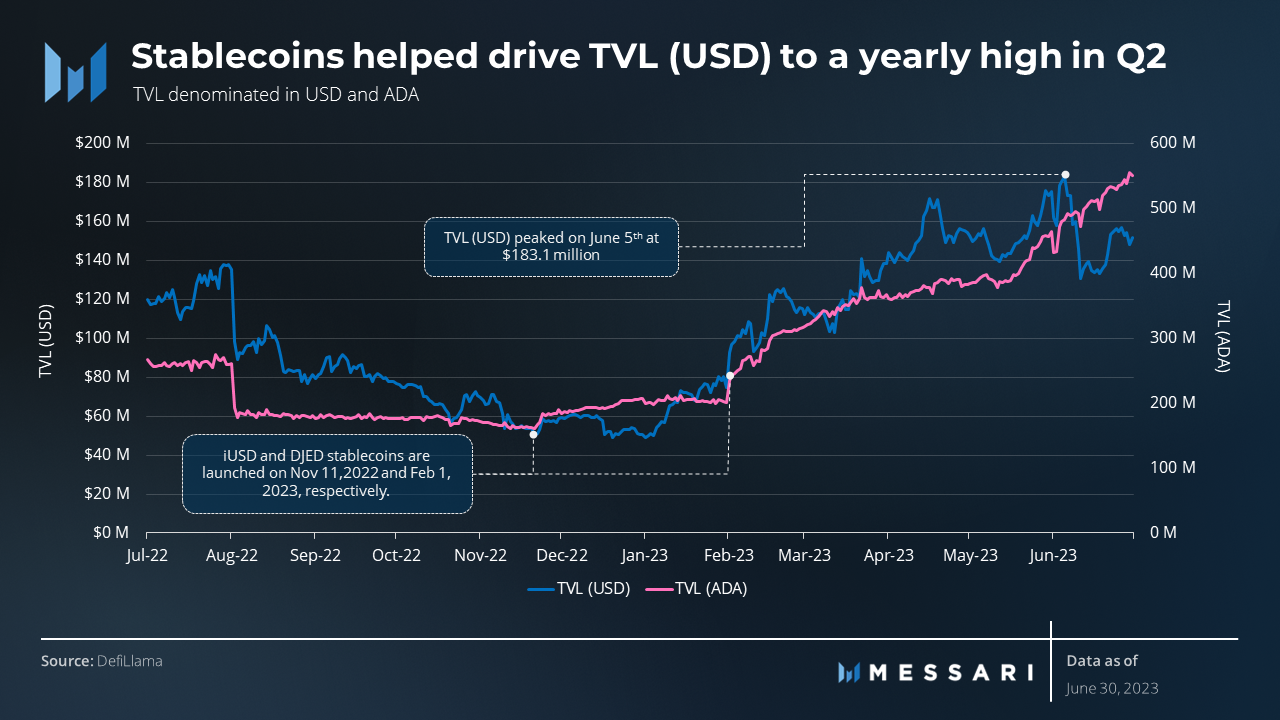

TVL (USD) also increased in Q2, up 9.7% QoQ to $151.7 million. This TVL increase is impressive in the face of ADA’s price decline. Cardano’s 198.6% YTD increase in TVL (USD) has boosted its TVL ranking among all networks from 34th to 21st in 2023.

Stablecoins, arguably the most important piece of infrastructure that is fueling this TVL run, also grew in both absolute and relative terms. The total stablecoin market cap grew 34.9% QoQ from $10.0 million to $13.5 million. Relative to other networks, Cardano’s stablecoin market cap moved up from 54th to 37th in 2023. Stable assets are ideal for pairing in liquidity pools, borrowing and lending, creating leverage, and quick escapes from volatility - which is quite common in the crypto market.

Staking and Decentralization Overview

The number of stake pools and delegators did not change significantly in Q2. Stake pools are run by various entities, such as individuals (public or anonymous) or organizations (crypto-native or other). Regardless of the entity in charge, many stake pool operators (SPOs) operate several pools, due to the current incentives limiting the maximum size of a pool. Accounting for multi-pools, there were 1,921 unique SPOs in Q2. Not all SPOs identify their pools in ways that can be linked, so the real number may be slightly lower.

Stake and delegator distribution were largely unbalanced across total pools in Q1.

- Of the 22.7 billion total stake, the top 188 pools (6.5% of pools) accounted for over 50%.

- Of the 1.29 million total delegators, the top 47 pools (1.6% of pools) accounted for over 50%.

Of the total 2,912 stake pools, 1,108 (38.0%) created one or more blocks during the final epoch of Q2. The most productive stake pools produced 70+ blocks during the epoch, which lasted five days.

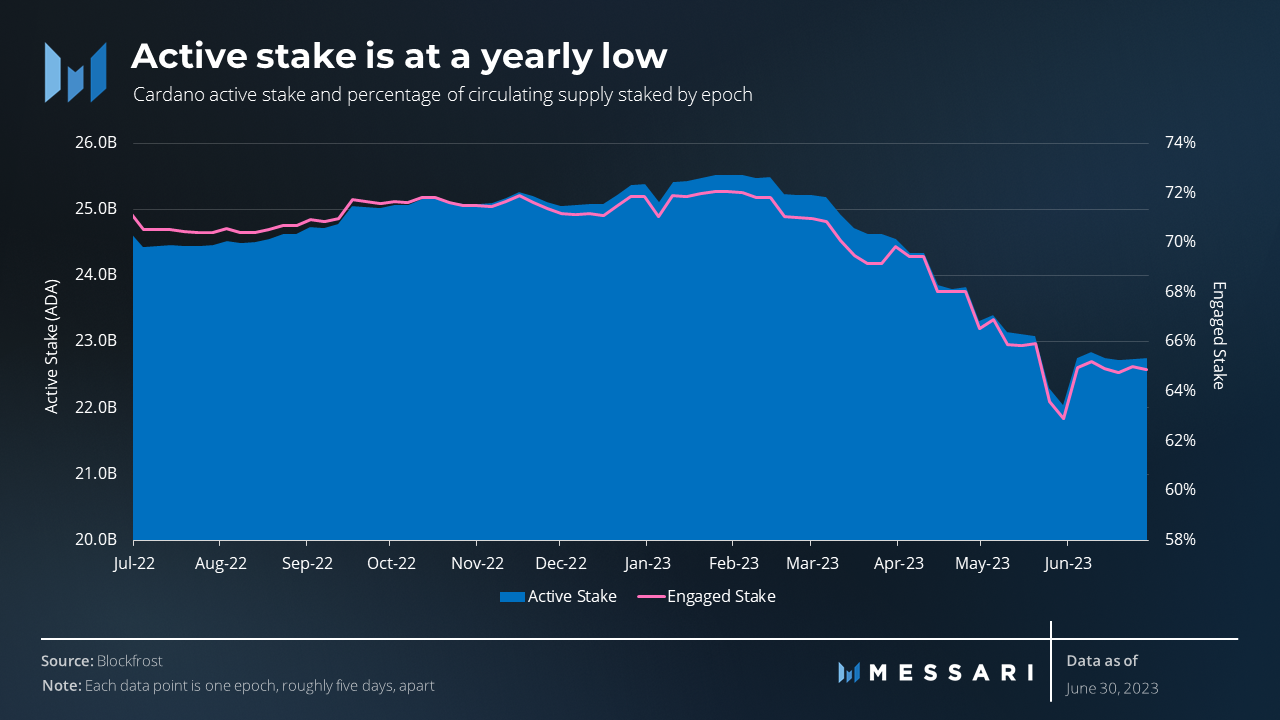

Active stake decreased 7.7% QoQ to 22.7 billion ADA, its lowest level in a year. Similarly, engaged stake decreased to 64.8%, also a yearly low.

There are 228 stake pools that are both retired and still have ADA delegated to them. Those pools have a combined 83 million ADA delegated to them by 18,900 delegators, worth $22.9 million (0.4% of the total stake). The absence of slashing on Cardano partially explains why this stake delegated to retired pools exists, as delegators receive no penalty for not updating their delegation other than not receiving rewards.

To register a stake pool, a pool operator must deposit 500 ADA. In addition, users must pledge a voluntary, chosen amount to the stake pool to generate a delegation certificate. There is no minimum amount required for the delegation certificate, but a higher pledge is intended to attract more delegators, given that network rewards are issued in part relative to the total stake weight of a pool. If, at any point, an operator unstakes tokens and has less at stake than originally pledged, the stake pool will not generate rewards until the pledged amount has been restored.

Stake Pools and Staking Parameters

Since 2022, there has been discussion over changing two vital variables related to staking:

- K parameter: the level at which a staking pool becomes saturated and experiences diminishing rewards.

- Min pool fee: the flat amount paid to a pool before rewards are split among delegators, which is done automatically so there is no risk of delegators not being paid.

The discussion over both remained divided and nuanced. In general, the majority of SPOs wanted to raise the K parameter to 1,000, which would change the optimal pool size from 70 million ADA to 35 million ADA. However, the SPOs that control a majority of the stake voted to keep the K parameter at its current value of 500.

A large or smaller k parameter is not objectively better than the other; the same goes for the minimum pool fee. They require balance to encourage decentralization, Sybil resistance, and incentives for small pools. There are many other ideas floating around the community, such as removing the cap entirely and letting multi-pools consolidate.

Qualitative Analysis

Community

Notable community events include:

- The first CF Annual Report, written by the Cardano Foundation, explored statistics, educational initiatives, and adoption of the Cardano network.

- The State of Web3.0 Africa report, written by PwC and Emurgo, explored regulation, investment, and development of cryptocurrency across various countries in Africa.

- The 2023 Cardano Summit was announced and will take place in Dubai in November.

- The IOG Academy, an initiative presented by IOG Education, provided open courses and technical guides to development with Marlowe, Haskell, and Plutus.

- The Cardano Foundation and Emurgo continued to run developer education programs.

- Community-run projects for education and developer tools, such as Gimbalabs and Genius Academy, continued to produce content and host events.

- IOG continued to facilitate Working Groups to assist and support Cardano ecosystem developers.

- Intersect—a member-based organization for the Cardano ecosystem—launched with the aim of bringing members together behind a shared vision to enable a more resilient, secure, transparent, and innovative Cardano ecosystem.

Development

Notable development events and efforts in Q2 include

- Continued development on Marlowe, Aiken, and other programming languages.

- Dynamic P2P is live and development on Ouroboros Genesis continued.

- A shared security model for sidechains was introduced, and development on several sidechains continued.

- Hydra, a family of scaling protocols, continued development.

- Mithril, a solution for light clients, continued development.

- Node Series v8 and Node v1.35 were launched.

- Lace V1.0 went live. Lace is a light wallet platform compatible with browsers that aims to simplify UX.

- The Atomic Wallet exploit affected ADA holders. There are still 13+ other wallet options and even more coming out of Project Catalyst.

- The UTXO Selection Benchmarking tool was released by dcSpark. This tool helps developers create more efficient coin selection algorithms.

Dynamic P2P and Ouroboros Genesis

Dynamic P2P networking was introduced with the v.1.35.6 node release. Dynamic P2P enables SPO relays to automatically connect to each other, removing the need for static configuration. P2P makes the network more performant and resilient to changes such as node or routing failures. It also streamlines the flow of information between the thousands of distributed nodes.

Dynamic P2P improves upon the initial federated structure and takes a step towards Ouroboros Genesis and, eventually, peer sharing, which are being developed in parallel. Ouroboros Genesis is the next evolution of Cardano’s consensus mechanism and builds on Ouroboros Praos. It does not have an expected release date but does have a roadmap. Among other consensus improvements, Genesis guarantees that users can pick the right chain, even if there is only one “honest” peer. It will also enable anyone running their own node (such as with a Daedalus wallet) to connect to a fully decentralized and self-organized network.

Sidechains

IOG launched a toolkit for building custom sidechains for Cardano. The toolkit currently includes a technical specification for developing sidechains on Cardano, a chain follower, and was showcased alongside the announced proof-of-concept EVM testnet. In the future, it will entail templates for mainnet smart contracts and a sidechain module to interpret mainnet data.

Sidechains built with this toolkit will be validated by any participating Cardano SPOs, which will be incentivized by additional rewards offered by the sidechain’s tokenomic model. The shared security model for Cardano mainnet and its sidechains bears some similarities to EigenLayer’s restaking model with Ethereum validators.

Milkomeda C1 is working towards increasing the adoption and utility of Cardano. The network already hosts an array of projects and is being further fueled by incubators and hackathons. New developments with Paima may position it to see increased adoption. Milkomeda and Paima developers plan to allow Cardano wallets to directly access EVM contracts.

Midnight is Cardano’s upcoming data-protection-focused sidechain. By leveraging zero-knowledge cryptography, Midnight aims to bridge the principles of DeFi with the requirements of TradFi. It will enable users to have selective data disclosure while meeting regulatory needs. They will also be able to choose which data they wish to reveal publicly or keep private. Unlike Milkomeda, Midnight will have its own token: DUST.

World Mobile has plans to partner with IOG to build out its own sidechain. This proposed sidechain will use the Cosmos SDK; however, it is unclear what security model it will use.

Wanchain is an L1 PoS EVM blockchain and a decentralized blockchain interoperability solution. Since Q3 2022, it has been working to connect Cardano to fully heterogeneous blockchains, such as Ethereum, Polkadot, and Bitcoin. In this way, Wanchain will serve as an EVM-compatible sidechain to Cardano. The Wanchain Foundation also recently announced that its bridge is now live on the Cardano preview testnet environment.

Hydra

Hydra is a family of scaling protocols, mostly L2s based on state channels. Hydra Head, the first solution from the set, is an off-chain mini ledger working between a small group of participants, not unlike other popular state channels such as Lightning. Hydra leverages the eUTXO model for a more efficient and flexible transfer from L1 to L2 and back, allowing for the isomorphic transfer of data. Hydra for Payments is an open-source toolkit for implementing payment solutions that will leverage Hydra Head.

The first Head on the Cardano mainnet, also known as a channel, was opened in a limited form in March 2023. Right now, the protocol can be considered to be in a “public beta.” Until the protocol is more thoroughly tested, the quantity of ADA committed is limited for user safety. Heads can be used for a variety of use cases, from making P2P payments to moving dapp activity off chain onto cheaper Head channels. In Q4 2022, Sundae Labs demoed an instance of the SundaeSwap DEX on Hydra on testnet. Sundae Labs has submitted a proposal to Project Catalyst Fund 10 to secure funding for continued development. MLabs and IOG continue to explore how to leverage Hydra Head channels to execute auctions that will be higher throughput, faster, and cheaper than if they were on L1.

Several topologies, or architectures, have been proposed for Hydra. Testing and development continued in Q2, with a mobile demo being shared.

Mithril

Mithril is a stake-based multisignature scheme that is intended to help the Cardano network to scale. It offers a lightweight, efficient experience, and a secure alternative for users and applications to access all or parts of the state of the chain. Because users do not require access to the full current state yet receive a similar level of trust, clients can become thin enough to be run on laptops, browsers, and even mobile devices.

Mithril is both a novel cryptography scheme and a network of signing nodes deployed alongside the Cardano network. Mithril signers are lightweight processes run by SPOs alongside block producers which produce stake-based signatures sent to aggregators. Mithril clients can download and verify certified snapshots from untrusted so-called aggregators and use those snapshots to resolve chain synchronization, state bootstrapping, and chain validation. Developers of the open-source project are aiming for a mainnet deployment of a beta version in early Q3.

Closing Summary

New infrastructure such as stablecoins, programming languages, and wallets are helping Cardano developers create more sophisticated applications with improved UXs. During Q2, Cardano's ecosystem grew 49% QoQ in dapp transactions and 10% QoQ in TVL (USD). More importantly, the ecosystem diversified with newer protocols contributing significantly to various activity metrics.

Multichain solutions, such as Hydra Head and the Milkomeda C1 sidechain, continued to mature and are aiming to support future activity increases, whether that be from DeFi or from gaming. Development on various other sidechains and L2s signifies Cardano's multichain vision for the future, even as usage on the base layer continues to experience growth.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Input Output Global. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Red is a researcher, educator, and developer in the web3 space. Red's background is in electrical and software engineering. His main interest is privacy technology, through zero-knowledge proofs and general cryptography.

Read more

Research Reports

Read more

Research Reports

About the author

Red is a researcher, educator, and developer in the web3 space. Red's background is in electrical and software engineering. His main interest is privacy technology, through zero-knowledge proofs and general cryptography.