Key Insights

- Cardano’s revenue (USD) increased 44% QoQ. This was partially driven by ADA’s 7% QoQ price increase.

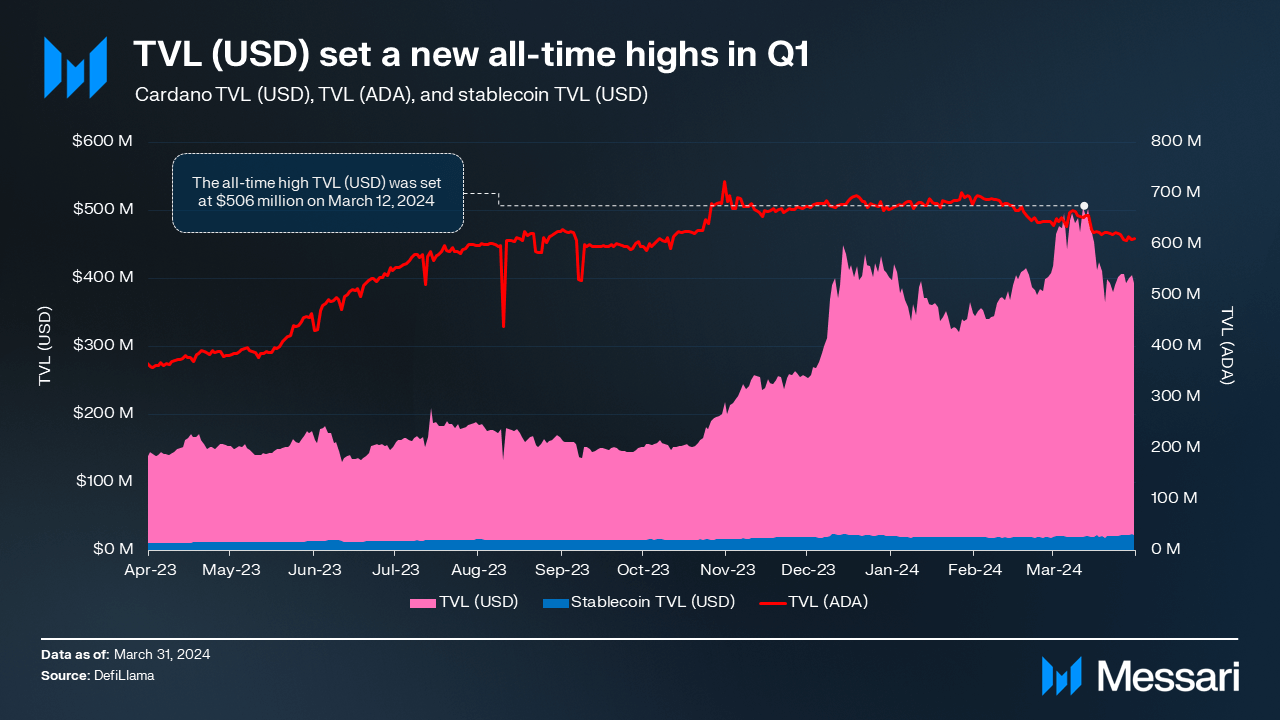

- TVL (USD) surpassed $500 million in March, setting an all-time high. Several new protocols launched or are nearing production, such as Axo and USDM, while incumbents continued to grow, such as Indigo and Minswap.

- Core infrastructure — such as SanchoNet, Hydra, and Mithril — continued development and testing.

- Member-based organization Intersect started a grants program for governance features. Early grant recipients include projects for educational materials and a DRep platform.

Primer

Cardano (ADA) is a Proof-of-Stake (PoS) Layer-1 smart contract network launched in 2017. Cardano aims to provide security, scalability, and sustainability to decentralized applications and systems building on top of the blockchain. In addition to the community of developers, node operators, and projects, Cardano is supported by multiple entities: Input Output Global (IOG), dcSpark, MLabs, The Cardano Foundation, EMURGO, Intersect, Well-Typed, Galois, Tweag, and more. They work together to support the network’s development, adoption, and finances while Cardano moves toward the age of Voltaire.

Cardano has taken a unique approach to development when compared to other smart contract networks. The Ouroboros consensus model allows for delegation of stake, the extended unspent transaction output (eUTXO) accounting model enables native token transfers, scalability, and decentralization, and smart contracts were enabled by the Alonzo hard fork in 2021.

With a dedicated community of users and developers, Cardano has demonstrated staying power. Post-Alonzo, Cardano began to compete in more traditional crypto markets, such as DeFi and NFTs. For a full primer on Cardano, refer to our Initiation of Coverage report.

Website / X (Twitter) / Telegram

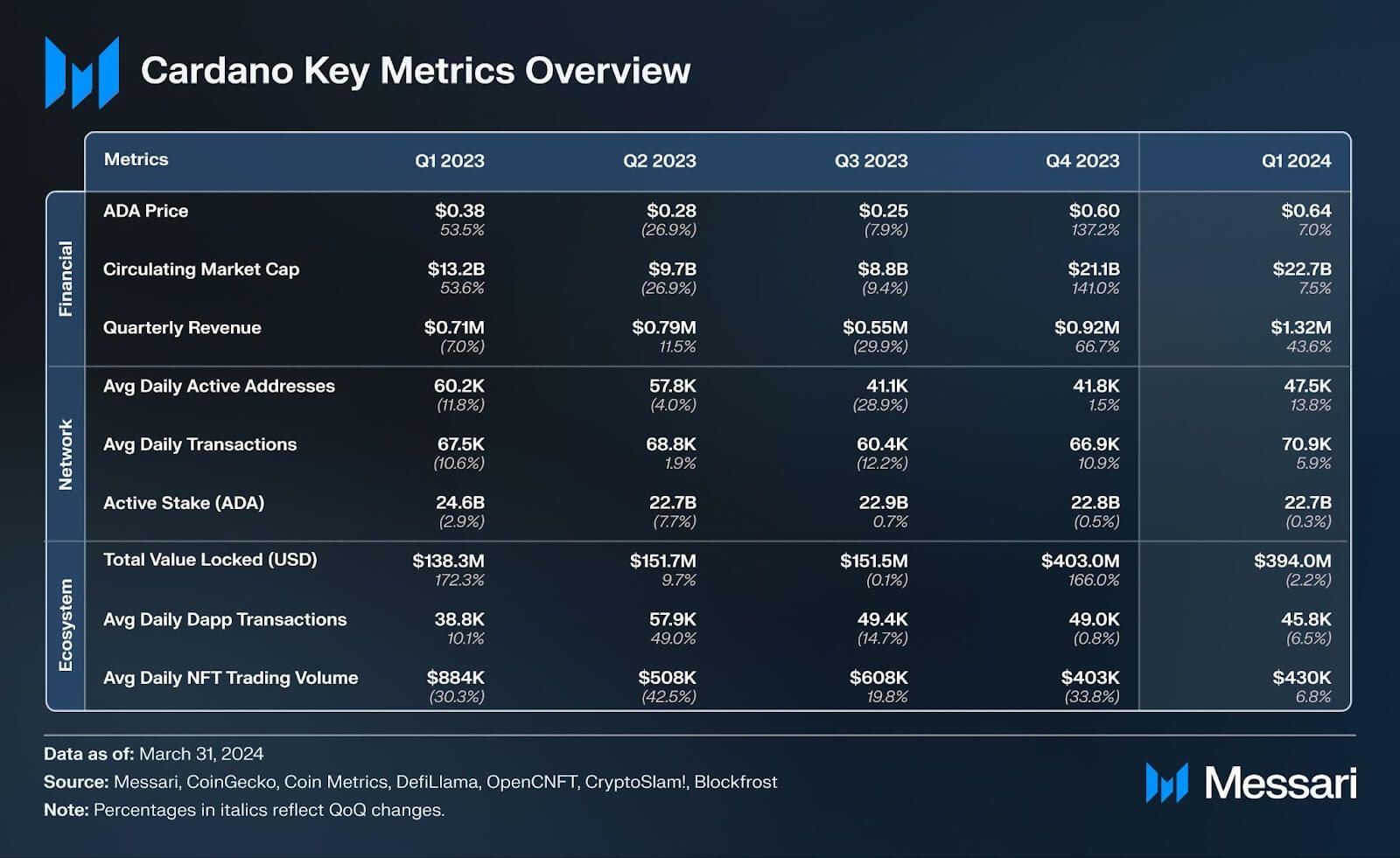

Key Metrics

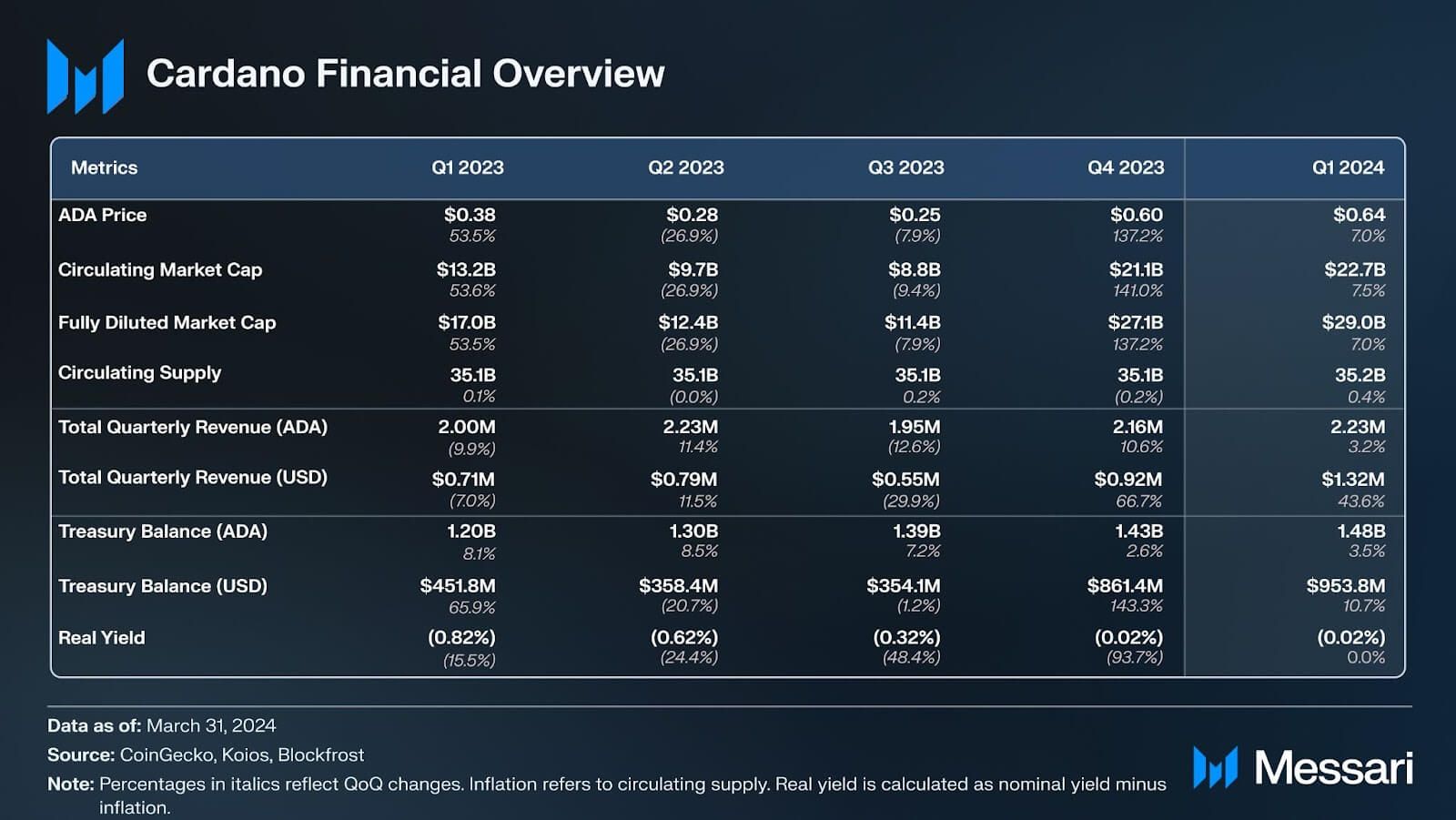

Financial Analysis

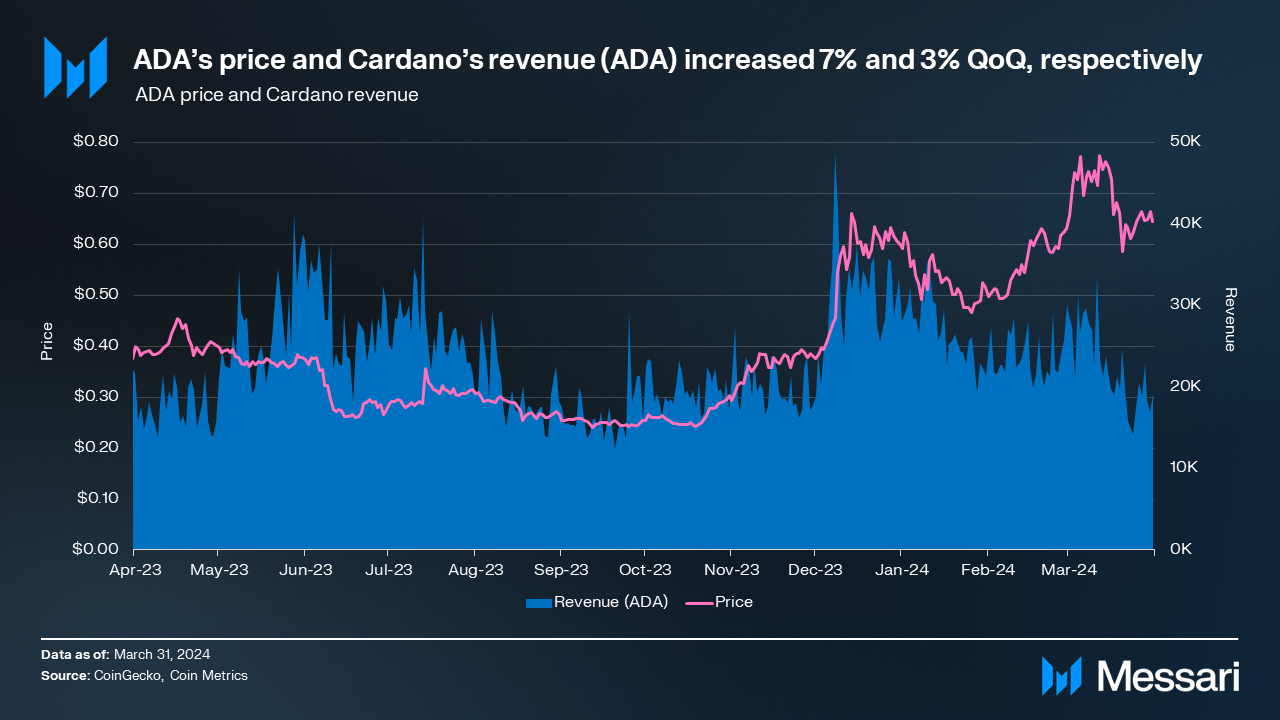

ADA’s price continued to increase in Q1, up 7.0% QoQ, following a 137.2% increase in Q4. ADA’s market cap increased by a similar amount, 7.5% QoQ, with the discrepancy due to a 0.4% increase in circulating supply. Despite the QoQ increase, ADA’s market cap rank fell from 8th to 9th. ADA is the native asset of Cardano. It has three primary use cases: (1) settling network fees, (2) being used to register a stake pool to participate in network consensus as a pool operator, and (3) staking as a pool operator or delegator to help secure the network and earn token rewards.

In November 2023, the SEC once again alleged ADA to be a security — along with other assets including SOL, ATOM, and NEAR — in a case with Kraken. Unlike the SEC cases earlier in 2023, this instance did not trigger significant price volatility in ADA.

Revenue (USD) increased 44% QoQ, while revenue (ADA) only increased by 3% QoQ. Revenue is measured as total transaction fees.This difference was largely due to ADA’s price reaching ~$0.75 for two weeks in March, while revenue (ADA) was relatively higher.

Cardano’s Treasury balance grew 3.5% QoQ to 1.48 billion ADA. The 50 million ADA increase was slightly higher but generally aligned with previous quarters' growth. Currently, 20% of all transaction fees go to the treasury, which can be changed via governance as needed.

The nominal staking yield on Cardano is generally 3.3% for ADA delegators, although it can vary by stake pool. Real yield is calculated as nominal yield minus inflation, which accounts for any value dilution due to inflation. In Q1, the real yield was -0.02%. ADA’s supply is capped at 45 billion; however, the active supply experiences “inflation” until it reaches that limit. In each epoch, 0.3% of ADA reserves (i.e., the ADA not in circulation) are distributed as stake pool operator (SPO) rewards. This “inflation” trends towards zero as the reserves deplete and the circulating supply approaches 45 billion.

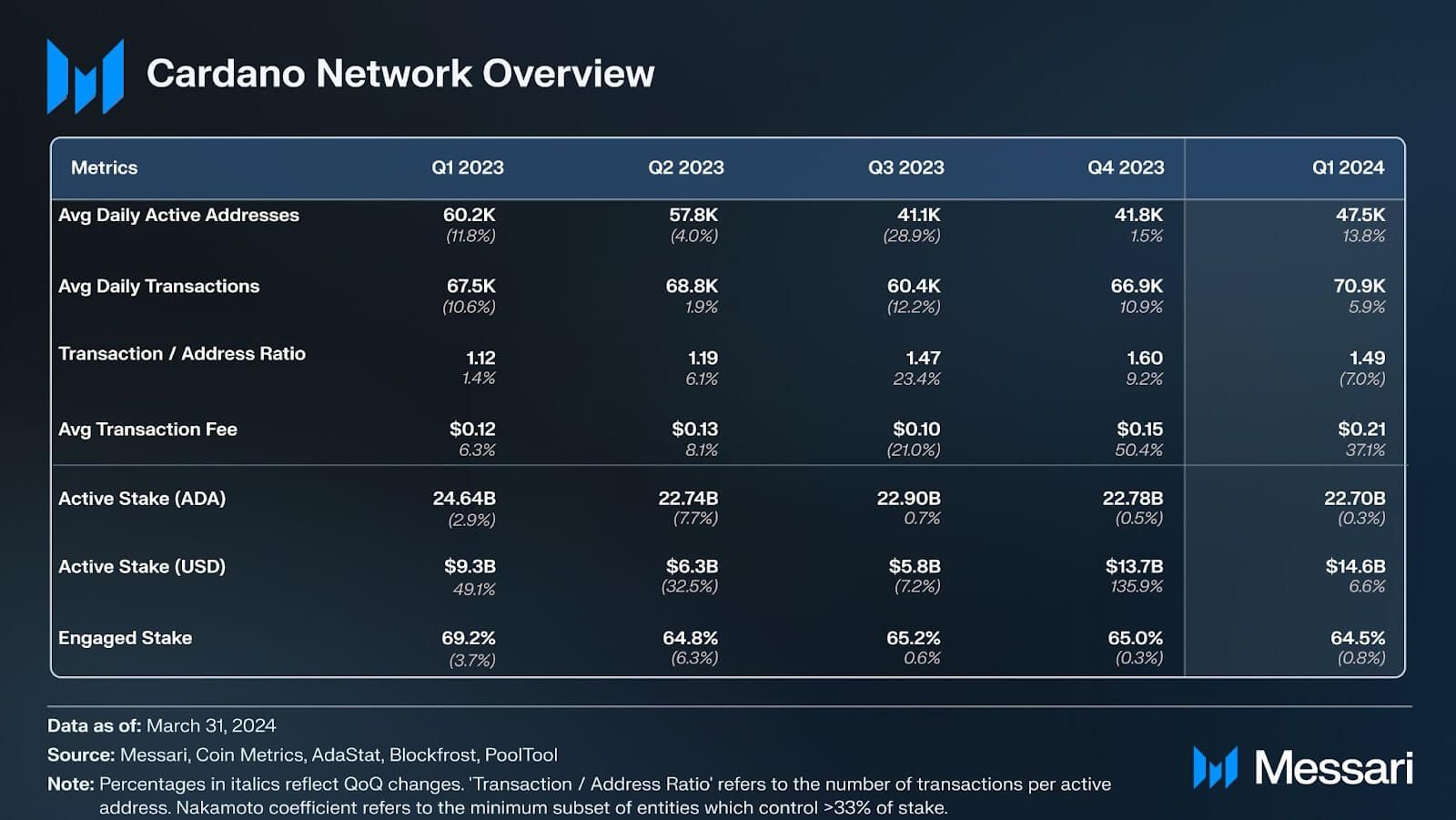

Network Analysis

Each transaction on Cardano is accompanied by a fee for processing actions and storage costs. Fees are calculated by a minimum payable fee in addition to transaction size. The average transaction fee (USD) increased 37.1% QoQ from $0.15 to $0.21. On the other hand, the average transaction fee (ADA) of 0.35 ADA did not change QoQ. The disparity indicates that ADA’s price action was almost completely responsible for the increase denominated in USD.

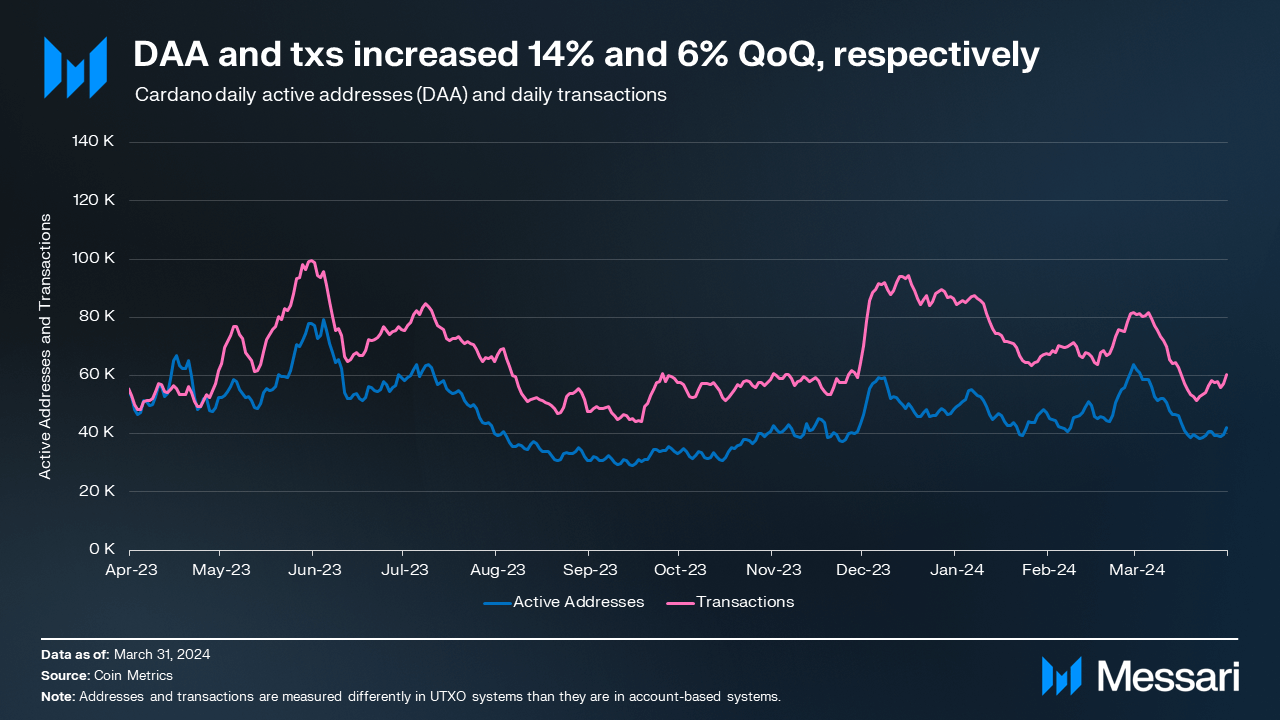

Cardano’s average daily transactions grew by 5.9% QoQ, lagging behind the 13.8% QoQ growth in daily active addresses. The ratio of transactions to active addresses (tx/daa) declined in Q1 after steadily increasing over the past five quarters. A declining tx/daa ratio suggests activity increases to be more distributed across users while an increasing ratio suggests an increase in “power users.” The Q1 tx/daa ratio of 1.49 was down 7.0% QoQ.

Staking

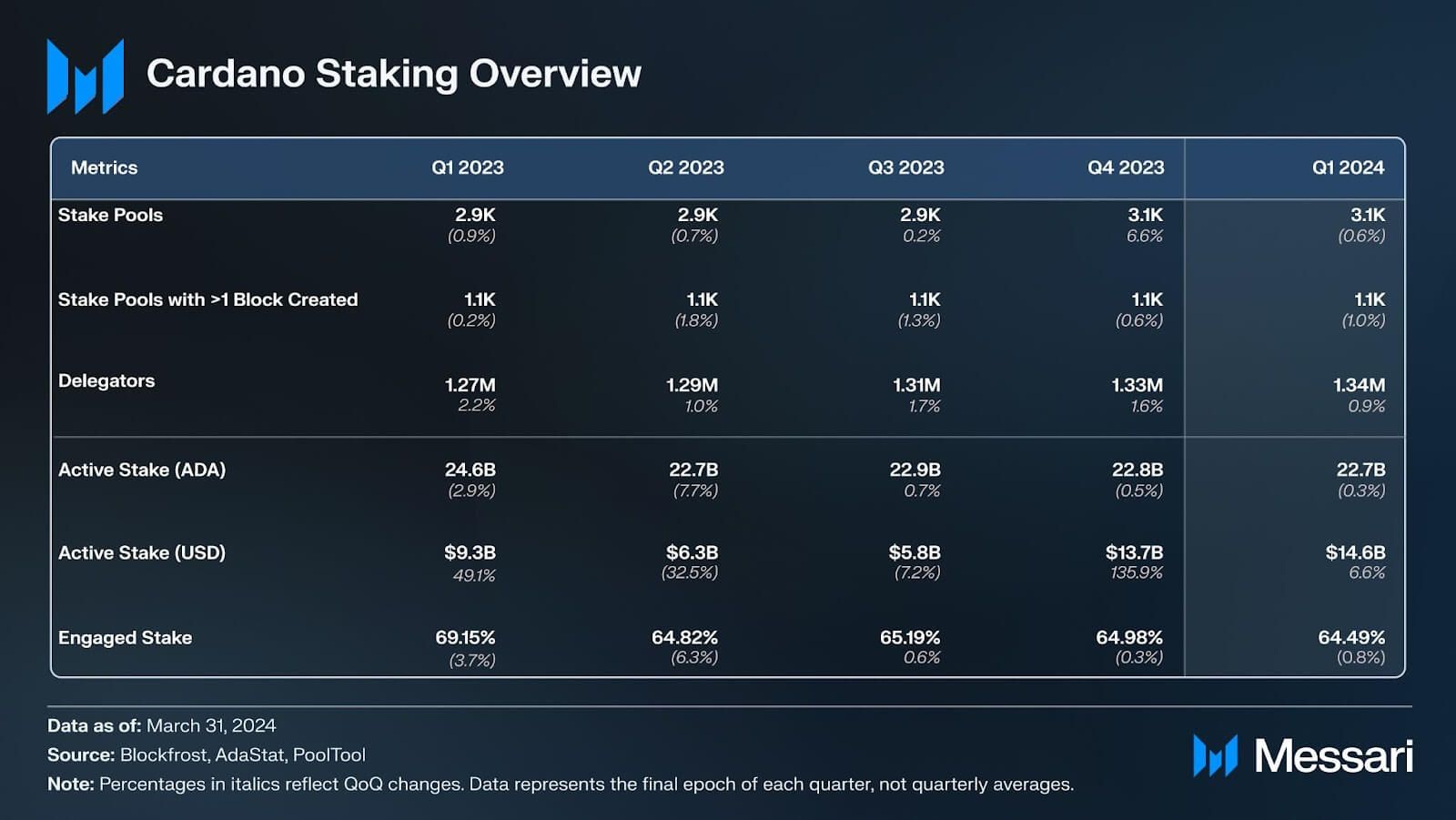

The number of stake pools (with more than one block created) was flat, decreasing 1.0% QoQ. Delegators, on the other hand, increased 0.9% QoQ. Overall, these consensus metrics did not change significantly in Q1.

Stake pools are run by various entities, such as individuals (public or anonymous) or organizations (crypto-native or other). Regardless of the entity in charge, many stake pool operators (SPOs) operate several pools due to the current incentives limiting the maximum size of a pool. A Cardano staking product powered by Liqwid was launched on the Swiss SIX exchange in Q1. The Staking ETP offers institutional investors access to ADA staking yield.

In Q4 2023, the Cardano Foundation made a forum post to lay out the changes to its delegation strategy. In addition to delegating to single-pool operators, the Cardano Foundation now also delegates to multi-pool operators, supporting the broadest community of ecosystem builders.

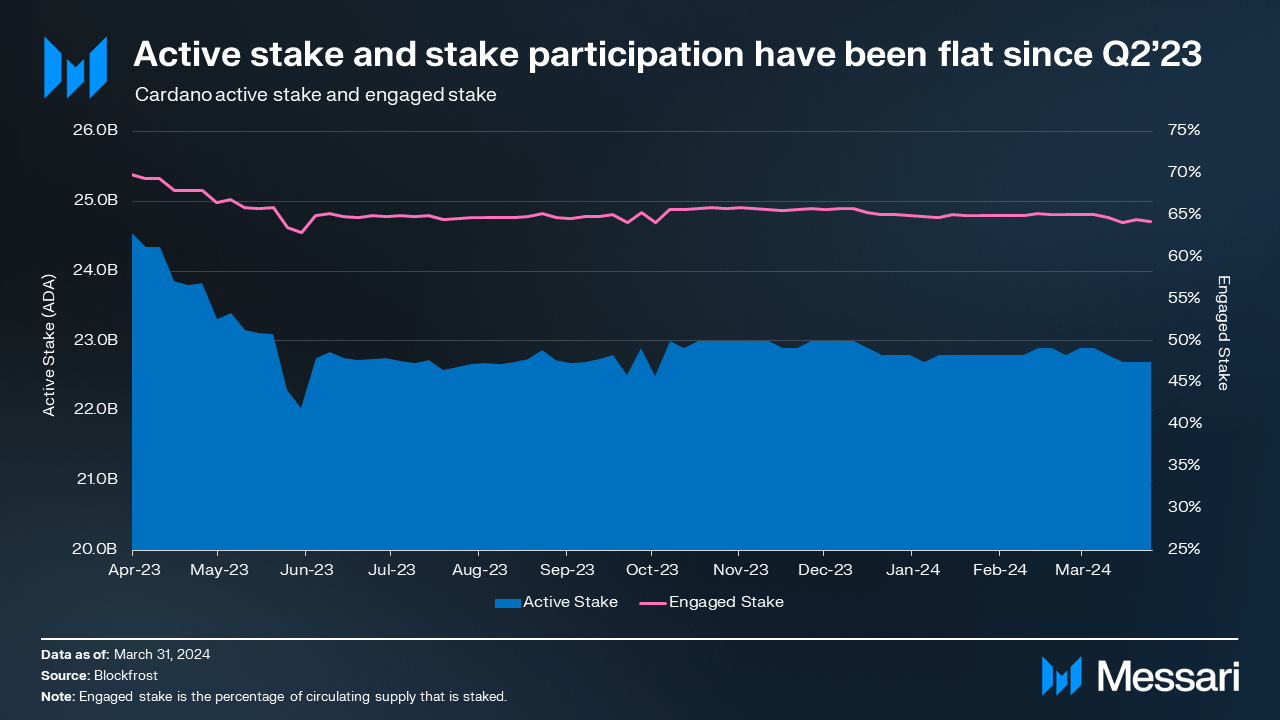

Active stake (ADA) and engaged stake declined 0.3% and 0.8% QoQ. Active stake ((USD) increased 6.6% QoQ to $14.6 billion, driven by ADA’s price increase. Active stake (USD) represents the economic security of the network.

Mithril

Mithril went live on mainnet in beta and produced its first snapshot in Q3 2023. Since then, over 230 stake pools have joined the network to sign Mithril certificates, representing over 4.6 billion ADA in stake. Mithril is a stake-based multisignature scheme intended to help scale the Cardano network. It offers a lightweight, efficient experience and a secure alternative for users and applications to access all or parts of the state of the chain. Its users do not require access to the full chain, yet they receive a similar level of trust. As such, Cardano's network becomes more efficient, streamlined, and capable of supporting a wider range of applications and use cases.

Mithril will enable applications such as

- “Light” wallets with no additional trust assumptions

- Fast bootstrapping of full nodes

- Efficient voting systems

Mithril is both a novel cryptography scheme and a network of signing nodes deployed alongside the Cardano network. Mithril signers are lightweight processes run by SPOs alongside block producers which produce stake-based signatures sent to aggregators. Mithril clients can download and verify certified snapshots from untrusted so-called aggregators. They can then use those snapshots to resolve chain synchronization, state bootstrapping, and chain validation.

SanchoNet

SanchoNet was launched in Q3 2023 in the node V8.2.1 pre-release, marking a milestone for onchain governance. SanchoNet is a testnet for Cardano’s onchain governance, as defined by CIP-1694 specification and as a core initiative of the Voltaire roadmap phase. Users can interact with SanchoNet through various wallets, such as NuFi and Lace, and there is now a governance dashboard in active development.

Voltaire will take the final steps toward self-sustainability via onchain voting and offchain mechanisms and institutions, including the member-based organization, Intersect. After completion, the community will be able to determine parameter changes, implement hard forks/ upgrades, and transfer responsibility over from IOG, Cardano Foundation, and EMURGO — which combined hold all seven governance (genesis) keys. Voltaire will also enable Treasury withdrawals to fund Cardano’s continuing development via community vote. Intersect has been operating a grants program for governance tools, with projects awarded for purposes such as education and DRep platforms.

The infrastructure required for a successful onchain voting platform does not yet exist. To meet this need, SanchoNet serves as a sandbox to test and build out not only processes but also tools. Developers can use the testnet to launch new infrastructure (e.g., wallets and vote explorers), SPOs can test voting/proposing to find pain points, and a new user role — delegate representatives (DReps) — can be hashed out.

SanchoNet is championed by Intersect — a member-based organization for the Cardano ecosystem — among other community members, SPOs, and teams. Intersect launched with the aim of bringing ADA holders together behind a shared vision to enable a more transparent and innovative Cardano ecosystem. Intersect is heavily aligned with Voltaire and bottom-up coordination for further decentralization.

In Q1, PlutusV3 became available for SanchoNet, introducing new cryptographic primitives and development tools for builders. SanchoNet has proven resilient, after holding up against.

Ecosystem Analysis

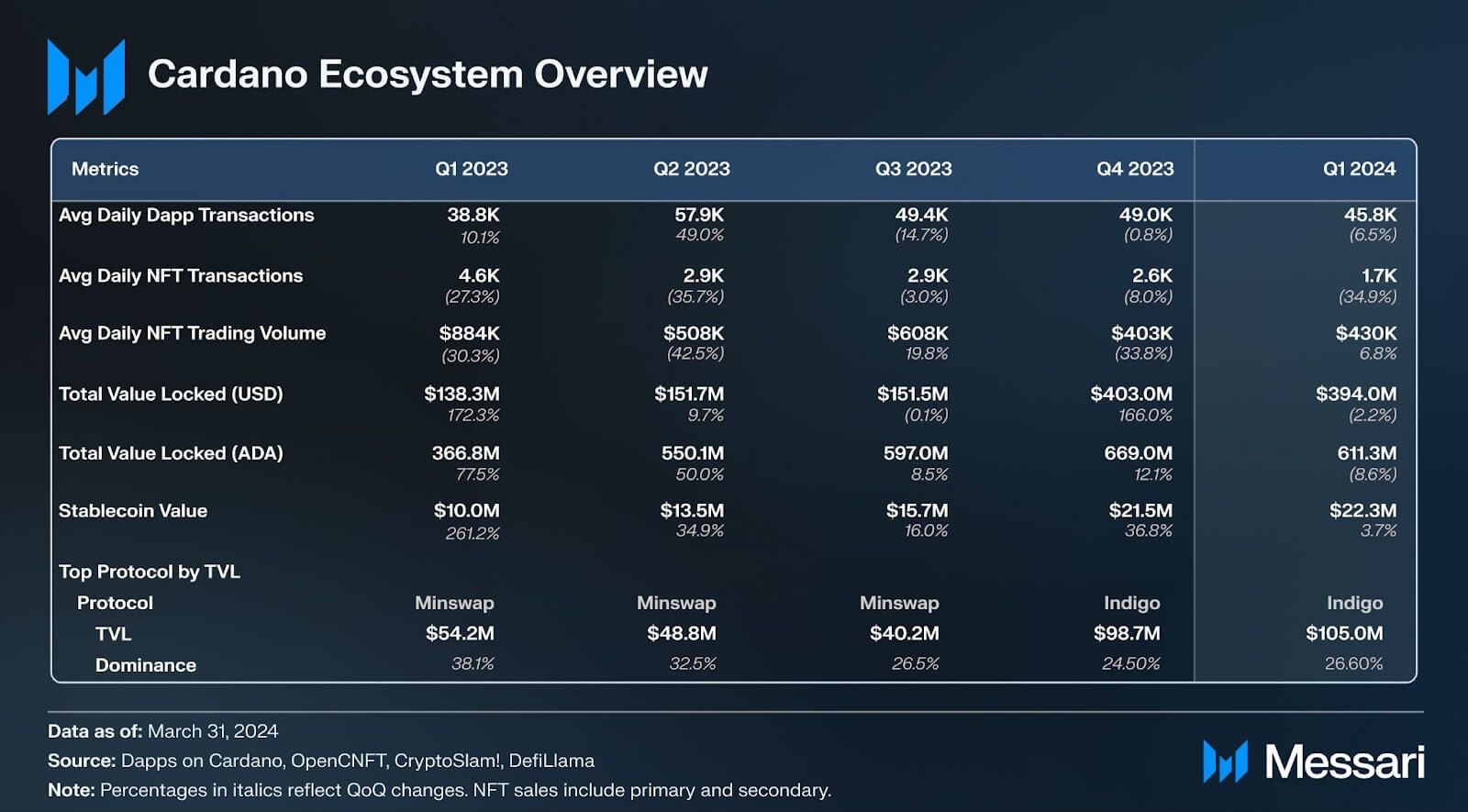

The Cardano ecosystem was mixed in Q1, with some sectors growing and others pulling back.

- Stablecoin value increased 4% QoQ to $22.3 million. Growth came almost entirely from iUSD and DJED, the second largest stablecoin, decreased in TVL.

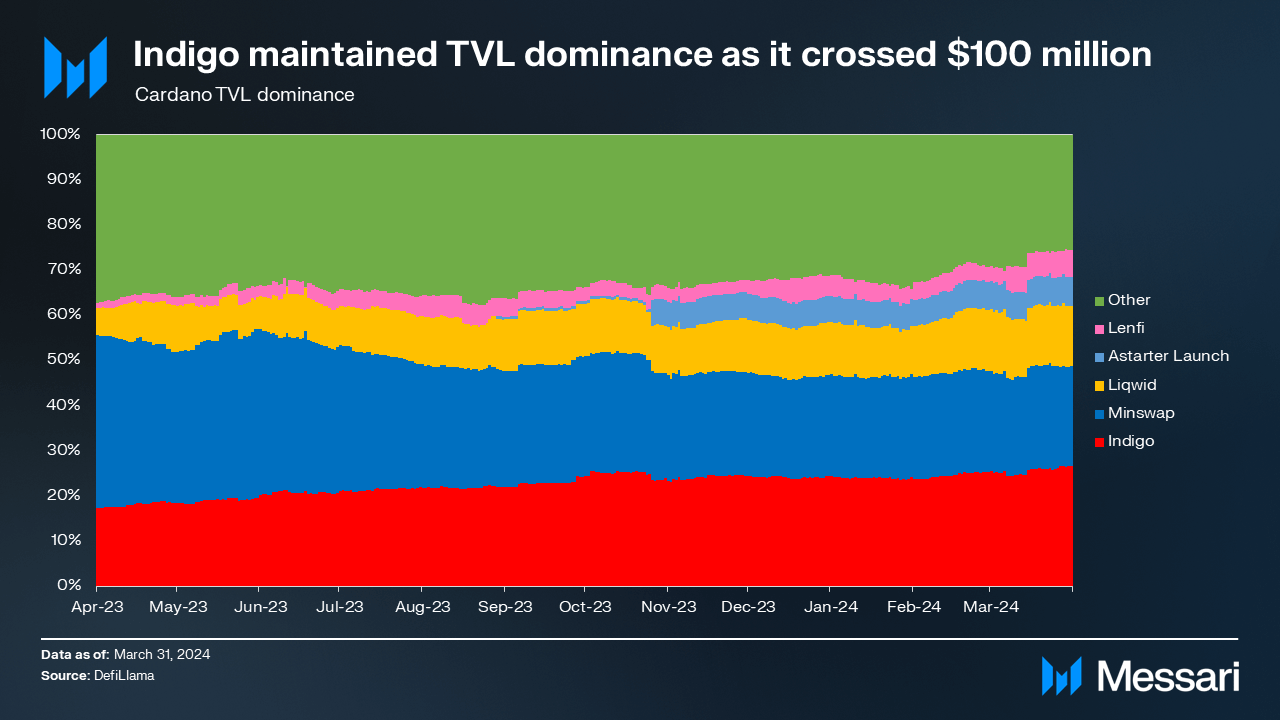

- TVL (USD) decreased 2% QoQ. Indigo remained the largest protocol by TVL as of the end of Q1.

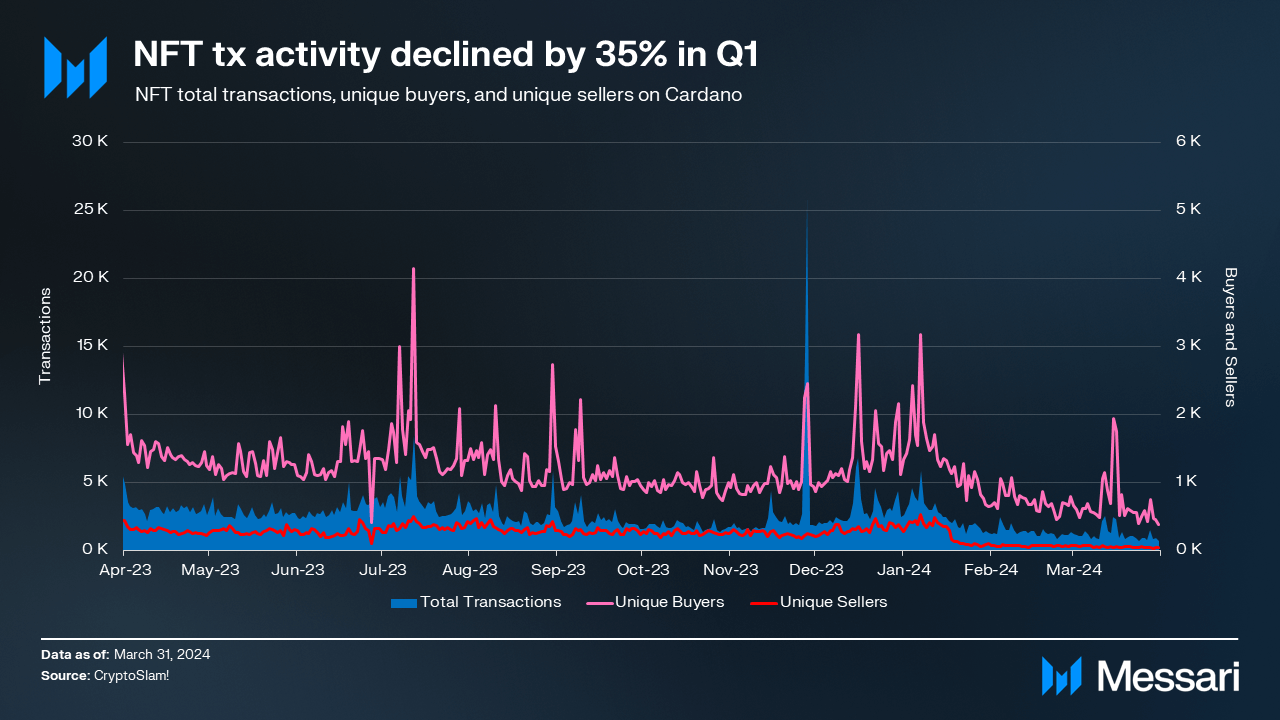

- Average daily dapp and NFT transactions decreased 7% and 35% QoQ, respectively. Both of these metrics have declined for three consecutive quarters.

While TVL is a popular metric for measuring an ecosystem, it should not be the only metric considered. Many dapps and services won’t meaningfully contribute to TVL in the way that a lending protocol can. For example, Iagon — a decentralized storage solution — will not be a TVL driver because it is infrastructure. Even within DeFi, aggregators such as DexHunter and non-custodial platforms such as Axo do not contribute to TVL directly.

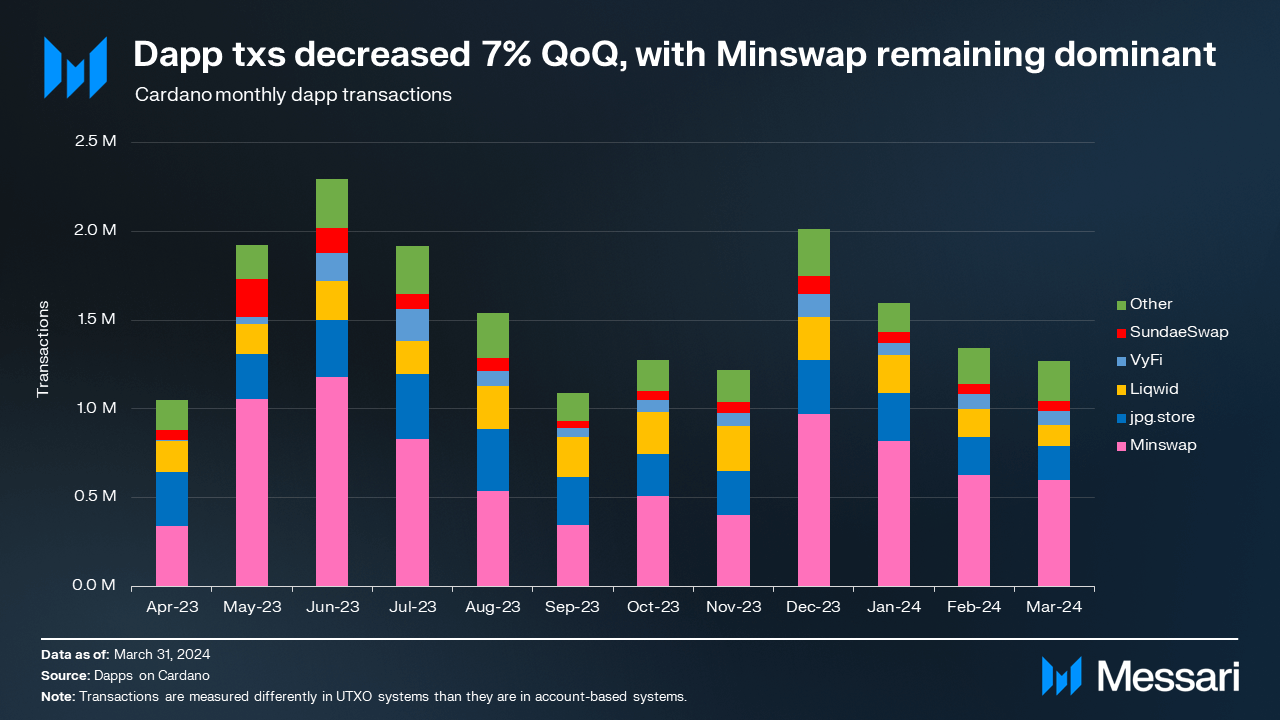

Average daily dapp transactions decreased 6.5% QoQ. Overall dapp activity is largely affected by Minswap, the largest DEX and routinely the most active dapp on the network. The next two largest contributors are jpg.store and Liqwid.

- Minswap, an automated market maker (AMM), has been the most popular Cardano dapp by transactions since dethroning NFT marketplace jpg.store three quarters ago. Minswap remained the most-used dapp in Q4 partially due to its massive December volume. In December, Minswap transactions increased 140% QoQ to 971,000. Minswap’s in-development Stableswap feature may help the protocol drive even more activity by providing minimal slippage and more efficient trading.

- jpg.store, an NFT marketplace that was previously the most active dapp by transaction count. This marketplace is dominant for NFTs in terms of both transactions and volume.

- Liqwid Finance, a lending and liquid staking protocol, has also been steadily growing in activity. In just under on year, It has moved up to the third most popular dapp by transaction volume.

DeFi

TVL (USD) set an all-time high of $506 million in Q1 2024, after previously setting a then-all-time-high of $449 million in Q4 2023. Cardano’s TVL ranking among all networks decreased from 11th to 20th during Q1, although it’s generally trending upwards from 34th at the beginning of 2023.

Relative to other networks, Cardano’s stablecoin market cap rank moved down from 32nd to 37th in Q1 2024, although still up from 54th in the start of 2023. Stable assets are ideal for pairing in liquidity pools, borrowing and lending, creating leverage, and providing quick escapes from volatility — all of which are quite common in the crypto market.

Early in 2023, Cardano’s TVL growth was catalyzed by the introduction of new stablecoins: iUSD and DJED. Similarly, Mehen’s USDM stablecoin may cause a similar effect, having recently launched in Q2 2024. Different users prefer different architectures, and USDM is the first of its kind on Cardano. Unlike iUSD and DJED, Mehen’s USDM is not algorithmic or synthetic; it’s 1:1 fully backed with U.S. dollars. Indigo’s iUSD has had an inconsistent peg, something that can’t happen with 1:1 backing and more accessible redemptions to create arbitrage opportunities.

Wanchain — an L1 PoS EVM blockchain and a decentralized blockchain interoperability solution — has made USDT and USDC available on Cardano through its various bridges. Wanchain’s bridges are secured by Wanchain validators, connecting Cardano to Wanchain, Bitcoin, Ethereum, TRON, and more.

Smart token standards such as CIP-68 or CPS-0003 could open the door for built-in compliance, allowing USDC to be natively available on Cardano as well.

Much of the TVL growth in the past year was driven by newer protocols. Synthetic asset-issuer Indigo is the oldest and largest of these new (launched in the past year or so) protocols. It managed to dethrone Minswap in Q4, ending Minswap’s multi-year reign as the TVL leader. In Q1, Indigo remained the TVL leader.

TVL and DeFi ecosystem growth has come with growing pains, specifically for DEXs. Cardano’s novel eUTXO mechanism brought new DeFi paradigms with it, such as batching and transaction chaining. Many DEXs are exploring new or improved solutions, such as MuesliSwap working on transaction chaining. Transaction chaining, already implemented on protocols such as Optim, should be an improvement over MuesliSwap’s contested batching process.

Those growing pains have also sparked innovation in the form of new platforms. Genius Yield and Axo are two new protocols that launched in Q1. Genius Yield is a multi-faceted DeFi platform focused on yield optimization. Axo is a noncustodial trading platform focused on customization for traders.

Partner Chains

Partner chains is an encompassing term that can include technically sovereign sidechains or modular networks. One of these partner chains is Midnight, an upcoming data-protection-focused sidechain for Cardano. By leveraging zero-knowledge cryptography, Midnight aims to bridge the principles of DeFi with the requirements of TradFi. It will enable users to have selective data disclosure while meeting regulatory needs. Unlike Milkomeda, Midnight will have its own token: DUST.

In Q4 2023, several of Midnight’s features and use cases were announced. From a developer experience perspective, Midnight will use a language designed to integrate with Typescript and built on Substrate — a development framework popularized by Polkadot. This isn’t the first synergy between the two ecosystems, as Polkadot’s consensus is built on top of Ouroboros. The initial devnet has onboarded over 600 dev teams since it launched in November 2023.

Midnight’s use cases include identity verification, controlled access to tokenized digital assets, enhanced AI and LLMs, decentralized credit scoring, decentralized anonymous voting, and more.

Cardano has a handful of other sidechains — some live in production and some still in development. Some of these networks include Milkomeda C1, Wanchain, and World Mobile.

Milkomeda C1 launched in early 2022 as Cardano’s first sidechain. It initially brought EVM compatibility to the Cardano ecosystem, but in 2023, it brought EVM compatibility directly to Cardano wallets. In Q1 2024, Milkomeda enabled direct interoperability between Cardano and Arbitrum (the top Ethereum L2 by liquidity and users) with no centralized bridge in between.

Milkomeda C1 is primarily maintained by dcSpark. Most of Milkomeda’s activity comes from games built with Paima Engine — a framework for rollups focused on creating onchain games and autonomous worlds. Unlike most other rollups (including Ethereum rollups that use centralized sequencers), Paima-built rollups are true rollups with decentralized sequencing/proving.

NFTs

NFT transactions were down 34.9% QoQ, but overall volume increased 6.8% QoQ. This suggests that trading in ‘blue chip’ projects (i.e., NFT collections with higher floor prices) stayed more active relative to lower-priced NFT collections.

Hydra

In Q4 2023, Hydra V0.14.0 was released. Hydra is a family of scaling protocols, mostly L2s based on state channels. Hydra Head, the first solution from the set, is an offchain mini ledger. It works between a small group of participants, not unlike other popular state channels such as Lightning. Hydra leverages the eUTXO model for a more efficient and flexible transfer from L1 to L2 and back, allowing for the isomorphic transfer of data. Hydra for Payments is an open-source toolkit for implementing payment solutions that will leverage Hydra Head.

The first Head on the Cardano mainnet, also known as a channel, was opened in a limited form in March 2023. As of writing, the protocol can be considered to be in a “public beta.” Until the protocol is more thoroughly tested, the quantity of ADA committed is limited for user safety. Builders from various teams are actively working on improvements to Hydra Head. Early applications include gaming, auctions, and P2P payments. At the Cardano Summit, masterclasses showed developers how to use Hydra for dapps and how it can work with Mithril. All in all, Hydra Head is a flexible protocol with several proposed topologies.

Closing Summary

Cardano’s ecosystem continued to develop and mature in Q1. TVL (USD) set an all-time high of $506 million in March. The ecosystem continues diversifying as new DeFi tools, like Axo, launch and alternatives to existing tools, such as USDM’s upcoming stablecoin, hit production.

The decentralization of governance remained a key focus of the Cardano community. SanchoNet continued development, while Intersect began giving out a grants program for governance tools. Concurrently, multichain and modular efforts, such as Partner Chains (e.g., Midnight) and Hydra state channels, continued development.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Intersect MBO. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Red is a researcher, educator, and developer in the web3 space. Red's background is in electrical and software engineering. His main interest is privacy technology, through zero-knowledge proofs and general cryptography.

Read more

Research Reports

Read more

Research Reports

About the author

Red is a researcher, educator, and developer in the web3 space. Red's background is in electrical and software engineering. His main interest is privacy technology, through zero-knowledge proofs and general cryptography.