Key Insights

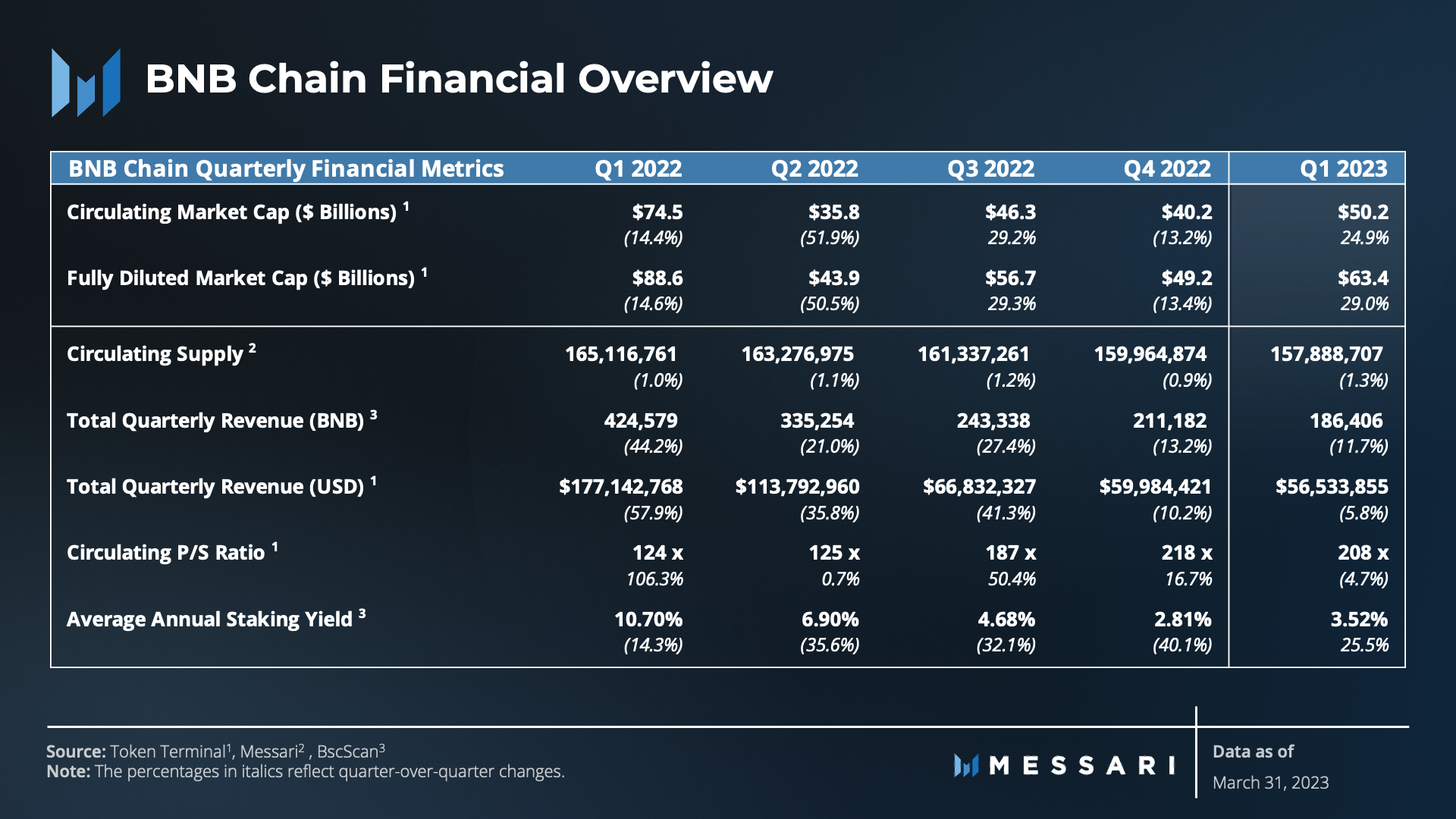

- BNB Chain’s market cap rebounded this quarter along with the broader market, increasing 24.9% QoQ. However, BNB Chain revenue (in BNB) decreased 11.7% QoQ.

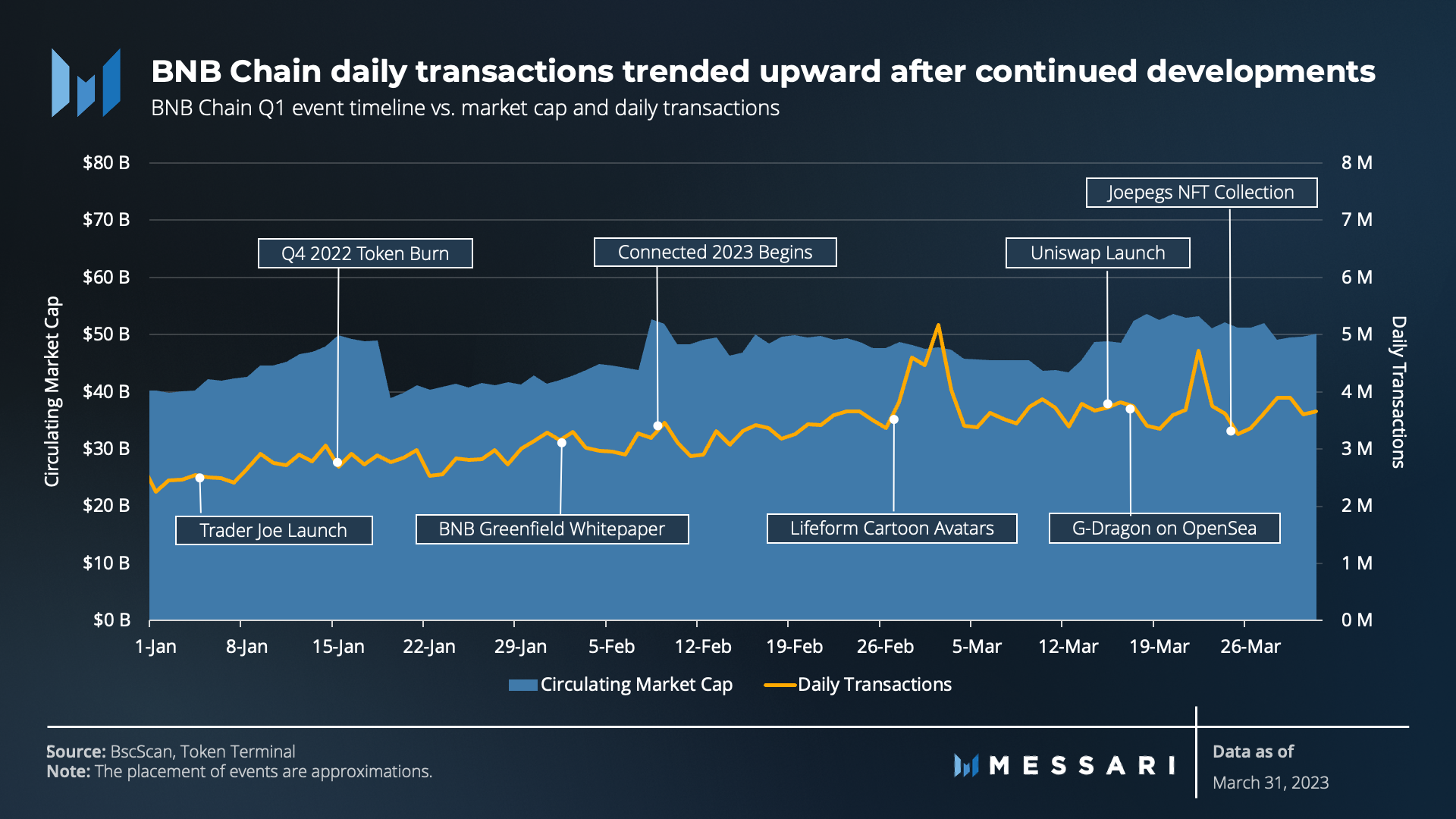

- Several ecosystem developments continued to drive address and transaction activity during Q1, driven by the launch of Uniswap, new GameFi, and SocialFi applications.

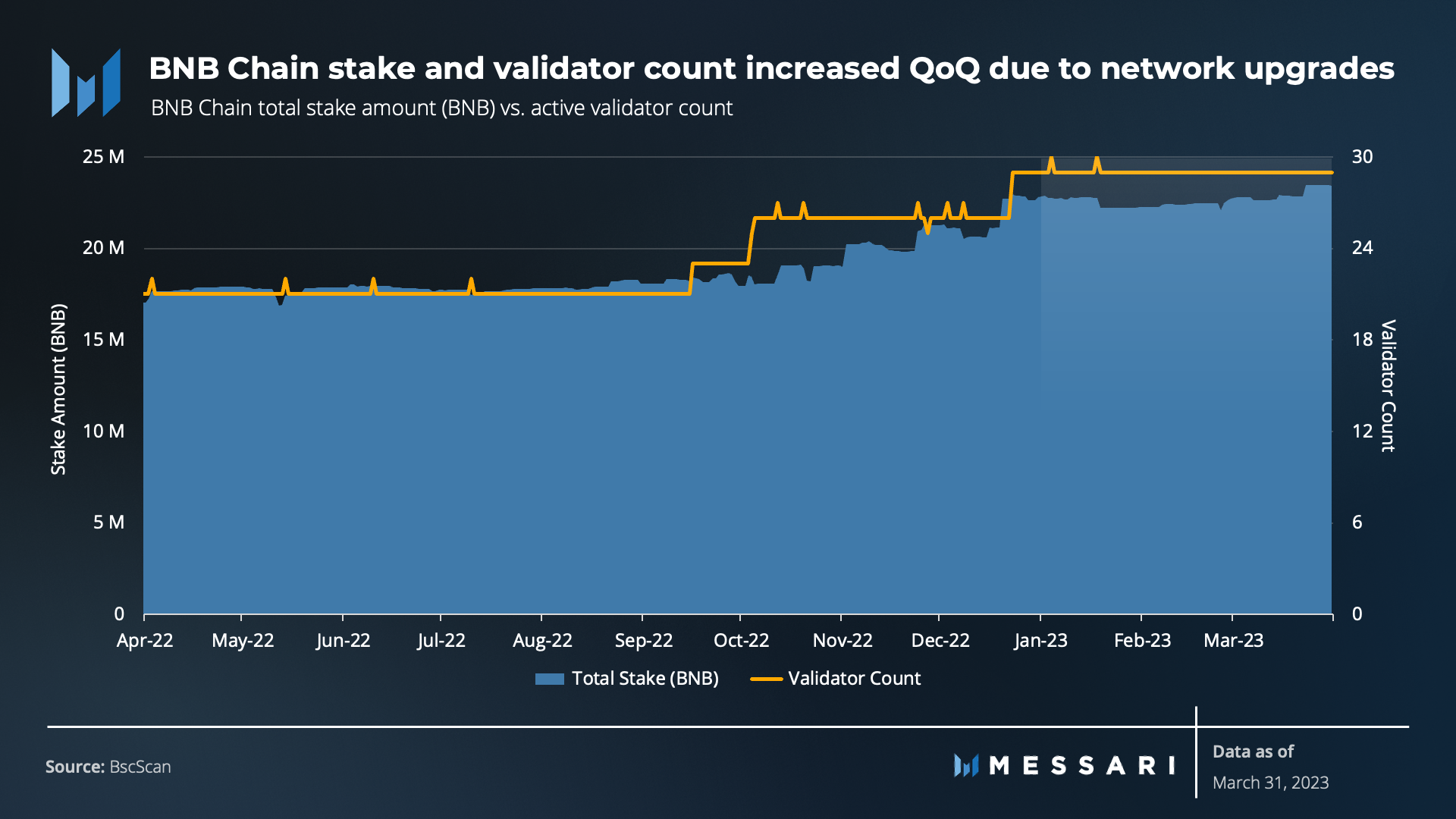

- Network upgrades in Q4 led to further decentralization this quarter. The average number of validators and total stake increased 10.7% and 12.1%, respectively.

- Jump Crypto discovered a vulnerability in the BNB Beacon Chain, which was patched within 24 hours, preventing malicious exploitation and protecting funds.

- BNB Chain released robust plans for 2023, including increased scalability through modular rollup architecture, data storage with BNB Greenfield, and account abstraction infrastructure.

Primer on BNB Chain

BNB Chain is a public, open-source blockchain that aims to deliver scalable smart contract support for decentralized applications. It seeks to accomplish this with a modular design and scaling solutions. BNB Chain consists of a multichain framework — the BNB Smart Chain, Beacon Chain, BNB Sidechain, BNB ZkRollup, and most recently, Optimistic Rollup and BNB Greenfield.

The Beacon Chain is the dedicated layer for governance (staking and voting), and the BNB Smart Chain is the dedicated layer for Ethereum Virtual Machine (EVM) consensus and execution. The BNB Smart Chain is based on a Proof-of-Staked-Authority (PoSA) mechanism and is powered by a growing network of active validators. The BNB Sidechain framework is designed to create BNB Smart Chain-compatible sidechains. Plans also include the launch of ZK-rollups and optimistic rollups for high-performance scaling, allowing sidechains to customize solutions. Finally, BNB Greenfield is designed to serve as a decentralized storage infrastructure within the broader BNB Chain ecosystem.

Key Metrics

Performance Analysis

Network Overview

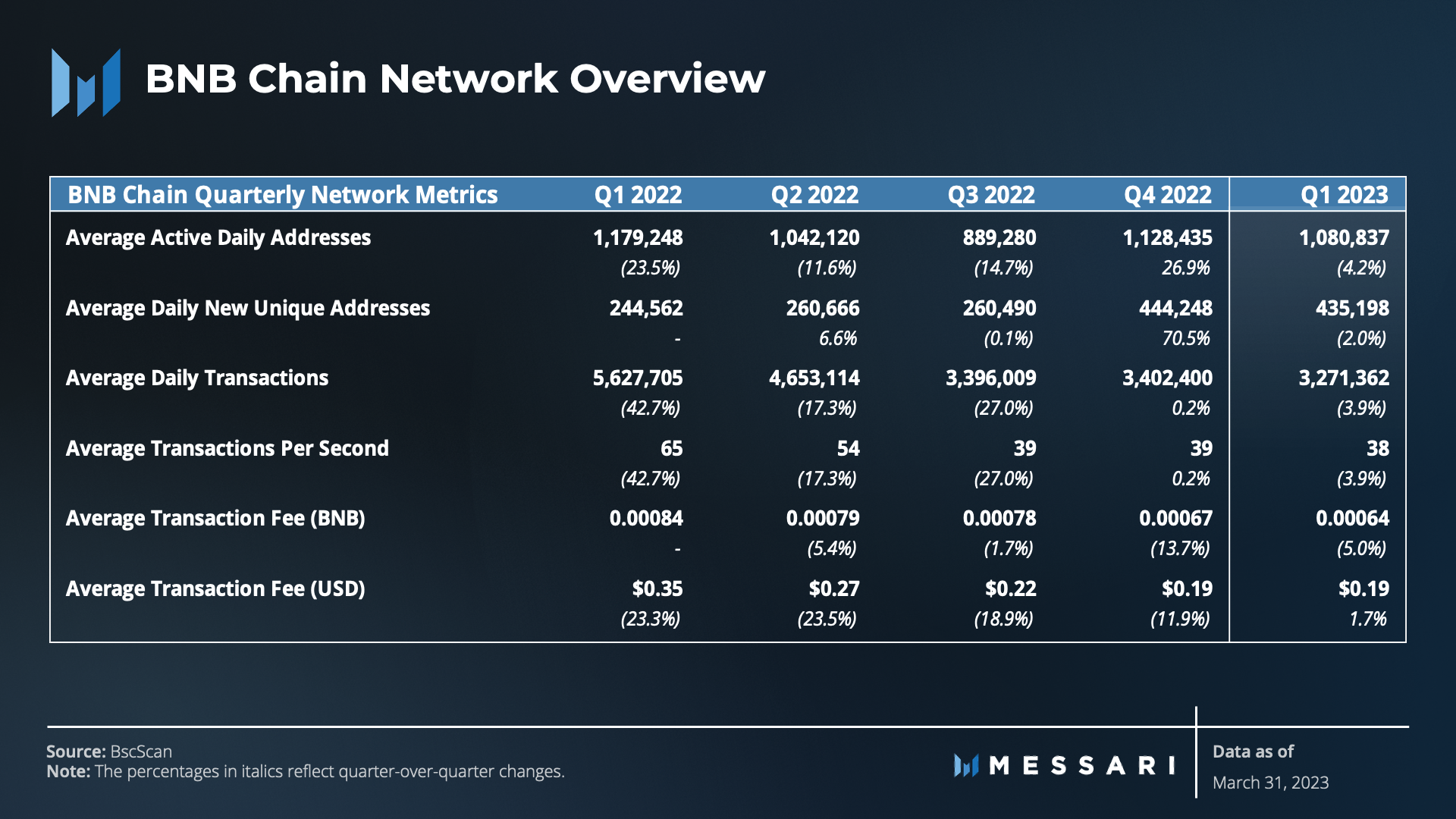

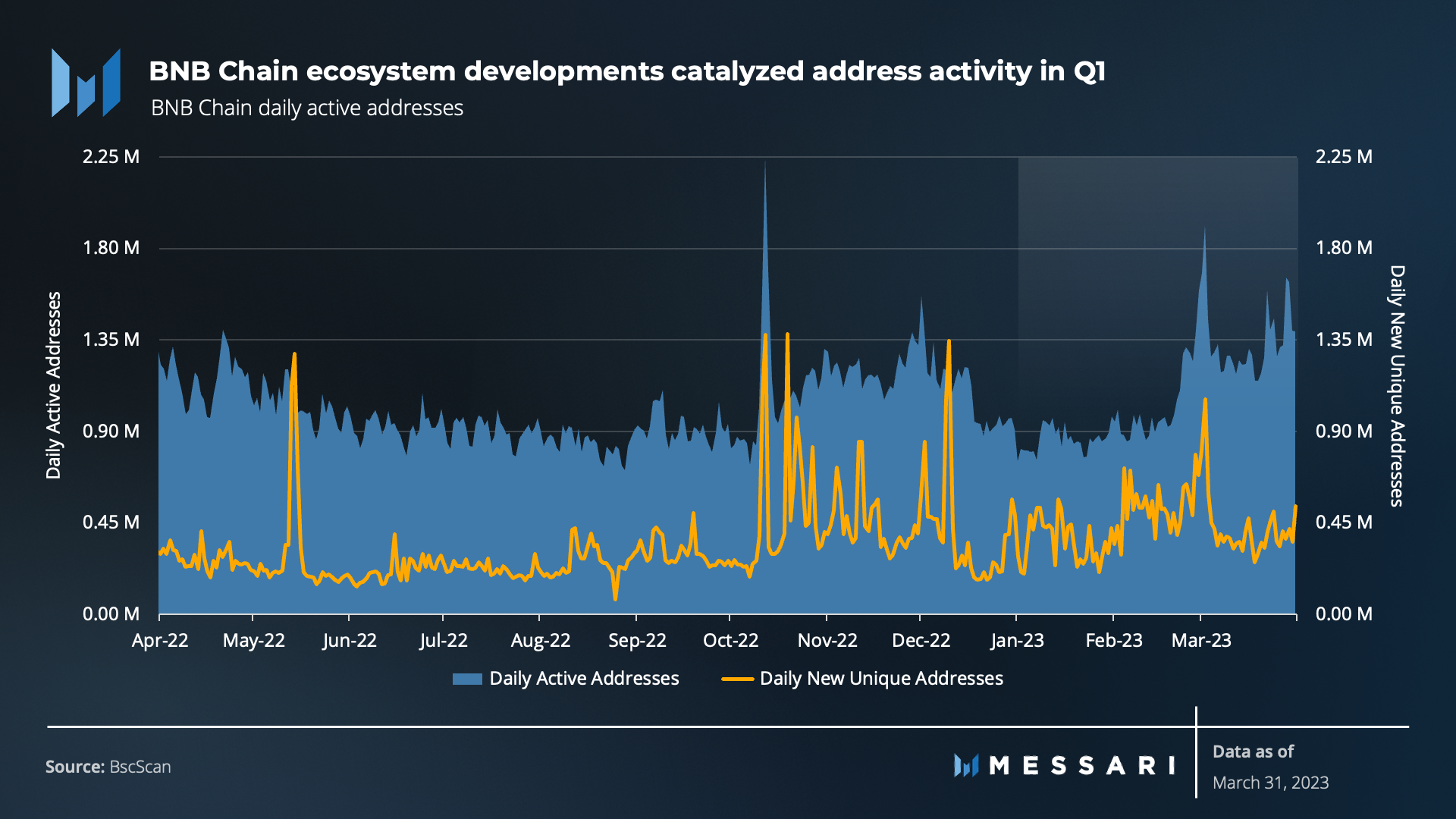

After reaching what appeared to be a foundational user base in Q3 2022, BNB Chain’s average daily active addresses and daily transactions began to trend upward through Q4 2022. During Q1 2023, activity levels stabilized but the trend was more consistently upward quarter-over-quarter (QoQ).

In Q4 2022, BNB Chain saw more foundational network utilization, as average daily active addresses reversed course and grew by ~30% to finish off 2022. Despite the continued economic headwinds, several ecosystem developments over Q1 2023 continued to drive address activity.

Similar to Hooked Protocol’s accelerated adoption in Q4, a surge of activity in Q1 stemmed from:

- Lifeform - A digital identification application.

- CyberConnect - A decentralized social graph protocol.

Details on these and other applications are provided in the “Ecosystem and Development Overview” section.

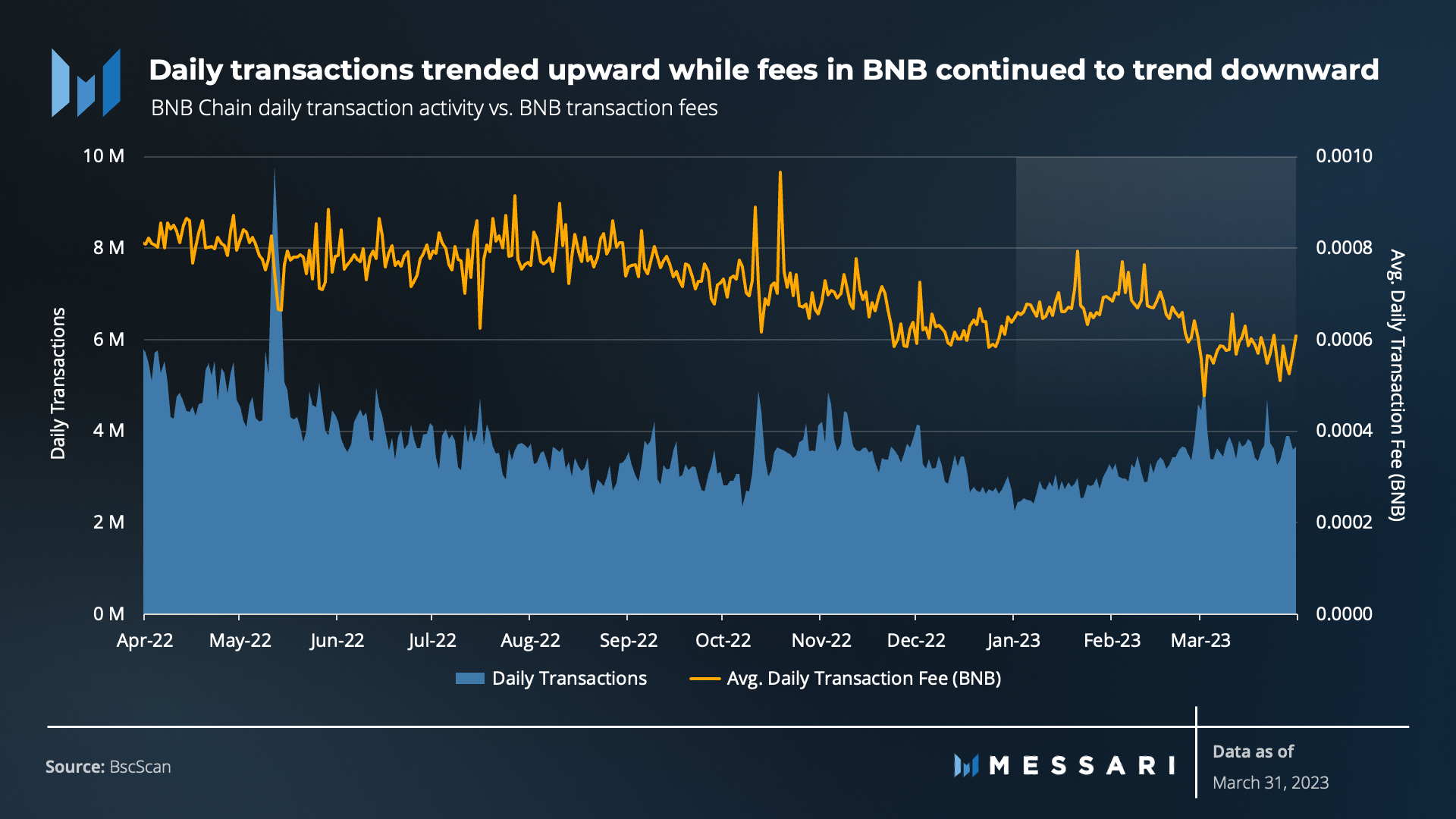

Daily transaction activity followed a similar pattern as daily active addresses. After reaching a foundational user base in Q3 2022, transaction activity stabilized in Q1 2023. In total, BNB Chain’s average daily transactions finished the quarter down slightly (3.9%), but steadily trended upward throughout Q1.

Financial Overview

After a turbulent 2022, the crypto market rebounded in January and demonstrated resilience through the quarter's end. As such, along with an uptrend in network activity, BNB Chain’s financial performance improved.

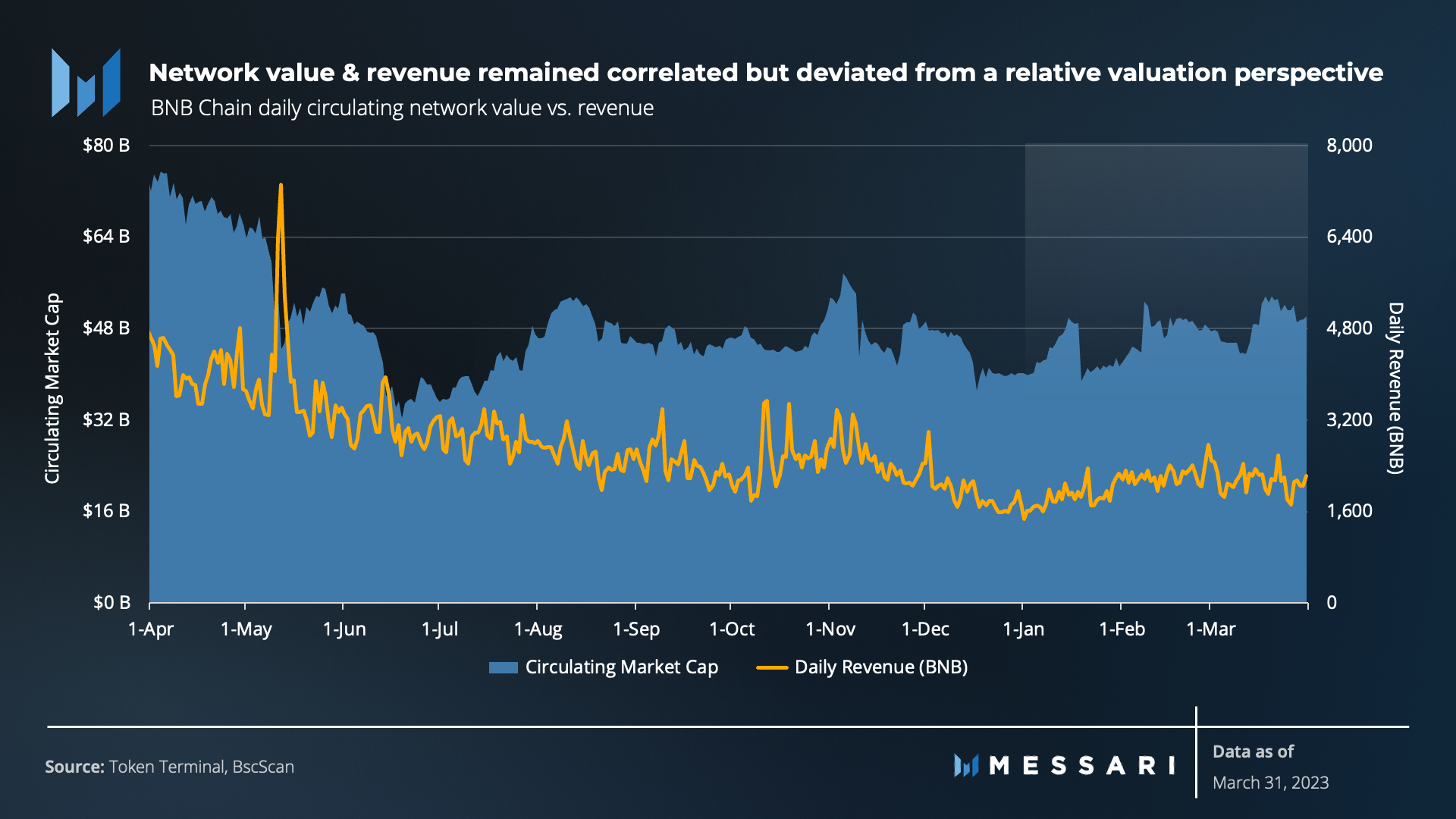

Average transaction fees decreased, generating less revenue; simultaneously, circulating market cap (i.e., network value) increased by 24.9% QoQ.

The circulating supply of BNB continued to decline due to BNB’s token-burning mechanism. By March 31, 2023, over 44 million BNB (~22% of its 200 million total supply) had been burned since the burn program began in 2017. BNB has averaged a deflationary rate of 1.1% over the last year.

Revenue in BNB (total transaction fees paid in BNB) declined by 11.7% while network value increased by 24.9% QoQ. The deviation between fundamental value accrual from revenue versus network value may suggest that overall market sentiment drove value more so than fundamental network utility.

For perspective, the circulating market cap of BNB was 670x the total quarterly revenue in USD at the end of Q4 2022 compared to 887x at the end of Q1 2023. The difference suggests a move to a less favorable valuation.

To that end, a simple P/S ratio may not be enough to evaluate blockchain assets. Blockchain assets may need several unique valuation techniques. One such technique recently introduced is the Expected Demand for Security Model. This model proposes that the key driver for the value accrual of a blockchain asset is the gross demand for security by all present and future infrastructure.

Ecosystem and Development Overview

The drivers of BNB Chain’s fundamental value accrual include its developer engagement and ecosystem growth strategy.

BNB Chain’s growth strategy has been at the core of recent activity across various sectors of its ecosystem and has extended beyond DeFi.

Ecosystem Growth Strategy

As highlighted in the State of BNB Chain Q4 2022 report, BNB Chain executed several growth initiatives that continued through Q1 2023, including:

- MVB Accelerator Program

- BNB Builder Grants

- European Innovation Incubator Program

- Growth Incentive Program

- Kickstart

Simultaneously, the BNB Chain community launched additional initiatives to invest in its ecosystem throughout the quarter, including:

- BNB Chain Bounty Program - Introduced a new Ecosystem Bounty Board that allows developers, students, and researchers to contribute to the development of BNB Chain and earn rewards.

- BNB Game Jam - An eight week campaign to incentivize the development of gaming applications on ZK BNB Chain and BNB Chain.

- Connected 2023 - A Web3 social hackathon with $50,000 of incentives for building decentralized social networks with CyberConnect.

- Innovation Hackathon - Prizes and seed investment from BNB Chain and prominent investors.

DeFi

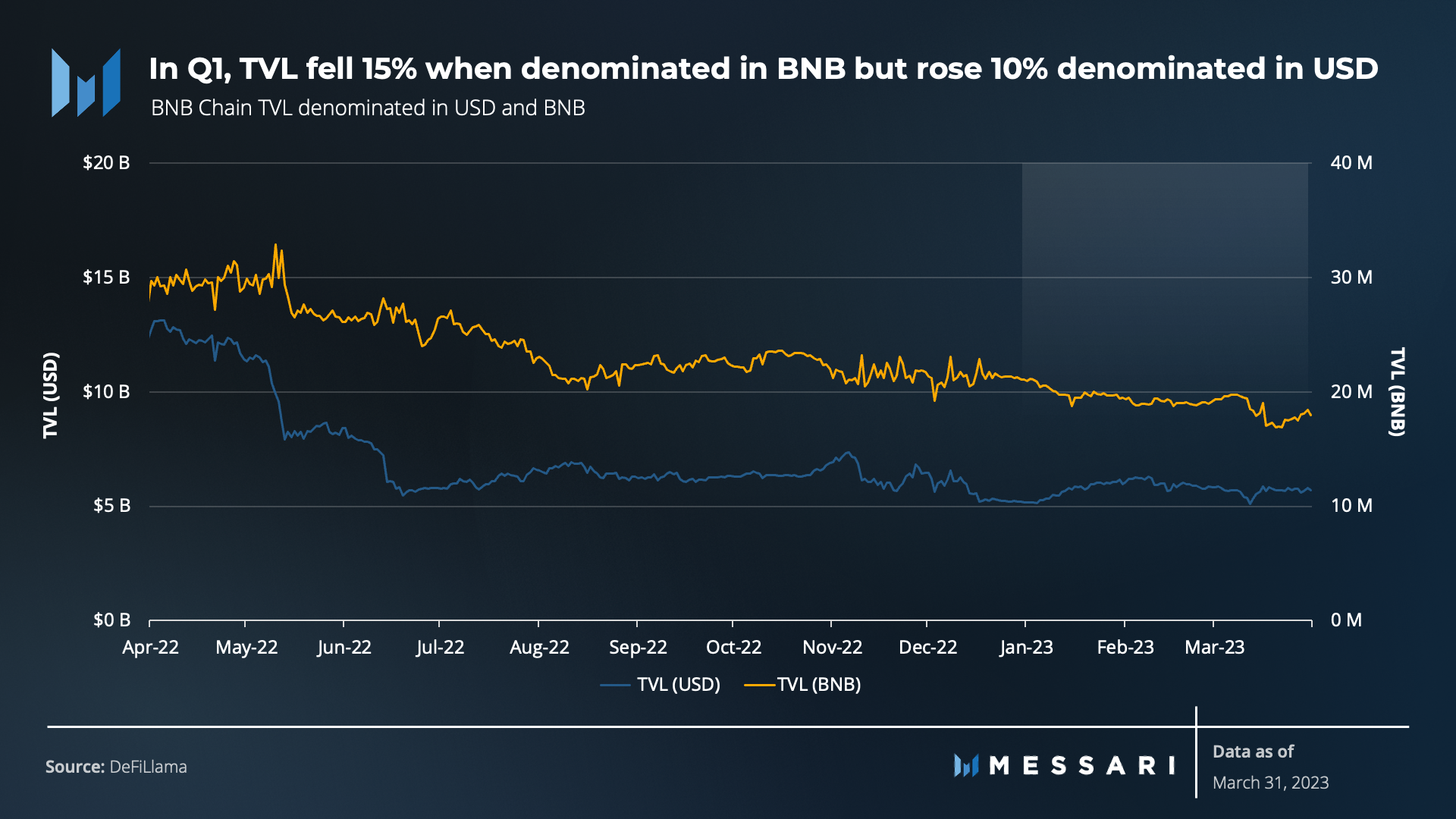

Along with the relief rally that began in January, TVL denominated in USD increased by 10.2%. However, TVL denominated in BNB declined by 14.6%, suggesting TVL was accrued by asset price increases in USD rather than native token utilization.

Liquid staking and yield farming platforms continued to support BNB Chain and its DeFi ecosystem. Ankr, a liquid staking derivative (LSD), and Coinwind, a yield farming platform, continued to grow over the quarter. They finished Q1 in the top 10 by TVL, collectively holding ~$245 million in TVL. Note that these platforms were excluded from the above TVL figures to avoid double-counting.

Nearly all DeFi applications on BNB Chain benefited from the market rebound throughout Q1. BNB Chain's most prominent protocol, PancakeSwap, was up 3% QoQ in terms of TVL. At the same time, TVL on Venus and Alpaca Finance grew by double digits, causing PancakeSwap's dominance to decline for the third consecutive quarter.

The continued shift in TVL dominance on BNB Chain signals that a more robust DeFi ecosystem is forming. There is a decreasing risk of TVL concentrated in a single application like PancakeSwap. PancakeSwap made up ~43% of BNB Chain's DeFi TVL at the end of Q1, down from 46% the prior quarter. Despite losing market share, PancakeSwap continues to innovate. It announced the rollout of its V3, which will host a slew of new features and campaigns in early Q2.

Beyond PancakeSwap, BNB Chain saw a significant development in expanding DeFi with the launch of Uniswap in mid March. Uniswap experienced immediate traction: processing over $50 million in volume and capturing $11 million in TVL in its first two weeks.

Other notable developments across BNB Chain DeFi included:

- Trader Joe - An emerging DEX that originated on Avalanche expanded onto BNB Chain.

- Euler Finance - A non-custodial lending protocol deployed on BNB Chain.

- Symbiosis - A cross-chain engine and liquidity protocol integrated with BNB Chain.

- Uniwhale - A decentralized leveraged trading platform launched on BNB Chain.

- Lif3 - An LP perpetual exchange launched on BNB Chain.

- Radiant Capital - An omnichain money market built on LayerZero deployed on BNB Chain.

Stablecoin Landscape

BNB Chain's place in the stablecoin space is relatively substantial, with the third-highest total stablecoin market cap behind Ethereum and TRON.

At the start of Q1, BUSD made up 52% of the stablecoin market cap on BNB Chain. However, after regulators forced Paxos to cease the issuance of BUSD, its users moved away from using BUSD. As a result, the BUSD market cap on BNB Chain declined by ~$2.5 billion (~54%) QoQ, and dominance shifted to USDT.

Although BNB Chain’s stablecoin market cap ultimately decreased 30% QoQ (~$2.8 billion), the network remained in third regarding total stablecoin value on-chain.

NFTs

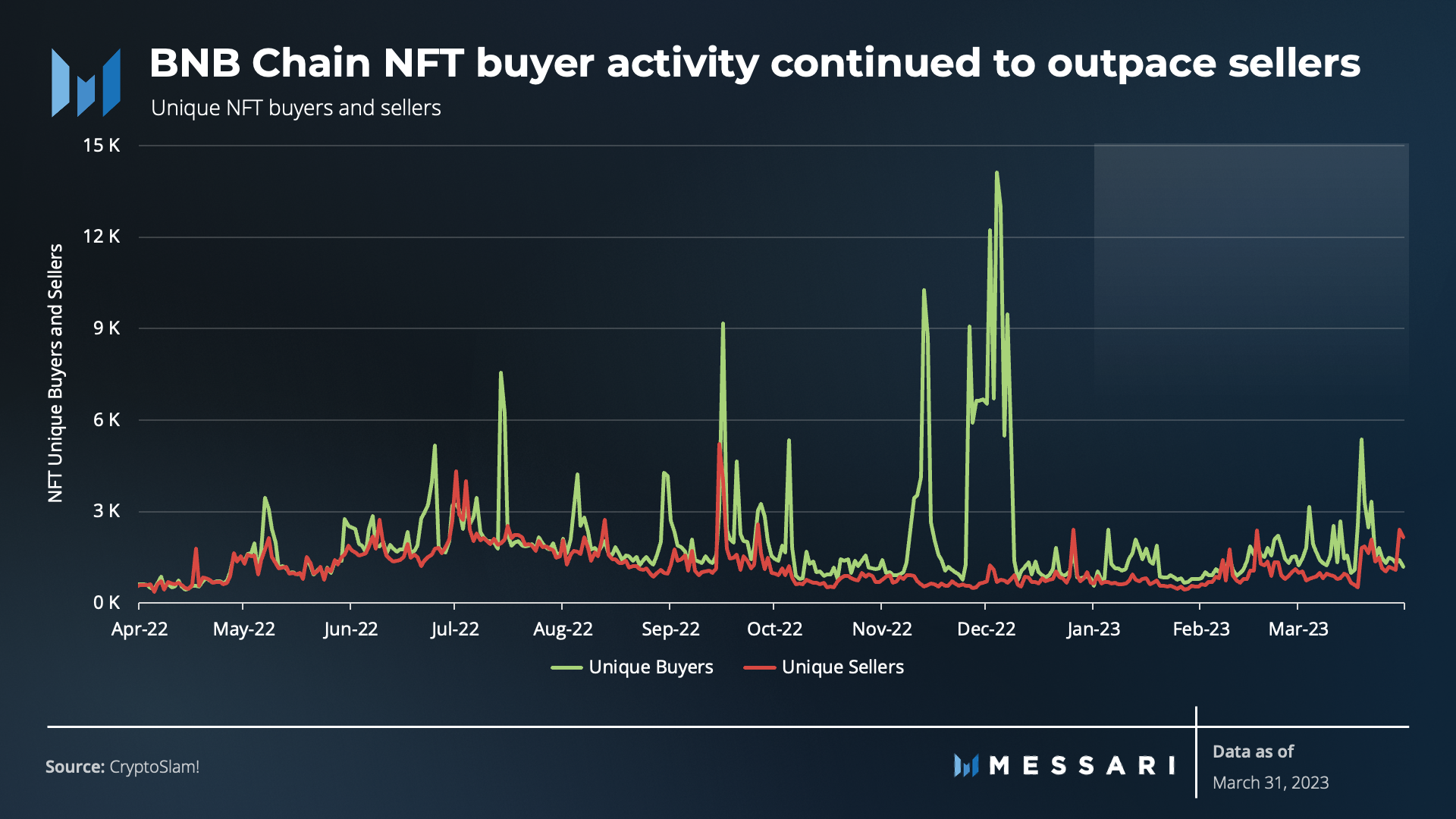

2022 was a breakout year for the BNB Chain NFT sector. While macro forces may have stalled sales volume in Q4, they stabilized through Q1 as total NFT secondary sales volume increased by 2.9% QoQ.

While sales volume was uneventful, unique buyers continued to outpace unique sellers.

Buying activity spiked when BNB Chain NFTs were made available for listing and sale on OpenSea in Q4 2022.

Similarly, buying activity surged at the end of Q1 as the Joepegs NFT Marketplace expanded to BNB Chain and hosted the “ORIGINS collection.” Further, popular South Korean K-Pop artist G-Dragon released the “Archive of PEACEMINUSONE” collection on OpenSea in collaboration with Fandom Studios.

Other notable developments across the BNB Chain NFT sector included:

- Fellaz - Partnered with BNB Chain to bring NFT ticketing to the Ultra Music Festival in Abu Dhabi.

- Nandi - An NFT marketplace aimed to promote the work of African and Black artists, won the January BNB Chain Builder Grant.

- zkBNB NFT Marketplace - NFT marketplace launching to bridge the gap between Web2 scale and Web3 monetization with features built on BNB Chain’s Layer-2 scaling solution.

GameFi

Era7: Game of Truth, X World Games, Tiny World, Meta Apes, and SecondLive launched within the last year. These five games are the top five gaming applications on BNB Chain with the highest daily average of unique active wallets (UAW). During Q1, wallet activity slowed as gaming UAWs were collectively down 41% relative to Q4 2022.

While these top gaming applications saw declining wallet activity, new games continued to launch and experienced traction on BNB Chain. Yuliverse and PlayZap Games averaged just a handful of daily UAWs in Q4 2022. However, by the end of Q1, both were trending upwards, with Yuliverse averaging 1,500 daily UAWs and PlayZap 8,500 daily UAWs.

Further, MOBOX continued to average ~5,000 daily UAWs, and Gameta continued to host several mini-game series on its platform, cementing its place as one of the top 15 most used applications on BNB Chain.

BNB Chain’s ongoing growth strategy will look to reverse the downward trend in gaming wallet activity with initiatives, including:

- BNB Game Jam - Incentives aimed at developing gaming applications on ZK BNB Chain/BNB Chain concluded with several prize winners in March.

- GAIMIN - A blockchain company partnered with BNB Chain to support developers and help gamers monetize the underutilized computational power of their gaming PC.

- Seedify - A blockchain gaming incubator with over 50 projects partnered with BNB Chain to usher in GameFi development.

Other Use Cases, Infrastructure, and Tooling

Outside of the DeFi, NFT, and GameFi sectors, noticeable network activity stemmed from other use cases.

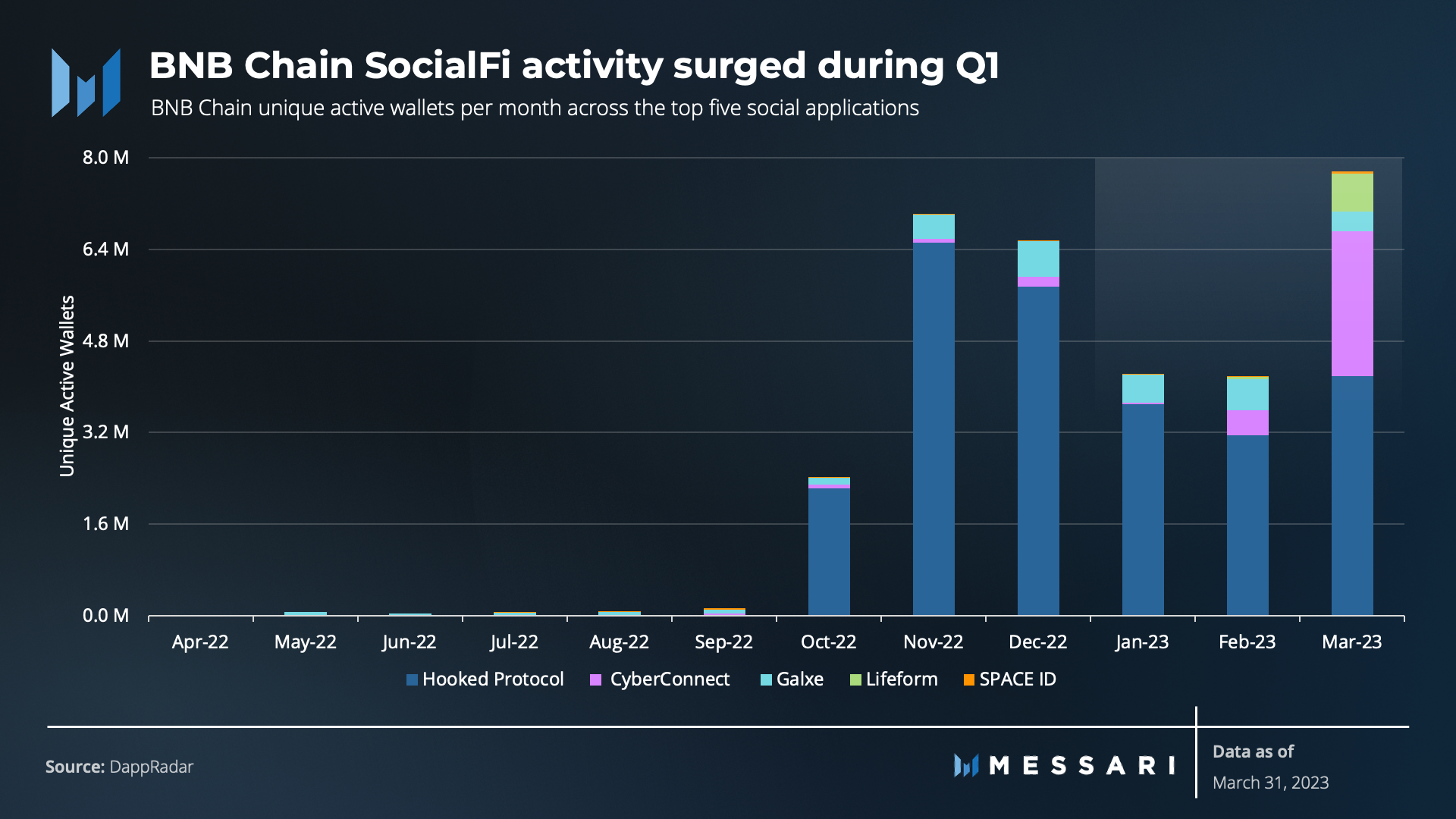

Gamified SocialFi platform Hooked Protocol sustained a user base after substantial traction in Q4 2022.

Social platform CyberConnect followed a similar trend to Hooked Protocol in Q1. CyberConnect averaged ~30,000 UAWs, catalyzed by Connected 2023. Connected 2023 was a hackathon that consisted of four weeks of app development, concluding with 23 teams winning $50,000 in prizes across six categories.

Several other use cases emerged, including:

- Lifeform - A decentralized identifier (DID) protocol held a one-month FreeMint Event that resulted in over 600,000 UAWs. However, the user activity subsided towards the end of Q1.

- Push Protocol - A decentralized communications protocol launched on BNB Chain.

- Atem Network - A decentralized content creation protocol launched on BNB Chain.

- FranklinDAO and Identity.com - Announced as winners of the February BNB Chain Builder Grant.

Through Q1, BNB Chain maintained an aggressive strategy to deploy financial and human capital across its ecosystem. Although BNB Chain held its position in DeFi, NFT, and GameFi, the most incremental network activity QoQ was driven by its other use cases, especially in the SocialFi space.

Development Activity

Developer engagement has yet to catch up to BNB Chain’s growth strategy. Unique contracts verified are determined by the number of smart contract verifications, which developers trigger to translate code into a higher-level language. This measure continued to trend downward, down 9.5% QoQ

Further, data sources tracking the events in BNB Chain’s GitHub repository can also give insight into core developer involvement. According to Electric Capital's 2022 Developer report, full-time developers on BNB Chain dropped from over ~190 to ~130 during 2022.

Staking and Decentralization Overview

Staking and decentralization of the network continued to improve through Q1. Total stake, average engaged stake (total stake divided by total supply), and the number of validators that validated a block all increased QoQ.

As highlighted in the State of BNB Chain Q4 2022 report, the network continues to further decentralize and increase censorship resistance of the network through the ongoing efforts put forth by:

- BEP-131 - Introduced candidate validators onto BNB Smart Chain to improve the robustness of the network.

- BEP-153 - This release went live in Q4, enabling staking support on the BNB Smart Chain via a new staking system contract.

- BEP-159 - This BEP introduced a permissionless validator election mechanism, bringing the staking economy onto the Beacon Chain.

BEP-131, 153, and 159 will continue to facilitate the growth of the active and candidate validator sets. This growth should enable more validating and staking participation, catalyzing a greater distribution of stake.

Qualitative Analysis

Key Events, Catalysts, and Strategies for Ecosystem Growth

Aside from the ecosystem growth strategies mentioned above, BNB Chain had other growth-oriented aspects of its strategy. Three strategic elements stood out during Q1:

- Technical developments — Evolve network architecture and improve functionality.

- User access and experience — Captivate users and developers with improved user access and experience.

- Community — Acquire developers and drive adoption through community building.

Technical Developments

In January, BNB Greenfield released its whitepaper. BNB Greenfield is a standalone, storage-oriented blockchain and a decentralized network of storage providers. The launch of the BNB Greenfield testnet is planned in the coming months. Users and dApps will be able to create data, store it off-chain, and exchange data with ownership.

BNB Greenfield aims to serve several use cases powered by three core features:

- Enabling Ethereum-compatible addresses to create and manage data and token assets.

- Natively linking the data permissions and management logic onto BSC as exchangeable assets and smart contract programs with all other assets.

- Providing similar API primitives as popular Web2 cloud storage providers.

Other notable technical developments during Q1 included:

- BNB Beacon Chain hard fork was postponed to allow discussion among the BSC validator set regarding BEP-159 and the reward ratio.

- BNB Beacon Chain V0.10 series of upgrades throughout Q1 enabled BEP-159. The upgrades allow users to stake their BNB to become validator candidates or delegate their BNB to trusted validator candidates.

- BSC client V1.1.21 release scheduled the Planck hard fork. This hard fork will implement BEP-171 and BEP-172, which aim to enhance network stability and security. BEP-171 brings several security enhancements to the cross-chain bridge between BNB Beacon Chain and BNB Smart Chain.

User Access and Experience

During Q1, NodeReal, a blockchain infrastructure provider, notably improved the user and developer experiences on BNB Chain. NodeReal released a tutorial for building Python applications that query gas prices on BNB Chain.

Further, NodeReal and Cocos-BCX launched a strategic partnership to build a game-focused optimistic rollup on BNB Chain. This collaboration will expose BNB Chain to over 1.6 million Cocos developers.

Finally, NodeReal announced its support for Erigon on BNB Chain. Erigon is an infrastructure tool that provides an efficient, memory-optimized Ethereum execution client written in Go. With NodeReal’s support, Erigon will help to seamlessly implement new BEPs of BNB Smart Chain, such as new features, enhancement proposals, and hard forks.

Further, Erigon aims to deliver more reliable snapshot download services for faster synchronization of Archive Nodes without syncing from the genesis block themselves.

Community

The BNB Chain community consistently grew its diverse set of members. Outside of allocating financial capital, the community also uses non-financial means to draw human capital to the ecosystem

Following the community engagements such as BNB Chain Kickstart, Patika, and BNB Chain Innovation Pitch Days in Q4 2022, BNB Chain remained persistent in growing its community in Q1 with the following:

- Web3 Mastery - A six week series of workshops for developers.

- Web3WonderWomen - A mentorship program to empower women in Web3.

- Zero2Hero Program - A six-month virtual program to assist Web2 and Web3 developers in building the skills, networks, and resources to advance their careers.

- Founders Academy - A 12-week program designed to help startup founders advance the stages of their businesses.

Ecosystem Challenges

Despite BNB Chain's progress towards its long-term goals and continued adoption, the network faced some challenges in Q1.

In February, the security team at Jump Crypto discovered a vulnerability in the BNB Beacon Chain. Had it been exploited, the vulnerability would have allowed an attacker to mint unlimited tokens on BNB Chain, leading to a potential loss of funds. Jump Crypto privately disclosed the issue to the BNB team. The team subsequently developed and deployed a patch within 24 hours to protect the funds.

In March, the U.S. Commodity Futures Trading Commission (CFTC) filed a lawsuit against Changpeng Zhao "CZ," Binance Holdings limited, Binance Holdings (IE) Limited, Binance (Services) Holdings Limited, and Samuel Lim for allegedly breaking trading and derivatives rules. While the suit's outcome is unpredictable, a negative outcome could slow the advancement of the BNB Chain ecosystem.

For clarity, Binance and BNB Chain are separate entities — the former is a group of centralized entities, and the latter is an evolving decentralized network. However, Binance, Binance Labs, and the Binance Launchpad help grow the BNB Chain ecosystem through asset listings, liquidity provision, investment, and project launches.

The Road Ahead

BNB Chain was largely successful in executing its 2022 roadmap. As a recent Messari report highlighted, BNB Chain laid out robust plans for 2023 during Q1. Looking ahead, BNB Chain's approach to success will include growth strategies such as the MVB Accelerator Program

The network will also aim to boost throughput by increasing the network's gas limit from 140 million to 300 million, enabling the processing of up to 5,000 transactions per second.

Further, the network intends to roll out a Rust-based BSC node client and initiate state-offload to reduce data footprint.

BNB Chain also plans to further decentralize by introducing a new validator reward model (balanced mining) and a validator reputation system. These steps would increase the number of validators from 29 to 100.

The roadmap highlights several potentially impactful initiatives, including:

- Increased scalability through modular architecture, including multiple ZKP and optimistic rollup-based L2s.

- The creation of a data storage network (BNB Greenfield).

- The implementation of consumer protections provided by blockchain security firms.

- The advancement of infrastructure to support mass adoption, including account abstraction and identity solutions.

Ultimately, BNB Chain has wide-reaching plans to remain competitive through 2023.

Closing Summary

As market sentiment shifted and a relief rally ensued in Q1, BNB Chain user activity remained strong. Daily active addresses and transactions remained steady. Increased stake amounts and a growing validator set signaled that the network progressed toward a more decentralized state.

DeFi on BNB Chain expanded beyond PancakeSwap with the launch of Uniswap. New games continued to launch and experienced traction. Other use cases in the SocialFi space drove the most incremental network activity QoQ.

Despite BNB Chain's progress toward its long-term goals, Q1 presented some challenges. Jump Crypto discovered a vulnerability in the BNB Beacon Chain. Regulators forced Paxos to cease the issuance of BUSD, and the U.S. Commodity Futures Trading Commission (CFTC) filed a lawsuit against Binance Exchange.

Despite these challenges, BNB Chain looks to remain competitive, continue its growth strategies, and pursue its robust plans for 2023.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Binance. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

James believes that the future of finance and economics will be algorithmic, decentralized, and distributed efficiently on a global scale. He is a Research Analyst with Messari focusing on Layer-1 protocols and previously held traditional finance positions at Northwestern Mutual and U.S. Bank. James also has experience as an analyst at research firms like Morningstar.

Read more

Research Reports

Read more

Research Reports

About the author

James believes that the future of finance and economics will be algorithmic, decentralized, and distributed efficiently on a global scale. He is a Research Analyst with Messari focusing on Layer-1 protocols and previously held traditional finance positions at Northwestern Mutual and U.S. Bank. James also has experience as an analyst at research firms like Morningstar.