Key Insights

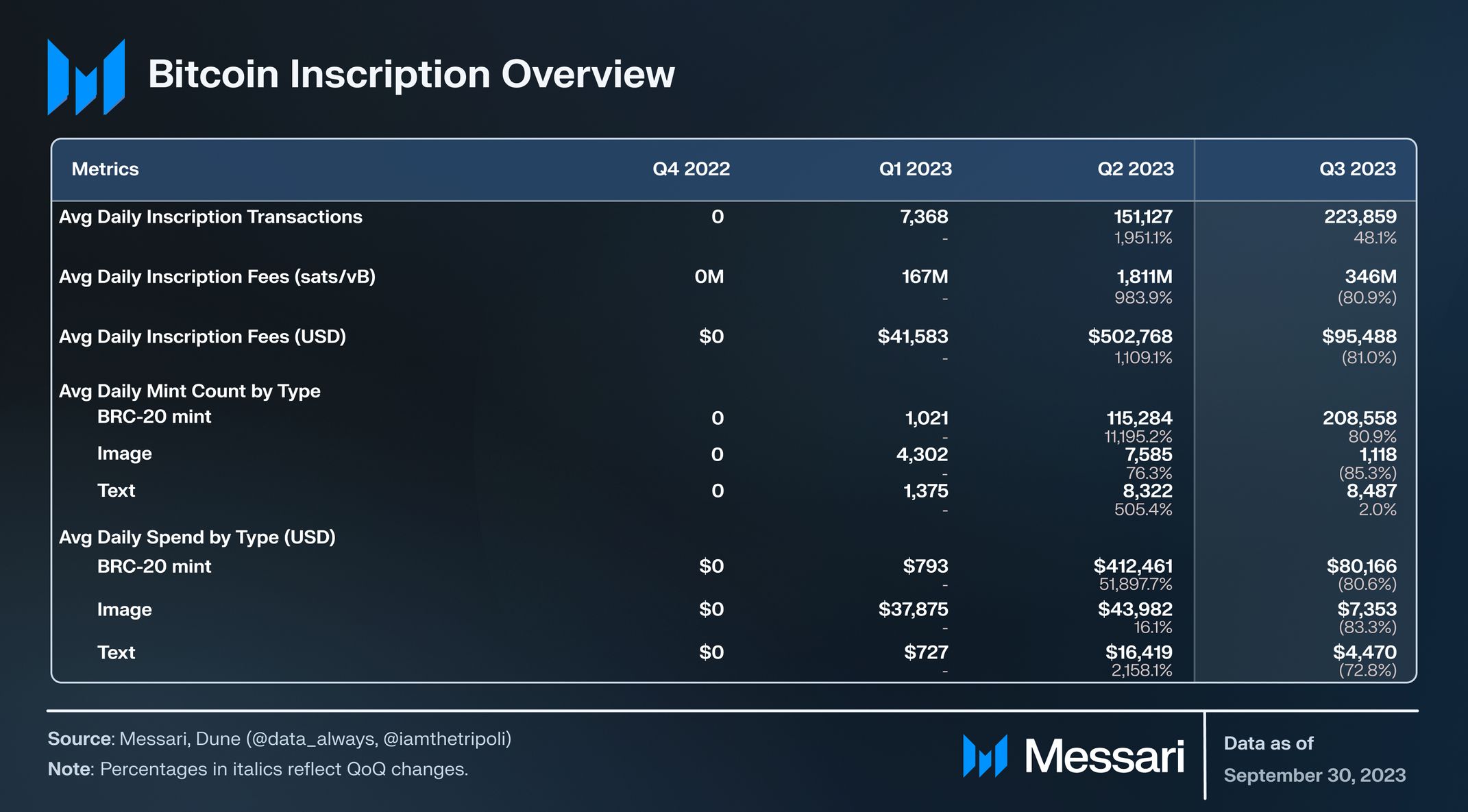

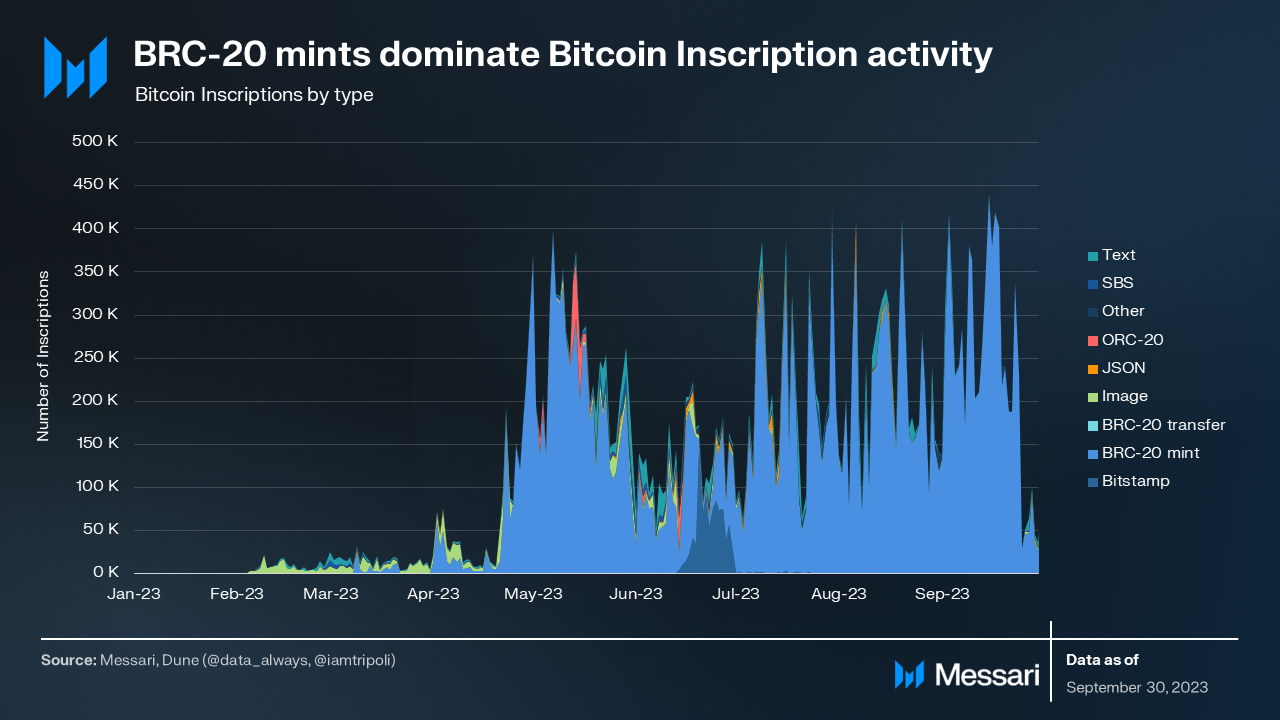

- Inscription activity was up 48.1% QoQ to 224,000 average daily transactions, led by BRC-20 mints increasing 80.9% QoQ. $SATS was the leading BRC-20 by activity.

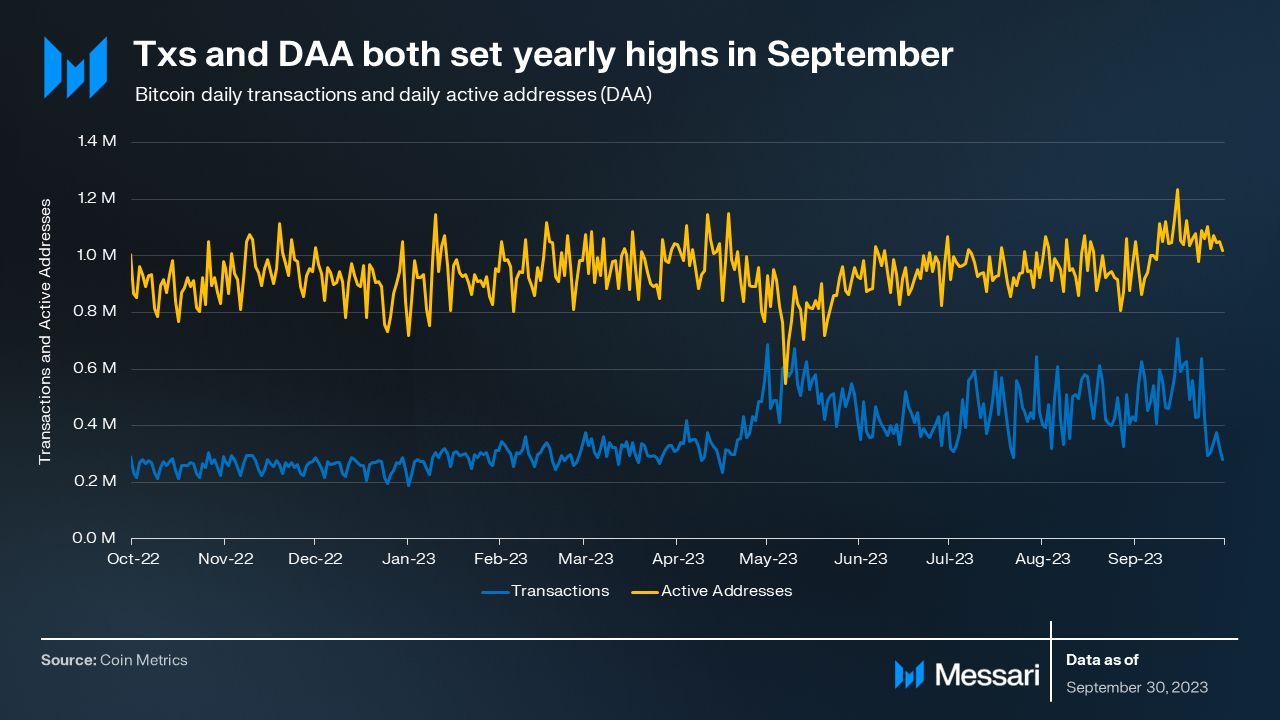

- Daily transactions and daily active addresses set yearly highs in September. Transactions and active addresses were up 9.1% and 7.4% QoQ, respectively.

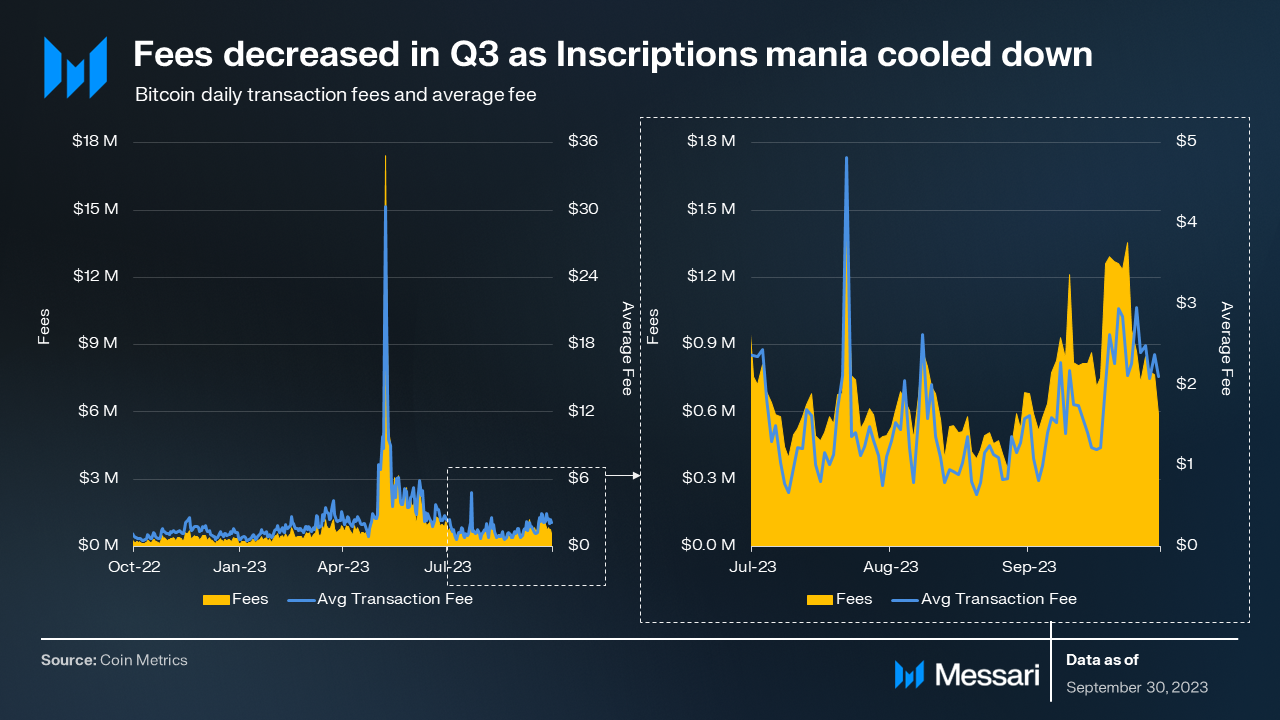

- The average transaction fee was down 66.9% QoQ. Declining fees were due to Inscription mania cooling down. Inscription activity was up, but there was not the same urgency that drove fees up in Q2.

- More spot BTC ETF applications were filed in Q3, bringing the total to 12.

- Interest in Bitcoin programmability has persisted since the introduction of Inscriptions. More recent explorations include BitVM, Drivechains, and Bitcoin rollups.

Primer on Bitcoin

Bitcoin (BTC) is the first distributed consensus-based, peer-to-peer payment settlement network. Bitcoin, the native asset of the Bitcoin blockchain, was the world's first digital currency without a central bank or administrator. Often referred to as digital gold, bitcoin has a predictable, stable monetary policy that operates autonomously, giving it the ideal store-of-value properties. To secure its network, Bitcoin uses a consensus mechanism known as Proof-of-Work (PoW) to solve the “double-spend problem.” PoW requires participants (miners) to contribute computing power to solve arbitrary mathematical puzzles in order to add a new block to the blockchain. Bitcoin is awarded to the miner who solves the puzzle first, thus minting new bitcoins.

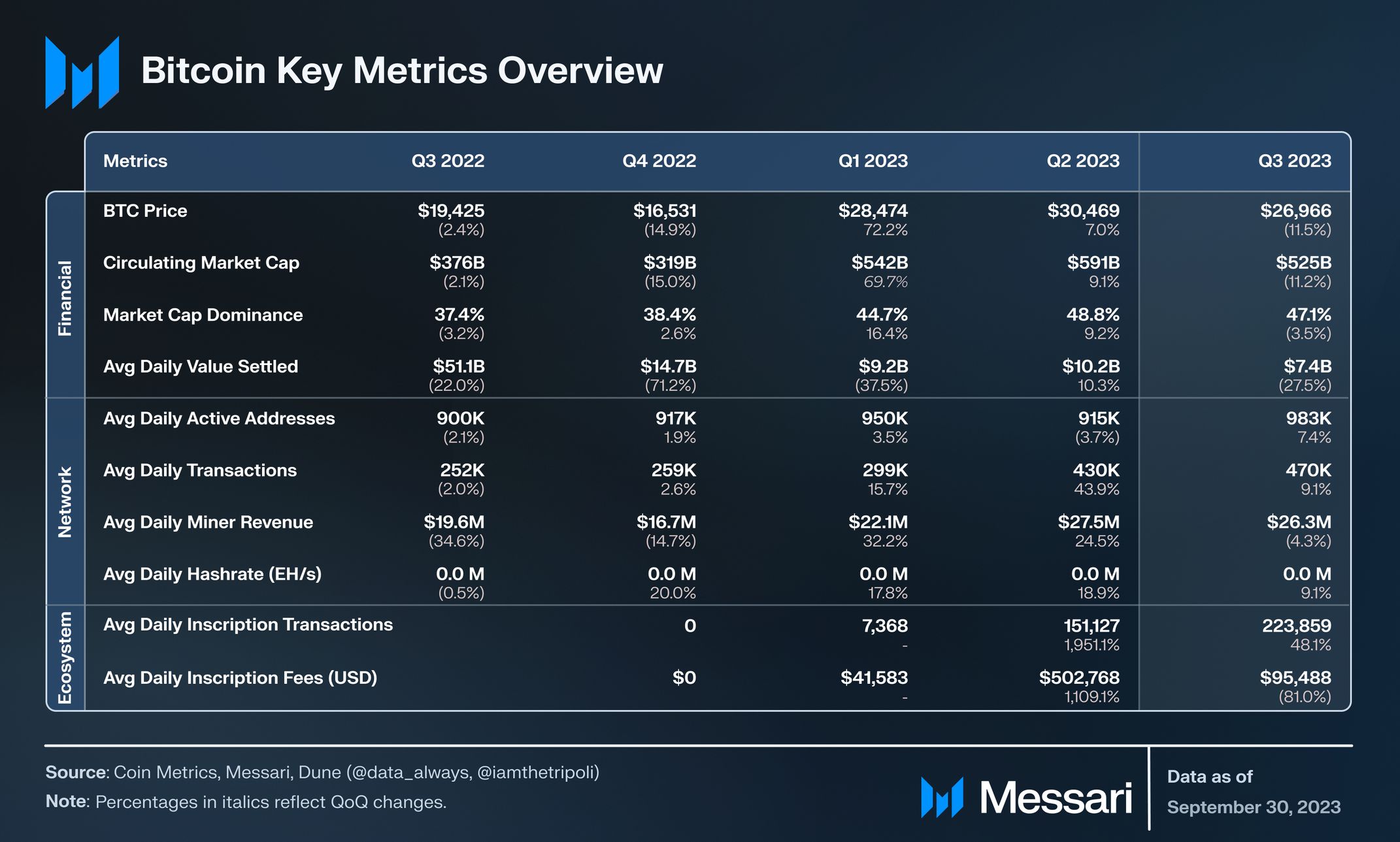

Key Metrics

Financial Analysis

BTC’s price declined 11.5% QoQ. This decline exceeded the decline of the overall crypto market, decreasing BTC’s market cap dominance by 3.5% QoQ, from 48.8% to 47.1%. Despite these quarterly declines, both price and market cap dominance have steadily increased over the past year.

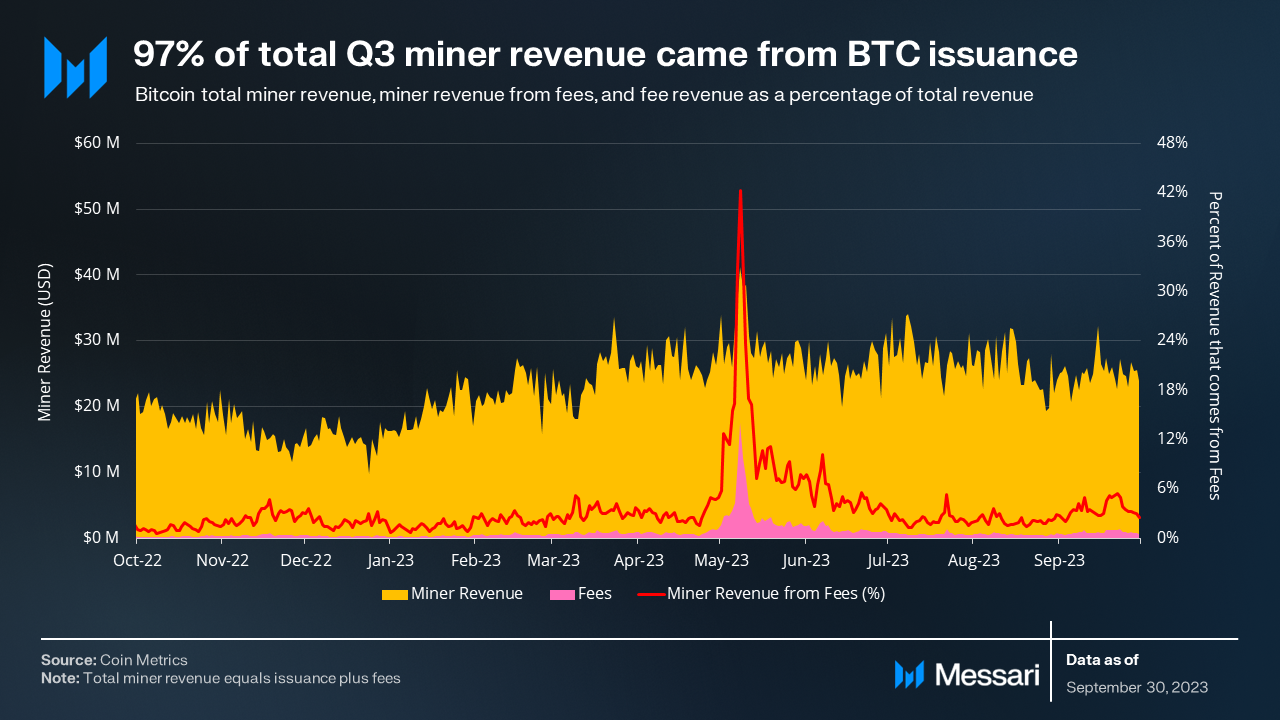

The massive increase in fees in May 2023 was due to mania around inscriptions. As the urgency to mint these assets died down, so did fees. Average daily fees increased 305% QoQ in Q2, up from $510,000 to $2.06 million. In Q3, average daily fees decreased 67% QoQ to $680,000. Inscriptions are explored further in the Ecosystem Analysis.

Paxos accidentally paid 20 BTC (~$500,000) for a transaction of only 0.7 BTC in value on September 10, 2023. This mistake pulled the average daily transaction fee up to $2.18, which was 42% higher than the quarterly average of $1.53. Despite the heightened activity, this day did not rank among the quarter's top ten for average transaction fees. Given the network's extensive daily transaction volume, individual events typically lack the impact to significantly skew fee metrics.

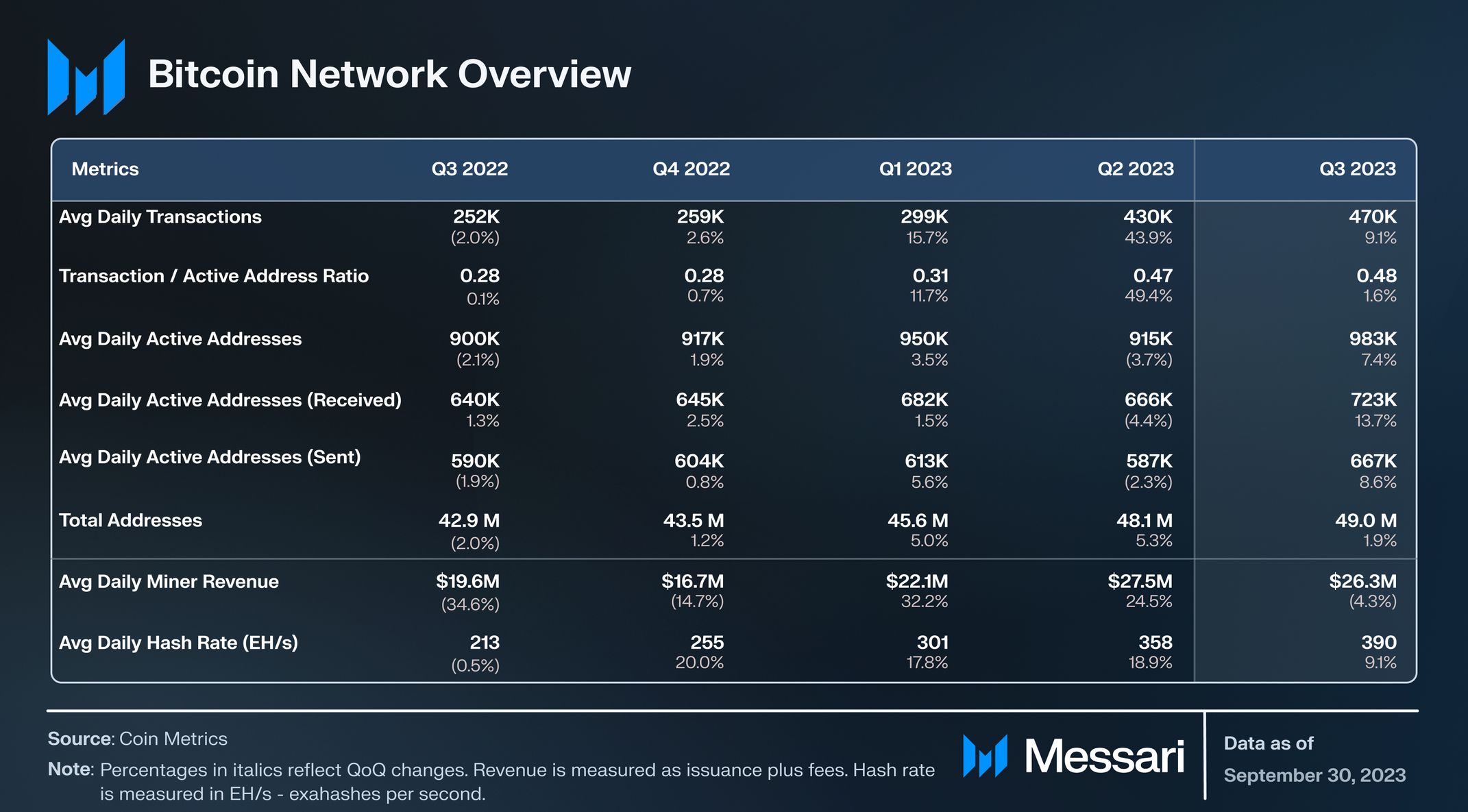

Network Analysis

Activity increased in Q3, with daily active addresses and daily transactions up 7.4% and 9.1% QoQ, respectively. In September, both metrics set yearly highs. The ratio of transactions to active addresses has increased for the fifth consecutive quarter. This suggests that either the average user is becoming more active or the network has gained a relatively small group of “super users” that account for a large portion of the activity. Ecosystem innovations such as Inscriptions are likely responsible for this behavior shift.

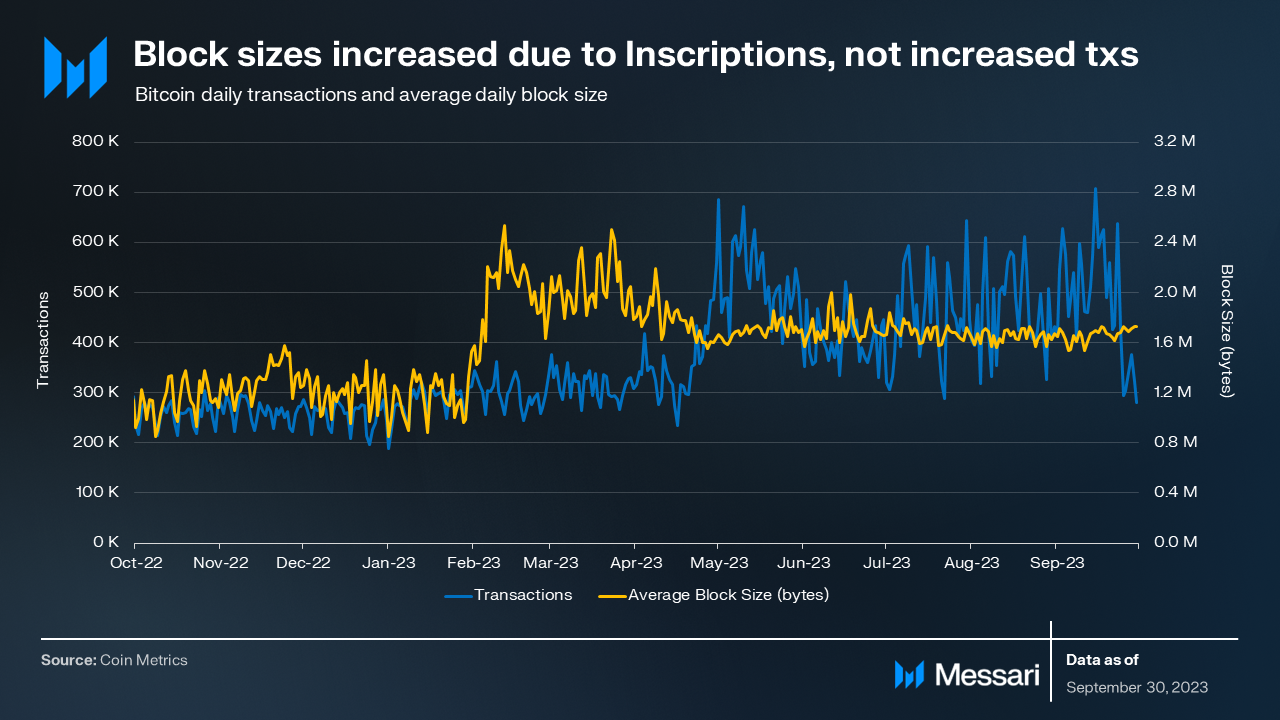

The average block size was generally flat throughout Q3 and stabilized following the increase in early 2023. The increase in average block size aligns with the introduction of Inscriptions in early Q1. Transaction activity didn’t see significant increases until the end of Q2. As such, the type of transactions (i.e., Inscriptions) is likely what increased average block size YTD rather than the volume of transactions themselves. Inscriptions are explored further in the Ecosystem Analysis section.

Mining

In Q3, 97.4% of miner revenue came from BTC issuance rather than transaction fees. In Q1 and Q2, 97.8% and 93.1% of miner revenue came from BTC issuance, respectively. In 2022, this rate averaged 98.4%, showing that fees increasingly make up a larger portion of revenue. At block 740,000, which will occur in April 2024, the block reward will halve from 6.25 BTC to 3.125 BTC. Because revenue comes almost entirely from this block reward, miner revenue will essentially be cut in half in Q2 2024. This will be important to watch as hashrate (and, by extension, miner overhead costs) continues to grow.

Hashrate represents the security of the Bitcoin network. It increased in Q3 for the fourth consecutive quarter. Galaxy Digital attributed this to a combination of dipping natural gas prices and a pronounced hashrate expansion in regions such as the Middle East, Russia, and Latin America.

Ecosystem Analysis

Inscriptions

Bitcoin saw new innovation in 2023, leveraging the SegWit and Taproot upgrades, called Inscriptions. Inscriptions refer to the process of embedding arbitrary data onto the Bitcoin blockchain through the witness data portion of a transaction.

Inscription-based projects, such as Ordinals, revealed a serious appetite for added functionality in the Bitcoin ecosystem. Following the first Inscription mint on December 14, 2022, 20.6 million Inscriptions were minted in Q3, bringing the cumulative total to 35.0 million.

Ordinals were the Inscription type that popularized the technology. They enable arbitrary data (images, text, etc.) to be inscribed on an individual satoshi (sat), effectively creating entirely onchain NFTs. The term “ordinals” originates from Ordinal Theory, which is the idea that a numbering scheme can be used for tracking and transferring individual sats throughout the Bitcoin supply. This numbering scheme effectively creates a way to serialize sats, transforming a sat into an NFT. Ordinals are the foundation of many other Inscription types.

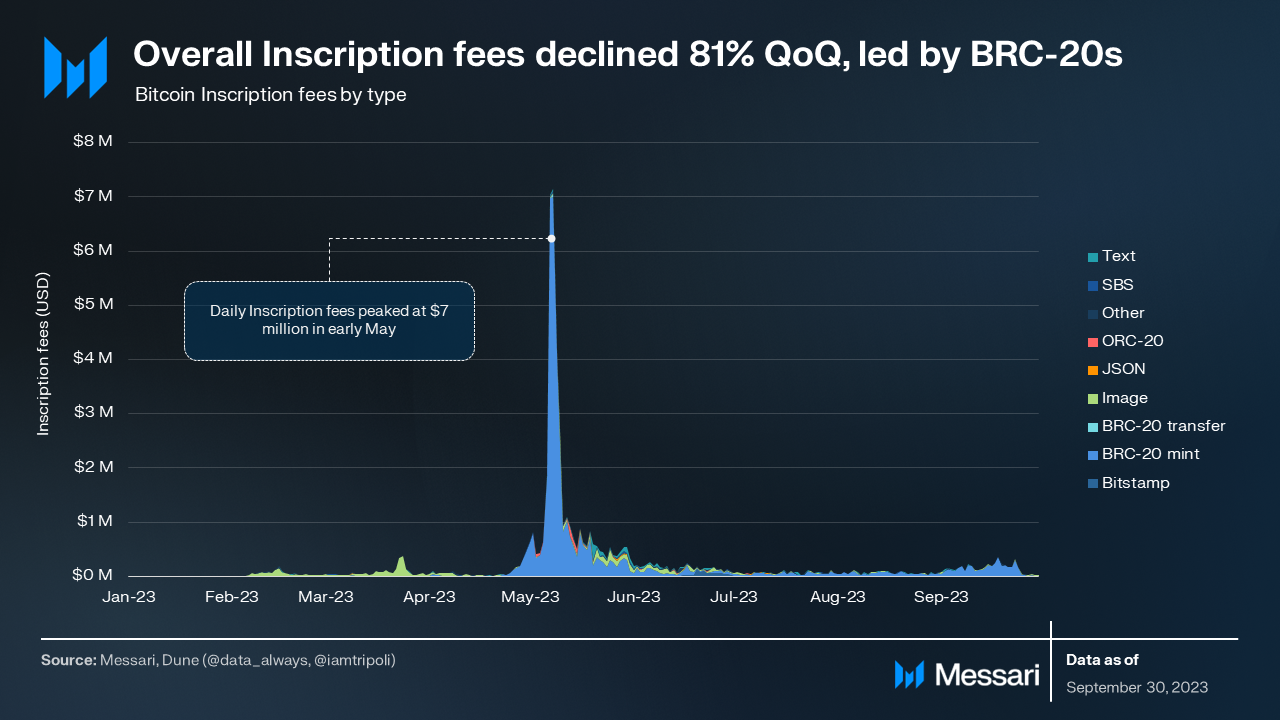

Average daily Inscription mints increased 48.1% QoQ, but average daily fees spent on Inscriptions decreased 80.9% QoQ. This divergence was due to multiple factors: BTC’s QoQ price decline, a shift in the dominance of Inscription mints, and less urgency from minters. The urgency around BRC-20 token releases has created high-fee environments as users seek to outbid each other. BRC-20s are semi-fungible tokens on Bitcoin created by attaching JSON data to sats. Although they’re meant to be fungible, they are actually semi-fungible and similar to ERC-1155 tokens in architecture due to the inherent nonfungible nature of sats.

Alternative asset types, such as Stamps, Runes, and recursive Inscriptions, did contribute to increased activity, but the increase in BRC-20 activity was the primary driver of the overall activity increase. BRC-20 mints increased 80.9% QoQ. This increase and subsequent decline can be attributed to a single BRC-20 token, $SATS. Since the start of March, $SATS has undergone a fair launch minting process, which concluded on September 24 when the token reached its maximum supply.

While certain Inscription types, such as images, are disproportionately expensive (relative to BRC-20s, text, JSON, etc.), they are still the Inscription type that contributes most to total Inscription fees, due to the volume of BRC-20 activity.

Ordinals is a meta-protocol due to the fact that much of the Inscription management is handled offchain. The indexing of Ordinals must take place offchain due to Bitcoin’s limited scripting capabilities, which can’t enforce the custom logic around various asset types. UTXO management in wallets, Ordinal transfers, and marketplaces rely on this offchain indexing. New tools and infrastructure, such as Hiro’s Ordinals Explorer, conform to the community-accepted indexing standard, leaving much of the process enforced by external sources rather than Bitcoin itself.

The Open Ordinals Institute was launched to finance and support Ordinals developers. Additionally, Inscriptions-related projects are being supported through development programs/incubators, such as the Bitcoin Startup Lab.

A side effect of Inscriptions is UTXO state bloat. The number of UTXOs on Bitcoin has increased from 84 million in the beginning of 2023 to 131 million as of the end of Q3. BRC-20s create a new UTXO with each transfer and contribute to growing UTXO sets that cannot be pruned. Because this state bloat requires more physical resources from full nodes, it could ultimately affect decentralization. However, not all Inscriptions are subject to these same factors. Runes, for example, make better use of the UTXO model and can be consolidated.

Lightning Network

Bitcoin has many sidechains and modular networks but very few true Layer-2s (L2s). An L2 is an offchain protocol with a trust-minimized bridge to and from the base layer. Bridging from the Bitcoin base layer to an L2 is relatively simple, but the reverse is much more difficult, as Bitcoin lacks smart contact functionality. Bitcoin’s limited scripting language does not allow for arbitrary logic. State-channel-based L2s, such as Lightning Network, use built-in features such as multisigs and hashed timelocked contracts (HTLCs) to facilitate the locking and unlocking of BTC.

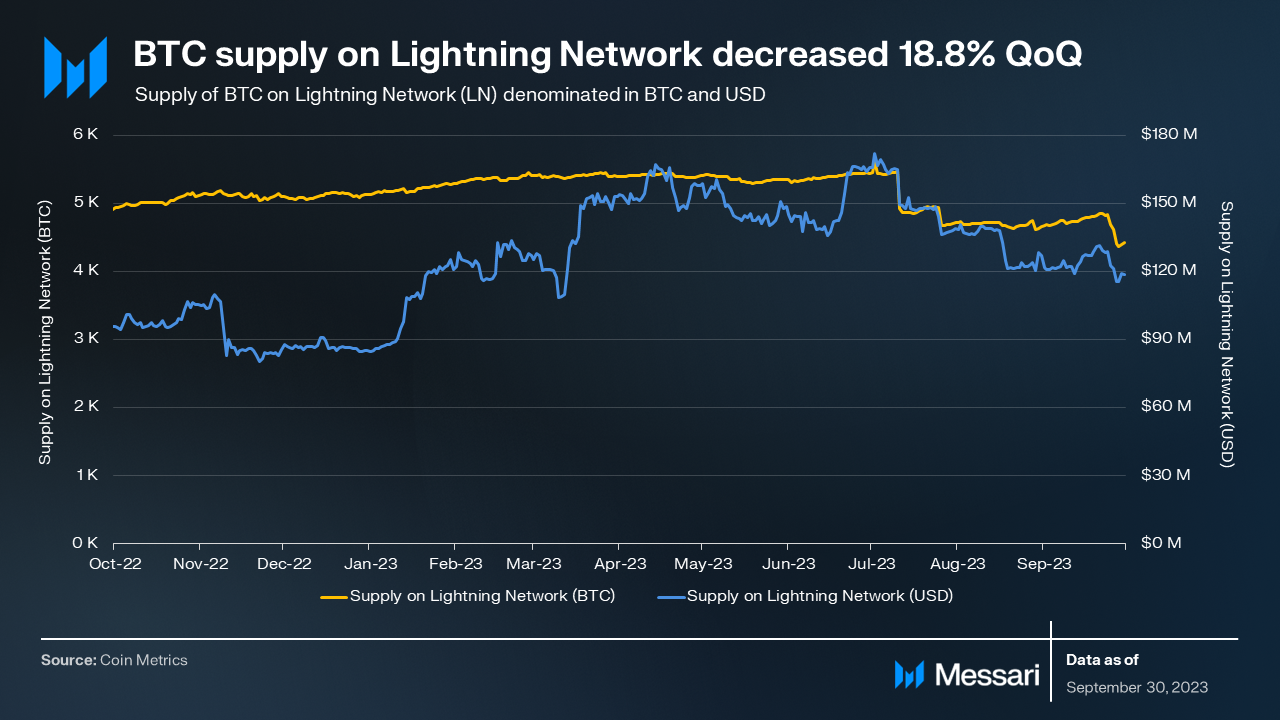

Lightning Network is an L2 state-channel solution created to scale Bitcoin. It increases the network’s throughput while decreasing transaction settlement time. First introduced in 2015, Lightning’s scaling approach has gained popularity over time and is now the de facto scaling solution for Bitcoin. After four consecutive quarters of growth, the supply of BTC on Lightning declined in Q3. The 18.8% QoQ decline brought the total number of BTC on Lightning down to 4,418 ($118.9 million).

Lightning uses the Sphinx packet format for secure encryption and packet structuring of data. Despite this, Lightning does not offer users privacy because it does not implement mixing or routing entropy. To improve Lightning’s privacy, the Ark L2 was introduced in Q2. It also aimed to address scalability and UX concerns.

Lightning has seen increased adoption from custodians in 2023. Coinbase announced in Q3 that it will integrate Lightning, joining Binance and other exchanges. While this event increases accessibility to users, it also contributes to the already-high centralization of Lightning. Over 90% of transfers and addresses are facilitated through centralized solutions, as self-custody and self-hosting have proven to be too cumbersome for many users.

Sidechains

Outside of state channels, there are several independent L1s that integrate Bitcoin in various capacities. Stacks is a Bitcoin layer for smart contracts, which has knowledge of the full Bitcoin state, thanks to its Proof-of-Transfer (PoX) consensus mechanism and Clarity programming language. sBTC (a trust-minimized version of cross-chain BTC) and the Nakamoto Release (an upgrade to reduce block times) are approaching mainnet on Stacks and aim to both access BTC’s liquidity utilization and improve the DeFi experience on Stacks.

Drivechains, defined by BIP-300 and BIP-301, is a soft fork upgrade utilizing a decentralized two-way peg. The Drivechain vision seeks to establish a native sidechain mechanism for Bitcoin to assimilate valuable experimentation from the altcoin world into Bitcoin via sidechains. Such sidechains could encompass features like enhanced privacy, bigger blocks for greater throughput, and smart contracts — all while operating through BTC instead of a distinct native asset. Other existing sidechains include Rootstock, an EVM-compatible sidechain secured by merge-mining, and Liquid, a Proof-of-Authority sidechain.

Programmability

Rollups on Bitcoin are being explored by the community. Similar to Drivechains, a true Bitcoin rollup would require a new opcode and a fork, which is no simple task. For a validity rollup to run on Bitcoin, a specific VM would have to be enshrined into Bitcoin through a new opcode. Any Turing-complete VM — such as WASM, Risc Zero, or CairoVM — could replicate all other VMs. However, by enshrining any single VM, the ecosystem would be locked into that one VM — and its performance — indefinitely. zkVMs are in a nascent stage of development, harboring unknowns about the performance of current VMs and their implementations. As such, it’d be difficult to onboard the entire Bitcoin community to the idea of enshrining a specific VM.

BitVM, presented by Robin Linus of ZeroSync, offers arbitrary functionality on Bitcoin without adding any new opcode or softfork. The idea is as simple as creating an NAND — a basic logic gate — with hashlocks and two opcodes: OP_BOOLAND and OP_NOT. Unlike most Drivechain and validity rollup ideas of enshrining a specific zkVM, BitVM is more like an optimistic or fraud-proof setup. Rather than verifying directly on Bitcoin with a zk-verifying opcode, BitVM relies on a hashlock-enabled challenge period. This setup is still enforceable onchain but not locked into a specific proving/verifying scheme.

Concerns for practical implementations include two-party restraints, offchain data management costs, and the sheer complexity of building complex transactions with binary bits.

Modular data availability (DA) solutions partially leverage Bitcoin security without executing onchain. Using Bitcoin for DA would essentially entail posting a hash of the most recent state of another network to Bitcoin, similar to posting data on Bitcoin to create an Inscription. One example of this approach is Babylon, a network in the Cosmos ecosystem.

Bitcoin’s best-in-class security makes it an attractive option for storing DA from any network, but even more so for modular solutions such as rollups in other ecosystems. Compared to decentralized L1s, Ethereum rollups, with their centralized sequencers, are more vulnerable to losing track of state from a network disruption. For this reason, they may have more to gain from leveraging such a solution. Kasar Labs has explored using Bitcoin for DA on a Starknet L3 operated by the Madara sequencer. Chainway posted the first EVM transaction on Bitcoin DA in Q3.

Cross-chain BTC

Cross-chain BTC exists on most smart-contract networks, including BNB, XRPL, Solana, Cardano, and others. It also exists in various forms, such as the centralized-custodian-issued WBTC, decentralized-network-issued tBTC, trusted-hardware-issued renBTC, or as an overcollateralized synthetic asset. The largest of which is WBTC, which is a top 20 token by market cap.

Wrapped/bridged BTC is imperfect due to Bitcoin’s limited scripting capabilities. It is backed 1:1 with real BTC, as opposed to synthetic BTC, which is secured by an algorithmic peg. As a result, facilitating BTC bridging requires a third party, in addition to the Bitcoin network and the destination network.

With centralized versions of wrapped BTC, the centralized custodian is the trusted third party. With decentralized versions of wrapped BTC, there is typically a network of nodes that are the custodians. The peg-in of BTC on smart contract-enabled networks is straightforward, as a smart contract can facilitate it. In other words, there can be no additional trust assumptions outside of the destination chain and Bitcoin. However, the peg-out — moving from wrapped BTC on the destination chain back to BTC on Bitcoin — is not as straightforward and comes with additional trust assumptions. There is an economic trust assumption on the third party for the peg-out, unlike the cryptographic trust assumption (i.e., trusting the smart contract on the destination chain) on the initial peg-in.

Exchanges, Custodians, and TradFi

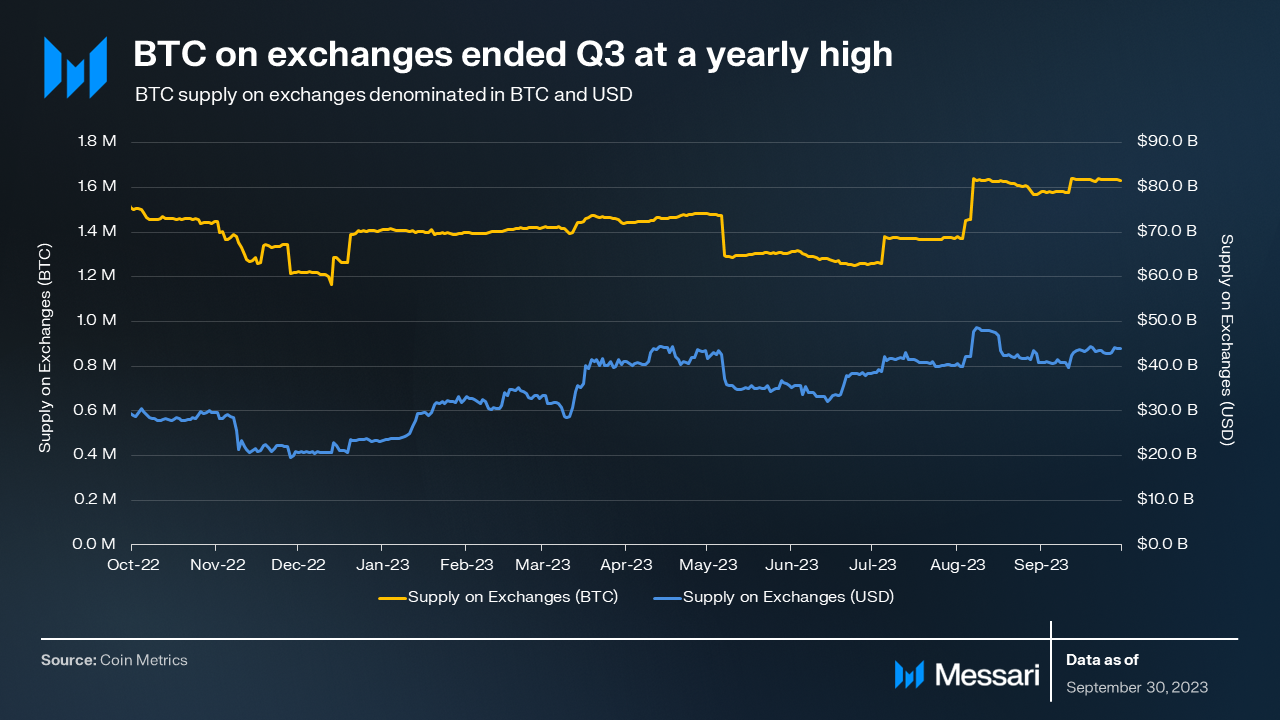

The number of BTC on exchanges increased 29.7% QoQ. This represents an additional 37 million BTC ($5.7 billion) of liquidity on exchanges.

Traditional finance has been consistently more interested in Bitcoin than the rest of the cryptocurrency asset class. While the perception of cryptocurrencies as a whole remained steady YoY, a larger proportion of investors expressed positivity towards Bitcoin compared to the broader crypto sector (47.3% versus 33.2% respectively), according to Binance’s Institutional Crypto Outlook Survey.

The growing TradFi interest can be seen in the series of spot ETF applications submitted in Q2 from major TradFi players such as BlackRock, Fidelity, ARK Invest, Invesco, and more. Q3 saw even more BTC spot ETFs filed, bringing the total to 12. In Q2, the SEC denied the conversion of the Grayscale Bitcoin Trust to a spot Bitcoin ETF. In Q3, the SEC lost this case and later decided not to appeal the loss.

Closing Summary

Programmability remains a key narrative in the Bitcoin community. Inscriptions activity increased again, up 48.1% QoQ. Despite the overall increase, much of the activity came from a single BRC-20, suggesting the new asset class has room to grow and diversify. Inscriptions have sparked more interest in other areas of programmability, such as sidechains, rollups, and even native arbitrary computation.

Bitcoin also gained attention outside of the crypto-native ecosystem. The number of spot BTC ETF applications rose to 12 in Q3. BTC’s price set a yearly high in July, with price action correlated to news and speculation on ETFs and other TradFi involvement.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Red is a researcher, educator, and developer in the web3 space. Red's background is in electrical and software engineering. His main interest is privacy technology, through zero-knowledge proofs and general cryptography.

Read more

Research Reports

Read more

Research Reports

About the author

Red is a researcher, educator, and developer in the web3 space. Red's background is in electrical and software engineering. His main interest is privacy technology, through zero-knowledge proofs and general cryptography.