Key Insights

- The 1inch DAO voted to discontinue the collection of a swap surplus, citing the inconsistency and negative impacts on users. The swap surplus will now go back to users, and the DAO plans to explore alternative revenue streams.

- Ethereum continues to dominate volumes making up over 70% of Q2’s total aggregation volume.

- The diversity of Fusion resolvers and total resolver volumes continue to increase, with over $11.7 billion in volume processed by resolvers in Q2.

- Development on 1inch Network’s Hardware Wallet continues, with 2 million USDC in funding to complete the product trade version.

Primer on 1inch Network

The 1inch Network is an all-in-one decentralized finance (DeFi) service provider operating on Ethereum, Arbitrum, Optimism, Polygon, zkSync Era, Avalanche, BNB Chain, Gnosis, Fantom, Klaytn, and Aurora. Launched in 2019, 1inch’s Aggregation Protocol (AP) allows users to route trades across various markets and realize the best available rate compared to any individual decentralized exchange (DEX). In late 2020, the 1inch Liquidity Protocol introduced a native automated market maker (AMM) to the network, which enabled users to provide liquidity and earn passive liquidity mining rewards. The network’s third product, the 1inch Limit Order Protocol (LOP), was introduced in June 2021 to support conditional limit and stop-loss orders with no fees. In late December 2022, the 1inch Swap Engine enabled Fusion mode, which is partially based on the existing tech, including the 1inch Limit Order Protocol and the 1inch Aggregation Protocol. This new feature empowers DeFi users to place orders with a specified price and time range without paying network fees. All three protocols, and Fusion mode, are governed by the 1inch DAO using the network’s native 1INCH token.

Note: This report includes data from Ethereum, BNB Chain, Polygon, Optimism, Arbitrum, Avalanche, Gnosis Chain, and Fantom. Data from zkSync, Klaytn, and Aurora are currently not included. We are working to improve access to this data.

Key Metrics

Performance Analysis

User Analysis

The user base of 1inch Network's Aggregation and Limit Order protocols has consistently grown over the year. Q1 reported 3.3 million total users for the Aggregation Protocol, which then rose to 4.5 million in Q2. Similarly, the Limit Order Protocol saw its user base increase from 261,000 in Q1 to 438,000 in Q2, marking a substantial 68% QoQ rise in users. On average, the 1inch Network accommodated 54,300 users per day across these two protocols. The 30-day moving average peaked at 64,800 users on June 22.

Ethereum upheld its reputation as the "whale chain" in Q2, commanding an average trade size of $31,000. Following Ethereum, Arbitrum and Optimism registered the next highest average trade sizes, at $4,600 and $4,200, respectively. Fantom had the smallest average trade size, measuring at $1,200. Across all chains, the overall average trade size stood at $6,800. This decline of 28.9% from Q1's average of $9,600 indicates a shift towards smaller trades in Q2.

On Ethereum, the spikes in average trade size in Q2 can be explained by the Shanghai upgrade and the enabling of ETH staking withdrawals. Although the upgrade happened on March 12 (the day the spike in average trade size goes off the chart), Lido didn’t open its withdrawals until May 15. As such, the next two large spikes visible on the Ethereum average trade size were on May 23 and June 15, when 96,000 stETH and 46,000 stETH were swapped through the 1inch Limit Order Protocol.

Execution Analysis

In Q2, the 1inch Network processed over $28 billion in total volume, reflecting a 37% decrease from Q1. This decrease, however, is not solely attributable to reduced volumes in Q2 but rather to the inflated volumes of Q1 resulting from the USDC depeg event in March 2023. Removing the week of the depeg from March 10-16 and replacing it with the average trading volume from the rest of Q1, we found a total volume of to $34.5 billion, only a 19% decrease from Q1.

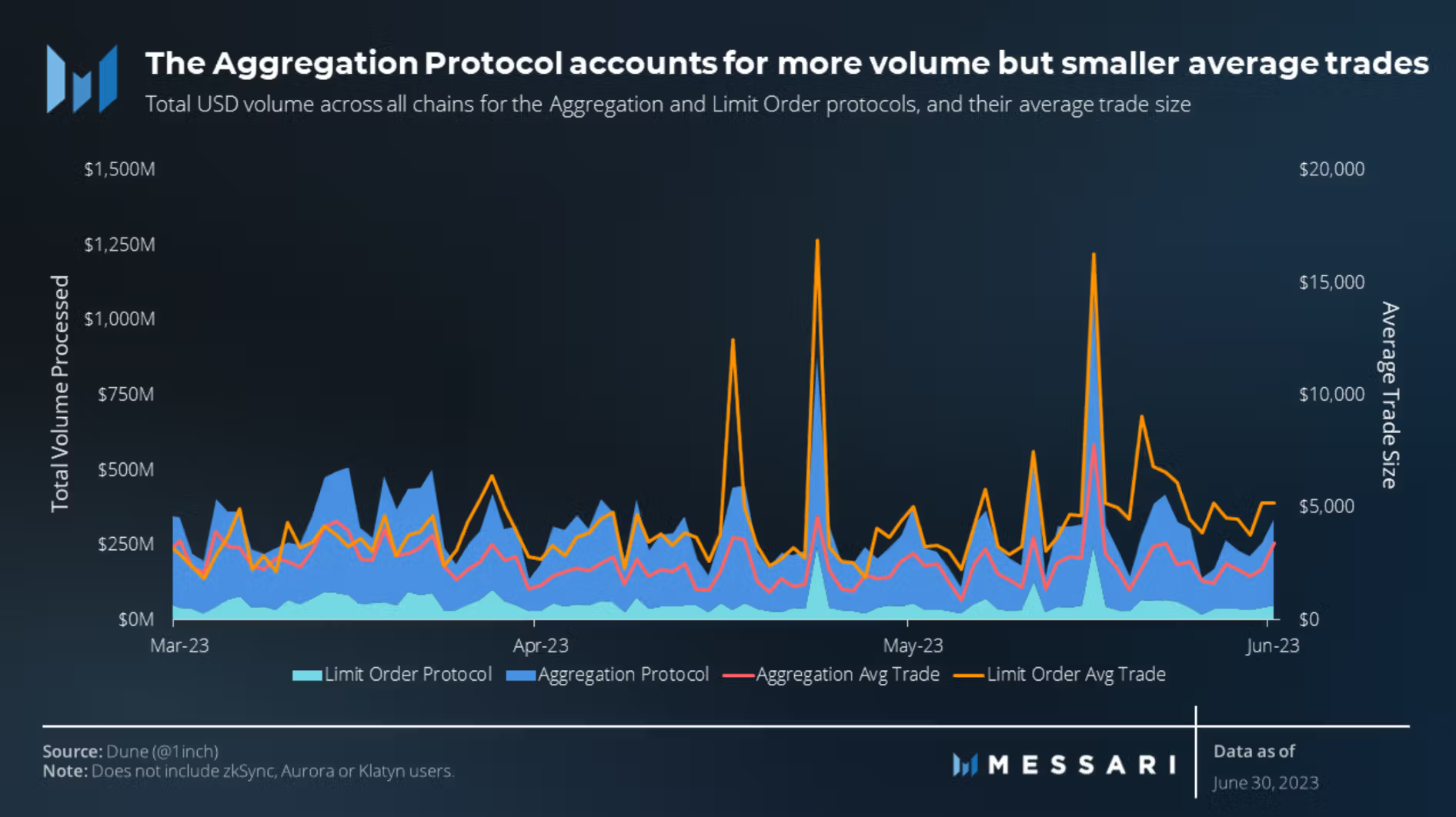

With regard to the average trade sizes, those on the Limit Order Protocol are larger than those on the Aggregation Protocol. This disparity becomes more pronounced on days with higher volumes and increased market volatility. As greater volatility leads to more significant price movements and more price execution uncertainty, it creates more opportunities for limit orders to be triggered.

In terms of the volume exported from 1inch processed by an underlying decentralized exchange (DEX), Uniswap continues to hold a significant lead. Out of the $18 billion in exported volume, Uniswap accounted for 34% or $6 billion. This figure represents approximately a 9% decrease compared to Q1, where Uniswap accounted for 43% of total exported volumes.

The volume processed by the 1inch Network maintained consistency with Q1, accounting for 9% in both quarters. A noteworthy shift was seen in Q2 for 'Other' DEXs, which includes hundreds of sources. These DEXs accounted for 12.9% of total volume in Q1, but this figure dramatically soared to 44% in Q2. This market share was primarily taken from Uniswap and Curve, which fell 9% and 14% QoQ respectively, highlighting an emerging diversification in the distribution of volume.

The second quarter of 2023 witnessed positive strides for Fusion Resolvers. It processed over $3.8 billion, marking a significant 21% decline from the $4.8 billion processed in Q1. Fusion Mode is a method of executing swaps without spending gas or risking front-running. While it functions like a swap, Fusion mode technically operates as a limit order filled by a third-party resolver; the order’s exchange rate decreases until it becomes profitable for resolvers to fill the order.

Q1 volume was boosted by the USDC depeg event, driving over $2 billion of volume in just a two week period. Excluding volume from March 6 to March 19, the weekly average in Q1 was $265 million while the Q2 average was $293 million, an 11% increase.

Only the top ten resolvers, ranked by Unicorn Power, have the eligibility to process Fusion volumes. By the end of Q2, 1inch Labs held a substantial 30.6% of the total network share, measured by Unicorn Power. Other prominent resolvers included Seawise, The T Resolver, Arctic Bastion, and OTEX, holding respective shares of 28.9%, 16.1%, 11.1%, and 6.9%. Laertes, the next in line, held a relatively smaller share at 4.3%.

Market Share Analysis

Quarter over quarter, the market share amongst aggregators remained largely stable. The "Other" group saw the largest gain of 5%, and 1inch experienced the most substantial loss of 6%. Nevertheless, 1inch maintained a significant lead over other aggregators, accounting for 49% of all direct-user volume share for aggregators in Q2.

Following behind 1inch, the next closest aggregator was ParaSwap, which accounted for 11% of all direct-user volume share. The “Others” category, which includes over 15 different aggregators, accounted for 15% of the direct-user volume share in Q2. The landscape of aggregators appears to be broadening, with a slight redistribution of market share this quarter.

Throughout Q2, the 1inch Aggregation Protocol maintained a significant share of total trade volume, accounting for 81% across both of 1inch's protocols. This represented a marginal decrease from the 83% dominance observed in Q1. The 1inch Limit Order Protocol witnessed its peak volume dominance on May 16. It contributed 32% of the total volume for that day, which can be explained by Lido stETH withdrawals going live on May 15. In contrast, May 27 marked its lowest volume day in Q2, with the Limit Order Protocol making up only 10% of the day's total volume.

Conceptually, the dominance of the Aggregation Protocol in trade volumes is logical. The Limit Order Protocol operates on the basis of price movements triggering a swap, while swaps on the Aggregation Protocol occur instantaneously, facilitating a larger volume of transactions.

In Q2, Ethereum maintained its leading role in the 1inch Network, accounting for 70% of the total aggregation volume across eight different measured chains. Arbitrum emerged as the second closest chain, contributing 12% to the total aggregation volume. Interestingly, this marks the second consecutive quarter where Arbitrum was the preferred choice for aggregation traders by volume. This achievement comes on the back of Arbitrum’s native token ARB airdrop in late March 2023.

However, a closer analysis of Ethereum's performance reveals a decline in its dominance. Ethereum, which accounted for 81% of the total aggregation volume in January, saw its share diminish to 71% by June. This trend suggests a migration of activity to more cost-effective networks as they mature and become more robust.

Overall, Q2 saw a decrease in aggregation volumes across all chains compared to Q1. While Ethereum experienced a notable drop of 42.5% in aggregation volumes, Arbitrum weathered the decrease with the smallest dip of just 0.3%. Conversely, Fantom saw the steepest decline, with its aggregation volumes plummeting by 53.3%.

Treasury and Staking Analysis

The second quarter saw the 1inch DAO treasury experience a decrease, ending Q2 with a 10.8% decline and settling at $16.3 million. This decline can be attributed to several factors, including the approval of 2 million USDC for 1IP 30 (aimed at completing the production of the 1inch Hardware Wallet) and 100,000 USDC approved for 1IP 31 (intended for the 1inch Community Builders Program).

Furthermore, the discontinuation of the swap surplus collection, previously the primary source of revenue for the 1inch DAO, contributed to this decrease. In response, the DAO is exploring alternative revenue avenues. One such initiative involves a deposit of 1 million USDC into AAVE V3, which would generate an estimated APR of 1-2%. Looking ahead, there are plans in motion to further explore how the Fusion mode could potentially generate additional revenues.

Throughout Q2, 1INCH V2 staking amassed an impressive 184 million 1INCH staked by the end of the quarter. This figure represented a substantial increase of over 20% from the previous quarter. The staking incentives that brought on this increase include the accumulation of Unicorn Power, which can then be used to vote on proposals in the 1inch DAO or delegated to a resolver to earn an APR. Incentives to delegate began at the end of January which contributed to the dramatic staking inflows in February.

However, May saw a small shift in this upward trajectory of 1.2 million. For the first time, the month registered more outflows than inflows for 1INCH V2 staking. This decline coincided with broader downturns in the overall crypto ecosystem, which witnessed an 11% decline in total crypto market capitalization by May 30 compared to its peak in April 2023. June saw staking inflows rise to 29.3 million.

When compared with the V1 staking contract, the V2 staking contract has attracted more staked 1INCH in absolute terms. Yet, when viewed as a percentage of circulating supply, the staking dynamics shift. The V1 staking contract reached a peak of 31.5% 1INCH staked in September 2021, whereas V2 staking is currently representing 19.8% of the circulating supply. It should also be noted that the circulating supply in September 2021 was 165 million compared to the 943 million today.

Qualitative Analysis

1inch DAO Treasury Updates

During June 2023, a significant amendment was passed, courtesy of 1IP 28. It effectively discontinued the collection of Swap Surplus, otherwise known as positive slippage. This resolution was favored by an overwhelming majority, with 96% voting in support. The driving factors behind this change were the inconsistencies associated with positive slippage, particularly during periods of high market volatility, as well as the observed negative impact it had on a subset of users. Consequently, users will now be the recipients of any positive slippage, a stark contrast to the previous mechanism. In the past, slippage was routed to the 1inch DAO treasury, which historically accumulated over $22 million from swap surpluses.

In light of this fundamental modification to the revenue streams of the 1inch DAO, the community began to explore different alternatives. Particular attention was given to the potential opportunities arising from the implementation of the Fusion mode, including how it could pave the way for other revenue sources as well as how to optimize the capital residing in the 1inch DAO treasury.

One viable alternative was brought forward in 1IP 27, which gained approval from the DAO with 62% of the votes. This proposal stipulated the allocation of 1 million USDC to Aave V3 on the Ethereum network, which, at the time of the proposal, promised to generate a passive yield of 1-2%. Another intriguing proposal, shared on the 1inch DAO forum, suggested deploying 1 million USDC to sdETH. This diversified staked ETH index encompasses popular Liquidity Staking Tokens such as rETH, wstETH, and SETH2, presenting a potential avenue for additional revenue.

Governance Updates

In Q2, governance of the 1inch Network underwent a series of changes, beginning with the passing of 1IP 26, Voting Parameter Adjustments, on April 11. This proposal, approved by a 96% majority of votes, enacted several shifts in the governance structure. These included the following changes:

- Removal of st1inch (V1) voting and delegation strategies, and the substitution of st1INCH (V2) voting and delegation strategy with Unicorn Power in lieu of token balance.

- The 20% weighted v1INCH strategy was replaced by a new strategy that mimics the power decay of Unicorn Power.

- The minimum voting weight required for Snapshot proposal creation was increased from 25,000 to 100,000.

On June 5, 1IP 29, i.e., the Recognized Delegates Program, passed with 82% of the vote, receiving $100,000 USDC over six months. The proposal creates a six month trial for a funded recognized delegates program. Essentially, this proposal aims to reduce the collective cost of governance while increasing efficiency. Recognized delegates are elected, paid positions for qualified 1inch DAO members who work closely with the team and contribute to the growth of 1inch. The requirements are as follows:

- A minimum of 500,000 in voting weight and a maximum of 250,000 in self delegation.

- Contribute to forum conversations for 3 months.

- Post a public link with an audio recording communicating their vision and values.

To learn more about this program, more details from the forum discussion can be found here. Later in the quarter, StableLap put forward 1IP 32, i.e., the StableLab x 1inch Grant Request. It requested $33,000 in USDC to produce a DAO constitution and related governance documentation. The proposal was officially canceled on June 29 after not reaching a quorum. Had it passed, $26,000 of the requested funds would have been allocated to the creation of a 1inch DAO constitution. This constitution aimed to clearly delineate the responsibilities between 1inch Labs and 1inch DAO. It would have also introduced accountability mechanisms to mitigate potential conflicts arising from decision-making within each entity. The residual $7,000 would have been devoted to overhauling the 1inch governance documentation, aimed at clarifying DAO governance practices for both new and existing members.

General Updates

During Q2, a flurry of exciting developments emerged for the 1inch Network. One key update involved the 1inch Hardware Wallet. After garnering an overwhelming 99% of votes in favor of 1IP 30 (1inch Hardware Wallet Production Completion), it secured $2 million in funding. The wallet is packed with distinctive features, including transparent signing, data decoding, payment requests, multi-seed wallets, a mobile app, and an easy backup system. This product has been under development since it received a $175,000 grant in 2022 to build a minimum viable product. With the recent grant, the product has advanced to the finalization stage. It can now utilize the funds to complete the product trade version, initiate manufacturing, and conduct vital technical and security audits.

At the end of Q1, the Solidity.io team made a proposal requesting $295,000 to create an open-source 1inch marketplace. However, the proposal did not pass, with 69% of the voters casting their vote against it. This outcome underlines the democratic process in DAO decision-making, where the community has a direct impact on the path of development and growth.

By contrast, 1IP 31 (the 1inch Community Builders Program) was passed on June 24, commanding an impressive 99% of the vote. This proposal allocated $100,000 USDC for a three-month trial of the 1inch Community Builders Program. It aims to boost brand awareness, create educational content, showcase talent, and drive user engagement with 1inch products by establishing local hubs and community interaction.

Lastly, another milestone was achieved on April 20, when 1inch was deployed on zkSync Era, a Layer-2 scaling solution for Ethereum that leverages zero-knowledge proofs. This move was welcomed by the 1inch community and should bring additional volumes to the 1inch Network’s products. ZkSync's Total Value Locked (TVL) exceeded $190 million with over 1 million unique deposits by the close of Q2.

Closing Summary

During the second quarter of 2023, the 1inch Network continued to grow user engagement while going through a number of changes. The number of daily users for both the Aggregation and Limit Order protocols grew significantly, demonstrating the platform’s growing reach within DeFi. Even though Ethereum continued to account for the majority of aggregation volume, there was a gradual shift to more cost-effective networks in Q2. The quarter also saw the network process a considerable $28 billion in volume. Governance changes, especially the discontinuation of swap surplus collection, led to the exploration of alternative revenue avenues. Taken together, these changes reflect the platform's responsiveness to evolving market conditions and user needs.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by 1inch Limited. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Ryan is a research analyst in the protocol reporting division with a focus on DeFi. He graduated from Clark University with his MBA and previously worked in Real Estate. Ryan's true passion has been in crypto and he now focuses on understanding DeFi protocol design, governance and tokenomics.

Read more

Research Reports

Read more

Research Reports

About the author

Ryan is a research analyst in the protocol reporting division with a focus on DeFi. He graduated from Clark University with his MBA and previously worked in Real Estate. Ryan's true passion has been in crypto and he now focuses on understanding DeFi protocol design, governance and tokenomics.