Key Insights

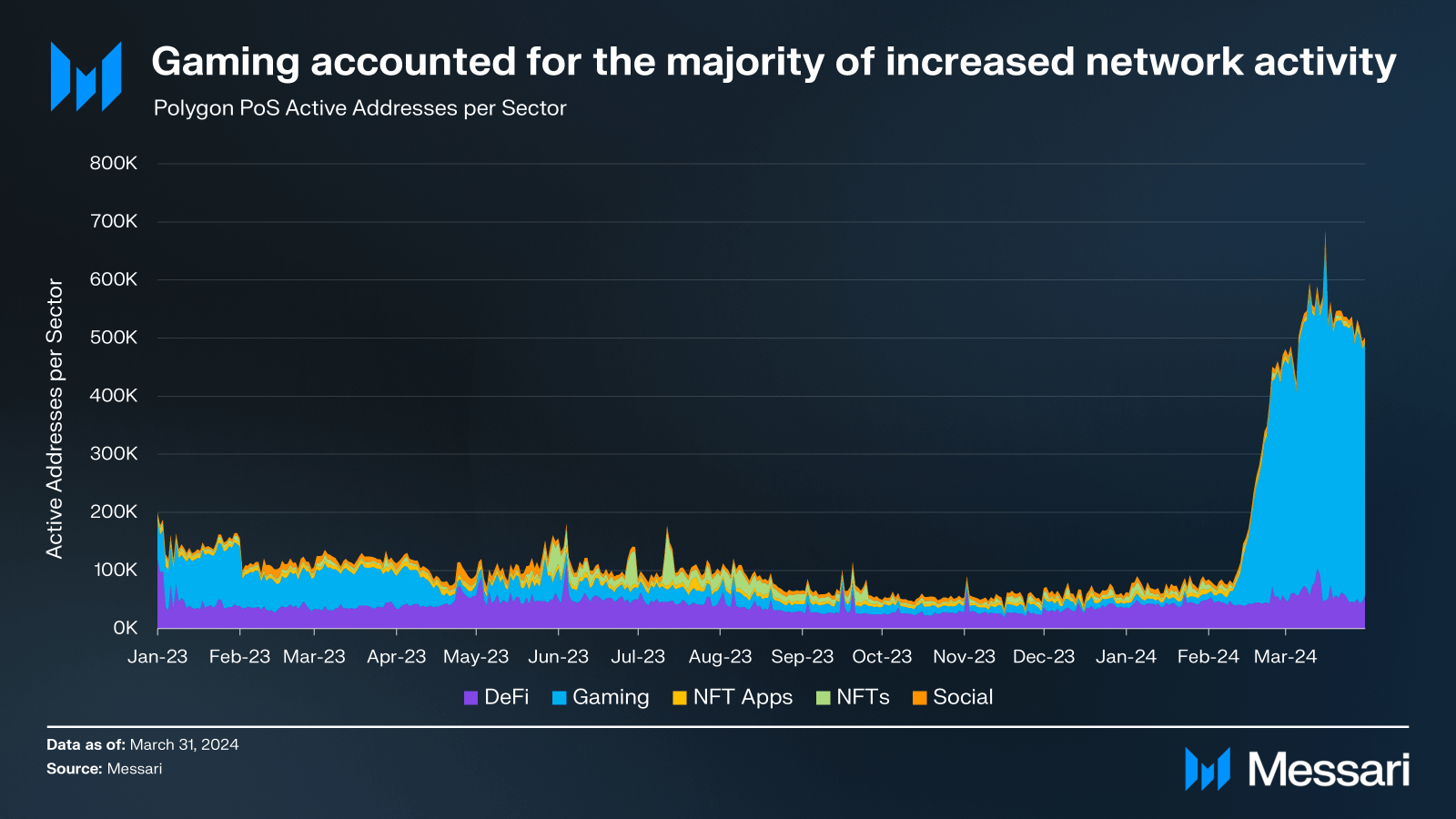

- Polygon gaming activity spiked in Q1 2024, with daily gaming addresses increasing by 1,615% QoQ to 207,000, and daily gaming transactions rising by 469% QoQ to 734,000. The increase in activity was primarily driven by MATR1X’s MATR1X FIRE game.

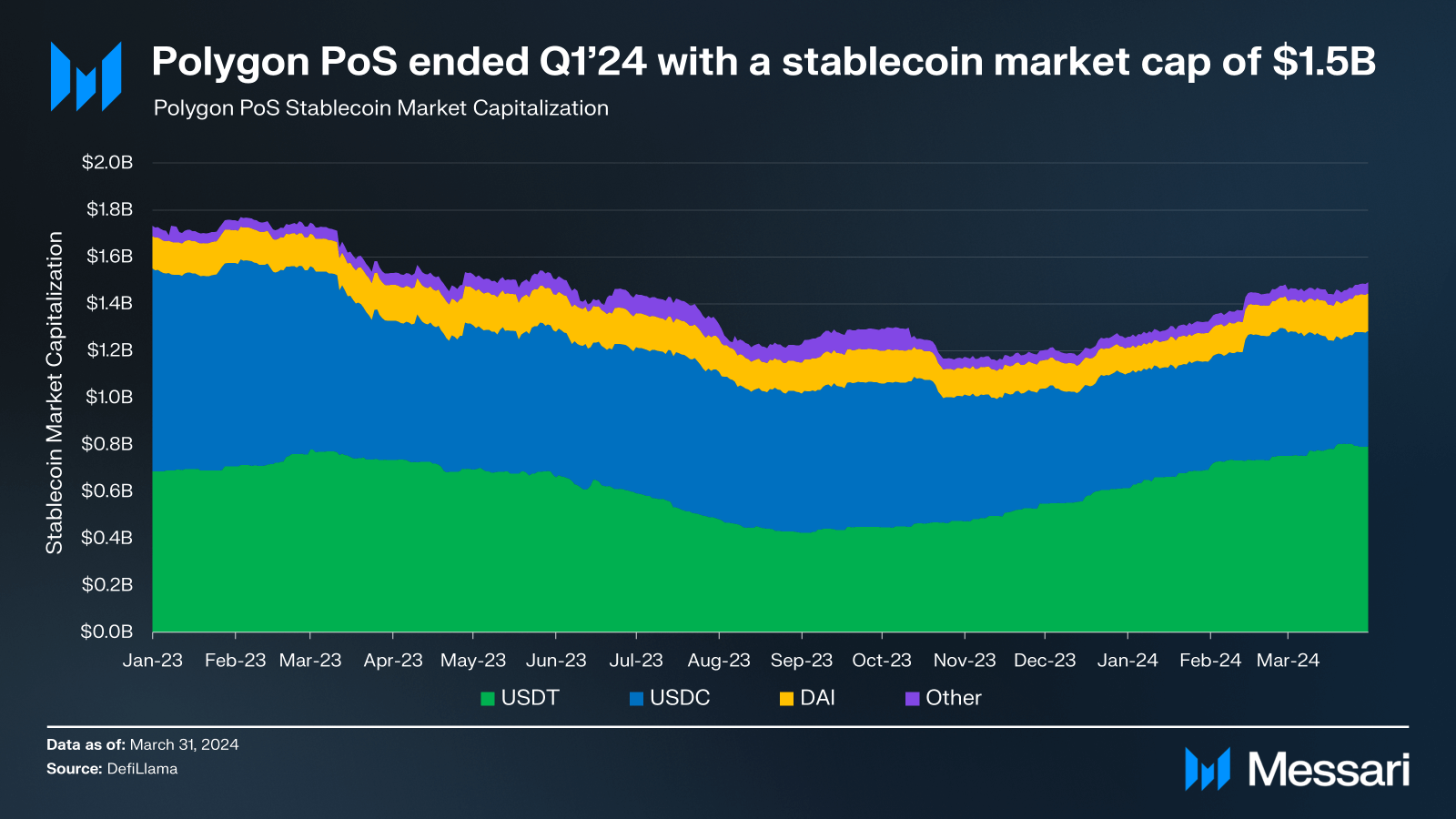

- Polygon’s stablecoin market cap increased to $1.5 billion, marking a 19% growth QoQ. USDT extended its position as the leading stablecoin, with its market cap growing by 29% QoQ to $792 million, representing 53% of the total stablecoin market cap.

- Polygon Labs introduced the AggLayer, designed to unify liquidity and state of any chain connected to the AggLayer. The AggLayer aggregates proofs of chain states to ensure cryptographic safety for cross-chain transactions and unified liquidity.

- Polygon Labs announced the development of a Type 1 ZKEVM prover. The Type 1 prover is Ethereum-equivalent, enabling any existing EVM chain to become a ZK chain and use existing EVM clients as-is.

- Astar launched Astar zkEVM on mainnet, built with the Polygon Chain Development Kit, and connected to the AggLayer. Astar is one of many Polygon CDK chains in development, including Immutable, Manta, OKX, Hypr Network, Moonveil, FlipKart, OEV Network, Libre, Arianee, and more.

Primer

Polygon Labs is a zero-knowledge (ZK) focused software company building and developing a network of aggregated blockchains via the AggLAyer, secured by Ethereum. As public infrastructure, the AggLayer will bring together user bases and liquidity for any connected chain, and leverage Ethereum as a settlement layer. Polygon Labs has also contributed to the core development of several widely-adopted scaling protocols and tools for launching blockchains, including Polygon Proof-of-Stake (PoS) network, Polygon zkEVM, and Polygon Miden. Polygon Chain Development Kit (CDK) is a collection of open source software components that makes it easy for developers to design and launch ZK powered L2s on Ethereum.

The core vision of an aggregated network is to enable shared state and unified liquidity through the integration of ZK technology, for a horizontally scalable web of chains that looks and feels more like the internet. As a part of the roadmap, the Polygon PoS network will be upgraded to a zkEVM Validium network that shares security with Ethereum. Community and core developer discussion remains ongoing about significant updates to protocol architecture, tokenomics, and governance.

In January 2024, Polygon Labs released information about the Aggregation Layer (AggLayer) which will be an aggregated blockchain network that unifies liquidity across all connected chains. The AggLayer, in conjunction with Polygon CDK, has been described as the future for Polygon.

Key Metrics

Polygon

Introduction

Polygon has undergone a number of significant evolutions. Kicking off a year of community participation and feedback, the most recent evolution came in a number of proposals in June 2023, called at the time Polygon 2.0. This is perhaps the most substantial shift in the evolution of Polygon, from a handful of disparte solutions to an aggregated blockchain network. This upgrade aims to address inherent scaling challenges in Web3 by synthesizing the two most significant approaches to blockchain design: modular and integrated designs. While modularity means new sovereign chains can be spun up and designed to any specification, often this results in fragmented liquidity and an underwhelming user experience. On the other hand, integrated chains will face scaling limits as more users pour into Web3. The thesis of Polygon’s aggregated approach is that a single chain does not have the capacity for a truly Web3-oriented internet; only an aggregated network will suffice.

AggLayer

In January 2024, Polygon Labs introduced the AggLayer, designed to unify the liquidity and state of ZK chains. The AggLayer will be a credibly neutral service that will aggregate proofs from all connected chains, verify chains states are consistent, and settle to Ethereum. Doing so allows for cross-chain coordination at low latency. It will be a simple, cryptographically enforced service which allows different chains, with different execution environments, to safely interoperate. Chains will be able to accept messages or bundles from other chains, and with an emerging coordination layer, can enable atomic cross-chain transactions.

Developers will be able to connect existing or newly spun up chains to the AggLayer. All chains "maintain full sovereignty," even as they tap a larger pool of liquidity, aggregated users, and protocols. For developers, this means focusing on use case and project design without having to worry about bootstrapping liquidity or users. The first chain, Astar zkEVM connected to the AggLayer in March, with more chains expected to connect and more components of the system released throughout the year.

Polygon CDK

In Q3 2023, Polygon Labs released the Polygon CDK. Polygon CDK is an open-source development framework for launching ZK L2 chains and transitioning existing EVM L1s to L2s. Polygon CDK's primary attributes focus on customizability, interoperability, and ZK tech.

Since going live, a number of teams have announced adoption of the CDK including: Immutable, Astar Network, Manta, OKX, Hypr Network, Moonveil, FlipKart, OEV Network, Libre, Arianee, Aavegotchi, Accentrik, CapX, Gameswift, Gnosis Pay, IDEX Nubank, Outerlife, Powerloom, and WireX.

In the fourth quarter, there were a number of notable CDK integrations and announcements including with Celestia, Hyper Oracle, and Gateway. Additionally, Polygon Labs and the NEAR Foundation entered into a collaboration to develop a ZK-prover specifically designed for WebAssembly blockchains; NEAR DA has also integrated with Polygon CDK. The zkWasm prover aims to bridge the gap between Wasm-based chains and the Ethereum ecosystem, including Polygon CDK chains.

In Q1 2024, Polygon Labs announced the development of a Type 1 upgrade as part of the next generation of ZK proving technology. The Type 1 enables any existing EVM chain to become a ZK Layer-2 chain and makes for a more ZK-friendly integration with Polygon's AggLayer. Type 1 can also prove Ethereum: Type 1 proved existing Ethereum blocks at an average cost of $0.002 to $0.003 per transaction. The Type 1 prover is open-source, dual-licensed under MIT and Apache 2.0.

Polygon Miden

Polygon Miden is an upcoming ZK L2 rollup utilizing the Rust-based Miden Virtual Machine (MVM) instead of the Ethereum Virtual Machine (EVM). Miden aims for high-throughput, private applications using ZK-proofs, emphasizing privacy as a core feature for scalability. Additionally, Polygon Labs introduced Polylang, a TypeScript-based language for Miden VM.

On September 29th, Polygon Labs shared details about the development of Miden and announced plans for a testnet. Leading up to this Miden testnet launch, Polygon Labs has published a series of blog posts explaining Polygon Miden’s components. In March 2024, Rize Labs announced its online poker game Aze would be leveraging Polygon Miden's actor-based model and zero-knowledge proofs to ensure decentralized trust and fairness. This approach addresses trust issues in online poker by verifying every game aspect—shuffles, hands, bets, and payouts—cryptographically, without compromising privacy or efficiency. Additionally, Keom is developing a decentralized order book exchange utilizing zk rails.

Napoli

Polygon PoS has undergone the Napoli upgrade to enhance performance and expand features, including support for RIP-7212, improved parallel execution, and new opcodes from Ethereum's Cancun upgrade. The Napoli upgrade brings significant technical advancements, such as better account abstraction and more efficient parallel transaction execution.

Additional Developments

Additional developments related to Polygon 2.0 and the broader Polygon ecosystem in Q1 2024 include:

- Polygon Labs launched a Mirror account.

- Avail announced that developers building rollups on Polygon can utilize Avail DA.

- P2 Ventures committed $50 million through Hadron FC to support startup founders in the Polygon ecosystem.

- Union's announced plans with the AggLayer brings IBC connectivity to the broader network.

- Polygon Labs announced the introduction of new Sepolia-anchored testnets named Amoy and Cardona, respectively. These testnets will replace the Goerli-anchored testnets.

- Polygon Labs introduced dApp Launchpad, a CLI tool enabling developers to efficiently design, build, and launch EVM-compatible dApps.

- Polygon partnered with HackenProof to initiate a bug bounty program.

Financial and Network Overview

Market Capitalization

Revenue

Supply

As part of the Polygon 2.0 upgrade, MATIC is being phased out in favor of POL. POL will enable holders to contribute to network security on various protocols in the Polygon ecosystem via a native re-staking protocol, earning rewards for diverse services. These services range from basic transaction validations to more advanced tasks like generating ZK-validity proofs. Each protocol in the Polygon ecosystem can offer customized roles and rewards for validators. Validators can choose to validate multiple chains at once to compound their rewards in a similar manner to EigenLayer’s restaking offering on Ethereum.

POL adopts an inflationary model with a yearly emission rate subject to community governance to incentivize validator participation and fund a community-governed treasury. On October 25, 2023, the POL contract was deployed on mainnet.

Usage

In comparison to other leading chains during the same period, NEAR's daily active addresses were 1.2 million, Arbitrum averaged 181,000 daily active addresses, and Solana saw 889,000 in Q1 2024.

Outside of gaming, DeFi Defi daily active addresses grew to 50,000, an increase of 67% QoQ. NFTs and Social also saw increased activity, although both were much smaller than gaming and DeFi.

Governance

Polygon Governance 2.0 introduces three main governance pillars for the Polygon ecosystem. Each pillar of governance will have its own unique governance framework, aiming to create scalable and efficient governance mechanisms.

- Protocol Governance: Facilitated by the Polygon Improvement Proposal (PIP) framework, providing a platform for proposing upgrades to Polygon protocols.

- System Smart Contracts Governance: Addresses upgrades of protocol components implemented as smart contracts. The Protocol Council, governed by the community, will be responsible for these upgrades.

- Community Treasury Governance: Establishes a self-sustainable ecosystem fund, the Community Treasury, to support public goods and ecosystem projects. The governance process involves two phases, starting with an independent Community Treasury Board and evolving into community-driven decision-making.

In the fourth quarter, PIP-29 proposed the introduction of the Polygon Protocol Council, which was adopted by the community. The council is responsible for conducting both regular and emergency upgrades to system smart contracts, specifically those components of Polygon protocols that are implemented as smart contracts on Ethereum. The Protocol Council consists of 13 publicly-named members.

In Q1 2024, the Polygon Community Treasury Board (CTB) and Governance Framework were announced, aiming to enhance the ecosystem through strategic capital allocation. This framework includes direct and Grant Allocator funding tracks, overseen by the CTB, which is responsible for funding decisions, application reviews, and post-cycle reporting.

Ecosystem Overview

DeFi

In Q1 2024, Aave continued to lead as the dominant protocol by TVL on Polygon PoS, with its TVL rising to $705 million, marking a 35% increase from the previous quarter. Uniswap jumped to the second position, with its TVL reaching $130 million, up 41% QoQ. Quickswap followed with a TVL of $112 million, reflecting a 5% increase. Additionally, Sushiswap showed the highest percentage increase among leading protocols, with its TVL growing to $102 million, a 69% rise QoQ.

Circle announced native USDC on Polygon PoS in October, with the migration to native USDC occurring in March. This shift enhances user experience and capital efficiency by allowing direct minting and redeeming. It also streamlines transactions and improves liquidity by transitioning from bridged USDC.e to native USDC.

Circle announced native USDC on Polygon PoS in October 2023, and in March 2024 the migration to native USDC from USDC.e began.

NFTs

The DraftKings Reignmaker NFT collection continued to be the leading collection by transaction volume. The Polygon Origin pass by the NFT Marketplace aggregator Dew saw the highest levels by sales volume. This pass was a free mint that gives holders Dew & Dew Studio IP-related utility with NFT airdrops, token airdrops, launchpad WLs, and more as the ecosystem develops. Polygon Mini Girl and Polygon Gas Hero were the next leading collections.

Notable NFT-ecosystem developments included:

- Last June, Warner Music Group and Polygon Labs announced the launch of a music accelerator program, designed to co-support promising developers who are building the future of the music industry on Polygon protocols. In January, the list of teams participating were revealed.

- Digital fashion designer Stephy Fung launched her debut SYKY Collective collection 'Four Dragons' at NFT Paris.

- Starbucks Odyssey shut down.

- Social media platform Lens transitioned to a permissionless phase where anyone can mint an on-chain profile and join the platform. Lens has over 350,000 protocols created.

Gaming

The increase in activity was primarily driven by MATR1X’s MATR1X FIRE game. This mobile shooting game blends traditional gaming with blockchain technology, enabling players to earn through gameplay. It features a cyberpunk aesthetic and provides a dynamic battle experience with various firearms and tactical gameplay elements.

Further supporting the gaming ecosystem, Immutable, in collaboration with King River Capital and Polygon Labs, launched the $100 million Inevitable Games Fund, focused on the Web3 gaming ecosystem. Additionally, Square Enix partnered with Animoca Brands to expand its NFT game, Symbiogenesis, globally.

Institutional

Polygon has consistently been among the most institutional friendly networks, evidenced by its historical partnerships. In Q1 2024, Polygon had more institution-related announcements including:

- Libre announced the launch of a dedicated chain powered by Polygon CDK, tailored for institutional Web3 infrastructure for alternative investments. This initiative allows regulated entities to issue tokenized assets, with Brevan Howard and Hamilton Lane as the inaugural partners.

- Fox Corporation unveiled Verify, an open-source protocol on Polygon PoS, aimed at enabling publishers to register and authenticate the origin of media content, particularly in combating the proliferation of AI-generated media.

- Polygon Labs became a member of the Tokenized Asset Coalition (TAC), an initiative focused on leveraging public blockchains, asset tokenization, and institutional DeFi to transform capital formation and management onchain.

- Ernst & Young (EY) launched an enterprise contract management service utilizing Polygon PoS to facilitate secure, private contracts on a public blockchain using zero-knowledge proofs.

zkEVM

Polygon zkEVM had multiple upgrades and announcements in the first quarter of 2024 including:

- On January 29, 2024, the Etrog upgrade went live on mainnet, introducing support for five additional pre-compiled smart contracts, transitioning Polygon zkEVM into a Type 2 ZK-EVM, aiming to be an EVM-equivalent ZK rollup.

- On March 14, 2024, the Elderberry upgrade went live on mainnet, introducing important optimizations to the ROM to reduce certain out of counter errors on the network and additional fixes.

- Tellor launched on Polygon zkEVM.

- SettleMint integrated its Blockchain Transformation Platform with Polygon zkEVM, simplifying the app development process on Polygon's zkEVM

Of note, the Polygon zkEVM underwent a 24-hour outage caused by a sequencer fault in late March.

Closing Summary

Polygon's evolution into an aggregated blockchain network has marked a significant milestone in its journey to address crypto’s scaling challenges. The introduction of the AggLayer in January 2024 is a pivotal development, unifying liquidity and states across connected ZK chains while ensuring secure and efficient cross-chain transactions. The recent Napoli upgrade enhanced Polygon PoS with improved parallel execution, account abstraction, and new opcodes from Ethereum's Cancun upgrade. Polygon Miden, an upcoming ZK L2 rollup utilizing the Rust-based Miden Virtual Machine, aims for high-throughput, privacy-preserving applications.

Key metrics underscore Polygon POS’s growth: daily gaming addresses increased by 1,615% QoQ to 207,000, driven by the popularity of MATR1X’s MATR1X FIRE game, while daily gaming transactions rose by 469% QoQ to 734,000. Additionally, Polygon's stablecoin market cap increased to $1.5 billion, marking a 19% growth QoQ, with USDT leading the stablecoin market cap at $792 million.

As Polygon continues to innovate and integrate new technologies, its vision of an aggregated network remains steadfast. This vision promises a future where diverse chains interoperate seamlessly, leveraging shared liquidity and state, ultimately creating a horizontally scalable web of chains.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Matic Network (BVI) Ltd. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Nick is a research analyst at Messari on the Protocol Services team. Prior to joining Messari, Nick worked in Deloitte's Consulting practice.

Read more

Research Reports

Read more

Research Reports

About the author

Nick is a research analyst at Messari on the Protocol Services team. Prior to joining Messari, Nick worked in Deloitte's Consulting practice.