Polygon: A Multi-Sided Approach to ZK Scaling

Mar 23, 2022 ⋅ 26 min read

Key Insights:

- Polygon is an internet of blockchains company focused on scaling Ethereum through a portfolio of ZK technologies.

- The company is actively developing seven scaling solutions ranging from various ZK Rollups to side chains to engineering infrastructure such as software development kits (SDKs).

- Polygon will benefit significantly from its 7,000+ dapp ecosystem across DeFi, metaverse, NFTs, and gaming as its ZK based scaling solutions come online in 2022.

- Polygon’s corporate development strategy includes leveraging partnerships with venture funds, managing its own NFT/gaming ecosystem, and operating an internal investment fund tasked with finding promising crypto projects.

- Upcoming milestones for Polygon include more business partnerships with existing protocols and a redesign of the MATIC token to better fit the company’s future initiatives.

- Polygon’s global Web3 ecosystem benefits significantly from the burgeoning Web3 technology talent in India. Polygon offers developer training, partnerships with premier universities like IITs, and hackathons to grow the developer talent base and incubate high-quality Web3 startups in India and abroad.

Crypto made big strides these last two years. In the summer of 2020, DeFi primitives gained prominence in what became known as “DeFi Summer.” The following year, NFTs became popular – first as profile pictures, then as community tokens, and now with revenue-generating use cases such as music and gaming, among others.

Naturally, the growing interest behind blockchain corresponded with a surge in users. Total value locked (TVL) on smart contract networks rose from $500 million since the start of the pandemic to $170 billion two years later. Even more, with further interest in the metaverse, ownership of assets, and banking the unbanked, crypto’s growth is only expected to continue.

Though investors all benefit from crypto’s maturation, the expansion of the industry hasn’t come without growing pain. Quite infamously, the current blockchain infrastructure struggles to support the rise in users. Transaction throughput has slowed, and network fees have spiked. Ethereum in particular struggles to handle the transaction load submitted to its blockchain. According to Etherscan, average gas costs jumped from 10 gwei in March 2020 to 60 gwei two years later – without accounting for stretches in 2021 when gas consistently hovered around 150 or even 200 gwei, highlighting the need for improved infrastructure.

Thus, an emerging consensus we’re seeing amongst investors is the need for a cross-chain ecosystem. In other words, one monolithic blockchain may not be enough to support everything users need. By distributing the work across multiple entities, the total work required from one singular blockchain would diminish. If investors are right, building a cross-chain world is the way to achieve the type of scale needed to onboard the first billion users.

This report will highlight a major component of Ethereum’s cross-chain scaling effort: Polygon Technology. Key sections of this report include an overview of the company, a short introduction to ZK Rollups, Polygon’s ecosystem of projects, and the company’s upcoming roadmap.

A Multichain Ethereum World

Polygon Technology, widely known just as Polygon, is building a collection of platforms for blockchain infrastructure – specifically, for the Ethereum ecosystem. Its products are designed to support the growth of Ethereum as the network ramps up its user and application base. It’s worth noting, Polygon’s particular focus on Ethereum reflects the company’s core belief in the network as the center of the future cross-chain paradigm.

From a bigger picture, Polygon competes in what we should call the blockchain-as-a-service industry. Alongside competitors like Starkware, Arbitrum, Loopring, and Matter Labs, these startups create solutions designed to enhance blockchain scalability through increased network throughput and reduced transaction costs.

At present, blockchain scaling lacks a one-size-fit-all answer, meaning each startup’s solution – be it Optimistic rollups, Zero Knowledge rollups (ZK Rollups), or some other alternative – has a place in the current ecosystem. This sort of competitive research effort is what Mihailo Bjelic, co-founder of Polygon, has referred to in the past as “letting one thousand flowers bloom.”

Polygon started in 2018 as a joint effort between Bjelic – who was experimenting with Plasma rollups – and Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun, the three of whom had been working on another scaling blockchain, Matic Network. At that time, the joint entity combined with a few products under its belt: (1) The blockchain SDK development framework developed by Bjelic and (2) the Plasma rollup and Matic sidechain, powered by the MATIC token. Unfortunately, blockchain researchers discovered the data availability problem shortly thereafter (discussed further in the report), leading to Plasma being deprecated for other solutions. The resulting period of time left the team focused on the Matic sidechain, the SDK framework (later renamed to Edge), and in search of next steps.

Around February 2021, the team announced the rebrand from Matic Network to its current Polygon name and announced its strategy to become a cross-chain Hub for Ethereum. Its new goal would be to function as a company for a host of multichain services. Offering an emerging suite of products would become the new focus for the company, starting with the user-facing product that had survived since the beginning: Matic Network, now rebranded to Polygon Proof-of-Stake (PoS).

PoS Sidechain: The First Product

Users may already be familiar with Polygon PoS. The sidechain has been around for close to two years. It launched just before DeFi Summer and took full advantage of the opportunity in May 2021 when curiosity around decentralized apps exploded.

Much has been made about Polygon PoS’s technical classification given the company’s efforts around Layer-2 scaling. We think it’s an important distinction to qualify that the current iteration of the PoS Chain is a Layer-1 sidechain, largely attributing to the network not inheriting security from Ethereum nodes and having its own set of validators. Regardless, for users seeking affordable transaction costs, this EVM-compatible network is an option worth exploring; in fact, many of Ethereum's most popular DeFi platforms such as Aave, Curve, and Uniswap provide their services on the PoS Chain at a fraction of the gas cost required by Ethereum.

The chart above highlights the difference in average transaction costs between Polygon PoS and Ethereum. The data presented is striking. Average costs are only fractions of a dollar on Polygon PoS whereas users are frequently paying $20 or more on Ethereum. If we assume every transaction completed on PoS Chain in the past year was instead made on Ethereum, users would have paid almost $15 billion more in total transaction costs.

Now, it’s important to know this data is skewed by the lower price of MATIC relative to ETH. If the costs presented are adjusted to USD, the absolute cost on PoS Chain is lower than on Ethereum, but measured in gas prices, differences are not stark. Nonetheless, PoS Chain still represents a great option for users wanting to avoid the costs of Ethereum today. And it is a big reason why the sidechain processes more daily transactions than Ethereum – including hitting a peak 4x more than Ethereum – and has attracted 100+ million wallets to date.

Reaching these numbers is a milestone in itself, but one could argue it’s just an appetizer for Polygon’s larger aspirations. As we saw above, sidechains don’t level up blockchain scaling as well as Layer-2 solutions like rollups. That’s why Polygon is devoting its resources to Layer-2 scaling and ZK Rollups – to find solutions to improve throughput and reduce the amount of gas needed to make transactions. The thesis strikes a chord across the industry as leading tech and crypto-native investors alike have chosen to grab a seat at the table. In fact, notable names such as Sequoia Capital India, Andreeson Horowitz, Tiger Global, Union Square Ventures, Galaxy Digital, and others have backed the company, signaling faith in the team and alignment with the company’s vision.

Polygon’s roadmap includes the development of the company’s seven product solutions, ranging from the aforementioned PoS sidechain, to L2 Rollups, and to other blockchain infrastructure. In total, Polygon is committing more than $1 billion to acquire promising projects, invest in research, and create an Ethereum scaling ecosystem. Since a significant part of Polygon’s future incorporates ZK technology, it’s important to first understand how it works before getting to the rest of the report.

Primer to Zero-Knowledge Rollups

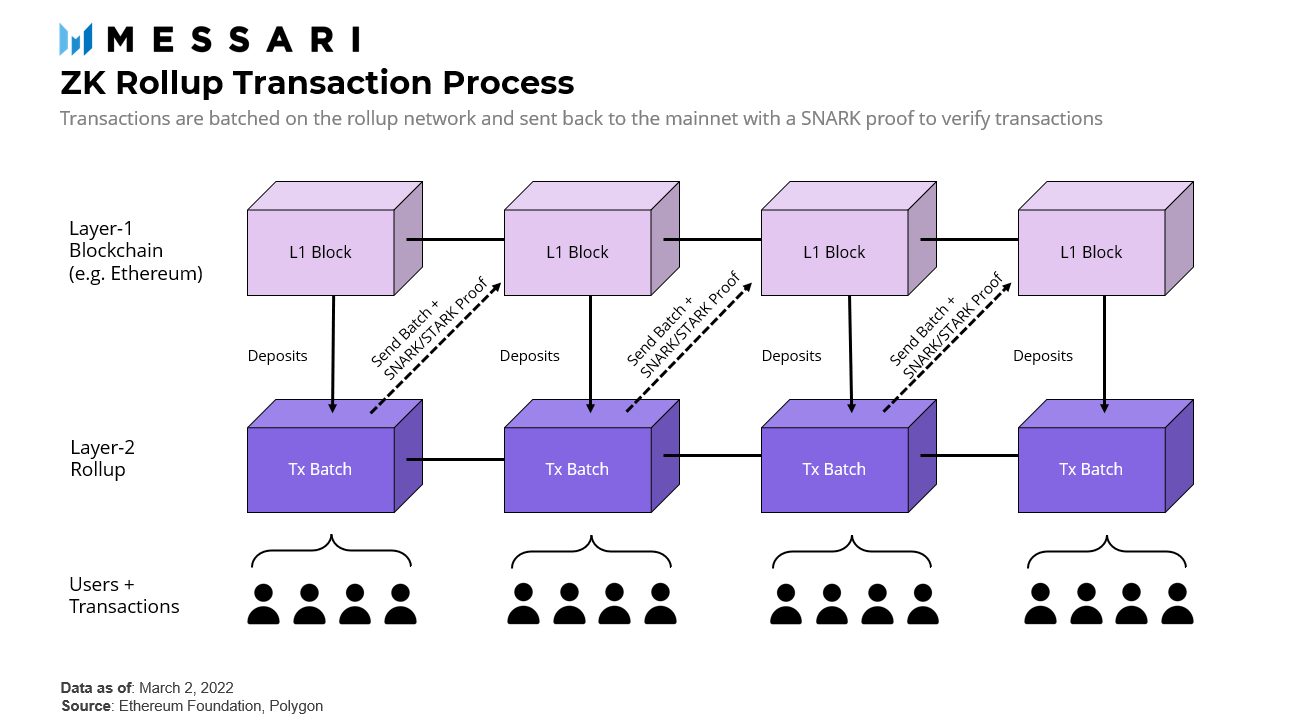

ZK Rollups are one of the two general categories of Layer-2 rollups, alongside their peer, Optimistic rollups. At its core, the idea of ZK Rollups relies on cryptographic proofs to verify changes to the network state before they are bundled into the Ethereum blockchain. As a result, some call ZK Rollups ‘validity proofs’. This stands in contrast to Optimistic rollups, which “optimistically” assume all transactions are correct and let verifiers on the mainnet check for fraudulent transactions over some course of time. Optimistic rollups are also referred to as ‘fraud proofs’.

Let’s get a little deeper behind ZK Rollups and see why they’re promising. The basic premise behind ZK Rollups is to have third-party operators batch transactions together instead of verifying each individually – hence the “rolling up” taxonomy – to increase the total processing capacity of the network. State changes to the blockchain are submitted in the form of ZK Proofs for the verifier on the mainnet to check. The verifier can be convinced of the validity of all the submitted transactions through the proof without – due to the zero knowledge feature – having to run each individual transaction.

An important part of this process is the soundness property of proofs, which ensures malicious provers are unable to deceive verifiers with false statements. Extrapolating this property for rollups is simple: all batched transactions must be valid if they are to be accepted onto the blockchain. And since zero knowledge of each transaction is required by the mainnet for validation, little interaction between the two chains is needed, making gas fees cheaper and the overall rollup scaling easier.

Another core advantage of ZK Rollups is the network’s ability to validate transactions immediately. Automatic verification leads to numerous benefits for the user. The simplest is the ability to move capital from the rollup chain to the mainnet right away, without needing to wait for others to check for fraudulent data, as is the case when using Optimistic rollups.

The technology behind ZK Rollups is promising, but for total fairness, it’s also worth mentioning that ZK Rollups have, to this point, not lived up to expectations. This is an important caveat based on the fact no ZK Rollup to date has launched with full EVM-compatibility on Ethereum’s mainnet. That’s why almost all active rollups to date use fraud proofs. However, several research initiatives are close, with a few operating on testnet in H1 2022, including those owned by Polygon. At the risk of sounding like a broken record, it does seem like the much-awaited day is close.

Polygon’s Product Stack

Polygon’s suite of products includes the aforementioned PoS sidechain and six ZK-supported projects. Out of those six, three of them (Hermez, Miden, and Zero) are direct ZK Rollups, another (Nightfall) is a privacy-enabling Optimistic rollup with ZK cryptography, while the remaining two (Avail and Edge) are designed to help build ZK and modular infrastructure. The graphic below lists the full product suite and classifies each in relation to shared Ethereum security. Low security products are akin to standalone chains with independent validators while high shared security products are full Layer-2 rollups entirely dependent on Ethereum. In the next section, we will run through each of the products, starting with the four ZK Rollups.

Hermez: Decentralized and Active

In August 2021, Polygon announced it acquired Hermez for $250 million in one of the largest blockchain network M&A deals to date. The transaction was financed through Polygon’s native MATIC tokens from the company’s token treasury. Previous holders of Hermez’s native token (HEZ) were able to redeem their tokens for MATIC at a rate of 3.5 MATIC tokens to 1 HEZ token. The outcome of the acquisition meant Polygon was in charge of the new resulting entity, Polygon Hermez.

Of the four ZK Rollups in Polygon’s suite, Polygon Hermez is the furthest along in use. It’s the first open-source decentralized ZK Rollup to operate on top of Ethereum’s mainnet – albeit without ZK EVM compatibility – and has been available to the public since March 2021. Users deploy funds to the rollup network where they can be quickly and cheaply sent between wallets as transfers and payments. Polygon Hermez is able to process up to 2,000 transactions per second, a number that’s expected to rise even higher as Ethereum implements sharding sometime in 2023 after The Merge. Regardless, the end result today is still a more than 90% reduction in transaction costs compared to typical mainnet gas fees.

Source: Polygon Hermez

As with each of Polygon’s other ZK Rollup products, Hermez has its own research focus. Hermez places a high emphasis on decentralization. It is the only active Layer-2 without a need for a centralized operator. While the use of decentralized sequencers seems trivial, particularly in the early innings of ZK Rollups, the long-term effects could be significant. As cited by the Polygon team, a switch from centralized to decentralized operators may be operationally and technologically challenging down the road, giving Polygon Hermez a head start relative to its competition.

What lies ahead for Polygon Hermez is the launch of Polygon Hermez 2.0, a future iteration combining the existing ZK Rollup with an implementation of a ZK EVM. The need for the latter is crucial for scaling Ethereum as non-ZK EVM rollups can only handle token payments and token transfers. A ZK EVM-enabled blockchain will allow the network to handle smart contracts directly on the rollup and open up another avenue of innovation. The final product is expected to closely emulate the 50 - 70 instruction codes available on the original EVM. This decision to stick with similar machine language opcodes allows engineers to port existing applications to the rollup or easily create new ones if needed.

A testnet release is expected sometime in the next three months (Q2 2022). Once testing is over, a full launch of Polygon Hermez 2.0 is anticipated to arrive sometime the following quarter. Should that timeline hold, ZK Rollup enthusiasts will get the opportunity to see this scaling option take shape.

Zero: Need for Speed

Polygon Zero began as Mir Protocol, a project for decentralized applications powered by recursive ZK Proofs. In December 2021, Polygon announced an acquihire of the Mir Protocol team, seeking to combine synergies between the Mir project and the rest of Polygon’s tech stack. The deal was even larger than the Hermez one. It was announced at around $400mm and financed through a combination of cash and Polygon’s MATIC token.

As part of the Polygon ecosystem, the Mir team’s goal remains the same: to build the world’s fastest ZK Rollup. Unlike Polygon Hermez – which devotes the majority of research resources towards decentralization – Polygon Zero’s target is speed. The optimal solution discovered so far is through scalable ZK-SNARKs, otherwise known as recursive proofs.

Recursive ZK Proofs speed things up by increasing the number of transactions that can be processed at any one time. We can do a comparison here: Existing ZK Rollups often take significant computing resources to generate a proof for batches with a large number of transactions; this is true for ZK Rollups that need to support general-use applications and even more true for those that are slowed down by a need for EVM-compatibility. In contrast, efficient recursive ZK Proofs allow for the distribution of processing into more manageable, concurrent chunks of work. Once each transaction has been verified, a recursive algorithm goes through and aggregates all the proofs until they eventually settle into one proof. The best way to imagine this is using a pyramid shape where the base layer represents all the transactions. As each transaction gets proved, it gets sent upwards until they all culminate at the top. The final proof can be sent to the mainnet at a quicker and more cost-effective rate than current alternatives.

Polygon Zero is able to do this through Plonky2, a recursive ZK Proof generator capable of generating a SNARK proof every 0.17 seconds, making Plonky2 the world’s fastest recursive ZK prover.

Inventing this technology has taken years of research. Practical applications behind recursive ZK Proofs only started in 2014. In 2019, two minutes were needed to generate each recursive proof. The slow proof generation clearly rendered the technology useless for blockchain scaling. In 2020, the development of Plonky, combined with a few other techniques, reduced that time to 15 seconds. Plonky2 brought the time down even further to 170 milliseconds, making it the world’s fastest recursive ZK prover.

That said, further research is needed before Plonky2 goes live. Timelines are yet to be announced, but further information will be provided by the Polygon team as additional prover breakthroughs occur.

Miden: STARKs not SNARKs

The next ZK Rollup in Polygon’s arsenal is Miden. Unlike most ZK Rollups, which use ZK-SNARKs, Miden utilizes another proof called ZK-STARKs. STARK stands for “scalable transparent argument of knowledge” while SNARK stands for “succinct non-interactive argument of knowledge.” It should not be surprising then to learn SNARKs and STARKs share similarities given how closely their names align. At their core, they both function as a privacy and scaling technology, providing applications with the ability to verify proofs at a more secure, faster rate.

Where they differ is in the details. STARKs traditionally do not require an initial setup process between the prover and validator, though some modern SNARKs have found ways to remove this process as well. What SNARK hasn’t matched is the ability to respond to the threat of quantum computing: SNARKs are vulnerable to quantum computing whereas the leaner cryptographic functions used by STARKs are provably post-quantum secure.

The tradeoff for using STARKS is the need for a larger proof, resulting in higher gas costs and lack of recursion. Implementing the latter may be possible but it is unproven for the time being. Additional research of both SNARKs and STARKs will continue to open new doors for Layer-2 proofs.

As the graphic below shows, the transaction rollup procedure is similar to the traditional ZK Rollup with the usual SNARKs replaced with STARKs.

Source: Polygon Miden

Miden’s advantage lies in the creation of Miden VM, a ZK-STARK compatible with EVM. Miden VM is a general-purpose ZK Virtual Machine, which lets developers utilize the full Turing completeness capability of the platform. In addition, multi-language support is offered for developers. These languages, including Solidity, Move, and Vyper, are compiled into Miden Assembly Language to be read by the VM.

Miden VM’s evolution began in 2019 as a library called genSTARK, which allowed developers to create simple STARK provers. Continued improvements, such as full Turing completeness, took shape with Distaff VM (early generation STARK-based VM) and Winterfell (upgraded iteration of genSTARK). The current iteration of Miden VM, a public v0.1 prototype, combines features from both Distaff VM and Winterfell and was launched in November 2021. Developers interested in building with the new virtual machine are able to experiment with the product’s features. A v0.2 prototype is anticipated to be released in Q2 2022. Testnet development should take the project through the end of the year, after which a mainnet deployment is expected to occur sometime in 2023.

Nightfall: Privacy for Enterprises

As mentioned in the ZK Rollup introduction, ZK Rollups do not, by default, offer privacy from prying eyes. That’s where Polygon Nightfall comes in. Nightfall is an Optimistic rollup enhanced by the privacy benefits of ZK cryptography. Here, the type of ZK cryptography used in Nightfall differs slightly from generic ZK Rollups; the former is used to foster data privacy while the latter is used for transaction verification. The idea behind the pairing of ZK cryptography with a fraud proof rollup originated from the need to service enterprises with a differentiated product, one that kept the privacy elements of ZK cryptography while maintaining low transaction costs.

Nightfall was originally created in 2019 by EY, the Big 4 professional services firm, as a way to conduct private transactions on Ethereum. This was a big milestone as it marked the first time a large enterprise got actively involved with Ethereum’s development. As demand for privacy-secure blockchains increased in the years since, EY began to look for partners to help scale the offering. What occurred as a result became Polygon Nightfall, a collaboration between EY and Polygon to create a public-facing privacy-focused rollup, making it an ideal option for enterprises.

Corporate transactions and operational tools benefit the most from this type of privacy feature. Nightfall will also be legally and KYC-compliant. The goal of the partnership is to create a whitelist of companies who can access the network; when a business makes a transaction, a proof will need to be provided confirming access before the privacy-secure transaction gets completed.

EY’s corporate clients can already connect to Polygon Nightfall through an EY front-end portal. Nightfall is currently exploring further ways to scale the product. No specific timelines have been set for the roadmap, but both EY and Polygon have aspirations to continue their partnership for other enterprise-specific blockchains.

Avail: Data Availability for Ethereum

Polygon Avail is the first of Polygon’s two architectural products. Avail seeks to address the challenges nodes face when processing malicious or incomplete data. In the blockchain world, these challenges are referred to as the data availability problem, which was the problem mentioned above that caused researchers to sunset Plasma rollup initiatives. Common situations where this problem occurs include when nodes accept blocks where data is incomplete or when nodes are unable to validate the accuracy of transaction data in the network (i.e., blockchain censorship).

Polygon describes Avail as the solution to this problem across the multi-chain Ethereum ecosystem. Avail is a data availability-specific blockchain designed for standalone chains, sidechains, and other scaling technologies – meaning the entirety of the Avail chain is purposed to store Ethereum ‘calldata’ tracking changes to the Ethereum state machine. No smart contracts are intended to be deployed on Avail, and no applications can be built on Avail either. Rather, the entire purpose of Avail’s existence is to sequence and store data in order to ensure data remains accessible by a sampling process conducted by light client nodes.

Source: Polygon Avail

Compared to current blockchain architecture, the Avail network will focus on ensuring full transaction data is posted rather than verifying state changes. Unlike full nodes, light nodes do not download the entire block data but instead prioritize sampling a random group of data from each block to evaluate for completeness. This process is known as a data availability check. It’s a technique shared by other data availability platforms and can be completed at a constant resource cost, regardless of data scale.

In its final form, Polygon envisions a scenario where developers might create their own standalone PoS chain and outsource network security to Avail. Operators on the standalone chain would send the transactions to Avail for ordering and storage. This helps immediately bootstrap network security since complete transaction data is held off-chain for easy access.

Avail currently remains in development with no key roadmap dates yet announced by the Polygon team.

Edge: Made With Developers in Mind

Previously known as Polygon SDK, Polygon Edge is an open-source modular blockchain development framework built for engineers who want to create their own blockchains. The framework allows for the creation of both secured chains (Layer-2 blockchains) and standalone Ethereum sidechains.

Both options have their respective advantages. Secured chains offer two unique features: easy bootstrapping for those with limited resources and enhanced security on a layer separate from the mainnet. New crypto protocols without the resources to bootstrap security or enterprises looking to enhance transaction throughput on their own network may want to utilize the Edge framework to build secured chains. Meanwhile, sidechains require their own validator set, making it a good fit for enterprises looking to maximize independence or for community-based networks capable of supporting their own decentralized blockchain.

Source: Polygon Edge

The diagram above represents the various components of the development framework. Each component, including known modules such as blockchains and consensus, and more obscure modules, such as Libp2p, GPRC, and JSON RPC, represents functions within the technical architecture. Developers are able to modify these modules to suit their needs, combining them like building blocks to make up the network. Polygon Edge supports both Proof-of-Stake and Proof-of-Authority as consensus algorithms.

Rollout of Edge for the standalone chain framework began in May 2021. The second iteration of the framework for secured chains is expected to follow shortly. Aligning closely with Polygon’s thesis of a more advanced multi-chain Ethereum ecosystem, products such as Polygon Edge help solve a pressing need regarding L2 communication and ease of project deployment.

Polygon Corporate Funds

As mentioned prior, the company also actively encourages protocols to use Polygon-enabled networks. Direct mandates include investing in founder teams, providing support for project token economics, staking, governance, and leveraging the Polygon network for marketing initiatives.

Ecosystem Partnerships

One strategic endeavor is to partner with active venture investors within the crypto community. Polygon maintains relationships with four organizations, though the company does not have the decision-making authority to invest capital.

- Polygon x Wintermute: Partnership with a $20 million fund to support project liquidity, business development, and token exchange listing purposes

- Polygon x 776: Collaboration with a $200 million general-purpose fund investing in Web3 and other crypto-native applications

- Polygon x Outlier Ventures: Polygon-based accelerator designed to foster mentorship and collaboration with the venture team at Outlier Ventures

- Polygon x StableNode: Partnership with a blockchain node management operator experienced in providing hands-on services such as staking, governance, and more

Polygon Ecosystem Fund

The company’s final corporate development team is its Ecosystem Fund. Unlike the partnerships mentioned above, the Ecosystem Fund is Polygon’s own internal investment fund. Capital allocation decisions are strategically designed to boost the adoption of Polygon’s blockchains.

The $100 million Ecosystem Fund manages all of Polygon’s corporate investments. This includes joint investments with the Polygon Studios team below. So far, $15 million from the fund has been deployed across 50 global projects. The team is still actively searching for investment opportunities.

Polygon Studios

In summer 2021, Polygon launched Polygon Studios, its internal unit aimed at drawing existing gamers toward blockchain games. Polygon Studios collaborates with ambitious NFT projects and marketplaces to scale user bases across a low-cost platform.

More than 100,000 gamers and over 500 apps are already onboarded. The team has announced partnerships with both crypto-native projects such as The Sandbox, Decentraland, and OpenSea, along with traditional entertainment brands such as DraftKings, Electronic Arts, and Atari. Capital from the Ecosystem Fund will also be used to make investments in projects beneficial to the company’s NFT/gaming initiatives.

Tasked with heading Polygon Studios is Ryan Wyatt, who left his previous role at Google where he served as both the Head of Gaming Partnerships at Google and Head of Gaming at YouTube. Wyatt started his career in professional esports as a gaming commentator, making him uniquely qualified to lead the Polygon Studios effort.

Leadership within the Community

Aside from its prominent reputation in the global crypto community, it’s important to also focus on Polygon’s role in the crypto community in India. The company’s status as an Indian-based startup unicorn has helped validate the industry in the eyes of skeptics and encouraged more of the nation’s youth to experiment with crypto. This form of leadership by example has been particularly beneficial to the country’s burgeoning ecosystem given the Indian government’s hot-cold relationship with the industry.

Polygon has also taken an active role in investing in its community. Polygon frequently sponsors, mentors, and judges hackathons in India. It was heavily involved with ETHIndia. In addition, the company also partners with students by offering smart contract application engineering courses and working with blockchain clubs at several of the IIT institutions, IT Mumbai, and other select Indian universities.

To showcase where Polygon stands as a financial platform, we can benchmark the company’s valuation against the largest Indian banks. By this methodology, Polygon would rank as the seventh-largest financial institution. Of course, there are some major caveats with this type of analysis. For one, Polygon doesn’t offer direct financial services and operates more as a financial payments platform. Moreover, the startup’s ecosystem includes indirect financial use cases such as NFTs and blockchain gaming. That said, this quick-and-easy comparison does highlight how rapidly Polygon has risen and the level of expectations investors have placed on the company moving forward.

Roadmap

Much of the Polygon’s team’s focus for the upcoming year is corporate, not technological, which could signal how comfortable the team is with the state of its product suite. As each product continues to research, test, or launch its own scaling solution, more emphasis will be placed on finding the right partners and protocols to integrate into Polygon’s network of offerings.

In public interviews, Polygon has expressed interest in reorganizing the company’s team structure and expanding partnerships with crypto projects, particularly in the NFT and gaming sector. Headcount growth is also expected to continue with the goal of doubling the number of employees by the end of the year. Though the exact details of each team’s organization are unknown, it’s important to note Polygon wants to centralize key leadership while keeping the decentralized autonomy of each team.

For investors, one of the most exciting updates will be a token redesign. The current MATIC token is a legacy remnant of the old Matic business and works with Matic’s network, Polygon PoS. The future token will have a new ticker and work across all Polygon products. Given what we know today, use cases may include staking to enhance security or selecting blockchain operators. Interestingly, the token will not be mandatory for all users, meaning it will not be necessary to buy, stake, or hold; for many users, it may just be something in the background. Although the timing is unclear, Bjelic has stated there is a desire to complete the token redesign sometime in 2022.

Conclusion

The next few years will be competitive for blockspace. Winners will be decided by determining which has the best ease of use, transaction speed, and transaction cost. This next stage of blockchain evolution means core infrastructure is now more important than ever. Users around the world need a network capable of rivaling Visa and Mastercard, the type of processing that can handle thousands of transactions per second.

Polygon is striving to meet the demand with its suite of rollup solutions. Its aggressive 2021 growth strategy, by acquiring and onboarding different ZK projects, now ensures Polygon’s portfolio offers something for everyone. If a user is wanting faster or more private transactions, there’s Hermez, Miden, or Zero; if an enterprise is seeking privacy, there’s Nightfall; and if a developer is looking for scaling solutions, Avail reduces the burden of data availability while Edge helps build new blockchains entirely.

The suite of products gives Polygon a significant moat. As long as it can draw projects to its platform, Polygon will continue to remain a big industry participant for years to come.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Polygon. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Jerry joined Messari as a Research Analyst after working in management consulting. He graduated with a B.S. in finance and a minor in computer science from Indiana University's Kelley School of Business.

Read more

Research Reports

Read more

Research Reports

About the author

Jerry joined Messari as a Research Analyst after working in management consulting. He graduated with a B.S. in finance and a minor in computer science from Indiana University's Kelley School of Business.