Messari Classifications

Messari

Jan 3, 2009 ⋅ 15 min read

For a nascent industry like crypto to flourish, a transparent and detailed methodology for metrics and classifications is crucial. The Messari library is composed of 15+ qualitative classifications available throughout our industry-leading data and research platform. You can learn more about each qualitative classification below. You will also find the finer details with respect to the four most important metrics: price, volume, supply, and market capitalization in our Methods page. To learn more about our quantitative metrics, head to our Metrics page.

Note that some of our metrics and classifications are only available to Messari Pro users. Visit this page to learn more about Messari Pro.

General

Categories & Sectors

Categories indicate the primary use-case or application of a cryptoasset network. Sectors indicate the specific solution(s) provided by a cryptoasset network. Each sector belongs to a single category. Below is our current classification.

I. Payments:

- Currencies: Operate as blockchain based money. Globally accessible and controlled by no single entity or group.

- Payment Platforms: Focus on payments for a specific use case or industry. Some platforms may integrate multiple currencies while others use a native cryptoasset.

- Rewards: Offer users cryptoasset based rewards for various actions. Often the rewards can be redeemed directly through the platform.

- Stablecoins: Attempt to keep their value tied to a peg, like the U.S. dollar, through collateral backing or other mechanisms.

II. Infrastructure:

- Application development: Provide the tools and infrastructure for creating blockchain based applications.

- Enterprise and blockchain-as-a-service (BasS): Help entities create and run their own dedicated blockchain platforms.

- Interoperability: Link multiple blockchains together allowing users to transact across networks.

- Scaling: focus on increasing the amount of transactions or speed of transactions that can be accomplished on the network.

- Smart contract: Act as computing systems that can execute arbitrary code and power decentralized applications.

III. Financial:

- Asset Management: Provide tools for on-chain management of cryptoassets.

- Centralized exchange: Offer trading, asset issuance, and other capital markets services. Cryptoassets on these platforms are generally used for trading discounts or feature access.

- Crowdfunding: Connect projects or ventures looking to raise funds with those looking to invest or donate. Typically a cryptoasset is used as the native currency or for access to the platform.

- Decentralized exchange: Allow users to trade and transfer cryptoassets directly between parties, without the need to give custody or control to a third-party.

- Lending: Allow users to borrow or lending cryptoassets.

- Prediction markets: Provide markets for speculating on the outcome of events.

IV. Services:

- Artificial intelligence (AI): Use cryptoassets to power AI models and technologies.

- Data management: Offer tools for managing personal or enterprise data on blockchains.

- Energy: Leverage blockchains and cryptoassets to enable more efficient trading and allocation of energy-grid resources without reliance on a traditional middleman.

- File storage: Offer marketplaces for renting file storage, with payments tied to cryptoassets.

- Healthcare: Provide various services, including cryptoasset payments and file management, for the healthcare industry.

- Identity: Provide unique digital identities or link immutable records of real world identity to the digital world.

- Shared compute: Offer marketplaces for renting compute resources with payments tied to cryptoassets.

- Timestamping: Underpin decentralized digital-rights management by using the permanence and irrefutability of blockchains to prove that a piece of content existed at a certain time.

V. Media and Entertainment:

- Advertising: Connect advertisers and consumers through unique cryptoasset incentive mechanisms.

- Content creation and distribution: Allow users to get paid for creating and publishing content through built-in cryptoasset payments.

- Collectibles: Non-fungible tokens that give the holder unique ownership to a digital or real world item.

- Gaming: Leverage blockchain and cryptoassets to give players unique incentives, ownership, or experiences within games.

- Gambling: Provide casino and other wager based gaming often using blockchain technology to provide "provably fair" games.

- Social media: Allow users to connect through a decentralized network without third-party control.

- Virtual and augmented reality: Use blockchain technology and cryptoassets to power digital worlds.

You can also learn more on specific sectors on our dedicated resource pages:

Tags -Messari Pro

Tags allow to group cryptoassets that share some similarities that fall outside of the general classification model. These can be features, specifications, fun facts, memes etc.

We currently only present Privacy as a tag but will be continuously adding more. Assets tagged under “Privacy” conceal information about senders and receivers during transactions through a variety of methods.

You can learn more on Privacy technologies on our dedicated resource pages:

Token Details

Token Type -Messari Pro

This indicates the standard or network on which a given cryptoasset operates. Below is our current classification. Note that a single cryptoasset may have multiple Token Types. Indeed, some assets exist on different chains (Ethereum and Binance chain for example), and others have both a Native token and a token on another chain. Other Token types will be progressively added as we cover more assets.

- Ardor Token: Asset that exists on top of the Ardor Blockchain

- BEP2: Binance Chain Standard

- EOSIO: EOS Standard

- ERC-20: Ethereum Standard

- ERC-20 until Migration: Asset that is currently an ERC-20 but will transition to its own chain in the future

- Native: Asset that is implemented on the protocol level of the blockchain (Bitcoin, Ethereum, EOS etc.)

- NEP5: NEO Standard

- Omni: Asset that exists on top of the Omni Layer

- Omni token until Migration: Asset that currently exists on top of the Omni Layer but will transition to its own chain in the future

- RSK: Asset that exists on top of the RSK Blockchain.

- TRC-10: TRON Standard

Token Usage -Messari Pro

This indicates how each cryptoasset can be used in its respective network. The classification was initially inspired by Max Mersch analysis in his excellent write-up An (Entrepreneurial) Investor’s Take on the Utility of Tokens beyond Payment. Below is our current classification. Note that a single cryptoasset may have multiple Token Usages.

- Access token: The asset needs to be held or staked in order to access goods and services provided in the network

- Discount token: Goods or services provided in the network are accessible at a discount price if paid in the network’s native asset

- Payments token: The asset is used as a mean of payment in the network

- Vote token: Holding or staking the asset provides governance rights in the network

- Work token: The asset needs to be staked in order to earn the right to perform work for the network

You can learn more on Token Usages on our dedicated resource pages:

Consensus

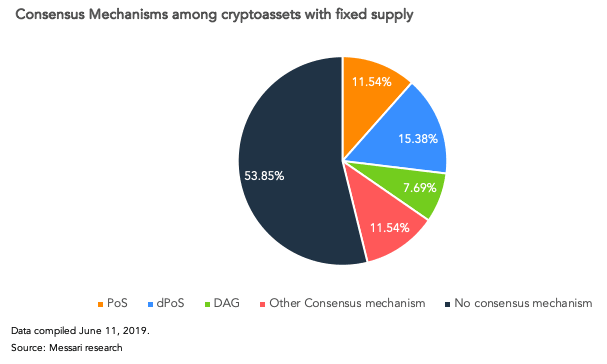

Consensus Algorithm -Messari Pro

This provides a general indication of the consensus type used by a given cryptoasset. In the future, we will provide more detailed information on the precise consensus algorithm of each asset (e.g Consensus Nakamoto instead of PoW for Bitcoin). Below is our current classification.

- DAG: The Directed Acyclic Graph distributed ledger uses new transactions to validate previous transactions. Each transaction in a DAG distributed ledger is linked to at least one other transaction. Each transaction in a DAG is directed towards later transactions and the connected transactions are represented by a mesh like graph.

- Delegated Proof-of-Stake: Allows token holders to elect delegates (witnesses, block producer) to validate transactions and achieve consensus.

- Hybrid PoW & DPoS: The network combines both Proof-of-Work and Delegate Proof-of-Stake to achieve consensus.

- Hybrid PoW & PoS: The network combines both Proof-of-Work and Proof-of-Stake to achieve consensus.

- Other: Consensus algorithms that are specific to the asset and not generalized across assets. This category includes consensus algorithms such as Proof-of-Authority, Proof-of-Believability, Proof-of-Contribution etc.

- Proof-of-Stake: Unlike proof of work systems, Proof-of-Stake systems mandate network participants to prove ownership by depositing ("staking") a certain amount of tokens. A new block is selected in a pseudo-random manner depending on the users’ stake. If they attempt to behave maliciously, they may have their stake slashed as punishment.

- Proof-of-Work: A system used to deter malicious use of a valuable resource. It was initially used to prevent email spam, by requiring the sender to generate a proof of the email’s content such that it would require significant computational resources to send mass emails. This was later adapted to require expending computational energy in order to add changes to a transaction ledger. This solved the issue of double spending which exists in most payment infrastructures.

You can learn more on Consensus Algorithms on our dedicated resource pages:

- Directed Acyclic Graph

- Delegated Proof-of-Stake

- Proof-of-Authority

- Proof-of-Burn

- Proof-of-Stake

- Proof-of-Work

Mining Algorithm -Messari Pro

This is the mining algorithm used by a given Proof-of-Work cryptoasset. Below is our current classification. Note that a single cryptoasset may have combine multiple Mining Algorithms. Other Mining Algorithms will be progressively added as we cover more assets

- Blake (14r)

- Blake2s

- CryptoNight

- Cuckoo Cycle

- Equihash

- Equihash-BTG

- Ethash

- Grostl-512

- Lyra2RE

- Lyra2REv2

- Lyra2Z

- Myr-Groestl

- NeoScrypt

- Qubit

- Scrypt

- SHA-256

- Sha-3

- Skein

- X11

- X13-BCD

- x17

- ZPool

Staking Type -Messari Pro

This is the method used for staking, as reported by stakingrewards.com. Below is their current classification.

- Masternodes

- Other

- Proof-of-Stake

- Proof-of-Stake + Masternodes

Supply

Launch Style -Messari Pro

This defines how the initial supply was issued and distributed. The term was first coined by Nic Carter, who analyzed cryptoassets launch styles in his master’s thesis. Below is our current classification. Note that a single cryptoasset may combine several Launch Styles. Other Launch Styles will be progressively added as we cover more assets that present a differentiated initial issuance and distribution mechanism.

- Airdrop: A portion or all of the initial supply is distributed for free to community members that have previously registered or performed small tasks, or by borrowing the distribution of an existing network (holders of an existing asset will receive part of the new asset initial supply proportionally to their share of the existing asset outstanding supply).

- Auction: Consists of conducting an auction to allocate part of the initial supply. Dutch auctions and reverse dutch auctions have been experimented. A Dutch Auction is where the bidding for an item begins with the price starting at its highest asking amount but is systematically lowered until someone makes the winning bid and the item is sold. In a token sale, a bid reserves that amount of tokens, and it ends when all are accounted for. All participants then pay the same price which is the lowest bid.

- Centralized Distribution: The entity issuing the asset allocates the entirety of the initial supply to itself and distributes or sells it continuously after the launch of the asset, through airdrops, third-party sales and partnerships, or direct sales, usually over a long period of time.

- Crowdsale: An open sale where participants can acquire part of the initial supply at a given price. The first token sale was held by Mastercoin in 2013. Crowdsales were predominants in 2017 with the raise of Initial Coin Offerings.

- Fair Launch: There was no premine, the coin was mineable from the start of the blockchain, and the launch was announced publicly.

- Fair Launch with Built-in centralized treasury: The launch gathers all the conditions of a Fair Launch but a percentage of newly issued coins are allocated to a treasury which is centrally managed by the issuing organization, or other contributing or investing organizations. This can be done through a percentage of each block reward, or by a superblock, that is to say a block every X blocks containing a higher reward to be distributed to the treasury.

- Faucet: Consists of allocating part or all of the initial supply in exchange for completing a captcha or specific task.

- Initial Exchange Offering (IEO): IEOs are similar to Crowdsales, except that the raise is conducted through the exchanges themselves.

- Instamines & Stealth Mines: Refers to a situation best defined by where: “founders use asymmetric advantages to mine large percentages of the coin at launch or fail to announce the inception of the coin, thus mining stealthily.”

- Ledger Fork: Occurs when nodes cannot agree on a change, and they lead to a permanent split in the network. The owners of the original cryptoasset receive proportional amounts of the new cryptoasset.

- Ledger Fork with Built-in centralized treasury: The launch gathers all the conditions of a Ledger Fork but a percentage of newly issued coins are allocated to a treasury which is centrally managed by the issuing organization, or other contributing or investing organizations. This can be done through a percentage of each block reward, or by a superblock, that is to say a block every X blocks containing a higher reward to be distributed to the treasury.

- Ledger Fork with Premine: The launch gathers all the conditions of Ledger Fork, but the fork includes an additional “premine” to cover fork costs and future development expenses and reward the team.

- Lockdrop: Modified airdrop where users on one network stake tokens for a specified amount of time in exchange for another set of tokens. The amount of time can be variable and the tokens are released through a smart contract.

- MerkleMine: Best defined by Kyle Samani “Merkle mining is similar to mining, but instead of running hashes to find a hash value that’s below some threshold, merkle mining requires merkle miners to generate merkle proofs demonstrating that a specific Ethereum address was in the set of accounts that had at least X ETH at some block height. The computations for each merkle proof are deterministic, can be computed ahead of time, and aren’t that computationally intensive (relative to PoW mining).”

- Private Sale: A closed sale where accredited or registered investors can acquire part of the initial supply at a given price, usually lower than the crowdsale price.

You can learn more on Launch Styles on our dedicated resource pages:

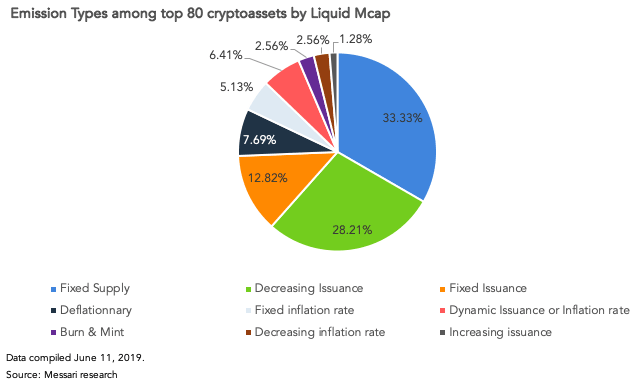

Emission Type - General -Messari Pro

This defines the general monetary policy ruling the issuance of new coins for a given cryptoasset. Therefore it's an indication of the future evolution of the Outstanding Supply (supply visible on-chain) for a given cryptoasset. Below is our current classification.

- Burn & Mint: The outstanding supply of the asset may both shrink or increase depending on network usage and its impact on deflationary (burn) and inflationary (minting) mechanisms.

- Deflationary: The outstanding supply of the asset shrinks through time due to programmatic or non-programmatic burn mechanisms. Note that in some cases a minimum supply is specified and the burn mechanisms will stop when it is reached.

- Fixed Supply: The outstanding supply of the asset if fixed. There are no inflationary or deflationary mechanisms.

- Inflationary: The outstanding supply of the assets increases through time due to minting mechanisms. Note that in some cases a supply cap is specified and the minting mechanisms will stop when it is reached.

Emission Type - Precise -Messari Pro

This further defines the monetary policy ruling the issuance of new coins for a given cryptoasset. It gives a more precise picture of the future evolution of the Outstanding Supply for a given cryptoasset (supply visible on-Chain). For example, it distinguishes ongoing emission structures based on issuance (absolute amount of coins generated) and inflation rate (% growth of the outstanding supply), ongoing destruction of coins based on programmatic burn mechanisms (transaction fees, contract creation fees, etc.) and non-programmatic burn mechanisms (% of profit used by the entity behind the project to burn coins). Below is our current classification.

- Burn & Mint Equilibrium: Tokens are burned to access an underlying service of the network. Independently of the token burning process, the protocol mints new tokens per period (block, day, year) and allocates these tokens to service providers. The percent of newly minted tokens allocated to a given service provider is equal to the percent of tokens burnt to access its services. If 10% of tokens burnt were in the name of a given service provider, this service provider will receive 10% of newly minted tokens. Kyle Samani from Multicoin Capital analyzed this model in its article “New Models for Utility Tokens”. You can learn more on the Burn & Mint Equilibrium token model on our dedicated resource page.

- Decreasing Inflation rate: The Inflation rate decreases over time, at defined intervals. Depending on the reduction rate of inflation, this can lead to an increasing, fixed or decreasing issuance per period.

- Decreasing Issuance: The amount of coins generated per period (block, day, year), decreases through time. This leads to an exponential decrease of the inflation rate. The issuance reduction is frequent for PoW coins with halvings and can also be implemented through a constantly decreasing block reward.

- Dynamic Emission: The amount of coins generated per period (block, day, year) or the inflation rate, depend on specific network conditions such as the % of network staking.

- Fixed Inflation rate: The amount of coins generated per period (block, day, year) increases through time.

- Fixed Issuance: The amount of coins generated per period (block, day, year) stays constant.

- Fixed Supply: Most of the coins that feature a fixed outstanding supply are non-native tokens that do not have to incentivize miners or validators with newly generated coins to provide security to the network. However, in some cases, even PoS and dPoS native tokens have a fixed supply. Indeed, there exist other ways to incentivize validators: transaction fees, premined rewards and secondary token issuance.

- Fixed Supply with Premined Rewards: The outstanding supply of the asset is fixed but the rewards have been premined. This leads to an inflationary circulating supply over time, although the outstanding supply stays fixed.

- Fixed Supply with Secondary Token Issuance: The supply of the asset is fixed but rewards are denominated in another asset, usually a secondary asset existing on the same chain.

- Increasing Issuance: The amount of coins generated per period (block, day, year) increases through time.

- Non-programmatic burn: The outstanding supply shrinks through time due to non-programmatic burn mechanisms such as the issuing entity burning an amount of tokens equal to a % of its profit on a regular defined basis.

- Other Burn & Mint models: The outstanding supply of the asset both shrinks and increases over time through a combination of inflationary and deflationary mechanisms, but contrary to the original burn & mint equilibrium model, the percent of newly minted tokens is NOT allocated to a given service provider based on the percent of tokens burnt to access its services.

- Programmatic burn: The outstanding supply shrinks through time due to programmatic mechanism (Fees burnt, slashing penalties, % of transaction value burnt).

Is Capped Supply? -Messari Pro

This indicates whether the supply of a given cryptoasset is capped (maximum supply defined by the protocol) or uncapped. Some assets such as Bitcoin, have a well-defined issuance schedule and supply cap. Others such as Monero, will have a constant tail emission which will have the effect of providing a small and perpetually decreasing rate of annual supply inflation.

Governance

On-Chain Governance structure -Messari Pro

This classifies the mechanisms through which governance happens on-chain for a given cryptoasset. This classification was inspired by Odysseas Sclavounis and Nic Carter's Overview of Governance in Blockchains. Below is our current classification. Note that a single cryptoasset may combine several different On-Chain Governance Structures.

- Delegative on-chain vote

- Direct on-chain vote

- No on-chain governance

- Third-party protocol

- Upcoming

You can learn more on On-Chain Governance on our dedicated resource pages:

Is Treasury Decentralized? -Messari Pro

This indicates if the cryptoasset incorporates a decentralized treasury where a group of token holders can allocate funds through On-Chain Governance.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in