Key takeaways from DappRadar’s 2019 dApp report

Messari

Dec 19, 2019 ⋅ 3 min read

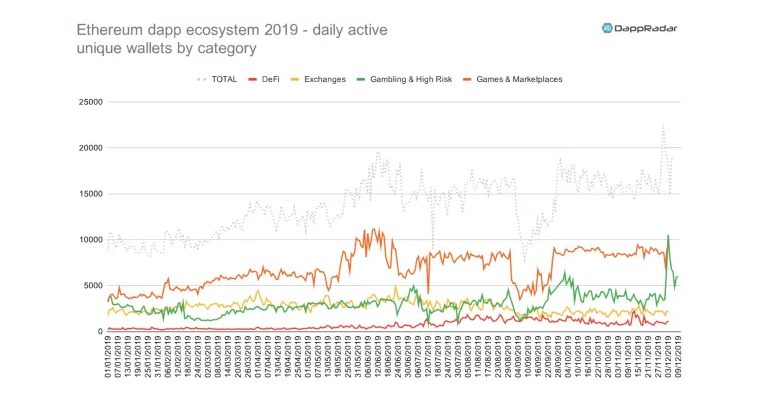

DappRadar, a data tracking site for blockchain-based applications, released a dApp industry review for 2019 to help everyone answer the question, “Who is actually using decentralized applications?” Based on the report, Ethereum dApps exhibited a steady growth trajectory in terms of users (measured by daily active unique wallets) and generated well over $10 billion in estimated value (combining both ETH and ERC-20 token volumes) over the last year. It is important to note that dApps within the DeFi sector account for only 6% of daily active unique wallets but contribute 45% of total dApp volume. On the flip side, gaming, marketplace, and gambling dApps account for 72% of daily Ethereum application users combined. But these same dApps generate only 4% of the total transaction volume.

A quick look at Ethereum competitors EOS and Tron shows that the two high-throughput alternative chains were less successful at cultivating dApp activity. User activity on EOS declined by nearly 50%, most likely due to the current congested state of the network. Tron saw an increase in daily unique wallet activity, with 90% of these users gravitating toward gambling dApps. Despite the growth in its user base, daily transaction volume generated by Tron dApps dropped by 75%.

DappRadar also scoured eight other chains for dApp activity. While most of the networks exhibited sporadic activity levels throughout 2019, the two chains with healthy signs of user growth were Loom Network and Waves.

Why it matters:

- Surprisingly, the data shows that gamers are not deterred by Ethereum’s latency and unpredictable transaction fees. This trend is more telling about the state of available alternative chains than Ethereum’s ability to serve as a gaming platform. As more compelling high-throughput and interoperable chains launch, gaming dApps and their users might look to migrate away from Ethereum.

- If games do shift away from Ethereum, it would not have a significant impact on daily network volume. Almost all of the volume generated via Ethereum dApps comes from the DEX and DeFi categories. The report also indicates that these financial applications only cater to a small number of crypto-savvy, high-worth investors at the moment. It will be interesting to see if the user base expands beyond this core group in 2020.

- While EOS endured a steep decline in user activity towards the tail-end of the year, DappRadar suggested bots were operating most of the lost accounts. The drop in active bot accounts coincided with the launch of the EIDOS contract, the “free” token airdrop that attracted a rush of network activity and caused the chain to enter into “congestion mode.” A possible explanation for bot activity approaching near-zero is the network’s congested state rendered bot accounts inoperable, and bot owners did not want to purchase extra resources to keep their bots running. With this perspective, the EIDOS contract acted as an indirect filter for bot traffic on EOS.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in