Key Insights

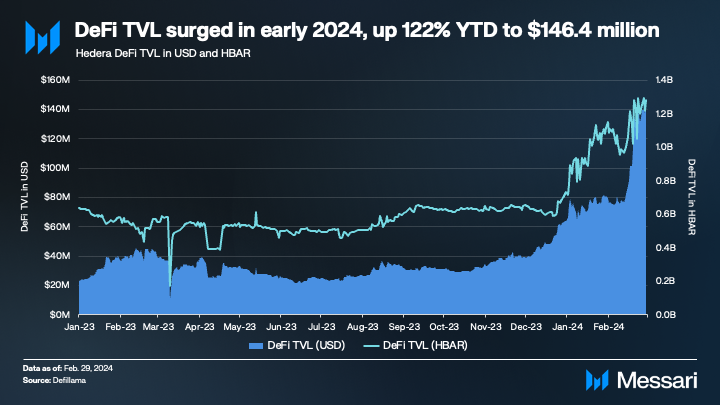

- Hedera DeFi TVL is up 146% YTD to $157 million. DeFi TVL denominated in HBAR is also up 89% YTD, implying that the TVL increase was in part due to capital inflows.

- SaucerSwap’s V2 launch in November 2023 has helped the DEX achieve impressive growth, with SAUCE price ($0.21), TVL ($150 million), and average daily trading volume ($5 million) all hitting all-time highs in 2024.

- Stablecoin market cap has continued to increase in 2024 after a strong Q4. The supply of USDC on Hedera is up 27% YTD to $8 million.

- Stader liquid staking TVL on Hedera has been decreasing in 2024, down 11% YTD from 378.6 million HBAR to 338.1 million.

Primer

Hedera (HBAR) is an open-source, public-permissioned Proof-of-Stake (PoS) blockchain network. It is governed by 30 global organizations, known as the Hedera Council, with input on the network’s features and ecosystem standards from the community via Hedera Improvement Proposals (HIPs).

The Hedera Network offers an optimized version of the Besu EVM for smart contracts (Hedera Smart Contract Service), alongside a native tokenization service (Hedera Token Service) and high-throughput data writing and verification service (Hedera Consensus Service). These services are known as the Hedera Network Services, which developers can use to build decentralized applications. The network is powered by the Hashgraph Consensus Algorithm, which delivers high throughput, fair ordering, and low-latency consensus for all transactions. The combination of the Hedera Network Services and Hedera’s high speed and cheap transactions makes Hedera an optimal solution for DeFi applications. This report will focus on Hedera’s growing DeFi ecosystem and highlight its key developments and metrics.

Website / X (Twitter) / Discord

DeFi Overview

Decentralized Exchanges (DEXs)

SaucerSwap

SaucerSwap is the largest native DEX on Hedera. The SaucerSwap DEX utilizes an automated market-making (AMM) architecture where token-based liquidity pools facilitate liquidity for trades. SaucerSwap consists of two different protocols: SaucerSwap V1 and V2.

SaucerSwap V1

SaucerSwap V1 is an AMM forked from Uniswap V2 and modified to interact with the Hedera Token Service (HTS) through the Hedera Smart Contract Service (HSCS). Uniswap V2-based AMMs are liquidity pools that consist of two cryptoassets. As the two cryptoassets enter and leave the pool, the price of the assets against one another constantly rebalances.

This price is determined by the formula:

x * y = k

“x” and “y” signify tokens in a liquidity pool, and “k” is the product of the token reserves.

All swaps routed through V1 liquidity pools incur a 0.3% fee. Then, ⅚ of the fee is directed towards the pool’s liquidity providers pro-rata, and the remaining ⅙ is directed to the protocol.

Upon depositing assets into a V1 liquidity pool, users receive liquidity pool tokens in return. These LP tokens can then be staked to earn yield farming rewards in both HBAR and SAUCE. Rewards emissions are determined by SaucerSwap DAO.

SaucerSwap V2

SaucerSwap V2 is a concentrated liquidity AMM forked from Uniswap V3 and modified to interact with the Hedera Token Service (HTS) through the Hedera Smart Contract Service (HSCS). Concentrated liquidity AMMs aim to improve various inefficiencies of traditional V2 AMMs. For AMMs that use the “(x)(y) = k” formula, the AMM provides liquidity at all price points from zero to infinity. This ensures that liquidity can be provided at every possible price point, but it also creates inefficiencies as less liquidity is provided at each given price point.

For example, assuming the price of HBAR is $0.10, a traditional AMM provides the same amount of liquidity at “HBAR = $0.01” or “HBAR = $1.00 million,” despite X only being $100.00. Since the likelihood of X increasing or decreasing 100x in a short period is very low, a large portion of the liquidity goes unused.

The concentrated liquidity model innovates upon this by allowing users to choose which prices to provide liquidity at through price ranges. V2 liquidity positions only provide liquidity, based on the formula “(x)(y) = k,” within the boundaries designated by a user’s chosen price range.

Source: Uniswap V3 Core Whitepaper

Swaps routed through V2 liquidity pools incur a fee ranging from 0.05% to 1%, depending on the liquidity pool. Similarly to V1, ⅚ of the fee is directed toward the pool’s liquidity providers pro-rata, and the remaining ⅙ is directed to the protocol.

Upon depositing assets within a V2 liquidity pool, users receive a liquidity pool NFT. V2 liquidity providers are eligible to receive rewards from the Liquidity-Aligned Reward Initiative (LARI). Any HTS token can be distributed as rewards through this initiative, and liquidity providers receive rewards based on the volume routed through their liquidity positions.

The SAUCE token is an HTS token on Hedera with a maximum token supply of 1 billion. SAUCE allocations are as follows:

- Yield Farming Emissions: 353.9 million (35.4% of the maximum token supply).

- Core Development: 240 million (24% of the maximum token supply).

- Community: 140 million (14% of the maximum token supply).

- LARI: 73 million (7.3% of the maximum token supply).

- Operations: 63.4 million (6.3% of the maximum token supply).

- Developers: 49.7 million (5% of the maximum token supply).

- Marketing: 40 million (4% of the maximum token supply).

- Advisor: 20 million (2% of the maximum token supply).

- Liquidity 20 million (2% of the maximum token supply).

The planned core utility of SAUCE is governance. SAUCE tokens will serve as voting power in SauceSwap DAO in the future. SAUCE is also used for both liquidity provision rewards (Yield Farming and LARI) and can be staked as xSAUCE. xSAUCE is a rebasing token that earns rewards from the following sources:

- ⅙ of swap fees collected from both V1 and V2 liquidity pools.

- 30% of farming emissions

- HBAR native staked rewards from WHBAR’s underlying HBAR balance.

Heliswap

Heliswap is another native DEX on Hedera. Similarly to SaucerSwap, Heliswap utilizes an automated market-making (AMM) architecture where token-based liquidity pools facilitate liquidity for trades. As of writing, Heliswap’s V1 AMM is forked from Uniswap V2, but a V2 version of Heliswap is on the roadmap.

All swaps routed through V1 liquidity pools incur a 0.3% fee. The entire fee is directed to Heliswap’s liquidity providers. Upon depositing assets into a V1 liquidity pool, users receive liquidity pool tokens in return. These LP tokens can then be staked to earn yield farming rewards in both HBAR and HELI.

The HELI token is an HTS token on Hedera with a maximum token supply of 888.89 million tokens. HELI allocations are as follows:

- Ecosystem Rewards: 311.11 million (35% of the maximum token supply)

- Team & Advisors: 177.78 million (20% of the maximum token supply)

- Ecosystem Development: 133.33 million (15% of the maximum token supply)

- DAO Pool: 88.89 million (10% of the maximum token supply)

- Grants: 66.67 million (7.5% of the maximum token supply)

- Council Treasury: 66.67 million (7.5% of the maximum token supply)

- Token Drops: 44.44 million (5% of the maximum token supply)

The core utility of HELI is governance. HELI tokenholders can both create governance proposals and vote on them. HELI is also used for liquidity provision rewards and can be staked in a single-sided staking pool.

Liquid Staking

Stader

Stader is a liquid staking provider that offers support for Hedera. As of writing, Stader is the only provider of liquid staking on the Hedera network. Users can stake HBAR with Stader and receive HBARX in return. HBARX is a liquid staking token that represents a user’s share of Stader’s staking pool. This approach allows users to access the benefits of staking without having to indefinitely lock up token holdings.

Additionally, HBARX rebases to reflect accumulated staking rewards. As such, the exchange rate between HBAR and HBARX increases as Stader accumulates staking rewards. Furthermore, Stader charges a 10% fee on staking rewards to cover the costs associated with operating the staking service. Users can unstake HBARX for the underlying staked HBAR and any accrued rewards at any time, but they must wait one day to withdraw.

Services

DaVinciGraph

DaVinciGraph is a token management service on Hedera that allows projects to streamline onchain management services related to tokens. DaVinciGraph deploys smart contracts on Hedera to achieve this. As of writing, the following services are live:

- Token Locker - Enables features to lock up tokens, liquidity tokens, and NFTs for defined periods of time.

- DaVinchi Pics - Allows projects to add logos to deployed tokens.

- Blackhole - Contract that permanently burns tokens.

- Token Vesting - Allows projects to deploy onchain vesting schedules for tokens.

- Token Creator - Tool for creating tokens on Hedera.

The DAVINCI token is an HTS token on Hedera with a maximum token supply of 90 million tokens. DAVINCI allocations are as follows:

- Private Sale - 30 million (33.3% of the maximum token supply)

- Liquidity - 30 million (33.3% of the maximum token supply)

- Airdrop - 30 million (33.3% of the maximum token supply)

- Team Airdrop - 10 million (11.1% of the maximum token supply)

- NFT Holders - 15 million (16.7% of the maximum token supply)

- Hedera Community - 5 million (5.6% of the token supply)

The core utility of DAVINCI is to access discounts when paying fees associated with DaVinciGraph services.

HbarSuite

HbarSuite is a DeFi service provider on Hedera. HbarSuite utilizes Smart-Nodes, which are customizable programs that enable users to interact with the Hedera Network without directly interacting with smart contracts. HbarSuite offers several products including:

- Multi-Sig Wallet Manager - A tool for users to easily deploy and manage a multi-sig wallet on Hedera.

- DAO Creator - A tool for projects to easily deploy and manage a decentralized autonomous organization (DAO). As of writing, 12 different DAOs have been deployed using DAO Creator.

- NFT Exchange - AMM liquidity pools for NFTs on Hedera. Users can pair an NFT collection with fungible tokens using this product. As of writing, there are over 50 different collections with liquidity pools.

- Decentralized Exchange - AMM liquidity pools for HTS tokens on Hedera. HbarSuite’s DEX utilizes the novel Smart Rebalance Market Maker (SRMM), which utilizes Smart-Nodes to enable atomic transactions that allow for zero-slippage swaps.

- Token Manager - A tool for users and projects to create and manage HTS tokens on Hedera.

- Cross-Chain Exchange - A bridge that enables users to swap assets on Hedera for assets that exist on other networks. The cross-chain exchange supports various EVM networks and non-EVM networks, including but not limited to, Ethereum, Bitcoin, Dogecoin, Solana, Ripple, and more.

- Launchpad - A tool for projects to launch and sell either NFTs or HTS tokens on Hedera. As of writing, ten different projects have been launched through HbarSuite’s launchpad.

The HSUITE token is an HTS token on Hedera with a maximum token supply of 50 billion tokens. HSUITE allocations are as follows:

- Immediate Pledge Offer - 2 billion (4% of the maximum token supply)

- Initial Token Offer - 9 billion (18% of the maximum token supply)

- Development - 9 billion (18% of the maximum token supply)

- Marketing - 3 billion (6% of the maximum token supply)

- Smart-Drops - 5 billion (10% of the maximum token supply)

- Treasury - 22 billion (44% of the maximum token supply)

The core utility of HSUITE is to operate a HbarSuite Smart-Node. Users with over 10 million HSUITE can apply to be a Smart-Node operator. Additionally, various products offered by HbarSuite require a fee payment to be used. HSUITE tokens are used to pay fees associated with using the protocol.

Dropper

Dropper is an NFT marketplace and launchpad for gaming projects on Hedera. The goal of Dropper is to abstract away certain elements of Web3 gaming by offering wallet and asset management tools.

Recently, Dropper announced a partnership with NeoTokyo, a cohort of gaming founders and investors. The partnership aims to onboard AAA gaming developers to the Web3 gaming community. As a part of this partnership, a $5 million grant program for Web3 gaming was established.

HeadStarter

HeadStarter is a project accelerator and launchpad native to Hedera that provides a platform for projects to launch tokens and raise funds. HeadStarter has helped launch 13 different projects and raise 19.4 million HBAR for said projects.

Additional Protocols

Other DeFi protocols on Hedera include:

- Builder Labs - DeFi application and tooling company that works within the Hedera ecosystem. Several projects that its contributing to include HeadStarter, Citadel Wallet, and Tomas Finance.

- EtaSwap - DEX aggregator platform on Hedera. It currently routes swaps through SaucerSwap V1 and V2, Heliswap, HbarSuite, and Pangolin.

- Hashport - Cross-chain bridge that connects Hedera with various other EVM-compatible networks, such as Ethereum, Avalanche, BNB Chain, and Polygon. In addition to tokens, Hashport can also be used to bridge NFTs. Hashport has facilitated over $48 million in bridging volume.

- Pangolin - Multichain DEX with support for Hedera.

DeFi Performance Analysis

Through two months in 2024, Hedera network's Total Value Locked (TVL) has built on its strength from Q4 and increased from $63.9 million to $157.1 million (+146% YTD). Additionally, the TVL denominated in HBAR also increased to 1.4 billion, an increase of 89% YTD. This suggests that Hedera’s TVL increase was not only driven by an increase in the price of HBAR (+24% YTD) but also by capital inflows.

Furthermore, SaucerSwap has further solidified its dominance within the Hedera network ecosystem, increasing its TVL YTD from $60.4 million to $143.8 million (+138% YTD) and accounting for 98% of the network's total TVL. SaucerSwap's launch of SaucerSwap V2 in November brought new features and improvements, including concentrated liquidity, MetaMask support, Tokenomics V2, and the Liquidity-Aligned Reward Initiative (LARI). As for Heliswap and Pangolin, their respective TVLs have decreased by 18% and 4% YTD.

DeFi Diversity measures the number of protocols that constitute the top 90% of DeFi TVL. A greater distribution of TVL across protocols reduces the risk of widespread ecosystem contagion resulting from adverse events like exploits or protocol migrations. Due to the dominance of SaucerSwap, Hedera’s DeFi diversity remains at 1.

Decentralized Exchanges (DEXs)

DEX volumes on Hedera continue hitting new highs in 2024, after setting an all-time high in Q4 of 2023. Led by SaucerSwap, daily average DEX volume is up to $5.2 million. This is 308% higher than Q4’s daily average DEX volume of $1.3 million. Throughout 2024, SaucerSwap has accounted for 99% of DEX volume on Hedera.

SaucerSwap

On November 17, 2023, SaucerSwap V2 was launched. Upgrades and changes included:

- Concentrated Liquidity Pools - As previously mentioned, SaucerSwap V2 includes concentrated liquidity pools. This enables 4,000x more capital efficiency as opposed to SaucerSwap V1.

- Revamped Web-App - A completely re-desgined web app to interact with the protocol and both V1 and V2 pools.

- MetaMask Support - Full integration with MetaMask to allow any user with a MetaMask wallet to interact with the protocol.

- Update Tokenomics Model - A 60% reduction in SAUCE token inflation to 126.84 SAUCE per minute accordingly:

- V1 Yield Farms - 59.82 SAUCE per minute

- DAO + LARI - 55.49 SAUCE per minute

- Developers - 11.53 SAUCE per minute

- Liquidity-Aligned Reward Initiative (LARI) - SAUCE token rewards for V2 liquidity providers.

The success of V2 is reflected in both SaucerSwap’s TVL and the price of SAUCE. On November 17, 2023, SaucerSwap TVL was $36.2 million. By the end of December, TVL had nearly doubled to $62.4 million, and by the end of February, TVL was $149.9 million, a 314% increase since SaucerSwap V2 went live. Similarly, the price of SAUCE also increased after V2. By the end of February, SAUCE was $0.21, an 824% increase from its November 17 price of $0.02.

The V1 pools with the highest liquidity include:

- HBARX/HBAR - $21.8 million

- SAUCE/HBAR - $15.1 million

- SAUCE/xSAUCE - $5.3 million

- USDC/HBAR - $2.6 million

- HBAR/xSAUCE - $2.4 million

The V2 pools with the highest liquidity include:

- SAUCE/xSAUCE - $7.1 million

- HBARX/HBAR - $3.8 million

- SAUCE/HBAR - $2.9 million

- USDC/HBAR - $1.4 million

- USDC/USDC (HTS) - $0.8 million

These ten pools represent 42% of SaucerSwap’s TVL. However, with the addition of concentrated liquidity, the absolute number of TVL does not necessarily dictate the liquidity of a DEX. An additional way to measure liquidity is through price impact on swaps. As of writing, a $100,000 swap of HBAR (769,946 HBAR) to USDC has a price impact of -2.47%. As for SAUCE, a $100,000 swap of SAUCE (521,342 SAUCE) to USDC has a price impact of -2.78%.

The success of V2 can be further explained through SaucerSwap’s DEX volumes, broken down by V1 and V2 volumes. In every month except January, V2 volumes outperformed V1. In December, V2 volumes were over three times higher than V1. However, V2’s best month came in February, when it set a monthly high of $123.3 million in DEX volume.

By the end of February, 52% of the supply of SAUCE had been staked as xSAUCE. Moreover, the exchange rate between SAUCE and xSAUCE is 1.1362:1, and xSAUCE stakers are receiving an approximate APR of 3.6%.

SaucerSwap has seen a healthy increase in both transactions and active addresses in 2024. In 2024, there has been an average of 12,300 daily transactions and 1,600 daily active addresses. Respectively, this is a 235% (3,700 daily transactions) and 186% (600 daily active addresses) increase compared to Q4 of 2023.

Stablecoins

The only stablecoin that has been natively deployed on the Hedera Network is USDC. USDC has built on its strong Q4 and is up 35% YTD to a market cap of $8.3 million. Furthermore, a significant portion of this USDC is being used in Hedera’s DeFi ecosystem. $3.1 million USDC (37% of Hedera’s USDC supply) is deposited into SaucerSwap liquidity pools. Additionally, USDT and DAI have each been bridged to Hedera using Hashport. $282,200 USDT and $104,900 DAI have been deposited into SaucerSwap liquidity pools.

Liquid Staking

Liquid staking is not included in the TVL figure. Despite this, it remains a relevant metric with growing significance. Stader is the only provider of liquid staking on the Hedera network. Liquid staking TVL in HBAR peaked in Q1 2023 and has been on a gradual decline since. Declines in Liquid staking TVL have continued in 2024 and are down 25% YTD to 338.1 million HBAR. Furthermore, liquid staking as a % of total staked for rewards has been steadily decreasing in 2024, down 25% YTD to 4.5% of all HBAR staked for rewards.

Services

The token services category is not included in the TVL figure. DaVinciGraph went live in November 2023 and has seen a steady increase in usage of its locker product. DaVinciGraph reached an all-time high of $1.5 million TVL on Feb. 29, 2024, and as of writing, there are 262 active locks on DaVinciGraph.

Closing Summary

Over the past few years, DeFi has emerged as one of the core use cases for blockchain technology. For DeFi to work at scale, the underlying blockchain needs to be able to support fast and cheap transactions. Additionally, DeFi developers need a highly performant smart contract platform to create secure and decentralized applications. Hedera, through both its Hedera Network Services and Hashgraph Consensus Algorithm, is a perfect candidate for supporting a robust DeFi ecosystem.

Hedera has been developing a DeFi ecosystem throughout the bear market, and its ecosystem is off to a hot start in 2024. Spearheaded by SaucerSwap, the native DEX is hitting its stride and has hit ATH in many important metrics including SAUCE price ($0.21), TVL ($150 million), and average daily trading volume ($5 million). This success story can primarily attributed to the launch of SaucerSwap V2 in November, which introduced concentrated liquidity, important tokenomic changes, and more. Additionally, stablecoin supply on Hedera has been gradually increasing, with the supply of USDC reaching $8.3 million by the end of February.

Although Hedera’s DeFi ecosystem is off to a promising start in 2024, there are still improvements to be made. Most noticeably, the ecosystem lacks a preeminent lending protocol that can offer users leverage on any assets. Regardless, the progress made over the past year for Hedera’s DeFi ecosystem cannot be ignored, and the ecosystem looks to continue to grow entering the next stage of the crypto bull run.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Hedera Hashgraph, LLC. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

AJC is a Research Analyst at Messari for the Asset Intelligence team. His primary focus is on DeFi. Prior to joining Messari, AJC wrote an independent crypto blog. A recent university graduate, AJC majored in Finance and History.

Read more

Research Reports

Read more

Research Reports

About the author

AJC is a Research Analyst at Messari for the Asset Intelligence team. His primary focus is on DeFi. Prior to joining Messari, AJC wrote an independent crypto blog. A recent university graduate, AJC majored in Finance and History.