By Ty Young and Mason Nystrom

A buzzword you’ll likely hear more in 2021 is DeFi. DeFi is short for Decentralized Finance which refers to applications on public blockchains aiming to create financial services without centralized intermediaries. DeFi is a potential long-term, world-altering future where individuals can coordinate financial activities peer-to-peer at a global scale.

However, in its current state DeFi also doubles as a permissionless casino built on top of Ethereum. You’ve probably heard people talk about their insane DeFi gains from last year and epic "rug pulls" from "ape-ing" into dangerous contracts, but have no idea what DeFi is or where to start. You probably want a piece of the action on this new frontier, but also are unsure of the risks from entering this space blindly. Well, in this short report we explain DeFi like you’re five to prepare you for the wild west of DeFi.

What is DeFi?

Bitcoin started the decentralized revolution by providing individuals a fixed supply, non-sovereign digital store of value. However, a robust financial system requires more than a single asset. Users need services and products that enable them to put their capital to work. That's where DeFi comes in. DeFi represents the infrastructure, such as lending platforms and exchanges required to innovate upon the traditional financial systems.

DeFi stands for Decentralize Finance. So what does that mean? DeFi is a broad term for various financial applications that utilize cryptocurrency or blockchain technology to solve problems that exist within the traditional financial system.

Today, the financial system (composed of banks, financial institutions, etc) mostly consists of centralized database systems littered with rent-seeking middlemen, high fees, and hold-ups. With DeFi, closed financial systems can be transformed into an open financial economy based on open-source protocols that are more accessible, with fewer intermediaries, and more transparent. Since these new financial protocols utilize smart contracts, they are both programmable and interoperable (are built with similar technical standards that enable them to easily communicate with each other).

DeFi and Ethereum

Most of what is known as DeFi today lives as code upon blockchains, predominantly Ethereum. Ethereum is an open-source blockchain-based distributed computing platform for building decentralized applications. Ethereum sets itself apart from the Bitcoin platform in that it makes it easier to build other types of decentralized applications beyond simple transactions. Through programmability and interoperability, Ethereum enables new kinds of financial instruments and more customizable assets than existing products and services.

Like many public blockchains, Ethereum is a digital ledger that allows several entities to hold copies of its transactional history, meaning a single, central party does not control it. For example, the DTCC (Depository Trust and Clearing Corporation) acts as the central clearinghouse for financial securities in the traditional financial system (i.e. stocks, bonds, etc). Whereas the Ethereum blockchain acts as the decentralized clearinghouse for transactions involving tokens and smart contracts. Ethereum currently settles billions in transactions every day without requiring a corporation like the DTCC to ensure a transaction is completed. That’s important because centralized systems and human gatekeepers often limit the settlement times of transactions while offering users less direct control over their money with higher fees.

Source: Ryan Watkins

Is DeFi Useful?

DeFi applications are useful because they allow anyone in the world access to financial services provisioned upon public blockchains which eliminate intermediaries and high barriers to entry. Approximately, 1.7 billion people are unbanked, while two-thirds of those people without bank accounts own a smartphone. DeFi has the potential to open up necessary financial services including the ability to borrow funds, take out loans, deposit funds into a savings account, or trade complex financial products, all without asking anyone for permission or opening an account anywhere.

It’s hard to appreciate the importance of access to the financial system from the developed world. A citizen of the U.S. can easily open a bank account by walking into any JP Morgan Chase bank branch with a government-issued identity, gain access to a mortgage, or purchase wealth-generating and preserving financial instruments like stocks or bonds. But, imagine you possess none of those or that access is limited based on your local geography, gender, education, government, or some other uncontrollable situation. These situations often limit capital formation for individuals and businesses since entrepreneurs are unable to get affordable access to capital. With DeFi, anyone can access these fundamental financial services required for economic development.

Examples of DeFi applications today?

Some examples of DeFi applications include lending and borrowing, spot trading, derivatives trading, stablecoins, asset management, prediction markets, and synthetic asset creation.

As the DeFi sector continues to grow, Messari has developed a definition for how we define decentralized financial assets. In order for a token to constitute "DeFi" it must satisfy the following requirements:

- Financial use case: the protocol must be explicitly geared towards financial applications such as credit markets, token exchanges, derivative/synthetic asset issuance or exchange, asset management, or prediction markets.

- Permissionless: the code is open-source allowing any party to use it or build on top of it without going through a third-party

- Pseudonymous: Users do not need to reveal their identity

- Non-custodial: Assets are not custodied by a single third-party

- Decentralized governance: Upgrade decisions and administrative privileges are not held by a single entity or at least a credible path exists towards removing them

Below is a breakdown of each of these financial use cases and an example of an existing crypto application.

Lending and Borrowing

DeFi protocols give users the ability to borrow and lend their assets. All DeFi lending today is currently over-collateralized, meaning users must post collateral in excess of the number of assets they borrow. The dynamic is similar to a mortgage where individuals pledge their house as collateral and receive a loan against it. Using DeFi protocols users can post a variety of assets as collateral and borrow other cryptoassets against them including stablecoins. When a borrower's collateral value drops below a specified loan-to-value ratio, their collateral will be liquidated to ensure the protocol stays solvent.

Notable examples of crypto lending and borrowing platforms: Maker, Aave, Compound.

Decentralized exchanges

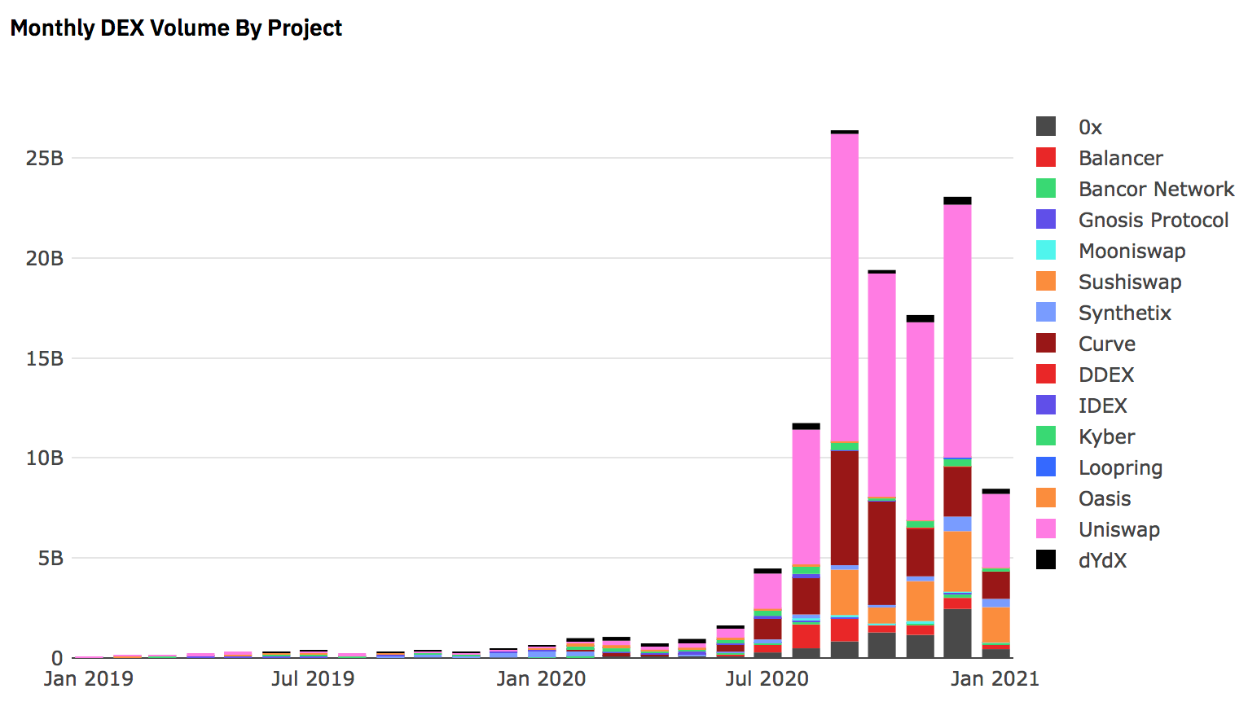

Decentralized exchanges (DEXs) are peer-to-peer marketplaces that allow direct cryptocurrency exchanges between two interested parties. DEXs aim to solve problems that are inherent in centralized exchanges such as centralized custody of assets, geographic restrictions, and asset selection. The most popular DEXs today utilize automated market making systems rather than a traditional order-book. Instead of matching individual buy and sell orders, users can deposit assets into a pool that is then traded against, with the price determined based on the ratio between the assets in the pool. Such DEXs allow users to passively provide liquidity to make markets for any asset on Ethereum as well as provide always available liquidity for traders.

Notable Decentralized Exchanges: Uniswap, 1inch, Sushiswap, Curve, Kyber, 0x.

Stablecoins

Stablecoins are cryptocurrencies that aim to be price stable with another asset. These assets can be pegged to fiat currencies such as the United States dollar, other cryptocurrencies, or precious metals. The primary benefit of these assets is price stability (duh), which is important because most cryptocurrencies are extremely volatile, making them difficult to use for transactions. The most popular stablecoins by far are price-stable with the US dollar and there are generally three types of stablecoin implementations: fiat-collateralized (each stablecoin is backed by a fiat currency in a bank account), crypto-collateralized (each stablecoin is backed by cryptocurrencies in a smart contract), and algorithmic (each stablecoin is backed by an incentivized system that ensures the price stabilizes at its target). Beyond price stability, stablecoins offer a borderless payments system that is faster, cheaper, and more secure than traditional networks like SWIFT.

Notable stable coins: DAI, USDT, USDC

Synthetic assets

Synthetic assets are financial instruments that simulate the value of another asset. There are many ways this value simulation is achieved; however, it is generally achieved through the use of price oracles which ensure the asset tracks its target value. There are limitless possibilities to the types of synthetic assets that can be created using crypto assets and the existence of these assets on public blockchains like Ethereum means more open access for investors worldwide. Prior to the creation of assets, only a select few had access and permission to global financial markets. Synthetic assets could provide value for investors such as more diversified capital allocation, hedging opportunities against risk, and tools to increase the return on investments.

Notable synthetic asset platforms: Synthetix, UMA.

Derivatives

Options, Futures, and Perpetual Contracts

The traditional finance definition of a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the “underlying.” Although traction has still been limited so far relative to other DeFi protocols like lending, exchange, and stablecoins, volumes on derivative exchanges have increased tenfold over the course of 2020. Platforms like Synthetix, Yearn Finance, and Hegic have helped give validity to DeFi derivatives DEXs.

Notable Options and Futures exchange platforms: Hegic, Opyn, Synthetix, Perpetual Protocol, Futureswap, Alpha Homora

Prediction markets

Prediction markets are platforms created to trade the outcome of events such as games, elections, etc. The market prices can indicate what the crowd thinks the probability of the event is. The main difference between decentralized prediction markets and centralized prediction markets is that the former are built on public blockchains, meaning that no single authority controls them. This makes these networks more flexible and secure, cheaper, more open, non-custodial, and censorship-resistant. and it gives them several other advantages. Some of these advantages include fees tend to be minimal while trending toward zero over time, anyone can trade and create markets on any outcome, and participants do not need to trust anyone to custody their funds, and decentralized prediction markets are more resistant to censorship and corruption. To date prediction markets have gained the least traction of the above DeFi protocols.

Notable Decentralized Prediction Markets: Augur, Gnosis, Polymarket.

Institutional Interest in DeFi

2020 was recognized (within the crypto community) as the year the institutions began buying Bitcoin, and there are early signs that Ethereum will receive additional interest with the launch of Ether futures from the CME in early 2021.

These signs could show institutions are walking a path that starts with Bitcoin, leads to Ethereum, and eventually warming up to DeFi. Don’t just take my word for it, a recent example could be from The Block's Developing a Digital Asset Strategy panel. During the panel, the Head of Morgan Stanley’s digital asset markets division stated, "I would say an evolution of this current momentum in terms of significant interest in [DeFi] will continue through 2021" and "I think some of the technology from this DeFi phase will certainly be utilized in some more regulated way throughout 2021 towards 2022." While DeFi is a growing industry in crypto, these are positive comments and signs of a market maturing.

Perhaps equally important, unlike Bitcoin and Ethereum, which are hard to analyze using traditional financial models, many DeFi tokens can be considered capital assets, which allows us to frame discussions about these assets’ worth using traditional valuation methods. This would allow investors to create Discounted Cash Flow Analyses, Comparable Company Analyses, and Comparable Transactions Analyses to value these assets. As familiar frameworks gain traction and valuation standards coalesce, DeFi assets will gain greater appeal from financial institutions and investors.

Potential future for DeFi in 2021

2021 is setting up to be a massive year for DeFi. With institutions diving into Bitcoin in 2020 and at most 1.2 million DeFi users, the sector may be poised for a breakthrough. While the number of DeFi users has been limited by the risks and complexity of interacting with DeFi, both issues will continue to be addressed in 2021. As more capital, developers, and users enter DeFi, the challenges of using decentralized financial protocols should decline. Better user interfaces in DeFi aggregators and better user education in DeFi will enable broader participation and exponential user growth in DeFi.

Final Thoughts on DeFi

Although these new financial protocols are experimental and aren’t without their issues, DeFi is building exciting applications with real-world use cases that have the potential to democratize finance. While institutions currently have only looked into Bitcoin and Ethereum, they will gradually become educated onDeFi protocols and hopefully, use them to create a more open and transparent financial system. A decentralized financial system will reduce fees and enhance existing inefficiencies, but more importantly, it will provide access to financial services to millions of individuals who are currently underserved.

Useful DeFi Resources

Every DeFi analyst or investor relies on a variety of tools to stay up to date on the DeFi ecosystem, assets, and overall crypto market. Our team has previously written about the most important tools for every crypto analyst.

The Messari DeFi Screener is in our (not so humble) opinion a necessity for every DeFi analyst, investor, or crypto enthusiast. The screener uses our DeFi methodology to provide the most accurate representation of the DeFi ecosystem.

Learn more about DeFi by reading one of our quarterly reviews.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Mason was a Senior Research Analyst at Messari focused on Web3 protocols and cryptoassets. Before Messari, Mason worked at ConsenSys as a Content Marketer focused on marketing strategy. Mason obtained his Master’s in Business Management at Hong Kong Baptist University.

Read more

Research Reports

Read more

Research Reports

About the authors

Mason was a Senior Research Analyst at Messari focused on Web3 protocols and cryptoassets. Before Messari, Mason worked at ConsenSys as a Content Marketer focused on marketing strategy. Mason obtained his Master’s in Business Management at Hong Kong Baptist University.