DEX Education: Uniswap, Optimistic Rollups, and the Layer-2 DEX landscape

Dec 14, 2021 ⋅ 12 min read

The following report was written by Messari Hub Analyst(s) and commissioned by the Uniswap Grants Program, a member of Messari Hub. For additional information, please see the disclaimers following the article

Ethereum has a gas problem. And whilst this may be less consequential at the depths that the largest ETH whales swim, for the everyday DeFi user and for those new to crypto, the smell is becoming unbearable. Thus, understandably, there has been much anticipation and hype around optimistic rollups and Layer-2 scaling solutions (L2). Optimistic Ethereum (OΞ), backed by a16z, was soft launched in January 2021. Arbitrum, from Offchain Labs, launched its flagship chain Arbitrum One in beta on Mainnet in May. Decentralized Exchanges (DEXs) have been flocking across in varying degrees on both platforms, including Uniswap, the largest on Ethereum Mainnet. With a few months of activity now behind us, we can assess its relative adoption across the two L2s and within the overall DEX landscape.

On A Roll

A look at the largest DEXs on the L2s shows some familiar names to Mainnet users and total value locked (TVL) in smart contracts on both platforms have seen healthy growth since launch. DEXs on Arbitrum have enjoyed more initial traction - there are 12 exchanges currently deployed on the L2, with 7 already over $50m TVL (Curve & SushiSwap have been leading the pack in terms of TVL). Only 3 DEXs were on OΞ at the time of writing, with Uniswap being the largest on the network. OΞ has opted for a slow-roll whitelisting for launch, which has meant slower adoption by other exchanges thus far.

It is worth noting that the picture is slightly different outside of spot markets, where derivatives protocol Synthetix has the highest TVL of the protocols on OΞ by some margin (~$250m), having deployed its beta early on with the soft launch of Optimism in January 2021. Along with the growth of options protocol Lyra (~$30m), the derivatives ecosystem on OΞ appears to have taken in more liquidity than spot exchanges for the moment.

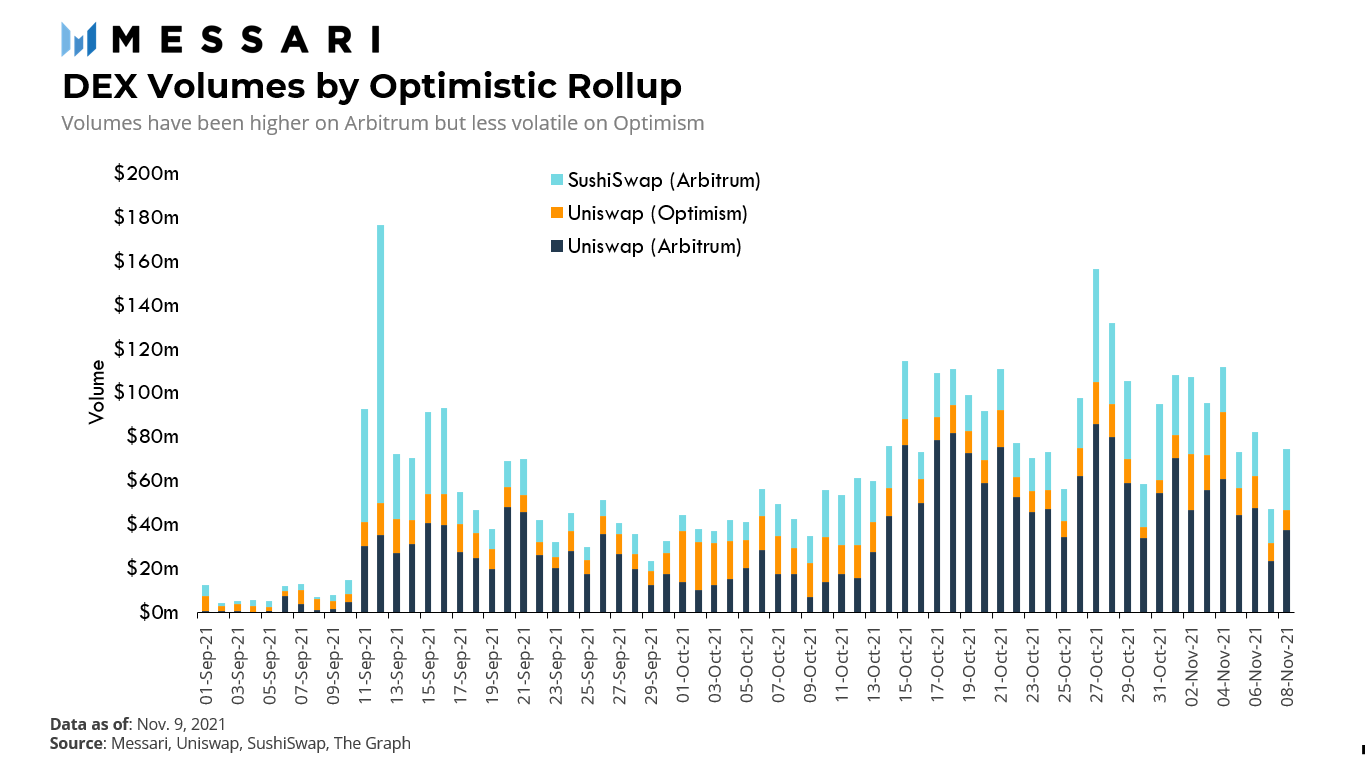

Comparing volumes on Uniswap and SushiSwap, the data also points to more adoption on Arbitrum in recent months. Yet despite Sushi’s higher TVL on Arbitrum, Uniswap V3 has seen higher volumes on the L2 partially due to Uniswap’s greater capital efficiency. Additionally, when comparing Uniswap volumes across both platforms, trading volumes on OΞ have been less volatile - whilst Uniswap on Optimism captured less of the surges in daily activity during mid September and the end of October, volumes have been steadier.

A look at the number of transactions paints a slightly different picture to the volume and TVL data, with Uniswap on Optimism having a higher number in recent months - the higher dollar volume on Arbitrum is driven by fewer trades of larger size. Although across all metrics both L2s still have some way to go before surpassing mainnet levels.

DEX on Fire

Comparing Uniswap’s market share of volume highlights how much more competition the DEX has seen on Arbitrum - market share on the L2 has been lower than it has enjoyed on Mainnet. Despite Uniswap still having the majority of volume on Arbitrum over this measurement period, SushiSwap has been a bigger competitor on the L2 than it is on Mainnet. Its dominance on OΞ is likely through its early adoption of the network and this will likely waine as more DEXs move to Optimism.

There are also notable differences in capital efficiency of DEXs across L2s - on Mainnet, Uniswap V3 has supported significantly larger volumes with less TVL than SushiSwap and Curve. This characteristic has translated to its L2 implementations, which have also been more capital efficient than other DEXs on L2s. Uniswap on Arbitrum has managed a 50% increase in efficiency over layer-1, although Uniswap OΞ currently turns over its TVL at a lower rate than on Mainnet.

When breaking down capital efficiency of Uniswap V3 across networks, concentration is significantly higher on the L2s given the lower number of pools relative to Mainnet. Over 80% of the turnover on Arbitrum was from the ETH/USDC (0.05%) pool, which had 30% of the DEX’s TVL on the network and has turnover (volume / TVL) persistently above 150%. Uniswap OΞ’s most efficient pool has been ETH/USDT (0.05%), however only ~5% of the DEX’s TVL on Optimism has been in the pool. The biggest Uniswap pools on Mainnet have had higher turnover but represent smaller proportions of overall TVL, as liquidity is more diversified across multiple pools than on the L2s. The largest 5 pools make up only 32% of overall TVL on Mainnet, compared with 85% and 80% on Optimism and Arbitrum respectively.

A driver for the difference in TVLs between L2s could be the lack of projects currently on boarded to OΞ. Despite being the largest traditional DEX on the network, Uniswap has 9 tokens with liquidity available on OΞ - this is half the number they have on Arbitrum and a quarter of the number that can be traded on Arbitrum via SushiSwap. Though there has always been differences in listing standards between the two DEXs on Mainnet, with Sushi consistently having a larger number of tokens available (~330 vs ~250), it would appear that Uniswap on OΞ has yet to reach a critical mass of token listings to begin attracting the same number of users as on Arbitrum. More projects deploying on Optimism will facilitate this.

As would be expected, Uniswap OΞ only currently has the largest tokens available - the median market cap of tokens traded on OΞ is still ~$10.5bn. This is higher compared to both Uniswap and SushiSwap on Arbitrum (~$840mn / ~$610mn respectively) and significantly greater than the median market cap of tokens traded on both DEXs on Mainnet (~$230mn / ~$60mn).

Kiss, Marry, Kill

Though there are potential network effects for an exchange to deploy across Mainnet and both L2s, Uniswap is one of the few larger DEXs to be on both the optimistic rollups (HOP Protocol, a rollup-to-rollup token bridge, is the only other at the time of writing and not strictly comparable). Even though Uniswap’s TVL experienced a faster start on OΞ given the L2’s earlier launch, its proportion across the two has settled at around 60/40 in favour of Arbitrum (TVLs for HOP across the two platforms show a remarkably similar picture).

When comparing the USD value per transaction of Uniswap across networks, we see evidence that the L2s have enabled smaller players to interact with Uniswap. Trades on Uniswap OΞ have been smaller, with the average trade size around $20 compared with $200 on Mainnet. After an initial ramping up period, trade size on Arbitrum settled below Mainnet but the median day was significantly higher than on Optimism at $160. Time will tell whether the L2s will converge or whether this is indicative of different user bases between the two scaling solutions.

Comparing the top ten Uniswap pools that are available across both L2s, there are noticeable differences in TVL stability. When focusing on the days in which liquidity is withdrawn from the pools, Arbitrum LPs saw the highest average percentage TVL decline in all but one case. This is not directly related to pool size and suggests less stable liquidity deposited on Uniswap Arbitrum pools relative to OΞ. In many cases, the average decline day on Arbitrum saw over 10% of TVL leave these pools, compared to Optimism where the majority of the same pools averaged less than 5% of outflow on days TVL declined. In 3 pools, this metric was even lower on OΞ than on Mainnet, indicating more dedicated market makers at this point in time.

When assessing volumes and TVL by token type, Uniswap on OΞ has a much higher percentage in Stablecoins (over 50% on both metrics), whereas on Arbitrum, ETH has been the most popular (50% of volume, 40% of TVL). Other tokens (besides ETH and Stablecoins) have seen similar popularity on both L2s (~7% of volume and ~25% of TVL), whereas Mainnet has had much higher activity in these categories (20% of volume, 35% of TVL).

Uniswap V3’s defining feature is concentrated liquidity - the ability to allocate liquidity provision within ranges on the price curve, with the additional flexibility for liquidity providers to select between fee tiers. In higher fee tiers, liquidity may be less likely to get utilised, but profit potential is higher. Comparing the TVL across Uniswap pools' fee tiers, Uniswap on Arbitrum have a significantly larger proportion of their TVL in higher fee tiers (0.3% and 1%) than on Ethereum mainnet or Optimism. Higher fee tiers are generally for token pairs with less stable price ratios, indicating more market making in exotic pools on Arbitrum, such as ETH/GMX (1%) in which 33% of Uniswap’s TVL on the network has been allocated to.

The most immediate benefit of L2s is the reduced transaction costs and sampling trades from Uniswap pools suggest that gas fees have been significantly lower on Optimism than on Ethereum Mainnet. Analysing transactions from one of the largest pools on Uniswap OΞ (DAI / ETH), the average gas fees for the swap have been between 3% and 4% of their costs in the equivalent Uniswap pool on Ethereum Layer-1. The intraday patterns in the pool's transaction costs have been similar on the L2 as on Mainnet, with lower transaction costs during the morning hours relative to PM (UTC).

Outages

Rollup technology is still relatively new and rollouts have not been unaffected by the jump in activity, with Arbitrum One experiencing downtime for around 45 minutes on September 14th, 2021 caused by a bug when receiving a large burst of transactions. OΞ has also gone through a temporary outage, with L2 transactions halted on November 19th, 2021 for over an hour. No funds were at risk during either episode but new transactions were not possible during these periods.

Though these haven't dramatically impacted volumes or appetite to provide liquidity on either L2, it is a reminder of the improvements still being made and potential diversification benefits for users in spreading risk across different scaling solutions.

Roadmap

A key distinction between side chains and true Layer-2 solutions, is that L2s rely on the main chain for security. Both Optimism and Arbitrum enjoy the benefit of Ethereum’s security as well as being EVM compatible, an attraction for developers over moving their projects to other Layer-1s. OΞ’s largest update to date was scheduled for November 11th 2021, which involved extending the rollup’s EVM compatibility to EVM equivalence. The main practical implications are that Ethereum Mainnet projects can deploy on Optimistic Ethereum with no modifications to their code, whereas EVM compatibility often still requires modifications or complete implementations of lower-level code. Successful rollout could improve fortunes for OΞ going forward - though it has yet to come through in the data so far. While TVL on Uniswap Arbitrum continued to increase through the second half of November, it has declined on OΞ following the completion of the update. Arbitrum volumes since November 11th have already matched the entire month of October at $1.4bn while on Optimism, the Uniswap has seen just over $200mn - around half of October’s volume. However it is still early days following the network upgrade and with projects such as Synthetix doubling down on their commitment to OΞ, it is clear that the network is here to stay for the intermediate term.

What’s notable about the traction of both Optimism and Arbitrum is the lack of incentive programs. Particularly during times when multiple competing ecosystems have announced large, aggressive incentive funds and partnerships. A few of which have proved to be quite successful in attracting users, liquidity, and blue-chip DeFi protocols. What drives these incentive funds is the elephant in the room regarding both Optimism and Arbitrum - the native token. Currently, both Optimism and Arbitrum have not announced any plans for a token. And without speculation on whether there will be or not be, the fact remains that each rollup has a card in its hand that’s already been played by many of the competing ecosystems. The optionality of this event - even the rumor - has already spurred additional adoption of both Optimism and Arbitrum.

As competition heats up with other scaling solutions coming online (such as zk rollups), it will be interesting to compare the success of Optimism’s slow and steady approach to the more direct and aggressive method taken by others.

Conclusion

The DEX landscape on L2s is beginning to take shape, with many of the larger projects planting their flags on their chosen approach to scaling solutions. Despite pioneering optimistic rollups on Ethereum and being first to market, Optimism has seen less uptake from DEXs thus far compared with Arbitrum and has lower adoption when comparing activity on Uniswap, which is on both L2s. The slower, white-listed rollout of OΞ has limited the growth of DEXs on the rollup thus far compared to Arbitrum and also other L1s. Once more capital flows to Optimism we will see if Uniswap can maintain its dominance on the network or if it will see the increased competition that it has on Arbitrum.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in