An Introduction to Dfinity and the Internet Computer

May 10, 2021 ⋅ 34 min read

This report has been unlocked for all Messari users. Sign up for our industry-leading data, tools, and research with Messari Pro or upgrade to our most powerful tools including monitoring of more than 150 networks with Messari Enterprise.

Dfinity is one of the most tenured and well-funded smart contract platforms in crypto. Yet it is also one of the least understood. Most of Dfinity’s obscurity is due to its technical complexity and abstract vision. The launch of their token and finally open sourcing their code will create more interest and understanding in the project.

We’ve seen blockchain technology, such as Ethereum’s “world computer” aspirations, applied to tackle traditional finance and analog collectibles. However, Dfinity is trying to tackle the issues related to traditional internet. Most content, functionality, and user data exist in proprietary ecosystems controlled by big-tech companies. Dfinity’s answer, the Internet Computer, is a reimagining of the IT stack where developers can build and host software free from the big-tech monopolies that control user data today.

Dfinity and the Internet Computer

Since 2016, Dfinity has been focused on building the “Internet Computer”, a decentralized blockchain network that aims to expand the functionality of the internet. The problem Dfinity is addressing extends beyond just blockchain technology. It aims to build a decentralized, scalable cloud-like platform that can store data, perform computation, and support community-driven governance. It’s addressing the issues plaguing traditional internet, such as relatively low data security and an oligopoly consisting of big tech companies.

Crypto natives might immediately think of Ethereum’s “world computer” or Polkadot’s “meta-protocol” when they think about analogies to the Internet Computer. However, Dfinity intends to redefine what a blockchain is supposed to do. While Dfinity’s first iteration looked similar to ETH 2.0, its scope now extends beyond Ethereum’s base capabilities. Dfinity wants the internet itself to support software applications and data, rather than simply providing peer-to-peer connections and relying on proprietary cloud-hosting services to handle the rest.

The Internet Computer (IC) is less about building an immutable ledger and more about building an open-access internet. The internet connects billions of people through TCP/IP protocols. The Internet Computer Protocol (ICP) aims to take this concept one step further by offering a public compute platform so that developers, enterprises, and government agencies can deploy software and services directly to the public internet. Like Ethereum, this platform would allow developers to run computing applications on decentralized infrastructure. Unlike Ethereum, the IC intends to offer companies the efficiency to run these applications at scale and the flexibility to build them to fit a particular user base’s specific needs (e.g. privacy).

In the current internet landscape, big-tech firms control user-created content and data. The algorithms and systems behind these platforms are proprietary. Big-tech platforms like Twitter and Google have a great deal of control over how users interact with each other and also how they interact with third-party services outside the platform.

Founder Dominic Williams cited that the internet has become much more monopolistic and corporate. Tech monoliths such as Facebook or Amazon Web Services (AWS) can change platform parameters and access without prior notice, putting users and companies that rely on these services at a heightened risk. Zygna, a social games company, was disenfranchised when Facebook changed its rules. Fortnite has been delisted from Google and Apple's App Store after refusing to pay the 30% revenue share. Twitter restricted the use of its API in 2012, crippling the development of third-party clients and limiting the possible uses of data from its network among non-partner entities. LinkedIn did the same in 2015.

Limiting access to third-party developers could stall innovation as entrepreneurs face a degree of 'platform risk'. In response, the IC hopes to bring a new generation of software and services that is open-sourced. It aims to not only reduce platform risk but also reduce complexity in building and maintaining systems. This would also accelerate the time it takes developers to launch a new product. Executed correctly, Dfinity hopes to offer the first blockchain that runs at web speed and can scale to support any volume of smart contract computations and any amount of data.

This new IT stack will have more hardware requirements. The IC will rely more on large data centers and high-end node machines (validators) compared to networks like Ethereum. But its advantages could lead to entirely new, more accessible, and less data extractive use cases. These applications could include interoperability, privacy, security, and openness. Use cases include social media, private messaging, search, storage, and peer-to-peer internet interactions. If the IC succeeds at replacing legacy IT, there would be no need for centralized DNS services, anti-virus, firewalls, database systems, cloud services, and VPNs either.

To summarize Dfinity’s new offering for developers who want an alternative, the benefits of starting to build on the internet include:

- Setup Cost: Developers don’t have to sign up for numerous vendors.

- Operating Cost: A secure protocol means that the operating cost of maintaining safety and dealing with complexity goes down.

- Development: Dfinity proposes that the Internet Computer reimagines software itself, simplifying the process of building and maintaining systems. This leaves more time to focus on user experience

- Openness: The IC introduces an open software that guarantees access to functionality through APIs to other services

History of Dfinity

Similar to how Polkadot’s network is built by Parity and the Web3 Foundation, the Internet Computer is built by the Dfinity Foundation. The non-profit organization was founded in 2016 by tech entrepreneur Dominic Williams who now serves as Dfinity’s Chief Scientist. The Internet Computer is the culmination of five years of research and development by top cryptographers and experts in distributed systems and programming languages. Dfinity currently has nearly 100,000 academic citations and 200 patents.

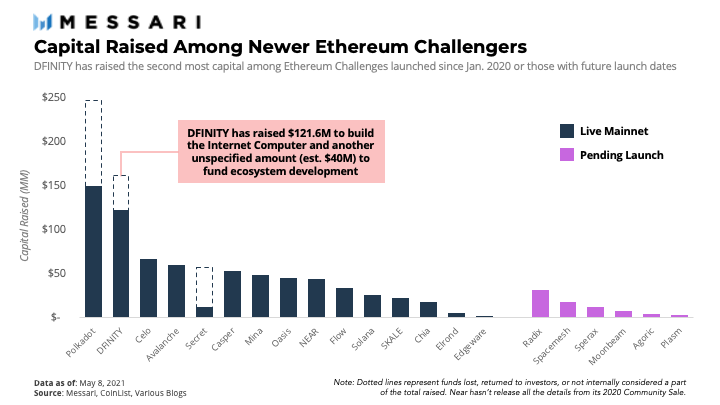

Dfinity is one of crypto’s most well-funded and publicized projects. Mainnet launches on May 7, 2021 and its token is slated to publicly launch on May 10. The project actually started fundraising before the ICO boom under the ticker $DFN but has since rebranded to $ICP. After Polkadot, Dfinity has raised the most capital. It has also raised the most non-frozen funds at $160 million to date:

There have been several conflicting versions of Dfinity’s fundraising rounds in the media. According to Dfinity, they had three main rounds and one airdrop event:

- Seed Round, Feb-2017: This round was advertised by a tweet and open to the public by downloading a web extension. Dfinity raised CHF3.9 million (US$3.9 million) from 370 participants, at a valuation of $16 million, or a price of $0.03 per token. It held a portion of these funds in ETH and BTC during the 2017 crypto bull run. According to the team, Dfinity at one point turned these earlier ETH and BTC allocations into $40 million worth of fiat.

Dfinity had promised these Seed investors that the subsequent round would be a CHF 20 million main fundraising event, similar to an ICO. However, after the 2017 boom, the project realized its valuation target was set too low. Furthermore, Dfinity cited that it didn’t have any immediate funding shortfalls, and running an ICO fundraise could have placed it in a grey legal territory where securities law was concerned. As a tradeoff, to reward early participants, the team promised that the Seed investors would be awarded 24.72% of tokens at genesis. - Strategic Round, Jan-2018: Dfinity raised $20.54 million for 7.00% of the initial supply (the number has been revised from the previously cited 6.84%). This allocation will vest monthly over three years starting from mainnet launch (May 2021). Participants include Polychain Capital, Andreessen Horowitz, CoinFund, Multicoin Capital, and Greycroft Partners. This round marks the first token a16z invested in. Polychain and Dfinity later collaborated to create the “DFINITY Ecosystem Venture Fund” of an undisclosed size. The goal is to fund new projects that would grow the IC’s application ecosystem. The media reported that Dfinity raised a much larger amount of $61 million. It’s possible that this enlarged amount has either been revised or included funds for the Ecosystem Venture Fund.

- Private Sale, Aug-2018: 110 participants contributed $97 million for 4.96% of the initial supply, sold at $4 per ICP token. This number has been revised from 4.75% previously reported. This allocation came with a monthly vesting schedule of one year from mainnet launch. Vesting will begin at the initial token distribution event on May 10, 2021. Participants in this round include Andreessen Horowitz, Polychain Capital, SV Angel, Aspect Ventures, Electric Capital, ZeroEx, Scalar Capital, and Multicoin Capital.

- AirDrop, May-2018: $35 million worth of ICP tokens (formerly DFN), or 0.80% of the initial supply, was airdropped to early supporters by being part of their mailing list, forums, slack, and community. At this time, valuations reached $1.89 billion. Airdrop participants received the IOU version of their ICP tokens in September 2020. These tokens will become transferable on May 10, 2021.

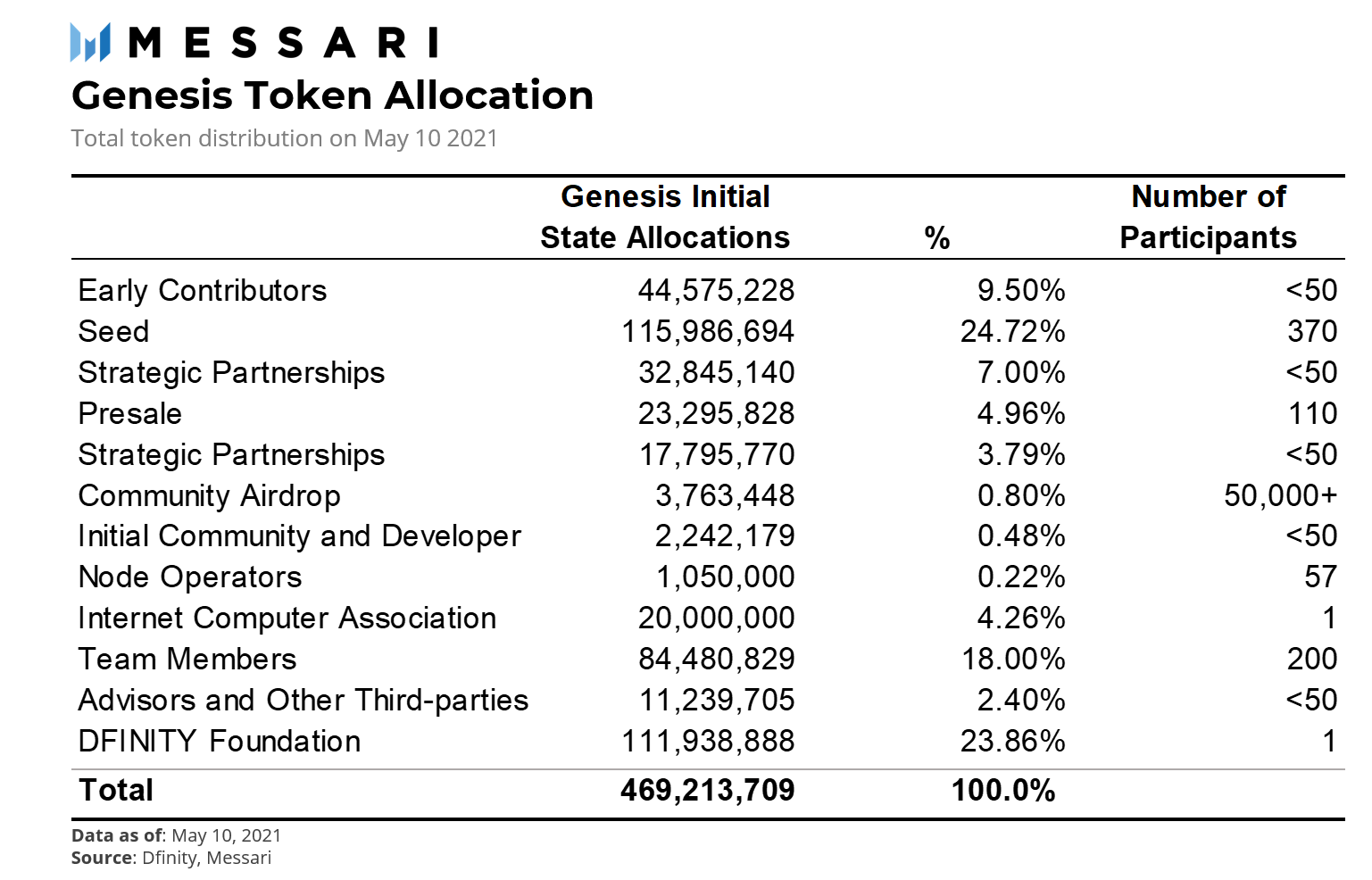

There will be 469,213,710 ICP tokens at genesis and the token supply will be distributed as follows. The table below summarizes the round, which can also be found in our spreadsheet here.

- 24.72% Seed Investors: those who invested in Feb-2017 for a total of CHF3.9 million (Swiss Francs)

- 23.9% Dfinity Foundation: The Dfinity Foundation manages the capital raised from the token sales. It also oversees its Foundation Endowment of ICP tokens. These tokens are those held by or already spent by the Foundation to fund R&D, operations, acquire technology, finance community-building programs, and partner incentives.

- 18.0% Team Members: There are ~200 team members

- 9.5% Early Contributors: these are the 50 people who helped in the team before the Foundation was set up

- 7.0% Strategic Investors: from the $20.54 million raise from Polychain Capital, Andreessen Horowitz, CoinFund, Multicoin Capital, and Greycroft Partners

- 4.96% Private Presale Investors: from the $97 million raised from a16z, Polychain, SV Angel, Aspect Ventures, Electric Capital, ZeroEx, Scalar Capital, and Multicoin Capital

Dfinity is growing its network of data centers and developers. At the time of launch, 12 independent data centers run 7 subnets with 68 nodes -- IC “nodes” are similar to ETH2 “validators.” The Foundation expects the number of IC data center and node operators to gradually grow post-launch to support the network’s ecosystem of apps (see below for details). The team targets for the network to reach 123 data centers running 4,300 nodes by the end of 2021. Dfinity hopes to eventually scale to thousands of data centers running millions of nodes in the future.

Team Background

Dfinity was founded in 2016 by Dominic Williams. The Dfinity Foundation has around 200 people on the core team. Notable contributors mentioned by the team and media include:

- Dominic Williams, Chief Scientist: Williams was a serial entrepreneur, having created a file storage service and children’s multiplayer online game involving a collection of monsters. Distributed computing was required to store the lists of monster fights and gold nugget rewards, connecting the games together. Williams also wanted to create a game coin and looked at Proof of Stake ideas, though the technology was still nascent. He went into full-time crypto research in 2014. Williams designed Internet Computer’s Threshold Relay.

- Jan Camenisch, VP of Head of Research & Crypto: Prior to joining Dfinity, Jan was at IBM Research, where he led the Privacy and Cryptography research team and was a member of the IBM Academy of Technology. He has published 130 papers and holds 140 patents.

- Johan Georg Granström, Director of Engineering: Granström came from Google, where he was a tech lead manager at YouTube.

- Andreas Rossberg, Researcher and Engineer: Rossberg was formerly at Google and spent time as the JavaScript language team lead at Chrome V8. He is also a co-creator of WebAssembly, a new type of code that can be run in modern web browsers, which is also used at Dfinity. He also created Internet Computer’s programming language Motoko.

- Benjamin Lynn, Engineer: Lynn is the “L” in BLS Signatures, which was introduced in a report in 2001 and has since become increasingly important in cryptography. One of Dfinity’s technological offerings is a secure randomness beacon, based on a threshold Verifiable Random Function (VRF). This means randomness that can be replicated, if under the same conditions. It’s a pseudo-random function that provides verifiable proof of its output’s correctness. BLS cryptography is used to generate randomness and achieve security, speed, and scale in public networks. Before that, Lynn was at Google and has a Ph.D. in Computer Science from Stanford University

- Timo Hanke, Principal Researcher: Hanke is a former mathematics and cryptography professor. He then joined CoinTerra in 2014, a manufacturer for Bitcoin mining ASICs and systems, where he served as Head of Research and later as CTO. Hanke has filed several patents on ASIC optimization for Bitcoin mining. He invented a method named AsicBoost that improves the cost and efficiency of Bitcoin mining by 20%.

- Mahnush Movahedi, Senior Researcher: Movahedi joined from Yale University where she worked on scalable and fault-tolerant distributed algorithms for consensus and secure multi-party computation, secret sharing, and interactive communication over noisy channels

Technology

The purpose of the Internet Computer is to extend the public internet, so it can also be the world’s compute platform. Dfinity has just publicly released the source code on May 10 2021. Before this, the technical and design information of the ICP and the cryptographic puzzle that makes the Internet Computer function was unknown. However, the public knew that the company and technology have also continued to evolve, with some methods discussed in the past years discarded and changed. Below, we summarize what Dfinity and its community have publicly shared:

The Internet Computer is a blockchain computer protocol, constructed from a hierarchy of building blocks. At the bottom of the pyramid are independent data centers around the world. They host ICP-specific node hardware, which communicates to achieve a consensus on what the state of the IC should be. A collection of nodes, which ensures decentralization, is called a subnet.

Subnets are likened to blockchains within the IC, the fundamental building blocks of the overall network. They are responsible for hosting a distinct subset of software canisters. A canister is a bundle of code that developers can create from any high-level programming language (like Rust or Dfinity’s own language Motoko) to form programs. Programs can include simple websites, decentralized applications, or even entire enterprise software. For example, an open version of Facebook would be hosted in millions of canisters. The state of these canisters is replicated in all of the nodes.

As canisters are computational units that consist of both code and data -- they can be analogous to an advanced Ethereum smart contract or a Windows operating system. For example, an operating system can make certain processes such as manipulating files and communicating with nearby devices. Similarly, the IC provides publicly specified APIs to canisters so that they can interact with each other, make payments, create and manage other canisters, manage permissions and get the system time. However, unlike an operating system, a canister is replicated over all nodes in a subnetwork.

For the IC to scale in a secure manner, add new features, or withstand unpredictable events such as natural disasters -- the number of and the composition of subnets can be adjusted. For example, new subnets can be added or split, nodes can be added, terminated, or moved. As a result, the IC needs to be able to decide how to evolve the protocol. To do this, the protocol has a Network Nervous System (NNS).

Network Nervous System

A subnet is created by the NNS, an open algorithmic governance system that oversees the network. As the name suggests, it’s the nervous system -- controlling all aspects of the network. Among other things, it can

- split and merge subnets to balance load across the overall network. For example, a subnet could have a dozen canisters and if the NNS splits the subnet, a portion of the canisters would stay with the original subnet while the rest would be hosted under the new subnet.

- upgrade the protocol and software used by node machines.

- combine different node machines from discrete data centers. This could be due to several factors, such as the requirements of the network, the desired security level, available capacity at data centers, and unpredictable hardware failures.

- configure economic parameters that control how much must be paid by users for compute capacity.

- protect the network from malicious actors.

The robustness of the subnets can be improved by adding new nodes to them over time. These nodes collaborate using the ICP blockchain computer protocols to replicate the data and computations pertaining to the software canisters that they host. The protocol can replace faulty or uncommunicative nodes with new ones, and can also revive entire subnets if too many of the nodes within have failed. This allows the ICP to seamlessly fix network bugs and update for new features.

The NNS has two important canisters: (1) a registry canister, which stores the configuration of the entire IC for everyone to see, and (2) a governance canister, which stores proposals and neurons, to determine who is allowed to participate in governance. We will cover more about this role under the Governance section below

Speed

At genesis, the IC will have a block rate of one block per second (bps), then move up to ~1,000bps by this year-end. According to Williams, there is theoretically no upper limit to blocks per second. This is difficult to comprehend from a traditional blockchain perspective but is achieved through Chain Key Technology (CKT).

CKT allows the IC to finalize transactions and update data in a couple of seconds. It consists of a set of cryptographic protocols that orchestrate the nodes, enabling the IC to have a single public key. This means any device can rapidly verify the authenticity of data on the IC. Chain Key Technology allows canisters (likened to an advanced smart contract) to all any canister hosted on any subnet (likened to a blockchain). This distributed model doesn’t use a hub, unlike Polkadot’s hub-and-spoke model. The IC hopes to bring service composability. In the open version of the Facebook example, and any other app would have permission to call “Open Facebook” for code or data such as games or photo filters.

The IC can host any number of canister smart contracts, meaning that data is fully on-chain. To overcome scaling issues, the ICP executes a potentially large number of canisters simultaneously. This means that the blockchain is sharded by default. However, sharded blockchains don’t communicate with each other in real-time.

Canisters can support requests for updates, which are limited by the blockchain’s throughput but should only take a couple of seconds. However, this is distinct from queries, which don’t persist changes and are discarded after they run. A canister can serve hundreds of queries concurrently. These are inexpensive and should complete in a few milliseconds, allowing users to have the user experience they’re familiar with on traditional internet.

For example, Dscvr.one is the IC’s version of Reddit. When a user browses the forum, customized views of the content would be delivered in their web browser by query calls, which run in milliseconds on a nearby node. However, if a user wants to write a post or tip an author, it would involve an update call, which takes a couple of seconds. In the future, this delay could be hidden by “optimistic execution” -- which first optimistically assumes the payment is valid and will work, and later can be contested and reversed.

Consensus

Given the ICP brings together different machines around the world, each machine (or replicas) must reach consensus on which inputs to include and in what sequence. This ensures that the system maintains a coherent state. Every software is executed and replicated by many node machines worldwide and the majority of the nodes together define the true state of the software. This means that outliers, or machines that report a tampered state, will not make a difference to the consensus.

Each subnet has a unique and permanent public verification key over its lifetime. The nodes in the subnet will need to be in agreement (by reaching a certain threshold) and collaborate to sign a message, so the subnet can create a signature on behalf of its canisters. While a sufficient number of nodes is required for this threshold to be reached, not all nodes need to agree -- leaving room for hardware malfunctions or malicious nodes.

Noninteractive Distributed Key Generation

On the IC, the set of nodes that run a subnet will evolve as nodes can join or exit their respective subnets. With nodes in flux, it means the group of threshold signers evolve over time, hindering the ability for nodes to register and distribute new public keys. As a solution, Dfinity introduced the Noninteractive Distributed Key Generation (NI-DKG) -- simplifying key management by always referencing the same subnet by a static public key.

NI-DKG provides proactive security. This key resharing protocol is ideal for an asynchronous environment -- enabling fast block times and unlimited scalability. Each of the old signers only need to broadcast a single message to new signers. To ensure security, many concepts are utilized -- including noninteractive zero-knowledge proofs and encryption with forward secrecy.

ICP Token Uses & Tokenomics

There are actually two native tokens that are involved -- ICP is the native governance token that is used to manage the network and Cycles is a stablecoin used to fuel computation.

ICP tokens can do three major functions -- two are inflationary while one is deflationary.

Facilitating Network Governance (Inflationary)

ICP tokens can be locked inside the NNS, the algorithmic protocol governance system that manages the network, to be used to create neurons, which can vote on proposals. A neuron locks a balance of ICP utility tokens and enables its owner to participate in network governance, thus earning voting rewards. Those rewards are also paid in ICP. Each month, the NNS tracks the proportion of votes a neuron participates in to pay a pro-rata share of the reward. To maximize participation and thus rewards, it’s possible for users to delegate votes to other trusted neurons.

Converting out of neurons to withdraw ICP isn’t instantaneous and takes a “dissolving” period. Users can set the duration of the dissolve delay. The longer the dissolve delay, the greater the neuron voting power and the greater the voting rewards. This is similar to Curve Finance, where longer (irreversible) lock-ups up to four years boost voting power to align stakeholders with the long-term success of the network. Dissolve delays can be increased but can’t be decreased. To start the unlock countdown, users can put the neuron into dissolve mode. Currently, to participate in voting, the dissolve delay must be set up between six months and eight years.

Another way for neurons to increase voting power and rewards is to grow older, measured by the time elapsed since it was last placed in dissolve mode. The 370 early token investors in the seed round, therefore, have a head start. They can choose to turn up the dial for a longer dissolve period to take advantage of the high pre-existing age, or they can dissolve their neurons to get their ICP tokens.

Rewarding Participation (Inflationary)

The network mints new ICP tokens to reward key players. Other than voting rewards for those participating in governance, “compute rewards” are given to those operating the node machines hosting the network. The NNS generates new ICP tokens to reward nodes that are run by data centers and neurons. This rewards scheme is inflationary to supply.

Production of Cycles for Compute (Deflationary)

ICP can be converted into Cycles as fuel for computation by canisters. The exchange rate of ICP-Cycles depends on external markets -- such that burning 1 SDR (an asset created by the IMF containing the USD, EUR, RMB, JPY, and GBP) will always create 1 trillion cycles. Terra also offers a SDR-based stablecoin called TerraSDR but ICP's burn mechanism is a novel stabilizing function. Software canisters must be charged with Cycles, which are burned during the process of computation or memory management. As the amount of computation on the network grows, the demand to burn Cycles increases, and thus more ICP is burned.

Unlike Ethereum, users aren’t paying the fees. Developers are pre-charging the canisters with Cycles for a certain amount of compute units. This user experience is similar to how the traditional internet works where developers would be the ones to pay AWS for cloud services. Therefore users don’t need to own ICP tokens to interact with hosted services or even know it’s running on a blockchain.

The burning of ICP tokens to convert to Cycles to power computation is deflationary. Essentially, data center and neuron owners exchange ICP tokens with canister owners and managers. Those canister owners and managers convert ICP to Cycles, and those Cycles fuel the canisters to enable them to run.

To avoid high gas fees, Cycles is a stablecoin to ensure that the cost of computation doesn’t fluctuate with the value of ICP. Firstly, the conversion mechanism of 1T cycles in exchange for 1 SDR worth of ICP. Secondly, if there’s a surplus of Cycles, users don’t need to convert their ICP and can first purchase the undervalued Cycles on the market, to be burned for fuel as computation. Eventually, when all the surplus Cycles are burned, the value will return to its peg. Only when the equilibrium is re-balanced will users again burn their ICP for Cycles. After iterations of algorithmic stablecoins and collateralized stablecoins, Dfinity offers a new method to produce a stable value.

To further keep gas fees low and scale infinitely, CKT is applied. The IC can -- with sufficient security and resilience -- replicate computation and data (that is not governance-related) across as few as seven node machines given they’re from seven independent data centers. Therefore, even though canister memory on the IC might be relatively expensive at $5 per GB per annum, the framework ensures the efficient application of that memory. This is relatively cheap if we compare it to other blockchains. As a comparison, a June 2017 report estimated that if a user tried to indefinitely store and send data on Ethereum, the cost would cost $4.7 million per GB. That said, blockchains like Ethereum are not specifically designed for storing large quantities of data, such as images, videos, and audio.

The use of Cycles extends to the application layer. Thus natural buyers for the ICP tokens include those who want to participate in network governance and developers who need to convert ICP into Cycles to pay for computation. Eventually, open internet services will be built from autonomous code that’s managed by open tokenized governance systems, which functions similarly to the NNS. Also, every canister can create its own token if it wishes, hold any amount, and send tokens to other canisters as part of function calls (queries or updates). The intention is that each internet service would have its own governance token, used for voting and potentially receive a distribution of the value created by the autonomous system. Each governance system would have its own decentralized financial exchange with a governance token that can be traded for Cycles.

ICP Token Supply

When Dfinity Foundation was first formed, 9.5% of tokens were was distributed to early contributors while the rest remained. On May 10, in a final decentralization step, a “Genesis Unlock” proposal will trigger the NNS to release the ICP utility tokens. This means thousands of token holders will create "voting neurons'' that control the NNS and thus the entire network.

While the unlocking schedule is publicly known for strategic investors and private sales, the number of tokens unlocked from the Internet Computer Association, team members, advisors, early contributors, and the Foundation is unknown.

Due to the governance mechanism and rewards for participation, it’s likely that a majority of tokens will be locked. The amount locked will depend on two factors:

Governance and Rewards

The ecosystem will find a natural balance of how many rewards are required to achieve an optimum amount of participation. Assuming that Dfinity wants 90% of the token supply to be locked in neurons, rewards should be sufficient to meet this target. For a fixed amount of rewards, fewer participants mean more rewards-per-participant, which should invite more participation (and thus locking of ICP tokens).

Initially, rewards will need to be much higher as risks and uncertainty surrounding the network are greater. However, as the network stabilizes, rewards can fall over time to reflect lower risks. Based on estimates of the required returns as a percentage of the current supply, Dfinity will begin by distributing 10% of supply each year, with the amount reducing to 5% in eight years to reflect lower risk and thus required rewards.

Curve Finance has a similar mechanism, with a maximum lockup period of four years. As of the time of writing, 49.5% of all circulating CRV is vote-locked for an average of 3.7 years. If ICP were to follow that benchmark, we can expect half of circulating tokens to be vote-locked for nearly eight years.

Pre-Payment

ICP is required to pre-charge canisters with Cycles to enable them to function for a certain amount of computing. This is similar to Filecoin, where clients lock up sufficient funds to cover the full cost of the storage agreement.

Based on the IOU markets at FTX the token price is at $180. At FTX’s ICP-PERP price, the circulating market cap is $22 billion while the fully diluted market cap is $85 billion. This is lower than the prices reached last week on Hoo and MXC in the range of $350 to $530 in the past days. The public’s anticipation of the launch of the IC has pushed IOU prices to all-time highs of up to 30x at the peak so far this year.

This would rank ICP at sixth place by fully diluted market cap. Major exchanges are paying attention. On May 4, 2021, Coinbase Pro announced it would list ICP at launch. Huobi, FTX will also be launching ICP. Very likely, all the major exchanges will follow.

Going forward, ICP has an undefined supply schedule because there are deflationary and inflationary pressures. Deflationary pressures will depend on the computation being contributed to the platform, which depends on the activity in their ecosystem. Inflationary pressures are based on voting and participation rewards. Furthermore, to participate in the network, tokens are locked in neurons. Therefore, those tokens are not liquid and able to be freely transferred to others.

Governance

Dfinity intends the Internet Computer to run like a digital government. The NNS governance system is responsible for a variety of things, including managing voting, the tokenomics, and the data centers. It also monitors the node machines, looking for statistical deviations that could indicate faulty behavior. While the NNS is an open governance system, it permits participation in the network. A potential node provider can apply for a Data Center ID to the NNS. Upon approval, the node provider can procure specialized machine nodes, install the ICP protocol and then connect to the IC network.

Anyone in the network can lock ICP to create a neuron to submit a proposal to the NNS, which operates like a decentralized autonomous organization (DAO): network participants cast votes, and the final decision is executed automatically by the network itself. Proposals can either be adopted or rejected immediately or after a time delay, depending on how the totality of neurons votes. To avoid users spamming the NNS with proposals, a fee levied on the neuron that submits a rejected proposal. Therefore, the user’s neuron (with ICP tokens locked) will be penalized.

Uniquely, the NNS enables participants to set their preferences prior to voting on a proposal, so issuing a vote is no longer a manual process. As mentioned above, votes are then cast by users through "neurons" or can be delegated to other trusted parties.

The digital government also has a meta-governance mechanism, where the NNS also has the authority to change the code on subnets -- controlling all the apps supported in the ecosystem. On one hand, this means that subnets aren’t censorship-resistant and will be under the purview of the community. Thus, the community decides what is desirable and what isn’t. This is similar to traditional internet where the App Store can choose to remove a certain app, or a search engine can decide which websites are ranked more relevant than others.

The concept of meta-governance is relatively new. What this implies for Dfinity’s ecosystem is uncertain. In the future, if there are different factions, it’s conceivable that the community could appease all sides (to avoid forking) by voting that several discrete ecosystems are possible. For example, in the traditional internet, Youtube has an adult and children’s ecosystem depending on what the desired user experience is. As with other Layer-1s, the risk of forking rewards diminishes as the layer becomes more mature and secure with higher values locked.

Application Ecosystem

The IC can be used to build a variety of new products. For example, it can build tokenized internet services, DeFi systems, enterprise systems, and websites. The IC is also introducing an “Internet Identity”, in which managers user data without usernames, passwords, or cryptographic keys. The internet ID can be used to log in to apps, under the cryptographic security of Chain Key Technology. This means that users aren’t tracked with Cookies across websites and services, and managing privacy could be easier.

Dfinity hopes to see open versions of Whatsapp, TikTok, Facebook, built using less than a thousand lines of code and capable of supporting millions of users. Currently, there are several apps in the IC ecosystem:

Infrastructure

- Fleek: makes it easy to create websites and applications on the open internet. All their products are built on the underlying protocols that power Web3, such as the Internet Computer, IPFS, Filecoin, and Ethereum. It raised $4 million to build a base layer of products mimicking traditional web infrastructure that any app or site would need like hosting, storage, databases, authentication, and serverless functions. It also supports Ethereum Naming Service (ENS) and Handshake’s decentralized domain name service (HNS). Already, 14,000 websites are running on Fleek

- Dfinity Explorer: is an open-sourced, community-built dashboard for the IC.

Decentralized Apps

- Origyn: is a pan-industry platform for tracking the provenance of luxury goods, starting with luxury watches

Decentralized Finance

- Enso Finance: is a decentralized exchange that has raised $5 million in a private funding round last month in Apr-2021. The round was led by Polychain, Dfinity, Multicoin, Spartan, and several other companies

- Tacen: is a high-performance, decentralized non-custodial exchange that has raised $2.3 million

- DfiStarter: is the first IDO platform on ICP, providing fundraising services, public relations, and marketing, in addition to tech support for projects planning to develop on the IC

- SailFish: is a gateway to open financial services. It’s a decentralized exchange with a social component

Social

- Distrikt: is a decentralized, professional social media network. It is the Open LinkedIn application shown off by DFINITY in Davos at WEF 2020 that is now being taken to market. They raised $500,000 in initial funding. Users can control their self-sovereign identity and govern the community.

- OpenChat: is the IC’s response to Whatsapp -- an open version of your standard chat app that is not owned by a large tech corporation. It’s a decentralized chat app built on the Internet Computer, with encrypted communication software.

- CanCan: is a decentralized video-sharing app. It’s essentially an open and tokenized version of TikTok, running on the Internet Computer and accessible through any browser or mobile device. It shows the scalability and power of the Internet Computer

- Capsule Social: is a decentralized social media platform that is censorship-resistant. The company raised $1.5 million from Polychain Capital’s Beacon Fund, valuing it at $10 million. It also has early backing from Balaji Srinivasan, former CTO of Coinbase

- Canistore: is a decentralized media service provider supporting video, music, and text. It fashions itself as a next-generation social store, allowing users to create and share content without worrying about platform risks, such as changes in algorithms that affect ratings and followings. Users can earn rewards for being active, earn royalties on content distribution and also participate in governance.

- Dscvr.one: is the IC’s answer to Reddit, with a custom governance function that manages future developments and content review

Valuations

The sensitivity of ICP pricing at genesis is below and can be updated in our spreadsheet here. The higher the amount locked, the lower the circulating supply, the more favorable price action is.

Since the protocol and its ecosystem is still new, it’s difficult to justify a fair valuation for ICP. Data started as of March 24, 2021, and there are approximately 120,000 messages daily, which is the equivalent of transactions.

However, if we were to compare the value of the protocol compared to the value of the ecosystem, we can start by looking at Terra (LUNA) and Polkadot (DOT). Similar to ICP, Terra has non-token projects such as the Chia, MemePay, PayWithTerra, BuzLink and Kash. Polkadot is similar in that the network is live but projects in the ecosystem projects have not launched on top of it and do not have floating prices because parachain auctions have not started.

If we look at the Ecosystem Value / Layer Value (see table below), the value of ERC-20 tokens is greater than the value of Ether. At the low-end, we have LUNA where the ecosystem’s value is 14% of LUNA’s circulating market cap. If we assume that ICP’s ecosystem value to layer value is 14% (in-line with LUNA), then we would expect that ICP’s valuation expects that the ecosystem would be worth $3 billion. As a comparison, the known amount of fundraising among ecosystem apps is ~$10 million, implying that ICP is priced above peers.

Dfinity would perhaps argue that, because the addressable market is larger, it justifies a higher valuation. ICP is trying to replace legacy IT such as Google, Oracle and AWS. The opportunity in the Cloud market alone could be $1 trillion:

Risks

Dfinity will immediately be catapulted into the top ten largest assets. The largest risk to price is that the protocol is not battle-hardened. The code was only be open-sourced today and waited to be open to scrutiny until after the launch. In Dfinity’s defense, their code is a trade secret to limit forking and competition. Dfinity’s competition is not only in the crypto-sphere but extends to traditional internet.

Their low trading volume pre-listing is another consideration. FTX’s pricing is about half of that seen on Hoo and MXC just days ago. Furthermore, potentially high inflation rate is another consideration. Along with DOT, FIL and CAKE have lower circulating supply, and therefore higher inflation in the next several years, ICP has one of the lowest circulating supplies. This could put pressure on the price, especially if tokenholders aren’t locking ICP in the ecosystem. The vesting schedule of half its tokens -- including those held by the foundation, team members and other partnerships is also not known at time of writing.

Lastly, Dfinity has raised $120 million from accredited investors and venture capital firms. Projects that have successfully fundraised get a lot of hype. However, there’s a risk that full valuations leave too little upside for the community. Without a robust, committed community, the project could face headwinds at launch. As an offset, Dfinity’s developer community is one of the fastest-growing.

Finally, Dfinity has ambitious plans and its market cap reflects those ambitions. The Foundation released a 20-year roadmap, where they hope, within five years, to achieve widespread knowledge of what ICP is among entrepreneurs and end-users. Within 10 years, it hopes the IC is on a path to overtake big-tech’s closed proprietary ecosystem, where capital will be redirected away from legacy internet companies to ICP and DeFi will match traditional finance technology. Within 20 years, they hope the ICP will overtake closed, proprietary big-tech ecosystems. Given the short duration since mainnet, it is too early to tell if Dfinity has a sufficiently strong community or execution capabilities to reach these goals. Furthermore, it’s coming relatively late to the Layer-1 game and competition is already intense at this stage.

Conclusion

Dfinity has big goals to remake traditional internet. It even wants to run ETH 2.0 inside a canister on the IC. The vision, while grand, will depend on Dfinity’s ability to execute. Currently, there’s a resemblance with Solana, in terms of how IC’s data centers control nodes that process subnet messages or canisters. There’s also a resemblance with Ethereum 2.0, though Ethereum has lately triangulated on DeFi and high-value transactions. Overall, the competition among programmable Layer 1s is intense. Dfinity is the newcomer, offering the world a new paradigm and technology. Dfinity has launched in the heart of the bull run, perhaps putting wind in their sails. However, successfully creating the ultimate world computer is still at play.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Nothing contained in this report is a recommendation or suggestion, directly or indirectly, to buy, sell, make, or hold any investment, loan, commodity, or security, or to undertake any investment or trading strategy with respect to any investment, loan, commodity, security, or any issuer. This report should not be construed as an offer to sell or the solicitation of an offer to buy any security or commodity. Messari does not guarantee the sequence, accuracy, completeness, or timeliness of any information provided in this report. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Mira was a Senior Research Analyst at Messari. Prior to joining Messari, Mira was a Senior Portfolio Manager for a US$6 billion Asia Pacific equities fund at APG Asset Management. Mira received a BA in Economics and Mathematical Methods in the Social Sciences from Northwestern University.

Wilson Withiam was a Senior Research Analyst at Messari. Previously, he worked at Circle Research where he conducted research on cryptoassets. He graduated with a B.Sc. in Kinesiology and Exercise Science before studying computer science and economics at UConn.

Read more

Research Reports

Read more

Research Reports

About the authors

Mira was a Senior Research Analyst at Messari. Prior to joining Messari, Mira was a Senior Portfolio Manager for a US$6 billion Asia Pacific equities fund at APG Asset Management. Mira received a BA in Economics and Mathematical Methods in the Social Sciences from Northwestern University.

Wilson Withiam was a Senior Research Analyst at Messari. Previously, he worked at Circle Research where he conducted research on cryptoassets. He graduated with a B.Sc. in Kinesiology and Exercise Science before studying computer science and economics at UConn.