Alpaca Finance: A Leveraged DeFi Product Suite

May 16, 2022 ⋅ 13 min read

Key Insights

- Alpaca Finance is the largest multi-chain leveraged yield farming protocol and has the third highest total value locked (TVL) on the BNB Chain.

- Lenders on the platform earn yield for supplying single-sided liquidity in a number of different assets and can collateralize their interest-bearing tokens to mint AlpacaUSD (AUSD).

- Yield farmers can use up to 6x leverage on certain supported pools to multiply yields. They can also deploy strategies to customize exposure and risk.

- Automated Vaults give users the opportunity to run leveraged market-neutral strategies without having to continuously rebalance positions or the possibility of liquidation.

- Alpaca’s deflationary governance and utility token, ALPACA, captures protocol revenue through its buyback-and-burn model and xALPACA staking (fee distribution).

- Alpies, one of Alpaca’s many NFT collections, is a precursor to a play-to-earn game in development.

Alpacas stand out for their friendliness and ability to thrive in high altitudes. Alpaca Finance has molded its platform around these qualities by offering a user-friendly way to earn higher yields through leverage.

DeFi users are always looking to maximize their returns. Alpaca, unlike most other DeFi lending protocols, allows users to borrow more than they put up in collateral. These undercollateralized loans increase APYs for both lenders and borrowers, albeit with added risk.

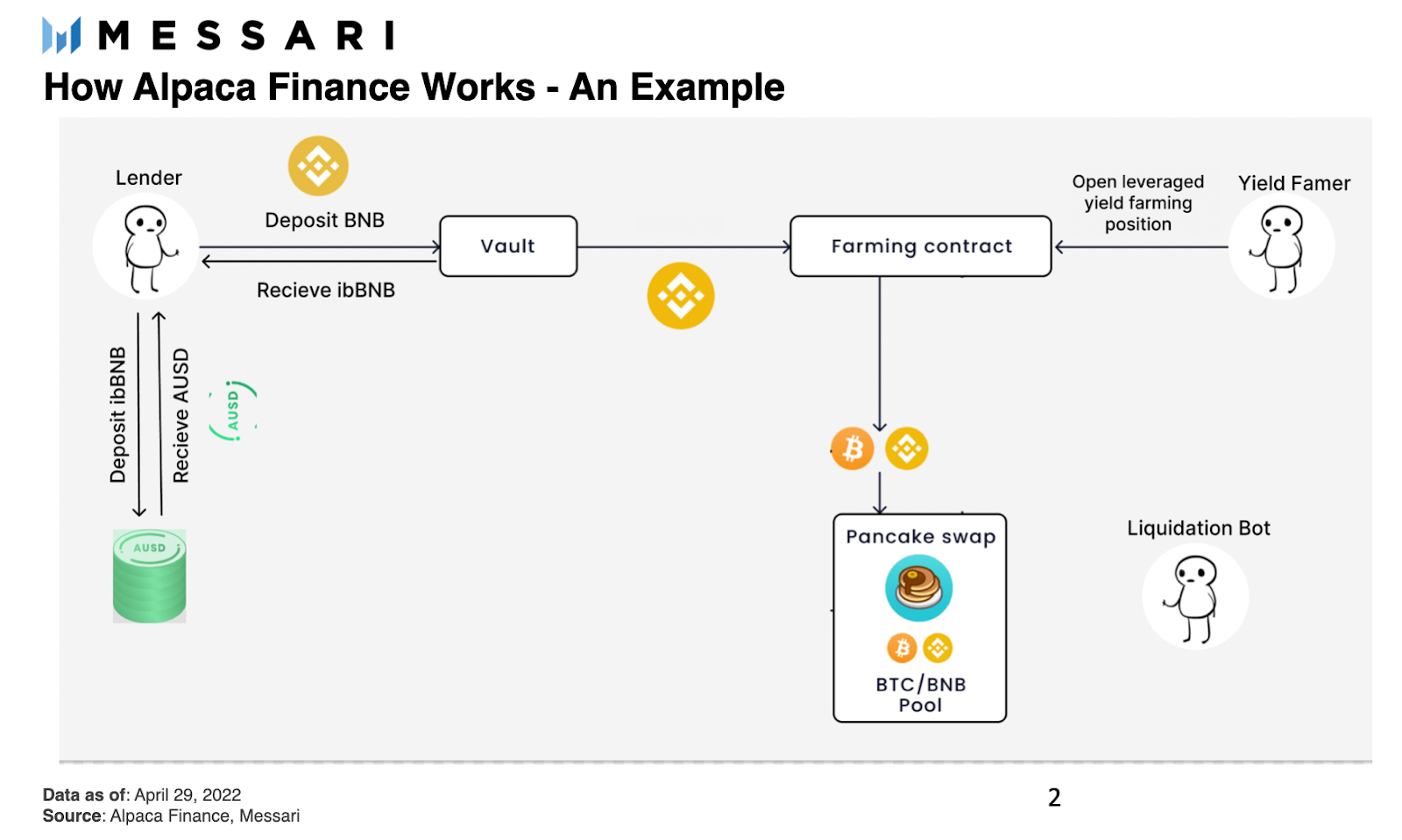

Yield farmers use Alpaca’s undercollateralized liquidity as leverage, multiplying their positions and thus, their prospective returns. Alpaca’s lenders, who provide the aforementioned liquidity to single-sided asset pools, benefit from higher pool utilization and thus higher lending APYs. Additionally, lenders can increase capital efficiency by borrowing against their interest-bearing tokens to mint AlpacaUSD (AUSD). Farmers also have the option to customize exposure and risk, or use Automated Vaults to access market-neutral strategies without having to continuously monitor and manage positions.

Aside from the platform's direct impact on users, Alpaca is amplifying the liquidity of DeFi as a whole by increasing market depth while maintaining safety across its suite.

Background

After the spike in Ethereum’s gas fees in early 2021, a lot of volume moved over to the BNB Chain (formerly Binance Smart Chain, or BSC). The surge in users and the absence of on-chain leveraged yield farming presented an opportunity. In late February 2021, the Alpaca Finance team opened lending vaults and fair launched the ALPACA governance token. About one month later, after running audits and attracting sufficient liquidity, they rolled out leveraged yield farming.

Over the following year, Alpaca expanded in several areas. It launched more vaults for lending assets, integrated additional pools for leveraged yield farming, and added features around user protection. Along with expanding to Fantom, the protocol released decentralized governance, an NFT collection, an overcollateralized stablecoin, and Automated Vaults.

The Ecosystem

At a very high level, Alpaca Finance mirrors a common two-sided market, with lenders and borrowers. Zooming in, however, there are a number of features and products working with and around this process to bolster capital efficiency, safety and ease of use.

Lending

Alpaca allows lenders to earn interest by depositing assets into their respective vaults. These assets are then offered to leveraged yield farmers as undercollateralized loans that can only be used on the platform.

In exchange for supplying assets, lenders receive a corresponding balance of pool-specific interest-bearing tokens (ibTokens). Alpaca uses these ibTokens (e.g., ibBNB) to track deposited funds and their accrued interest, which is expressed by the ibToken’s exchange rate.

For example, when Alpaca launched leveraged yield farming, 1 ibBNB could be exchanged for 1 BNB. Over the following year, the lending APY averaged 11%, thus by the end of the first year 1 ibBNB equaled 1.11 BNB.

To increase yield on ibTokens, lenders can stake them to earn ALPACA rewards. If they change their mind, lenders can always unstake their ibTokens and then swap them for the respective base token as long as there’s sufficient pool liquidity.

AlpacaUSD

AUSD is a fork of MakerDAO, and like DAI, is a decentralized, overcollateralized stablecoin. It is currently backed by BNB, USDT, and BUSD.

Lenders can collateralize their ibTokens or base tokens (e.g., BNB) to permissionlessly mint (borrow) AUSD. Unlike many other overcollateralized stablecoins, this system actually unlocks capital efficiency by allowing lenders to continue to earn interest on their collateral.

The stability fee (annual interest rate) for AUSD starts at 2% for most collateral types. Over time, it will be adjusted to stabilize the peg by incentivizing users to create or close AUSD positions. Another pegging mechanism is the internal Stable Swap Module, which allows arbitrageurs to buy and sell AUSD for BUSD at a 1:1 rate, with low fees. There is also an AUSD Peg Insurance Fund, which acts as a buyback backstop in case AUSD ever depegs significantly.

If an AUSD borrower's collateral falls below the liquidation price, Alpaca will gently liquidate their position. This means that rather than using all of the borrower’s collateral, Alpaca only liquidates the amount needed to bring the position back to health.

As of this writing, there isn’t much demand for AUSD in the wider DeFi ecosystem. Thus, despite the stabilization mechanisms outlined above, it is trading under its peg.

Leveraged Yield Farming

Alpaca’s core function is to allow users to yield farm certain pools with leverage. On BNB Chain, it’s integrated with select PancakeSwap and MDEX pools, and on Fantom, it offers access to some SpookySwap pools. The maximum leverage available on the platform is 6x, but the upper limit varies by pool. These integrations and parameters are currently decided upon and set by the Alpaca Finance team.

In addition to selecting desired leverage, users can decide how to deposit and borrow assets. The deposited assets, which are also effectively collateral, and the borrowed assets are equally split to supply the farm’s liquidity pool. This also opens up opportunities for farmers to long, short, or hedge risk. When a user takes more than 2x leverage, they are effectively shorting the borrowed asset. However, in pools where both assets can be borrowed (e.g., BNB-BUSD), farmers can open two separate farming positions and borrow a different asset in each, effectively nullifying their opening exposure (hedging neutral).

When a user starts farming, the LP token is staked automatically. Rewards consist of yield farm rewards, trading fees, and ALPACA rewards. Displayed yield farm rewards are shown with the Alpaca farming performance fee of 9% already subtracted. Additionally, the borrowing interest, which is tied to the respective Alpaca lending pool’s utilization rate, is also subtracted from total APY.

Farm rewards are auto-compounded, even making Alpaca attractive to yield farmers with no leverage (1x). Every time any Alpaca user interacts with a given pool, the protocol will automatically sell, convert, and stake every participant’s DEX rewards as additional LP tokens.

Farmers can always adjust their positions, increasing leverage by borrowing more tokens or decreasing leverage by adding more collateral. Another way to adjust leverage is by partially, or entirely, closing the position.

Each pool has its own liquidation threshold. If a position’s debt ratio, the value of the debt divided by the overall value of the position (debt value / position value), exceeds the liquidation threshold, it is liquidated by a liquidator bot. The position is closed, the debt is paid back, 5% of the position value is taken as a liquidation bounty, and the liquidated farmer gets to keep the remaining amount.

Automated Vaults

Since their launch at the end of January 2022, Alpaca’s Automated Vaults have stayed oversubscribed. The eight vaults, at or near capacity as of this writing, have almost $150 million in total value locked (TVL). They currently offer users, on BNB and Fantom, a leveraged pseudo-delta-neutral (market-neutral) strategy. To do this, each vault farms one long and one short position simultaneously, sizes them to net zero market exposure, and then automatically rebalances them to maintain neutrality. Through this strategy, users can earn 5–10x the returns of leveraged stablecoin-stablecoin pairs while maintaining a similar risk profile. Additionally, Alpaca guarantees no liquidations.

Automated Vaults auto-compound and offer flexible deposits (size and duration). The current bottleneck around scalability is due to the slippage incurred when rebalancing positions.

NFTs

Alpaca uses its fairly sizable NFT collection to reward participation in governance votes, AMAs, Grazing Ranges, etc.

In early November Alpaca launched Alpies, a 10,000 piece NFT collection on both the BNB Chain and ETH. Alpies will be used as heroes in Alpaca’s upcoming play-to-earn game.

User Protection

The Alpaca Insurance Plan is in place to cover any mishap caused by Alpaca’s smart contracts or infrastructure (e.g., exploits, oracle failures, and shortfalls). Additionally, Alpaca is covered by Nexus Mutual and InsurAce.io, giving users the option to purchase insurance against loss of funds.

The Alpaca Guard feature activates when the DEX (e.g., PancakeSwap) price for a given asset is more than 10% off the median price on a group of oracles. While users can still add collateral, they can’t borrow more capital, open/close positions, or be liquidated.

Token

ALPACA is Alpaca Finance’s fair-launched BEP-20 utility and governance token. ALPACA token holders also directly and indirectly benefit from protocol usage through fee distribution and a buyback-and-burn program.

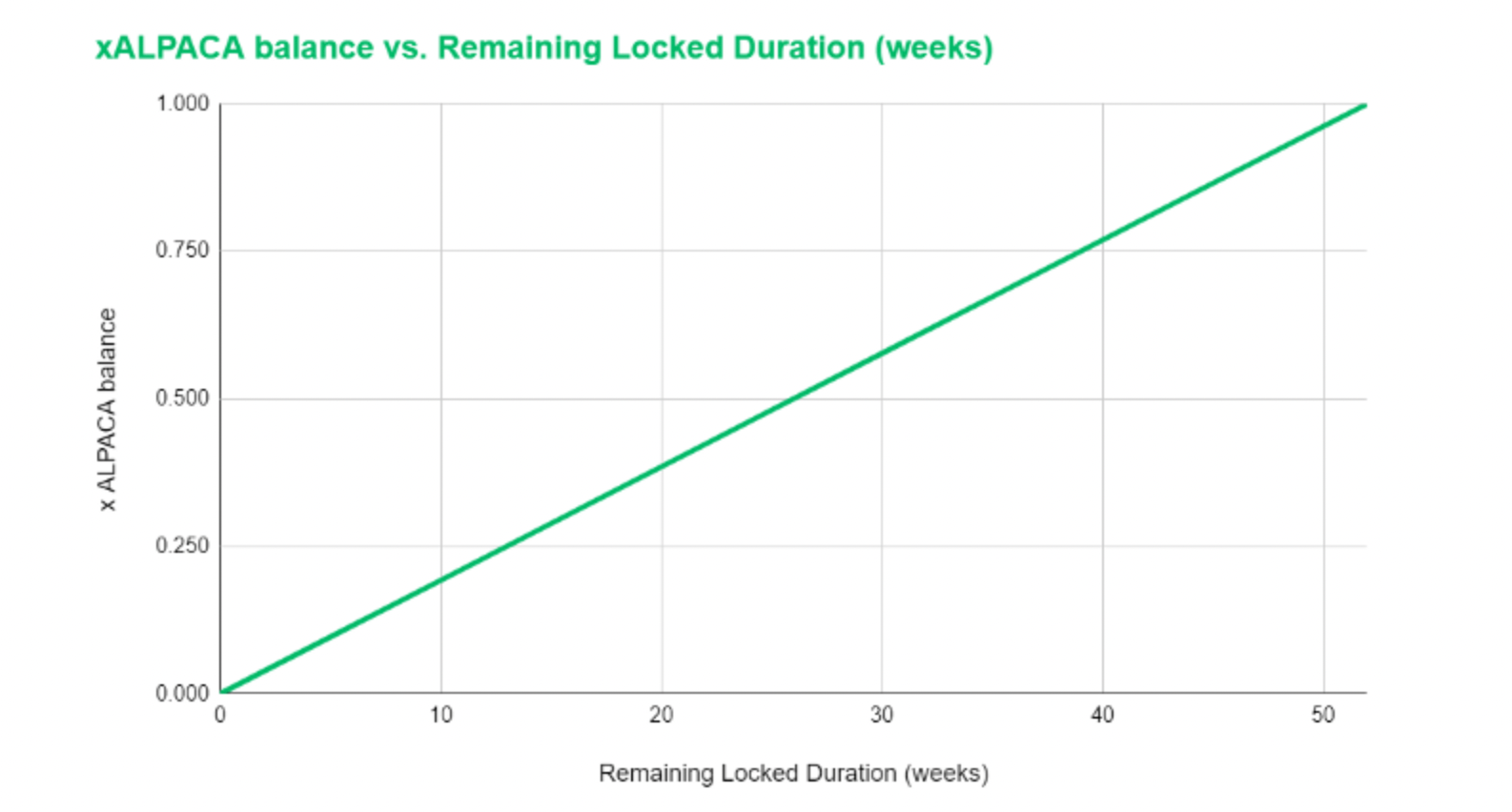

Alpaca’s governance vault is a fork of the Curve DAO. Holders can lock their ALPACA for up to one year and receive xALPACA in return. xALPACA increases with lock duration and represents a holder’s share of the governance rewards pool and voting power. The governance rewards pool is composed of ALPACA emissions, Grazing Range (partner project) pool rewards, and protocol revenue.

xALPACA balance over time. Source: Alpaca Finance Docs

Governance controls how protocol revenue is captured and distributed. For example, currently, 5% of user yield farming rewards are used to buy back ALPACA and provide part of xALPACA’s APR. Another example is the 10% of lender interest that is used to buy back and burn ALPACA.

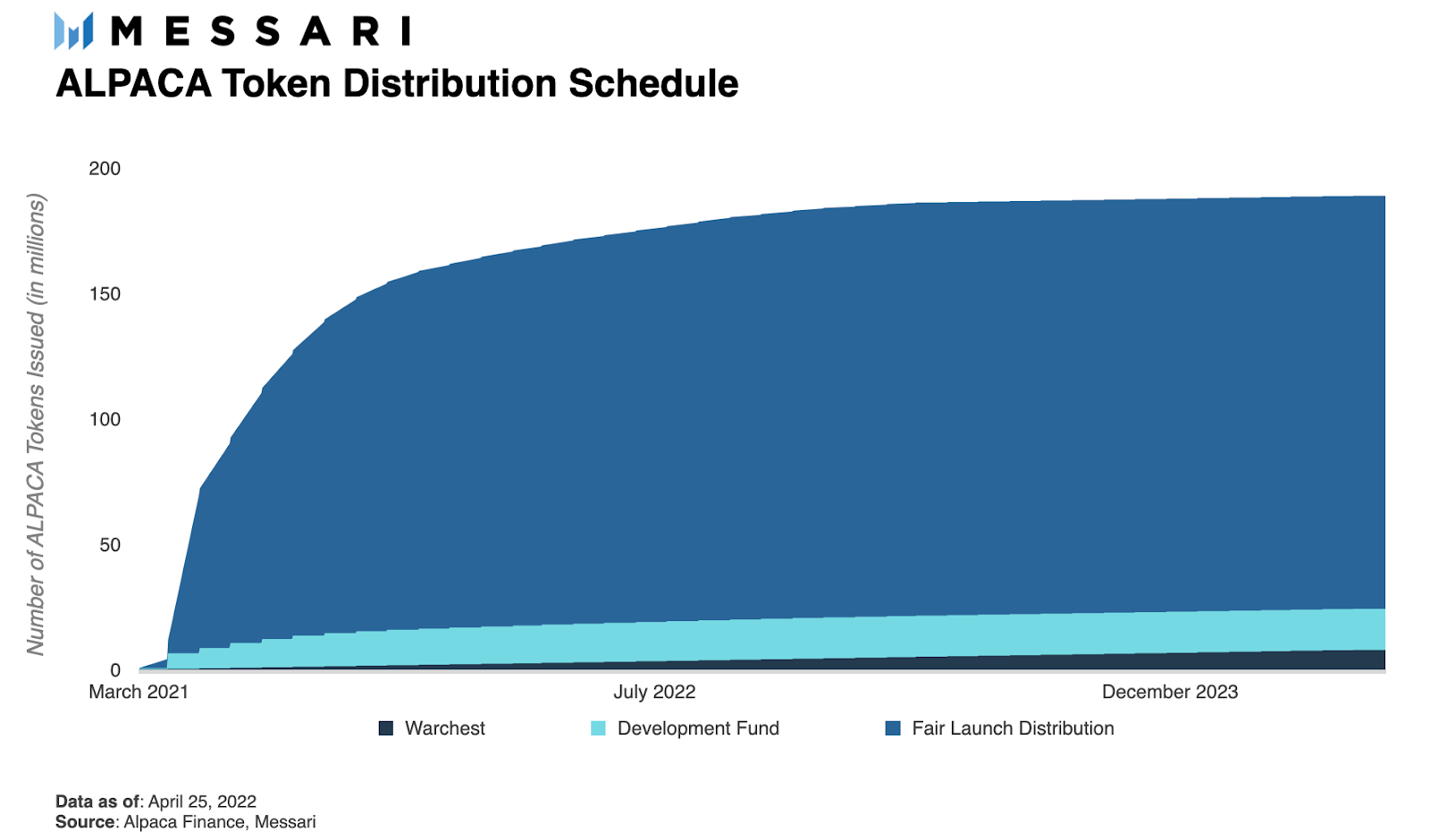

Since ALPACA emissions are hard capped at 188 million and the emissions schedule is decaying, the token will eventually become deflationary due to the buyback-and-burn.

As a fair-launch token, ALPACA has no pre-sale, investor, or pre-mine allocation. The vast majority (87%) of tokens are meant to help bootstrap the ecosystem by rewarding participants for using the platform and holding ALPACA. The Development Fund, an allocation for the Alpaca Finance team, is 8.7% and has the same two-year vesting schedule as the Fair Launch Distribution. The remaining 4.3% is for the Warchest, which (generally) means one-off, strategic expenses such as listing fees, partnerships, and audits.

Traction

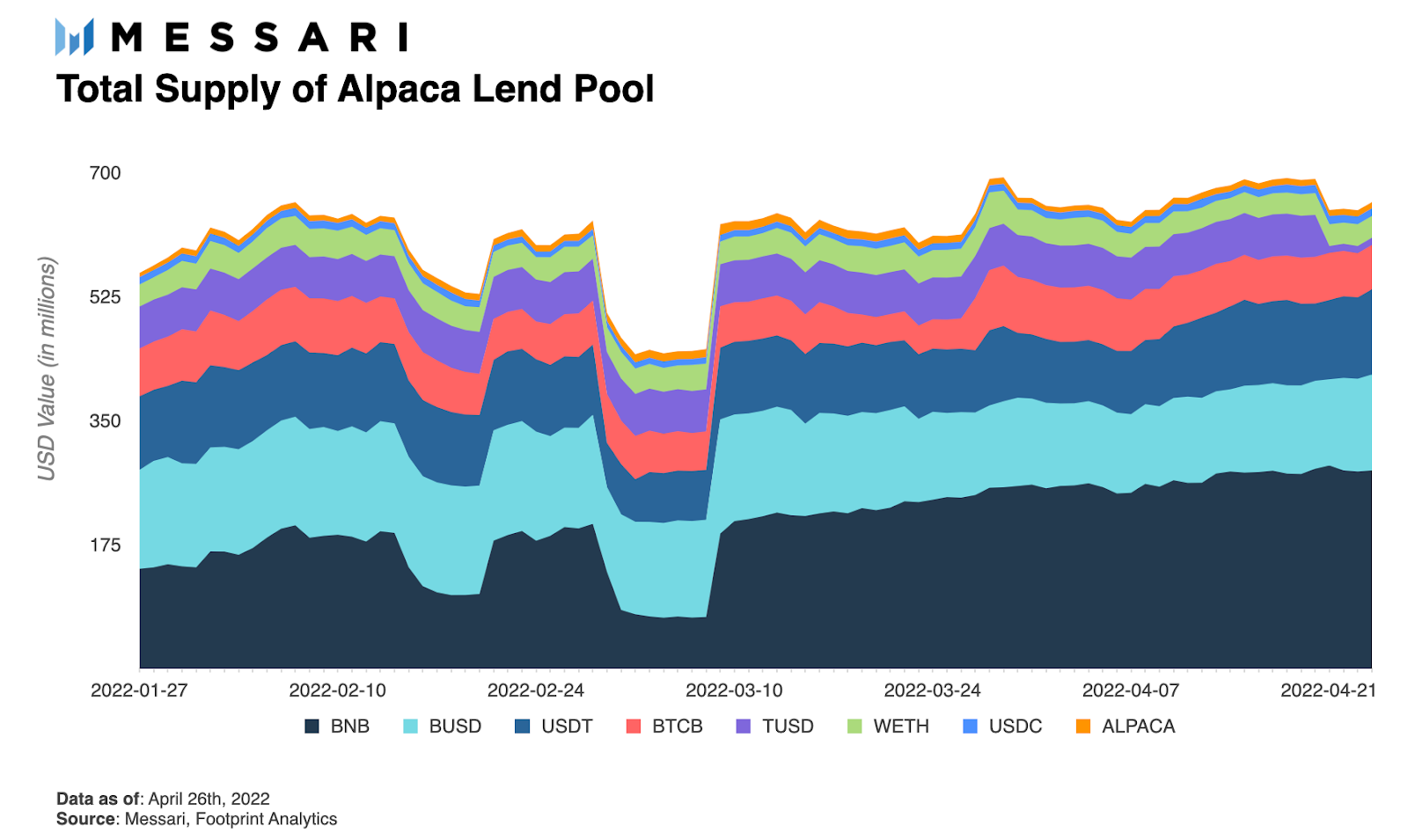

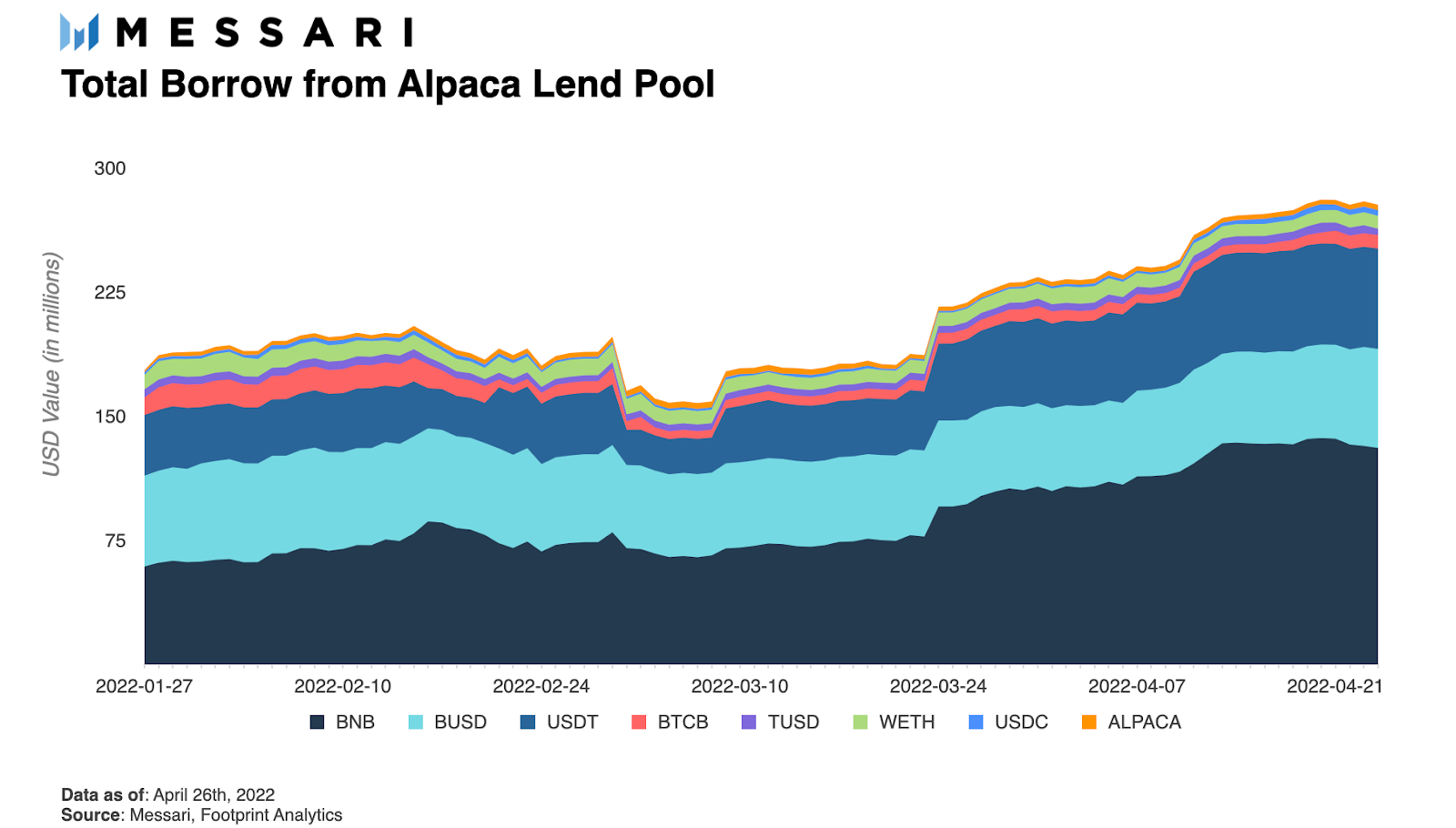

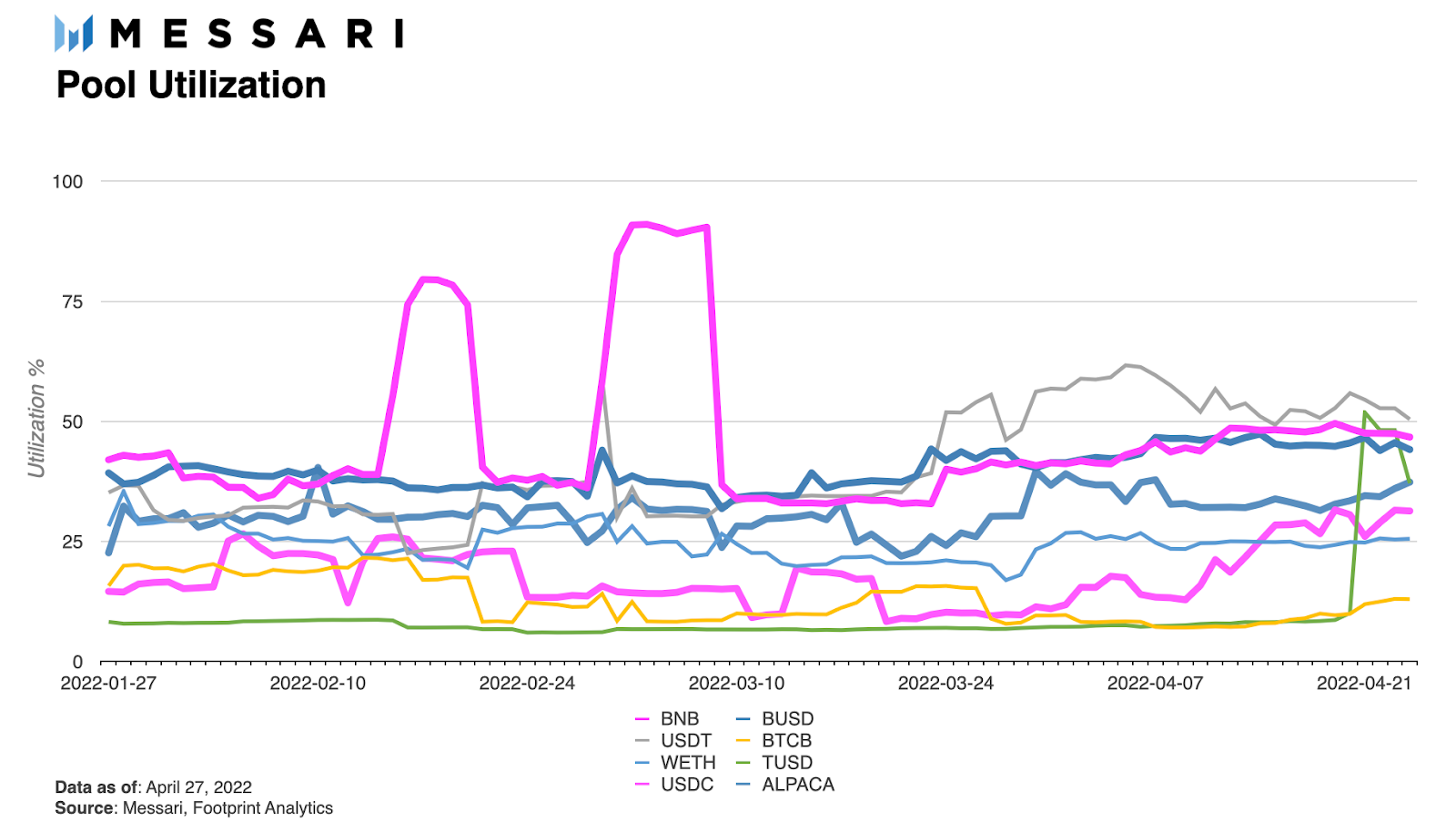

One way to understand and visualize Alpaca’s volume is through the lend and borrow pools.

Over the last three months, both the lending pool and, even moreso, the amount of borrowed assets have seen modest, gradual increases in total value. Additionally, the assets favored by borrowers have generally matched those favored by lenders. There have been a few dislocations (i.e., two sharp drops in the BNB lending pool) during Binance Launchpad and Launchpool events. However, the assets have historically returned to Alpaca within 7-10 days.

This is crucial since the pool utilization rate (borrowed assets / lending pool assets) must be somewhat stable to keep farming and lending yields predictable.

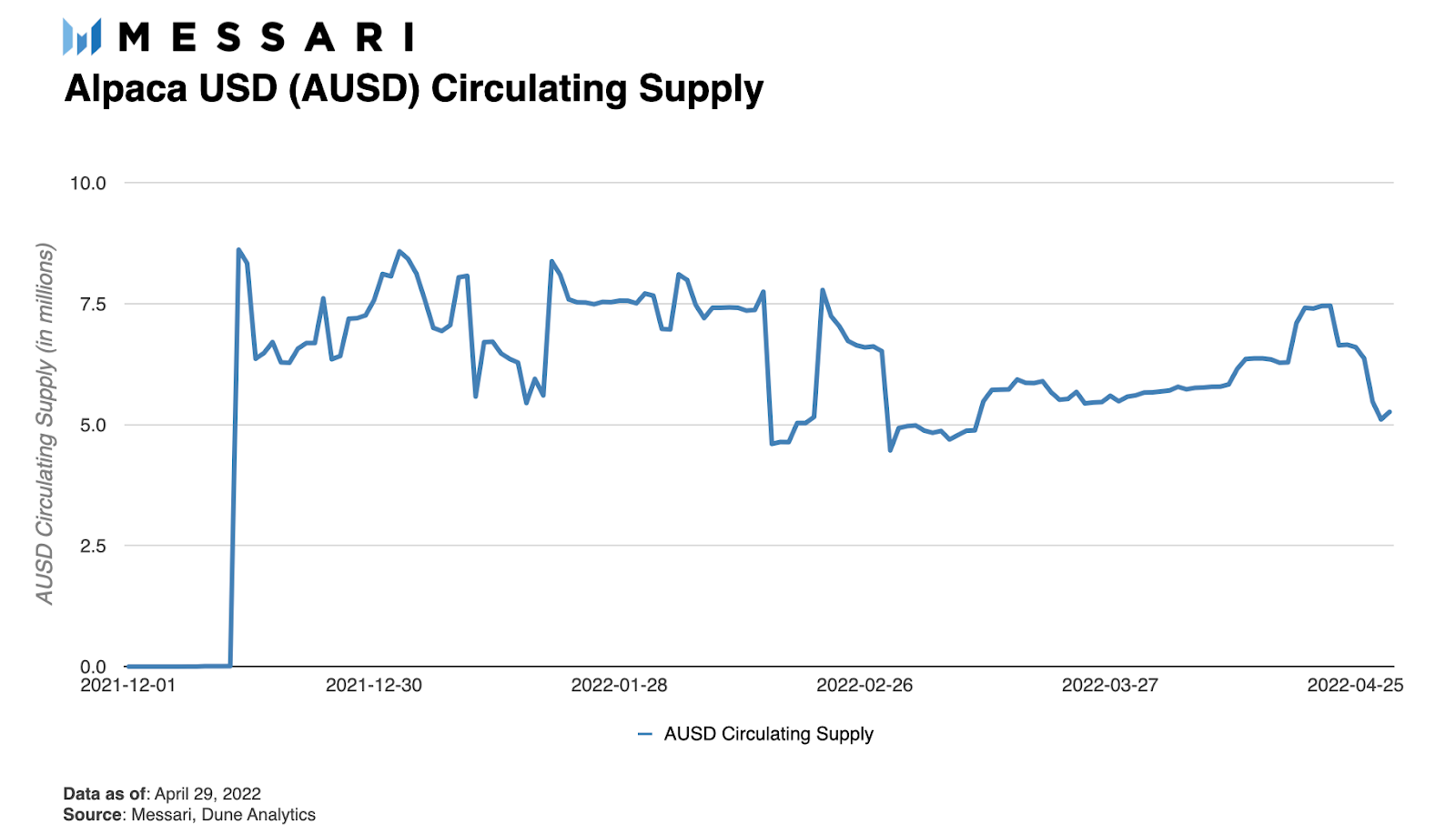

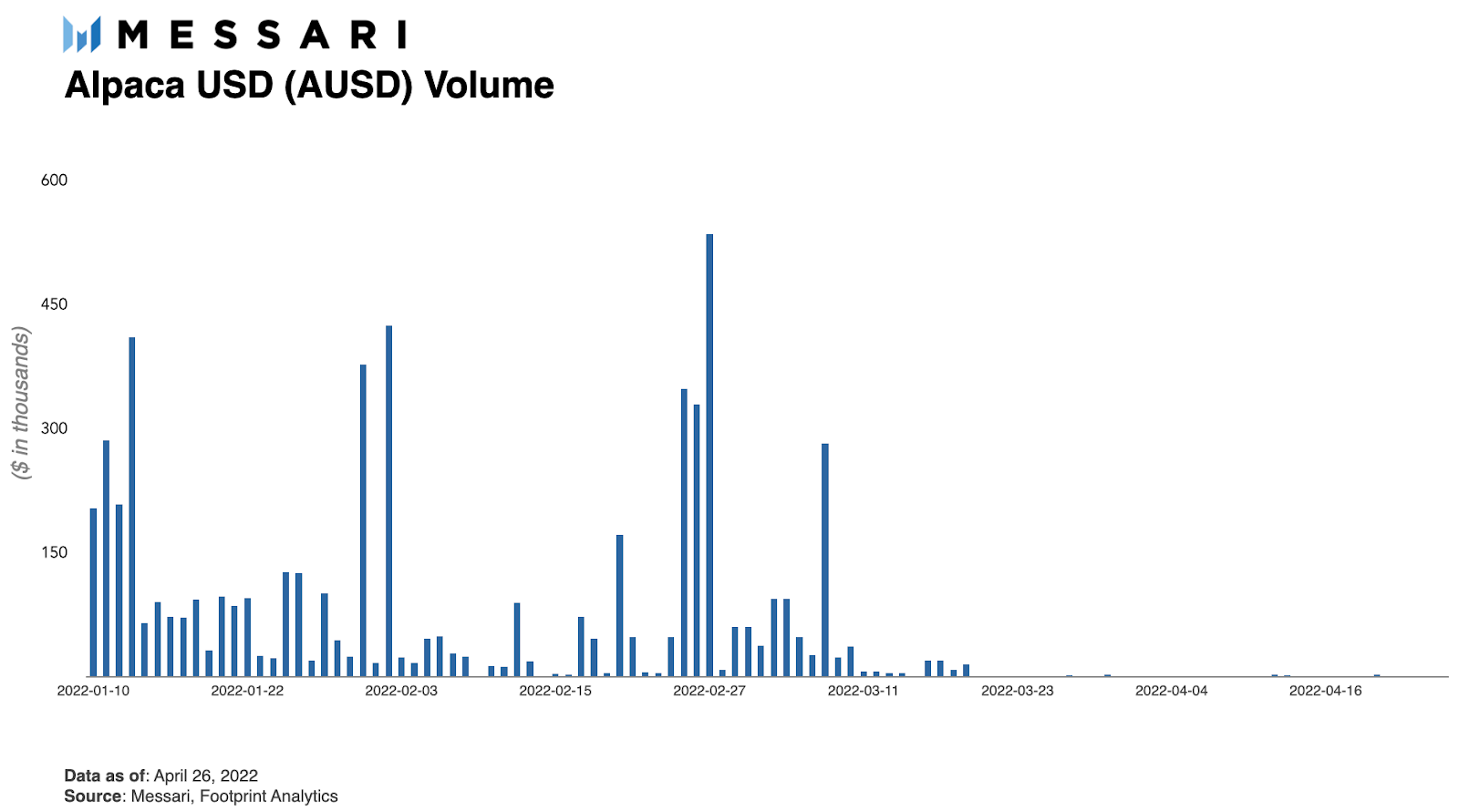

Most likely due to a combination of its lack of stability and current utility, AlpacaUSD (AUSD) has had a flat-to-slightly declining circulating supply and declining trading volume.

Competition

Despite being the third largest protocol in terms of TVL on the BNB Chain and the largest leveraged yield farming protocol across all chains, Alpaca Finance does have some competition in the BNB ecosystem.

Venus is a decentralized money market on BNB that allows users to lend and borrow assets and mint its stablecoin, VAI. Its market size, combining TVL and the amount borrowed, is over $2.3 billion, nearly three times larger than that of Alpaca. Unlike Alpaca, Venus borrowers over-collateralize their loans and can then use them however they want. Alpaca, on the other hand, offers users superior capital efficiency by giving them undercollateralized loans but requires them to stay in the platform’s integrated pools.

CoinWind, BNB Chain’s largest yield aggregator, currently has about 30% of Alpaca’s TVL ($250 million). CoinWind allows users to deposit single assets and asset pairs and then deploys the capital across the BNB ecosystem. CoinWind’s goal is to optimize and auto-compound yields. CoinWind’s main value proposition is that it requires less effort than Alpaca’s standard leveraged yield farming, but it also offers lower returns.

With its recent foray into the Fantom ecosystem and plans to continue going cross-chain, Alpha Homora is Alpaca’s only notable competitor. Alpha Homora’s TVL across all chains is currently about 80% of Alpaca’s ($650 million), with the vast majority on Avalanche. Despite launching on BNB before Alpaca, it has not been able to recover its footing on the chain since its exploit. On Fantom, both protocols are hovering around $35 million in TVL. Alpaca’s big differentiator, however, seems to be its extra features, such as Automated Vaults, AUSD, and the expansion towards NFTs/GameFi.

Roadmap

The three prominent themes in Alpaca’s roadmap are automated vaults, integrations, and NFTs/GameFi.

Alpaca will continue adding Automated Vaults to Fantom and BNB. Some of these will be the new, recently announced, Savings Vaults. They will function like the current Automated Vaults except positions will be balanced out to 1x long on a given token (e.g. BNB) instead of market-neutral. Additionally, updating the interest rate model and potentially changing the parameters around access will partially restructure Automated Vaults to sustainably increase capacity.

To increase throughput and reach, Alpaca Finance plans to add several integrations. Along with launching on new chains, Alpaca will support more mobile and web wallets. The roadmap also includes composable deployment of Alpaca products such as AUSD, ibTokens (as collateral), and lending pools, and the launch of an institutional platform.

Branching out a bit, the launch of the Alpies NFT collection is a precursor to Alpaca’s play-to-earn game. The goal is to integrate the game with Alpaca’s current product suite to bring in a wider customer segment. The private beta release is currently slated for Q4 2022.

Risks

Since launching in 2020, BNB Chain projects have had a disproportionate number of hacks and exploits. While this has nothing to do with the chain itself, it is a concern for many prospective users. Alpaca, however, has not had an exploit to date and has successfully passed 20 different security audits from firms such as CertiK and PeckShield. Alpaca’s Insurance Plan and insurance coverage from Nexus Mutual and InsurAce.io function as additional backstops.

Another challenge for Alpaca is the chicken-and-egg situation around pool utilization. Alpaca needs to figure out how to adjust the borrowing interest slope to keep rates attractive for lenders and economical for borrowers in all market conditions.

Conclusion

For the most part, Alpaca has succeeded in providing robust, capital-efficient yields to users. It now faces its next challenge: scaling the model through automated vaults, cross-chain integrations, and GameFi to the next 10 million users.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Alpaca Finance. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Ashu was a Research Analyst covering derivatives, structured products, asset management and macro.

Read more

Research Reports

Read more

Research Reports

About the author

Ashu was a Research Analyst covering derivatives, structured products, asset management and macro.