Akash: A Decentralized Approach to Cloud Computing

Mar 29, 2022 ⋅ 18 min read

Key Insights

- Outsourcing data storage and compute power to cloud computing providers offers many benefits; however, nearly one-third of server capacity goes unused and a majority of the market share is consolidated among three companies: Amazon, Google, and Microsoft.

- Akash addresses the lack of efficiency and centralization in the cloud computing market with a decentralized marketplace that connects entities seeking cloud services to providers eager to rent out their excess compute resources.

"Cloud computing is a great euphemism for centralization of computer services under one server." – Evgeny Morozov

Although the old guard of cloud computing uses more than one server, it can still exercise totalitarian power over its data centers, which are full of many servers. With cloud providers like Amazon Web Services (AWS), Google Cloud, and Microsoft Azure accounting for over 60% of the cloud computing market, most of the internet’s data lives on centralized networks at the behest of only three owners.

Akash Network gives consumers an alternative to centralized cloud providers in its Akash Deployment Marketplace that allows users to set a price they are willing to pay to deploy their software while providers with extra compute power bid to host the user’s application. This marketplace for underutilized computing resources functions very similarly to Airbnb, allowing providers to rent out unused capacity.

The Importance of Cloud Computing

No one is shielded from the omnipresent cloud. Whether it's your phone, car, streaming service, or social media accounts, you utilize cloud technology every day. In its simplest form, cloud computing allows you to access services on the internet instead of on your machine.

In the archaic days of DVD players, the only legal way to watch Disney movies was by physically purchasing the DVD and inserting it into the player connected to the television. Watching many movies required purchasing a collection of these discs. The cloud changed the mechanics of this physical interaction while keeping the same product, films. By storing the archived film data and running backend processes of the Disney Plus streaming service on remote servers, Disney eliminated the requirement for users to have product-specific hardware (DVD players) so it could deliver the same product through the internet.

Disney doesn’t just use the cloud to host customer-facing applications like its streaming service. For the operational side of its business, Disney and many other companies use cloud technology for data protection, data analytics, storage backup, server virtualization (virtual machines), and software development. But companies like Disney don’t need to own the server infrastructure that facilitates all of these necessary operations. Instead, most companies outsource server management to cloud service providers.

Before the prevalence of Amazon Web Services, Google Cloud, and Microsoft Azure, companies had their own onsite data centers. From hiring IT teams that manage hardware updates and maintenance to purchasing large plots of real estate and paying colossal energy bills, costs related to IT infrastructure would be recorded as capital expenditures. However, paying for cloud computing where the cloud provider absorbs all of the costs associated with IT infrastructure is considered an operational expense, which is tax-advantaged. Although deploying applications to a big three cloud provider comes with monetary benefits and improved operational efficiencies, cloud consumers are locked into vendors and have limited control over their deployments in a centralized cloud environment.

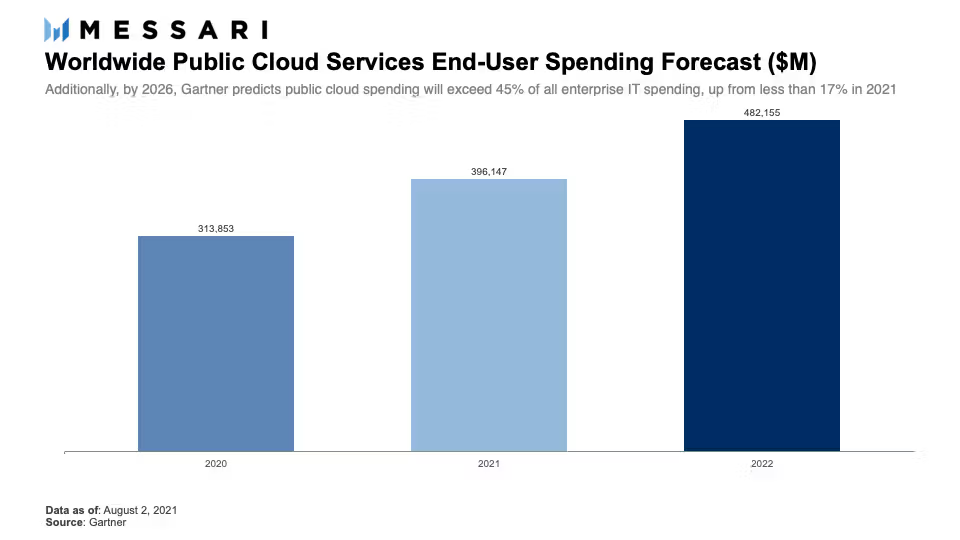

As more enterprises understand the higher levels of scalability, flexibility, and cost-savings they can achieve by outsourcing IT infrastructure to cloud service providers, Gartner predicts that in 2022 end-users will spend $482 billion on cloud services. This is up 54% from the $313 billion spent in 2020. The pandemic’s push for remote-hybrid work is only helping to accelerate the growth of the cloud computing industry. According to Flexera, 92% of U.S. companies already utilize cloud technology, with 90% claiming usage is higher than initially planned due to the pandemic. This is in stark contrast to Europe, where only 42% of enterprises were on the cloud in 2021, up from 19% in 2016.

Despite the rapid growth and prevalence of cloud computing, 30% of server capacity sits idle in many data centers. As the market for cloud computing continues to grow globally, a convergence will emerge among providers seeking to rectify supply-side inefficiencies and enterprises looking for the flexibility to scale their business, outsource IT infrastructure, and avoid the complications caused by centralized entities.

The Akash Marketplace

Akash is an open-source platform with a distributed peer-to-peer cloud marketplace that connects users seeking cloud services to infrastructure providers with excess computing resources. Its platform is used for hosting and managing deployments and contains cloud management services that leverage Kubernetes to run workloads.

These users, called tenants, are typically developers seeking to deploy Docker containers to cloud providers that meet specific criteria. A Docker container essentially contains packaged code, its dependencies, and ensures the corresponding application runs the same on any computing environment. For example, even if the configurations of an application differ when it is developed on a laptop, tested in a sandbox, and sent to the cloud to run, containers can support all three environments without requiring changes to the code.

The Akash marketplace functions through a reverse auction model, giving users the ability to name a price and describe the resources they want for deployed containers. When a cloud provider, which can range from an individual to a data center, underutilizes computing resources, it rents those resources out by bidding to host deployments, in the same way Airbnb hosts can rent out their extra space. Deploying containers on Akash costs roughly 10 times less than any of the big three cloud service providers (Amazon Web Services, Google Cloud, and Microsoft Azure).

All records of requests, bids, leases, and settlement payments are stored on-chain using the Akash Token (AKT).

Leadership

Greg Osuri, co-founder and CEO: With a cloud architecture and entrepreneurial background that dates back to 2008, Osuri founded Akash as a decentralized alternative to the traditional cloud computing industry. Before Akash, Osuri founded four other companies and worked at distinguished firms, including Miracle Software Systems as a technical architect, IBM as a critical infrastructure consultant, and Kaiser Permanente as a cloud infrastructure consultant. Osuri’s notable founding projects include AngelHack, one of the most diverse developer ecosystems in the world with over 175,000 developers in 50 cities, and Overclock Labs, Akash’s core contributor focused on making a decentralized and open internet.

Adam Bozanich, co-founder and CTO: Bozanich is a veteran in the software engineering space and has held senior-level roles since 2006. With experience across software development domains, Bozanich worked in QA automation at Symantec, security engineering at Mu Dynamics, and server engineering at Topspin Media. He also co-founded two other companies before Akash: Sprouts Tech and Overclock Labs with Osuri.

Overclock's and Akash's Roles

Overclock Labs essentially bootstrapped the Akash Network under the direction of Osuri and Bozanich. Since then, Akash has become a decentralized protocol. Although Overlock is still involved in Akash’s development, it does not control the majority of the 100 validators on the network and, hence, cannot manipulate AKT transactions. Despite its lack of control, Overclock is still Akash’s principal contributor to its open-source codebase, though many contributors come from outside of Overclock.

Since 2020, Akash Network’s GitHub has seen a rise in the commits of contributors not affiliated with Overlock Labs. A commit is an addition or change to the code of any length. Because commits vary in complexity and utility, they can be used as an indicator for developer activity within a given project. Although Overclock continues to account for the majority of Akash’s development, Akash’s own developer community is growing and contributing to the development of the project at an increasing rate.

The Akash Network

The Akash Network built its blockchain on a Cosmos SDK framework utilizing the Tendermint Byzantine-Fault Tolerant (BFT) engine for its Delegated Proof-of-Stake (DPoS) consensus algorithm. To simplify the seven or eight buzzwords used in the previous sentence, at its core, Akash uses the Tendermint engine as the security and networking layer of its blockchain. And it uses the Cosmos SDK to customize various aspects of its blockchain, from governance to staking.

Staking AKT in a DPoS Protocol

Because Akash uses a DPoS consensus algorithm, staking responsibilities vary between delegators and validators. Validators operate nodes to secure on-chain AKT network transactions. Although anyone can become a validator, only those with the computing resources and technical expertise to run an Akash node will.

The minimum system requirements that Akash recommends to operate validator nodes include a 4-core CPU, 16GB of RAM (memory), 256GB of SSD (storage), and a Linux Ubuntu OS. Of course, better specifications will equal better performance; regardless, these are relatively modest minimum requirements compared to a blockchain like Solana. On Solana, validators need a 12-core/24-thread CPU, 128GB of RAM at a minimum (256GB RAM suggested), and three separate storage units (recommended) totaling 2 TB (500 GB for accounts, 1 TB for ledger, 500 GB for OS).

The frequency with which the consensus algorithm chooses validators to approve network transactions — and hence, receive inflationary rewards — is in proportion to the amount of AKT the validator stakes. This creates a competitive environment among validators to acquire AKT themselves or from delegators.

Delegators delegate their right to earn validation rewards on AKT to a validator who does the work of running a node. This validator then splits the rewards with the delegator (in proportion to how much they delegated) and takes a commission fee off the top. AKT holders can delegate through the Keplr desktop wallet.

AKT Tokeneconomics & Utility

At genesis, 100 million AKT were distributed to the allocations found in the graphic above, while roughly 289 million AKT were scheduled to be released as inflationary emissions to stakers initially set to a 100% APR meant to halve every two years. Governance voting changed halving to roughly every 3.7 months. According to Akash founder Greg Osuri, the protocol has plans to reward cloud providers with emissions, though the functionality will be implemented at a later date.

The vesting schedules are described below based on the initial allocations of the 100 million AKT at genesis (September 2020):

- Investors (34.5% or 34.5 million AKT): roughly 17.3 million AKT released after a one-year lock-up, following a graded vesting schedule unlocking roughly 8.6 million AKT after every six months

- Team & Advisors (27% or 27 million AKT): 11 million AKT released after a one-year lock-up, following a graded vesting schedule unlocking six million AKT after every six months

- Decentralized Cloud Foundation (19.7% or 19.7 million AKT): one million AKT unlocked at TGE following a graded vesting schedule unlocking roughly 8.9 million AKT after the first month, then roughly 4.1 million AKT after the next six months, then roughly 2.1 million AKT after the following 11 months and after two more six-month periods

- Ecosystem (8% or 8 million AKT): 2 million AKT released after a one-month lock-up, following a graded vesting schedule unlocking 1.5 million AKT after the first six months, then after the following 11 months, and then after two more six-month periods

- Testnets (5% or 5 million AKT): 800,000 AKT released after a one-month lock-up, following a graded vesting schedule unlocking 1.05 million AKT after the first six months, then after the following 11 months, and then after two more six-month periods

- Vendors & Marketing (4% or 4 million AKT): 800,000 AKT released after a one-month lock-up, following a graded vesting schedule unlocking 800,000 AKT after the first six months, then after the following 11 months, and then after two more six-month periods

- Public Sale (1.8% or 1.8 million AKT): No vesting schedule

AKT is a utility token with multiple uses in the protocol encompassing security, rewards, network governance, and transactions.

Node operators that validate transactions on the mainnet and receive rewards must have a total stake of AKT that positions them as a top 100 holder among peers. This total stake comes from the amount the validator allocates themself combined with the amount delegated to them. Validators on Akash are not required to stake a minimum amount of their own AKT holdings. Accounting for more AKT increases the odds a node operator will get chosen to validate transactions, thereby increasing the frequency of their rewards. To dissuade malicious/lazy validators, those who do not adhere to the consensus guidelines risk getting a portion of their stake slashed.

Not yet implemented but mentioned in the whitepaper, Akash plans to charge a “take fee” for every successful lease. It would then send the fee to the Take Income Pool to be distributed to holders. The take fee is planned to be 10% for AKT transactions and 20% for when other cryptocurrencies are used. Akash also plans to reward holders for the time lock-up of their AKT holdings. Holders who stake for longer periods of time will be eligible for larger rewards.

Only AKT holders can participate in governance. This includes submitting proposals and voting on them. The cost of submitting a proposal is a non-refundable deposit of 1,000 AKT. For passed proposals that require binary updates(code changes), validators must update the codebase to avoid penalties and continue validating the network.

AKT is the ecosystem’s reserve currency, used for gas fees and as the default medium of exchange in transactions between providers and tenants. The Akash whitepaper describes a settlement option to lock in an exchange rate between AKT and a settlement currency that is meant to counter AKT price volatility in marketplace transactions. This settlement option has yet to be implemented.

Akash’s Continued Development

Akash learned not to develop too far into the future after postponing the development and release of supermini, the home-based miniature supercomputer that would have seamlessly integrated with the Akash Network allowing people to use it for heavy workloads or to rent it out.

With 33 cloud providers supporting 525 active leases at about a 90% discount to traditional cloud computing market prices (due to supply being much higher than demand), Akash is working on ways to unlock market expansion. It plans to improve both its blockchain and cloud marketplace. Developing on both fronts will make Akash’s products more palatable to traditional cloud computing consumers and open the protocol up to wider crypto adoption.

The release of Akash’s Testnet 3 on March 7, 2022, shows that the team is focused on developing new features for the mainnet including:

- Persistent storage: Workloads containing large data sets such as blockchain nodes will be able to persist data between restarts. If deployment drops or re-initializes, data will not be lost.

- Fractional uAKT: Removes the implicit minimum cost of deployment (one uAKT per block). Fractional uAKT will keep prices more consistent and resource consumption more accurate to the cost.

- AuthZ: Users can authorize a wallet to spend a set number of tokens by another source wallet exclusively on deployments. This reduces security concerns when big teams work together on deployments without using large shared wallets. It allows new community members to spin up deployments without access to a faucet.

- Inflationary Curve: An automatic curve mechanism that autocorrects when the inflation differs from the plan outlined in the whitepaper. This removes the need for human intervention where governance proposals would need to be quickly submitted to implement a fix.

The full list of developments Akash is planning for 2022 can be found on its roadmap. According to Akash founder Greg Osuri, most of the fourth-quarter deliverables from 2021 have been developed and are still in the process of being implemented into production.

Akash’s target markets, from Web3 to artificial intelligence and machine learning (AI/ML), continue to grow in parallel. As the Web3 crowd seeks decentralized computing infrastructure and the heavy-duty compute crowd seeks low-cost flexible solutions to deploy software, Akash will have many opportunities to meet the demands of the thriving cloud compute user base.

Decentralized Cloud Competition

Akash is not the only blockchain project disrupting the nearly half-trillion-dollar cloud computing market. Other decentralized competitors include Dfinity (Internet Computer), Ankr, and Cudos. Although Ankr launched with a similar model to Akash, today, Internet Computer and Ankr both approach cloud computing from different perspectives. Meanwhile, Cudos nearly replicates Akash.

Dfinity / Internet Computer

While Internet Computer is mostly considered a smart contract platform, it seeks to decentralize everything in its protocol, from the consensus algorithm to the servers the validation nodes connect to when approving network transactions that get broadcasted through the internet.

It’s not that unique to claim decentralization of the consensus algorithm. Nearly every project claims it, but few actually adhere to it (looking at Solana — validators can’t plan a network restart on a decentralized system). However, Internet Computer also claims to decentralize the servers its validator nodes utilize to perform consensus. This is in stark contrast to Ethereum, where roughly 25% of the nodes were being operated on centralized AWS infrastructure in 2019.

Internet Computer is not a direct competitor to Akash’s marketplace for underutilized computing resources. Instead, it created a system where independent node operators pay data centers to host their nodes while cloud providers get compensated for contributing computing capacity that facilitates network activity. By pairing computing resources provided by independently operated data centers around the world with its node operators, Internet Computer has attempted to make a truly decentralized protocol running on a decentralized network of data centers as opposed to AWS-owned servers. Despite similarly making use of excess computing power, Internet Computer does not generate market activity for cloud computing like Akash. It may take a share of potential cloud providers but does not seriously threaten Akash’s marketplace.

Ankr

The Ankr project launched with the intention to use idle computing resources in data centers to build an open-source cloud that it was going to call the “distributed cloud computing network.” This would have made Ankr a near replica and direct competitor to Akash. However, instead of letting users run any application on Ankr’s proposed cloud service, it pivoted to specifically providing access to Web3 infrastructure via RPCs (Remote Procedure Calls) that are used for making requests of server processes.

Exclusively focusing on Web3, node providers join the Ankr network to offer cloud services that connect those building decentralized apps, protocols, and smart contracts to various blockchains through API endpoints. Ankr uses its global node delivery system and developer toolkit to service over 50 PoS blockchains. Similar to the Internet Computer, the nodes in Ankr’s ecosystem that support its RPC layer may only threaten the number of providers Akash is able to connect to. Again, this does not seriously threaten Akash’s marketplace.

Cudos

Cudos is another item in the product line offered by the Cudo Network. With Cudo Network’s Cudo Miner product (different from Cudos), any user wishing to mine must download the Cudo Miner application, select a token to mine, and the application will mine the selected token while the machine sits idle. In the same spirit of utilizing idle compute power, Cudos will offer a very similar product to Akash with a marketplace that would connect cloud providers with underutilized resources to builders wishing to deploy WASM containers and virtual machines.

As of writing, Cudos is building its mainnet using the Cosmos SDK, while its testnet is accessible from the Big Dipper block explorer. Despite connecting idle compute power with builders, Cudos has no plans to operate its marketplace with a reverse auction or make its source code open-source like Akash. With yet to launch its mainnet, Cudos is far behind Akash in capturing market share from both the supply-side and demand-side of the cloud market.

VMs… Maybe Later

Virtual machines (VMs) are an extension of the old guard, the way virtualization solutions used to be implemented, and Akash does not have any explicit plans of supporting them. In a conversation with Akash founder Greg Osuri, he mentioned that compute providers have no restrictions on providing VM support — and that one even expressed interest — but that at this stage in Akash’s development, it wouldn’t make much sense. As a growing protocol, Akash is focused on supporting the technology with an expanding user base, not the one that enterprises use as an excuse to avoid change.

Although some industry doubts remain on containers’ ability to handle heavy-duty applications like artificial intelligence and machine learning in a similar manner to VMs, studies have proven negligible differences, if not better performance from containers. Akash recognizes the accelerating cloud compute demand for AI/ML and is preparing to handle the potential growth outside of its typical Web3 tenants.

A Compliment, not a Killer

Akash is not meant to replace the centralized cloud computing industry, it will simply complement it. If the conspirators are right, Ethereum might actually get killed by Solana, Polkadot, Cosmos, NEAR, or Algorand (not really, but a long-time Algonaut can dream). Cloud Computing and Akash’s fit in the industry is different. Similar to how Airbnb is not destroying hotels, Akash is not destroying centralized data providers. Both Airbnb and Akash simply allow individuals to rent out unused capacity.

Akash may be able to entice cloud customers by offering prices at a fraction of the cost of the big three providers, as well as providing the flexibility of no vendor lock-ins and control over the resources used to host deployments. As traditional enterprises build out crypto divisions and become more literate in Web3 technologies, Akash will be at the forefront of the decentralized cloud computing space with a functioning mainnet and a business model that alleviates supply-side inefficiencies.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Akash. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Upgrade to Messari Pro

Gain an edge over the market with professional grade tools, data and research.

Already a member? Sign in

Onchain Jíbaro. Background: Photography, Quantitative Banking, & Manual Labor.

Read more

Research Reports

Read more

Research Reports

About the author

Onchain Jíbaro. Background: Photography, Quantitative Banking, & Manual Labor.